This is sponsored content. Barchart is not endorsing the websites or products set forth below.

A Gold IRA, also known as a precious metals IRA, is a type of individual retirement account that allows investors to hold physical gold, silver, platinum, or palladium as part of their investment portfolio. These assets are held in a specialized account by a custodian, which is responsible for protecting and managing the assets on behalf of the investor.

Investing in a Gold IRA can be a smart choice for those seeking to diversify their portfolios and mitigate the risks associated with traditional investments. Gold has been considered a store of value for centuries, and its value is often considered to be relatively stable compared to other investments that are closely tied to the performance of the economy. In times of economic uncertainty, the value of gold has been known to increase, providing a hedge against inflation and currency devaluation.

Additionally, a Gold IRA offers several other benefits, such as tax-deferred growth and the ability to transfer the account to a beneficiary. By investing in a Gold IRA, you can potentially secure your retirement savings and protect your wealth from the uncertainties of the financial markets.

In conclusion, if you are looking for a way to diversify your investment portfolio and protect your wealth, a Gold IRA can be an attractive option to consider. This guide explains how Gold IRA’s work, how to open an account, storage options, and the best Gold IRA companies to choose from. Read this guide to get a complete understanding of Gold IRAs and how you can get started growing your wealth!

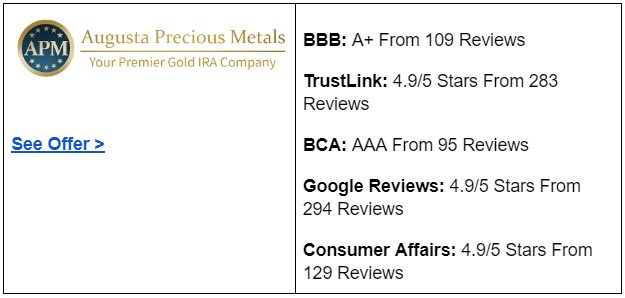

1. Augusta Precious Metals

Minimum IRA Account: $50,000

Eligible Precious Metals: Gold and Silver

Why We Picked It

Augusta Precious Metals is a leading Gold IRA company with a strong reputation for empowering investors to diversify their retirement savings and protect their financial future. The company has received numerous five-star ratings, perfect scores with the BBB and BCA, and positive customer reviews, demonstrating its commitment to customer satisfaction and expertise in the industry.

Augusta offers a straightforward investment model with no hidden fees, making it a reliable and accessible choice for those looking to invest in a Gold IRA. The company's knowledgeable staff provide top-notch customer service and support, ensuring investors have the information they need to make informed investment decisions.

Despite an initial investment cost that may be higher than other options, Augusta is a recommended choice for those seeking a trustworthy and reliable Gold IRA investment.

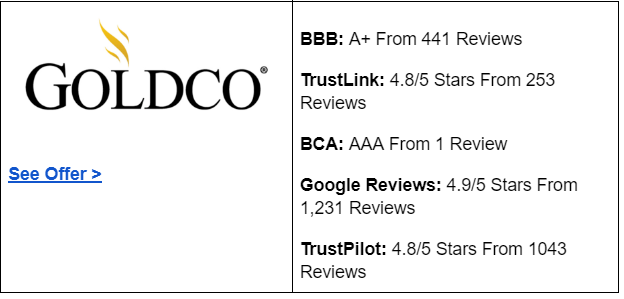

2. Goldco

Minimum IRA Account: $25,000

Eligible Precious Metals: Gold and Silver

Why We Picked It

Goldco is a leading Gold IRA company with a strong foundation in ethical values and exceptional customer service since its inception in 2006. Its resiliency has earned praise from notable media figures like Chuck Norris, Ben Stein, and Sean Hannity, showcasing its successful track record in the industry. Goldco is an excellent choice for clients looking to roll over their investments from traditional IRAs such as 401(k) and 403(b). The company places a significant emphasis on its buyback program, providing clients with a secure option to liquidate their gold investments.

Although the company may not offer direct 1-on-1 education on precious metals IRAs, it provides ample resources, including a comprehensive guide, to help clients gain a strong understanding of gold IRAs. With numerous positive endorsements from notable media personalities, we highly recommend Goldco for those seeking a trusted and reliable Gold IRA investment.

