Bitcoin reached a high of $25,238.72 on February 16, when it ran out of upside steam. In a February 11 Barchart article, I wrote, “History favors the upside” for the leading cryptocurrency, as Bitcoin has experienced many price explosions and implosions over the past years.

Bitcoin is an alternative currency that provokes emotions. The detractors detest the crypto and all asset class members, while supporters view them as the future of money and finance. The latest price action shows that volatility is back with a vengeance, and the potential is for higher highs.

The ProShares Bitcoin Strategy ETF product (BITO) follows CME Bitcoin futures higher and lower.

The dip was a buying opportunity

On Friday, March 10, news of bankruptcies in the U.S. banking sector sent markets lower, and cryptocurrencies were no exception. Silicon Valley Bank, an institution with assets over $200 billion and a leading funding source for emerging technology companies, went belly-up in the second most significant bank failure in U.S. history. Bitcoin had traded at $25,238.72 on February 16 after reaching a bottom of $15,516.53 on November 21, 2022. The potential for a banking crisis on March 10 sent the leading cryptocurrency 22.4% lower from the February 16 high to $19,593.39. The correction to a higher low as the world faced a U.S. banking crisis was a golden buying opportunity.

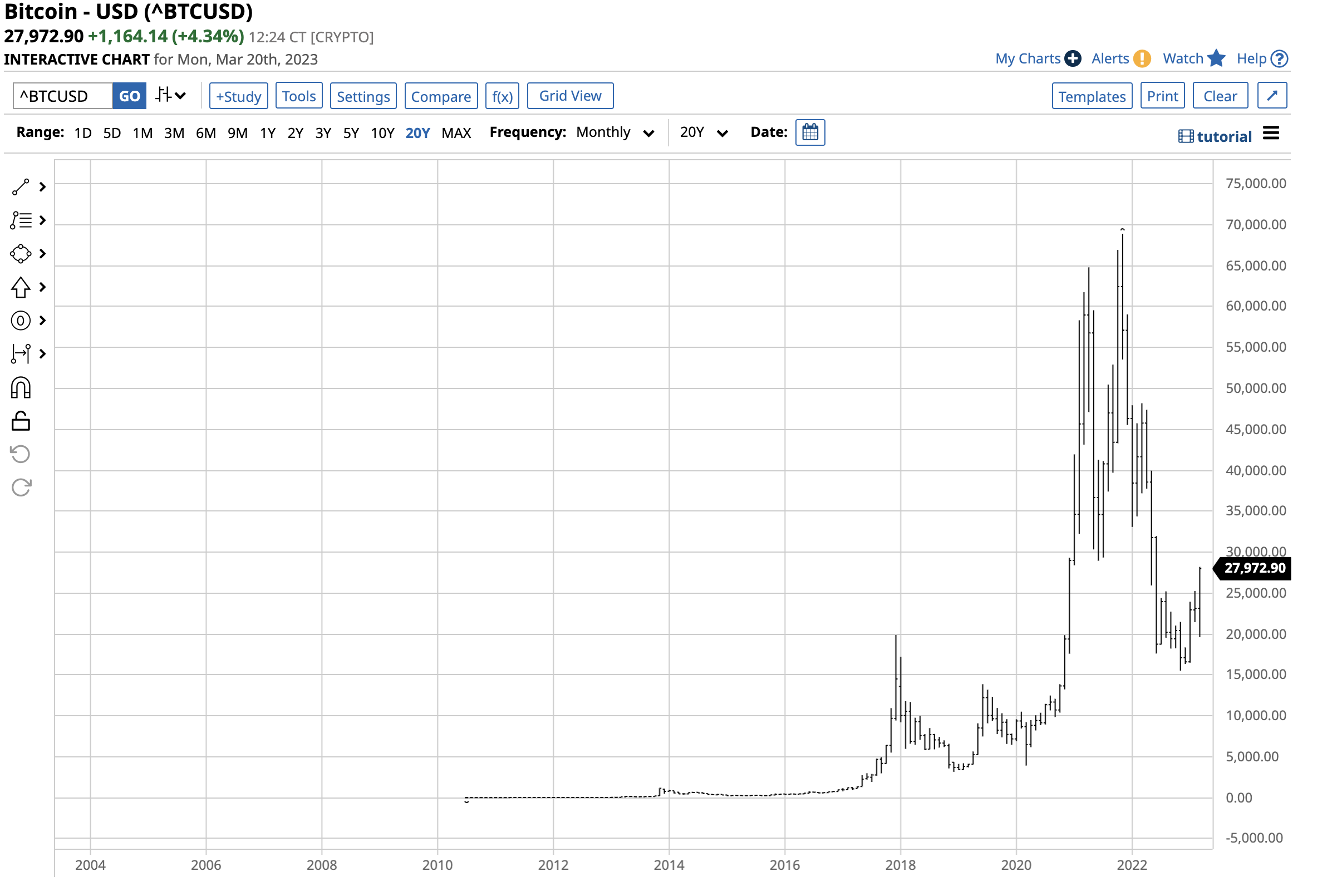

The chart highlights the explosive 43.85% rally that took Bitcoin from its March 10 higher low to $28,184.73 on March 19, the highest level since mid-June 2022.

A bifurcated world could favor the leading crypto

Markets reflect economics and politics, with both remaining highly uncertain in mid-March 2023. On the geopolitical front, the “no-limits” alliance between Russia and China, the war in Ukraine, rising tensions between Washington and Beijing, and other factors have widespread ramifications for markets. These factors have caused the bifurcation of the world’s nuclear powers and leading U.S. and Chinese economies.

The U.S. dollar has been the world’s reserve currency for decades, but the tensions between Washington and Beijing have caused China to seek other means of exchange for international cross-border transactions, threatening the dollar’s role in the global financial system. Meanwhile, all fiat currencies, including the dollar, yuan, euro, pound, yen, and others, derive value from the full faith and credit of the governments that issue legal tender. As that faith declines, the potential for increased demand for cryptocurrencies, which reflects the technological advances in finance, could rise. While governments will resist Bitcoin and other independent, non-central bank-issued digital currencies as they attempt to hold onto control of the money supply, the speculative fervor that pushed Bitcoin to over $68,900 per token in November 2021 could return in the blink of an eye.

