Chevron (CVX) announced huge free cash flow for Q4, a massive $75 billion share buyback program, and a 6.3% dividend hike. As a result, investors are playing CVX stock with covered calls and out-of-the-money (OTM) short puts to take advantage of the stock's high option premiums and to create income.

The company raised its quarterly dividend to $1.51 (i.e., $6.04 annually), up 9 cents from $1.42 or up 6.34%. As of Jan. 26, CVX closed at $187.79, giving it a dividend yield of 3.22%. Moreover, the company said it would increase its $25 billion buyback program, which ends in Q1 to $75 billion. There is no date for how long this will take.

As I pointed out in my last article on Chevron, the company is spending about 1% per quarter of its market cap on buybacks. For example, in Q3 it spent $3.75 billion on share repurchases, and it spent $3.8 billion in Q4. So at this pace, it will be buying back $15 billion annually. This works out to 4.186% of its $363 billion market capitalization.

So, between the 3.22% dividend yield and the 4.186% buyback yield, shareholders gain a total yield of 7.41%. That also implies that the $75 billion buyback program could take 5 years to complete at $15 billion a year. That is, this will be the case unless Chevron dramatically increases the pace of buybacks to over $15 annually So far, there is no indication that will happen.

For example, its free cash flow (FCF) this past quarter was $8.7 billion. That was actually lower than the $12.3 billion in FCF it generated last quarter.

Shorting CVX Puts and Calls for Income

As of Jan. 26 close, the CVX stock option premiums are attracting investors for out-of-the-money income plays. For example, the volume for the $195 and $200 strike price call options for Feb. 24 have all increased significantly.

The $200 strike price, which is 6.88% over the stock price, has a call premium that closed at 95 cents. That works out to 50 basis points (i.e., 0.50%) of the stock price at $187.79 from the Jan. 26 close. That represents a 6.0% annualized return if the covered call play can be repeated each month.

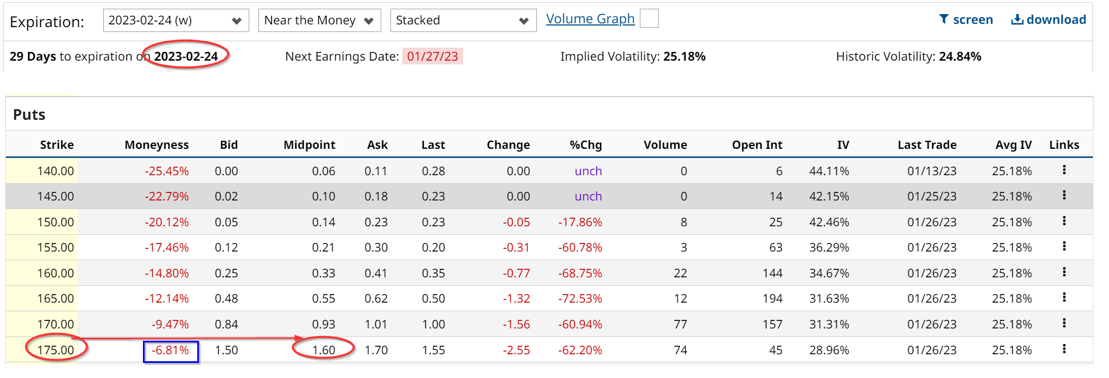

However, the OTM put prices are much more attractive. That skewness on the put side might reflect investor's sentiment that CVX stock could fall from its recent gains. However, it also makes shorting these puts more attractive in an option income play.

For example, the $175 put price has a premium of $1.60 per put contract. This means that if the stock falls 6.88% to $170 the investor who puts in an order to “sell to open” the $170 put for Feb. 24, will make an immediate yield of 0.91% (i.e., $1.60/$175).

Moreover, the short-put investor would be able to buy CVX stock at a much lower price if the stock falls by 6.88% to $175. However, the investor would not be able to make an unrealized gain if the stock rises, or collect any dividend income.

Nevertheless, these are two attractive ways to play the CVX stock for income with options due to its developments with its attractive FCF and buyback announcements.

More Stock Market News from Barchart

- Markets Today: Stock Indexes Decline on a Weak Revenue Forecast from Intel

- Bear Call Spread Screener Results For January 27th

- Weak Intel Guidance Weighs on Sentiment, Driving Premarket Losses for U.S. Equity Futures

- Stocks Jump as Recession Fears Ease

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)