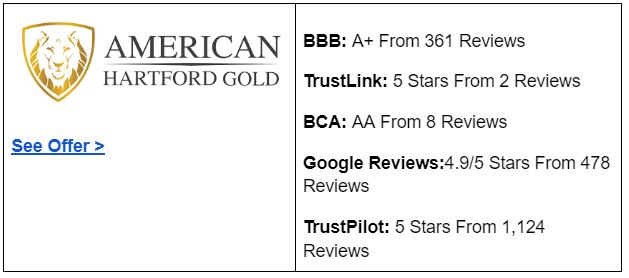

3. American Hartford Gold

Minimum IRA Account: $10,000

Eligible Precious Metals: Gold, Silver and Platinum

Why We Picked It

American Hartford Gold is a reputable precious metals IRA company with a clear vision and mission. Despite its relatively young establishment, the company boasts a team of specialized and experienced professionals who offer valuable advice to clients, especially amateur investors. American Hartford Gold places high importance on client security and confidentiality and takes extensive measures to ensure the protection of client information.

The company's reputation is further solidified by its A+ rating with the Better Business Bureau and its 5-star customer satisfaction ratings on trusted platforms like Trustpilot and Google. American Hartford Gold's excellence has earned recognition as the #1 Gold Company by the prestigious Inc. 5000's 2021 list of America's fastest-growing private companies.

Not only does American Hartford Gold have a strong reputation and track record, but it is also the only precious metals company recommended by prominent figures such as Bill O’Reilly, Rick Harrison, and Lou Dobbs. This recommendation adds to the company's credibility as a reliable and trustworthy choice for precious metals IRA investment.

4. Birch Gold Group

Minimum IRA Account: $25,000

Eligible Precious Metals: Gold, Silver, Platinum & Palladium

Why We Picked It

Birch Gold Group, established in 2003, has built a solid reputation as one of the leading gold IRA companies in the industry. With a focus on client education, the company provides its clients with the necessary knowledge to make informed investment decisions. The company's knowledgeable specialists are well-versed in their field and offer valuable insights drawn from years of experience.

Endorsed by high-profile figures such as Ben Shapiro and Steve Bannon, Birch Gold Group has earned a stellar reputation for their exceptional services in the precious metals investment industry. With a strong foundation and years of experience, the company is well-equipped to handle any situation that may arise, giving clients the confidence to invest in their future with peace of mind.

Birch Gold Group takes client security and confidentiality very seriously and goes to great lengths to ensure their clients' investments are protected. The company's commitment to providing a high-quality customer experience, coupled with their expertise and experience, makes Birch Gold Group an excellent choice for those looking to invest in precious metals IRAs.

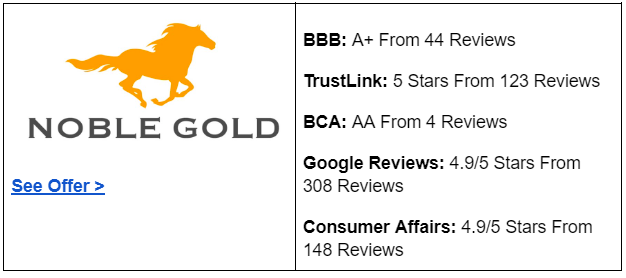

5. Noble Gold Group

Minimum IRA Account: $2,000

Eligible Precious Metals: Gold, Silver, Platinum & Palladium

Why We Picked It

Established in 2017, Noble Gold Group has rapidly established itself as a prominent player in the precious metals IRA industry. Under the leadership of Charles Thorngren and Collin Plume, the company was founded with the intention of providing investors with a secure refuge from market volatility. Throughout its operations, Noble Gold Group has maintained a steadfast commitment to serving its clients, placing their interests above all else, and thereby building a reputation for integrity and professionalism.

As a company that prioritizes its clients, Noble Gold Group is a dependable partner for investing in gold. With industry-leading customer support and a low minimum investment requirement, they have become a trustworthy choice for those seeking a secure investment option. The company's comprehensive FAQ section on its website ensures that customers are well-informed, making the investment process simple and stress-free. Noble Gold Group's promise is to make investing easy, and they are well on their way to fulfilling that promise.

Gold IRA Investing Guide

What is a gold IRA?

A gold IRA, also known as a precious metals IRA, is a type of Individual Retirement Account (IRA) that allows investors to hold physical gold as an investment, along with other approved precious metals, such as silver, platinum, and palladium. Unlike traditional IRA, where funds are invested in stocks, bonds, or other securities, a gold IRA offers investors the opportunity to diversify their portfolio and hedge against the risks of inflation, currency devaluation, and broader economic uncertainty.

Investing in a Gold IRA, or a Precious Metals IRA, is a sound strategy for anyone looking to secure their financial future and safeguard their retirement savings against the volatility of traditional investment vehicles. The most notable benefit of a Gold IRA is that it offers investors the opportunity to diversify their investment portfolio, thus reducing the overall risk of their investments. By including a portion of their retirement savings in precious metals, such as gold, silver, platinum, and palladium, investors are better positioned to weather any economic turbulence that may arise.

One of the key drivers behind the popularity of Gold IRAs is the fact that precious metals have proven to hold their value over time, even during periods of financial crisis. While stocks, bonds, and other securities can suffer steep losses in the event of an economic downturn, the value of gold has remained relatively stable over the long term. This stability makes precious metals a reliable store of value and an effective hedge against inflation and currency devaluation, which can erode the purchasing power of fiat currencies.

Another key benefit of a Gold IRA is that it allows investors to take advantage of the tax benefits offered by IRAs, including tax-deferred growth and tax-free withdrawals in retirement. With a traditional IRA, investors are allowed to make contributions that may be tax-deductible, while the growth of their investments is tax-deferred. With a Gold IRA, the same benefits are available, with the added protection that the physical gold provides against economic turbulence.

The process of opening a Gold IRA is straightforward and involves working with a custodian to ensure compliance with regulatory requirements regarding the reporting, storage, and types of precious metals allowed within the account. The first step in the process is to choose a reputable Gold IRA company that can guide you through the process, such as American Hartford Gold or Birch Gold Group. Once you have selected a company, you will need to provide your personal and contact information, and then the company will help you set up an account. After the account is set up, you can then choose from a wide range of IRA-eligible gold, silver, platinum, and palladium products and have your metals securely stored by a compliant custodian.

In conclusion, a Gold IRA is a smart investment choice for anyone looking to diversify their portfolio and protect their retirement savings against the risks posed by traditional investment vehicles. With its proven track record of stability, the ability to take advantage of IRA tax benefits, and the security of working with a compliant custodian, a Gold IRA is an investment that is well worth considering for anyone looking to secure their financial future.

How does a gold IRA work?

Setting up a gold IRA, also known as a precious metals IRA, involves several key steps that are necessary to ensure compliance with IRS regulations and to properly protect your investments. Here's a closer look at each step:

1. Choosing a reputable gold IRA company: To set up a gold IRA, the first step is to select a trustworthy and experienced gold IRA company. This company will act as your advisor and guide you through the process of opening and maintaining your account. The company should have a good reputation in the industry and provide clear information on its website, including its fees, investment options, and storage options. Before making your final selection, be sure to research the company and read customer reviews to get a better understanding of its level of customer service and professionalism.

2. Rolling over an existing IRA or 401(k): If you already have an existing IRA or 401(k) account, you may be able to roll it over into a self-directed IRA. This process allows you to transfer your funds from your current account into a gold IRA without incurring taxes or penalties. However, it is important to understand the rules and regulations regarding rollovers, so be sure to consult with a financial advisor or your gold IRA company to ensure that you are following the correct procedures.

3. Purchasing IRA-eligible precious metals: After your account is set up, you will have the opportunity to purchase a variety of IRA-eligible precious metals, including gold, silver, platinum, and palladium. Your gold IRA company will assist you in selecting the right metals for your investment strategy and will ensure that the metals meet all IRS requirements for inclusion in an IRA. The company may offer a variety of purchasing options, including bulk purchases, coins, or bars.

4. Selecting a storage option: Once you have purchased your precious metals, your next step will be to choose a storage option. Your gold IRA custodian will offer several storage options to choose from, including segregated and non-segregated storage. Segregated storage means that your metals will be stored separately from other customers' metals, providing you with more control and privacy. Non-segregated storage, on the other hand, means that your metals will be stored with other customers' metals, which can result in lower storage fees. The storage option you choose will depend on your personal preference and investment strategy.

5. Storing the precious metals: The final step in setting up a gold IRA is to have your precious metals securely stored by a compliant and insured facility. Your gold IRA company will ensure that your metals are stored in accordance with IRS regulations and will also ensure that they are adequately insured. This will provide you with peace of mind, knowing that your investment is protected and that you have easy access to it if you need it.

By following these steps and working closely with a reputable gold IRA company, you can ensure that your investment is protected and that you are maximizing your opportunities for financial growth and security in retirement.

Gold IRA Rollover

A Gold IRA rollover is a popular investment strategy that allows individuals to diversify their retirement portfolio by holding physical precious metals, such as gold, silver, platinum, and palladium, as an investment option. The process of transferring assets from a traditional IRA account into a self-directed Gold IRA account requires careful consideration and planning, as well as a good understanding of the regulations and restrictions involved.

There are two main types of Gold IRA rollovers: a transfer and a rollover. A Gold IRA transfer is when only a portion of assets from a traditional IRA account is moved into a Gold IRA account. On the other hand, a Gold IRA rollover involves transferring all assets from a traditional IRA account into a Gold IRA account.

Understanding the difference between these two options is crucial to ensuring a smooth and tax-compliant process. A Gold IRA transfer involves transferring only a portion of the assets from a traditional IRA account into a Gold IRA account. This type of transfer is generally less restrictive, with fewer penalties associated with it compared to a Gold IRA rollover. For example, a Gold IRA transfer is not subject to the 60-day rule, which requires individuals to complete a rollover within 60 days of receiving the funds from a traditional IRA account to avoid being taxed as a withdrawal. It's also not subject to the 10% withdrawal penalty for individuals under 59.5 years of age, making it an attractive option for those looking to invest in a precious metals IRA.

In contrast, a Gold IRA rollover involves transferring all assets from a traditional IRA account into a Gold IRA account. This type of rollover is subject to several restrictions and penalties, including the 60-day rule, the 10% withdrawal penalty for individuals under 59.5 years of age, and an annual limit of one rollover per year. For example, if an individual under 59.5 years of age completes a Gold IRA rollover and decides to withdraw the funds within 60 days, they would be subject to a 10% penalty on the total amount withdrawn. Additionally, if an individual completes a Gold IRA rollover and decides to complete another rollover in the same year, they would be subject to penalties and taxes on the second rollover.

Before committing to a Gold IRA rollover, it's essential to consult with a tax advisor to understand the potential implications and ensure that the process is carried out in compliance with all applicable regulations. Moreover, selecting a reputable and compliant Gold IRA company as trustee or depository for your assets is crucial for the success of the rollover process and the long-term growth and security of your retirement assets.

A trustworthy Gold IRA company will have a good track record in the industry, provide transparent and comprehensive information about their fees, storage options, and the process of opening an account. They will also act as a reliable custodian for your assets, ensuring that the movement of funds from a conventional retirement account to a precious metals IRA is executed in compliance with all regulations.

Ultimately, choosing the right Gold IRA company and following the steps involved in a Gold IRA rollover carefully and with due diligence will help ensure the long-term growth and security of your retirement assets.

How does a 401(k) to gold IRA rollover work?

The process of transferring funds from a 401(k) to a Gold IRA involves several important steps to ensure compliance with regulations and a successful transfer. The first step is to convert your traditional IRA to a self-directed IRA, which allows you to invest in a wider range of assets, including precious metals like gold, silver, and platinum. This conversion is essential because it gives you greater control over your investments and the ability to choose assets that align with your financial goals.

Once you have converted your traditional IRA to a self-directed IRA, the next step is to choose a reputable and compliant Gold IRA company to initiate the transfer of funds. When you select a Gold IRA company, you will be provided with the necessary paperwork to complete the process. This paperwork will ask for information about your current 401(k) account and your new self-directed IRA account. It's important to make sure that the information you provide is accurate, to avoid any delays in the transfer process.

The Gold IRA company will act as the trustee and handle the remaining steps, including transferring the funds from your 401(k) to your self-directed IRA account, purchasing the gold coins or bars, and storing them in a secure depository. It's worth noting that while the general procedure is consistent, slight variations may exist between firms, so it's a good idea to verify the details with your chosen service provider before beginning the transfer process.

Once you have completed the necessary paperwork, the transfer process typically takes several weeks to complete, and the balances in both accounts should be equal or zero when the transfer is complete. Keep in mind that the transfer process is subject to specific regulations, and it's essential to ensure that these regulations are followed correctly to avoid penalties or other issues. By working with a reputable and compliant Gold IRA company, you can ensure that your transfer process is completed smoothly, and your assets are protected for your retirement.

Is a 401(k) to gold rollover right for me?

When considering a 401(k) rollover to a gold IRA, it's important to think about your personal financial situation and investment goals, as well as to be aware of the potential advantages and disadvantages that come with investing in precious metals. To determine whether a 401(k) to gold rollover is the right choice for you, here are some questions you may want to ask yourself:

1. What is my risk tolerance? Precious metals, while they can offer stability and inflation protection, can also have a lack of liquidity. Understanding your level of comfort with risk is critical in deciding if a gold rollover is right for you.

2. What is my investment strategy? Diversifying a portion of your portfolio into precious metals can be a wise choice for some investors, but it may not align with your overall investment strategy.

3. What is my proximity to retirement? If you are closer to retirement, you may want to consider a more conservative approach and allocate a smaller portion of your portfolio to precious metals.

4. Do I have any employer restrictions? If you are rolling over a 401(k) from a former employer, this should not be an issue. However, if you are rolling over an existing 401(k) sponsored by your current employer, it's important to check if they allow 401(k) to gold IRA rollovers and transfers.

5. Do I want to transfer my entire 401(k) to a gold IRA or only a portion? You can choose to transfer all or a portion of your 401(k) to a gold IRA, depending on your investment goals and risk tolerance. A conservative approach could be to diversify 10-15% of your portfolio into precious metals and adjust it based on performance.

These questions can serve as a starting point in evaluating whether a 401(k) to gold rollover is the right choice for you. It is important to remember that the nature of the transfer and the decision to invest in precious metals should be based on your personal financial situation and investment goals. Therefore, it is crucial to consult with a financial advisor and to have a clear understanding of your financial standing before making a decision.

Investment options in a gold IRA

A gold IRA offers an opportunity for individuals to invest in precious metals as part of their retirement savings portfolio. The Internal Revenue Service (IRS) permits gold, silver, platinum, and palladium to be held in a gold IRA account. The precious metals held in a gold IRA serve as a hedge against inflation and a diversification of traditional financial investments, such as stocks and bonds. As such, these assets play a critical role in an overall investment strategy and can help protect wealth during periods of economic uncertainty.

There are several investment options available within a gold IRA, allowing individuals to choose the assets that best align with their specific investment goals and risk tolerance. The gold options include bullion coins, numismatic coins, and bars.

Bullion coins are the most common form of investment in a gold IRA. They are usually minted by government mints and their value is primarily determined by the gold content. Examples of bullion coins include the American Gold Eagle and the Canadian Gold Maple Leaf.

Numismatic coins are rare or collectible coins that have value beyond their metal content. They are usually older coins and their value can be affected by factors such as rarity, historical significance, and condition. Numismatic coins are typically more expensive than bullion coins and may have higher price volatility, making them a less conservative investment option.

Bars are another option available in a gold IRA. They are typically larger in size than coins and may have a lower premium compared to bullion coins. They are a suitable option for individuals who are looking to invest a larger amount of money in precious metals.

Silver, like gold, can be an attractive investment option due to its stability and potential to protect against inflation. Silver is considered to be a more liquid investment option compared to gold and may be a better choice for those looking for short-term investments.

In addition to gold and silver, platinum and palladium are also approved by the IRS to be held in a gold IRA. Platinum is often considered a precious metal with industrial applications, as it is used in various industries such as automotive, electronics, and jewelry. As a result, the price of platinum can be influenced by the demand for these industries. In contrast, palladium is primarily used in the automotive industry as a catalytic converter, which is why its price can be influenced by the demand for automobiles.

When considering platinum and palladium as an investment option within a gold IRA, it is important to consider the current market conditions and trends. For example, if the automotive industry is growing and demand for palladium is high, it may be a good time to invest in palladium. On the other hand, if the automotive industry is slowing down and demand for palladium is low, it may not be the best time to invest in this precious metal.

When deciding on the best investment options for your gold IRA, it is important to consider your investment goals and risk tolerance. For example, if you're looking for a more conservative investment, bullion coins may be the best option for you. On the other hand, if you are comfortable with a higher level of risk, platinum or palladium. Ultimately, it is important to consult with a financial advisor to determine the best investment strategy for your specific needs.

Gold IRA Storage

The storage of precious metals in a gold IRA is a critical factor to consider for ensuring compliance with the Internal Revenue Service (IRS) regulations and avoiding potential penalties. The IRS requires that all eligible precious metals, including gold, be securely stored in an approved depository. These depositories must meet strict guidelines set by the IRS for the protection and safekeeping of the assets, including state-of-the-art security systems and a staff of trained professionals who are responsible for the daily management and administration of the stored assets. By choosing a reputable, IRS-approved depository, you can have peace of mind that your precious metals are stored in a secure and compliant manner, protected by 24-hour surveillance, multiple access controls, fire suppression systems, and more. The storage decision you make for your gold IRA is an important one, and should be based on careful consideration and research to ensure the safety and security of your assets.

Home storage gold IRA

Storing precious metals in a self-directed Individual Retirement Account (IRA) is a complex matter and it is essential to follow the strict regulations set forth by the Internal Revenue Service (IRS). One of the key regulations is the requirement for all precious metals held in an IRA to be stored in an IRS-approved depository. Home storage of precious metals in an IRA is strictly prohibited and considered a violation of IRS rules.

If an individual were to disregard this rule and store their precious metals from their IRA in their personal residence, they would be in breach of IRS regulations. The consequences of such a violation could be severe, potentially resulting in the loss of tax benefits, fines, and penalties on distributions. In the worst case scenario, the IRA itself could be disqualified, leading to a complete loss of the invested assets.

Therefore, it is crucial to take this regulation seriously and work with a reputable gold IRA company that can assist in selecting an IRS-approved depository. By doing so, investors can rest assured that their precious metals are being stored in a secure, compliant, and tax-efficient manner, helping to ensure that their long-term investment goals are met.

How do you hold physical gold in an IRA?

The safe and secure storage of your precious metal investments is of utmost importance and is a requirement mandated by the Internal Revenue Service (IRS) for all Individual Retirement Accounts (IRA) that hold physical precious metals, including gold. To comply with these regulations, you must choose an IRS-approved depository to securely store your physical assets.

Most gold IRA companies have established relationships with a select group of approved depositories that are capable of providing safe storage for your precious metals. These depositories are specialists in the storage of precious metals and have the necessary controls and security measures in place to ensure the safety of your assets. The number of approved depositories that a gold IRA company partners with may vary, so it is important to consider all options when making your selection.

When selecting an IRS-approved depository, there are several important factors to consider. Location is one such factor, as you may prefer a depository that is closer to your home or in a more convenient location. Insurance coverage is another important factor, as you may want to consider a depository that offers additional insurance coverage to provide additional peace of mind. Finally, the security measures of the depository are also an important consideration, as you want to be sure that your assets are stored in a secure facility with state-of-the-art security systems and protocols.

The gold IRA company you choose will play an important role in this process and can assist you in choosing the best IRS-approved depository for your needs. Once you have made your selection, the gold IRA company will handle the transfer of your assets to the chosen depository, ensuring that all regulations are met and that your assets are stored safely and securely. With the right gold IRA company and approved depository, you can rest assured that your precious metal investments are protected and secure, allowing you to focus on growing your investment portfolio.

Gold IRA cost

When investing in a gold IRA, it's crucial to understand and consider the associated costs as these can impact the overall value of your investment. