Home mortgage rates keep rising, frustrating borrowers and home buyers. It is making it more expensive and difficult for borrowers planning on purchasing a home.

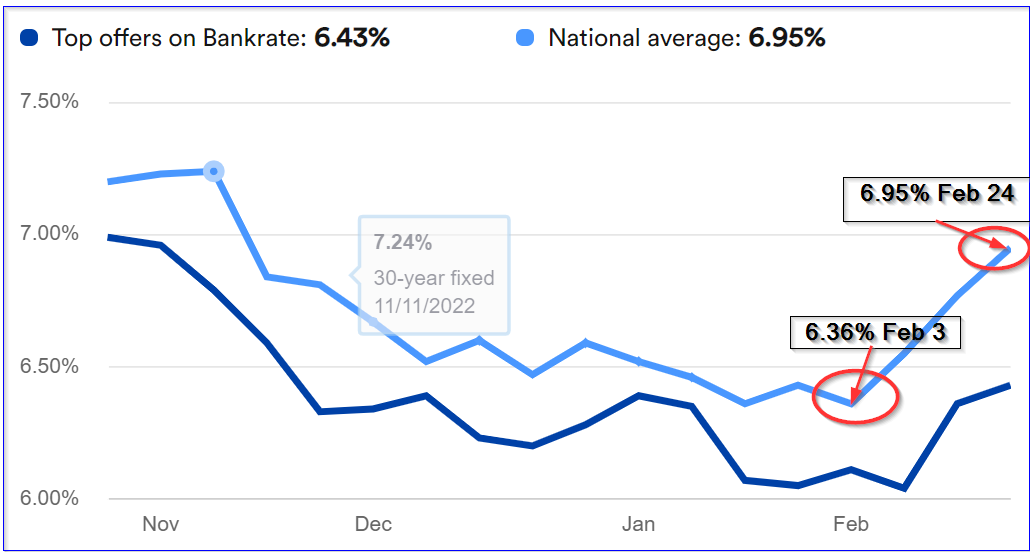

For example, Bankrate's survey of average 30-year fixed-rate mortgages was 6.36% on Feb. 3. Now, almost a month later, they were 6.95% on Feb. 24, according to Bankrate's latest chart.

Moreover, on Thursday, March 02, 2023, Bankrate.com says the current average 30-year fixed mortgage interest rate is 7.06%, up 11 basis points since the same time last week.

That means the cost of a home mortgage has risen over 11% since Feb 3 (i.e., 7.06% / 6.36% - 1=+11.1%).

Moreover, the refinance rate is higher at 7.14%, also up 11 basis points over last week.

What Is Pushing Rates Higher?

The market is not fooled. It appears that inflation is not cooling as expected, despite the huge Federal Reserve interest rate hikes.

Along with low unemployment and high economic growth, these three factors are putting pressure on interest rates. That is according to Joel Kan, Chief Economist at the Mortgage Bankers Association.

Home Price Increases and Higher Rates Give a Double Whammy to Borrowers

Not only are rates rising, but home prices are still moving up as well. That is giving borrowers and families that want to purchase homes a double whammy.

Realtor.com reports that the national median list price increased to $415,000 in February. This is up from $406,000 in January. That works out to an average 2.2% gain in the last month.

As a result, the average mortgage payment before taxes and escrow amounts has increased dramatically.

For example, let's assume that a borrower puts down 20% on the median list price and borrows the rest.

Last month a 30-year fixed mortgage at 6.36% for 80% of $406,000 (i.e., $324.8K) means the monthly payment was $2,023. That's the total for a 30-year fixed taken down in January, before taxes and escrow amounts.

But now by the end of February, the monthly payment is higher. For example, a 30-year fixed mortgage for $332,000 (i.e., 80% of the average $415K home price), at today's rate of 7.06% costs $2,222 each month.

That works out to almost a 10% increase in monthly payments in just one month (actually 9.8%).

What This Means For the Economy

This is a drag on the economy. The higher out-of-pocket cost to borrowers looking to purchase slows down family formation, and the national savings rate and contributes to slower economic activity.

In fact, it means those looking to buy a home will have to save more to put down a higher downpayment.

In addition, the Federal Reserve is likely to keep raising interest rates. The next Federal Open Market Committee (FOMC) meeting is scheduled for March 21 and 22.

The market is anticipating a further 25 basis point increase in the Fed Funds rate. The present effective Fed Funds rate is 4.58% with a target rate of 4.50% and a hike could raise it to over 4.75%.

That will likely lead to even higher mortgage rates, especially if the market anticipates further tightening by the Fed. As a result, borrowers might anticipate that mortgage rates could be over 7.25% by the end of the month.

Bottom Line

Over time, this will have a slowing effect on the economy and cause people to spend less.

It could also eventually lead to lower prices and lower mortgage volumes.

This could already be taking place. The volume of applications to purchase a home slid by 6% this last week over the prior week, according to the Mortgage Bankers Association.

Bottom line - watch rates and prices. If the Fed keeps hiking rates and home prices don't fall, expect to have to put more down to keep the monthly mortgage cost low.

More Interest Rate News from Barchart

- Stocks Recover Early Losses on Dovish Fed Comments

- Stocks Climb Higher Despite Rising Bond Yields

- Stocks End Mostly Lower as Global Bond Yields Push Higher

- Stocks Mixed as Global Bond Yields Jump

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

/Nike%2C%20Inc_%20swish%20by-%20Tartezy%20via%20Shutterstock.jpg)