Massive upside potential

While the debate over Bitcoin and non-government-issued cryptocurrencies will increase in volume if crypto prices rally, the price history shows the significant upside potential if the current rally continues.

The chart dating back to 2010 illustrates the boom-and-bust price history. The decline from the November 2021 high to the November 2022 low was a continuation of extreme percentage corrections after even more extreme percentage rallies. The chart shows that Bitcoin’s technical resistance is around the $29,000 to $32,000 per token level, and a rally above $32,000 could ignite another explosive upside move.

Bitcoin futures are regulated

Bitcoin devotees embrace the crypto’s independence that is free from government and regulatory control and depends solely on bids and offers to buy and sell. Many government officials fear the unregulated market could cause systemic financial risks if the market cap rises back to the $3 trillion level or higher.

Meanwhile, the Chicago Mercantile Exchange’s Bitcoin futures contract is CFTC regulated as a commodity. Bitcoin futures have been trading on the CME since December 2017, and while Bitcoin has seen significant price volatility, the futures market has not experienced any settlement or trading problems.

BITO tracks the futures

While the CFTC regulated Bitcoin futures, the SEC is the regulator responsible for the ProShares Bitcoin Strategy ETF product (BITO). The fund summary for BITO states:

The BITO ETF is SEC-regulated, and the futures it tracks are CFTC-regulated, providing investors and traders with two levels of regulatory oversight.

At $16.65 per share at the end of last week, BITO had nearly $851 million in assets under management. BITO trades an average of nearly 12.5 million shares daily and charges a 0.95% management fee.

Bitcoin fell 22.4% from the February 16 high to the March 10 low before rallying 43.85% to the March 19 high.

The chart illustrates BITO fell from $15.79 to $12.06 per share or 23.6% before rallying 38% to the $16.65 level over the same period. BITO does an excellent job tracking Bitcoin’s price action, but it only trades during U.S. stock market hours, while Bitcoin trades around the clock. Therefore, BITO could miss price moves to highs or lows occurring when the stock market is not operating. The latest rally did not reflect the rally to the latest March 19 high as the stock market was closed.

The most recent March 10 Bitcoin dip was a golden buying opportunity. If history is a guide, Bitcoin and the BITO ETF could have a lot more upside over the coming weeks and months.

More Crypto News from Barchart

- Bank Turmoil Sparks Flight to Crypto

- 3 Reasons to Exercise Caution Amid the Cryptocurrency Surge

- Bitcoin- Dramatic Forecasts From Both Camps

- Crypto Investors Need to Carefully Watch the $1 Trillion Mark

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)