Chevron Corp (CVX) stock is off over 13.5% from Jan. 26 to $162.41 as of Friday, Feb. 24, right before its Q4 earnings release last month when it peaked at $187.79 on Jan. 26. Nevertheless, value investors still see CVX stock as a cheap income and oil and gas play, with low forward multiples and high free cash flow (FCF) generation.

Moreover, as I discussed in my Barchart article on Jan. 27, Chevron raised its dividend and increased its $25 billion buyback program, which ends in Q1 2023 to $75 billion - although no time frame was put forth for this.

As a result, analysts now project $15.42 in earnings per share (EPS) this year, putting the stock on a forward multiple of 10.5x. And given its annual $6.04 dividend per share, CVX stock now yields 3.71%.

However, this is still below the stock's 5-year average dividend yield of 4.40%, according to Morningstar. That implies that it could drop to $136.81 at today's dividend yield. For example, $6.02 / $136.81 yields 4.40%. This implies the stock could theoretically drop another $26 or about 15.8% from today's price of $162.81.

It's possible this could happen if the economy tanks and enters a severe recession. This is what is stoking the market's fears about lower oil and gas prices and the effect on Chevron Corp's free cash flow.

In other words, the stock price reflects much of this FUD (fear, uncertainty, doubt) factor now. That is making its put premiums very high and attractive to value players.

Shorting Out of the Money (OTM) Puts

Last month I discussed in my last article shorting the OTM $175 strike price puts that expired on Feb. 24. Since the stock closed at $162.41, these short puts were exercised and the investor, despite receiving $1.60, now has an unrealized loss. Their account was charged $17,500 for 1 put contract that purchased 100 shares of CVX at $175.00

For example, their breakeven price is $175-$1.60 or $173.40, making the total investment $17,340. But at today's price those 100 shares are worth $16,241. So the unrealized loss is $1,099 (-$10.99 per contract), or -6.338% from the breakeven cost of $17,340.

But this is not as bad as it might seem. For one, the stock has fallen twice as much as this from the time when the investor would have shorted the puts. Second, the 100 shares in CVX the investor now owns can be used to sell covered calls. For example, the March 31 expiration $170 strike price calls have a $2.35 call premium. In other words, the investor could make $2.35 of the unrealized $10.99 loss.

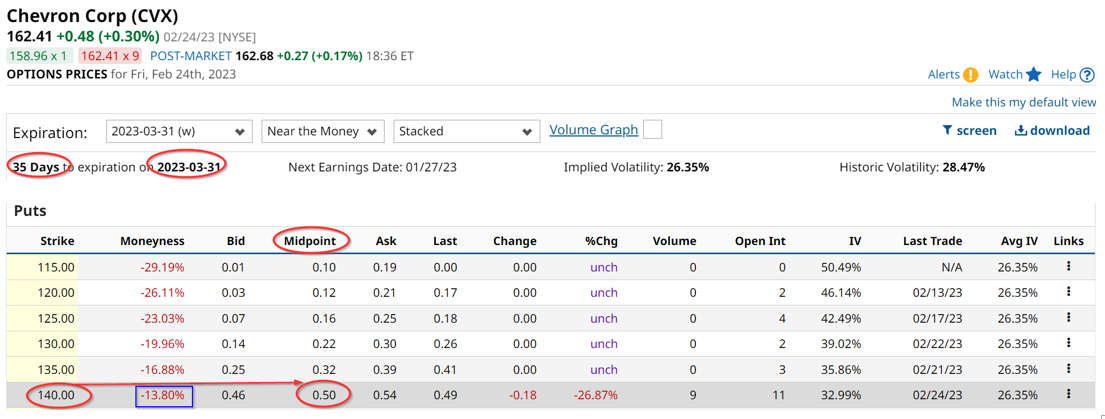

Lastly, investors can use the margin from the 100 shares of CVX held to short OTM puts at an even lower price. Depending on the brokerage firm's requirements the investor could short $140 strike price puts and receive 50 cents per put contract.

That strike price is 13.8% below today's price and the put premium provides a yield of 0.357% or 4.28% on an annualized basis. This allows the investor to make up more of the unrealized loss and also provides additional income on top of the 3.71% dividend yield today.

And even if the $140 strike price puts are exercised on or before March 31, the overall buy-in average cost will be lower that way. This way investors can naturally take advantage of this downturn in the CVX stock price. And that, in essence, is how value investors work. They buy quality companies at ever cheaper prices, as long as they can get paid to wait for the underlying intrinsic value to eventually emerge.

More Stock Market News from Barchart

- Alphabet Stock Has Tumbled But Short Put Income Plays Are Still Popular

- Earnings, ISM Reports And Other Key Themes To Watch This Week

- Stocks Close Lower as a Resilient Economy Bolsters the Case for More Rate Hikes

- Online Retailers Continue to Struggle

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)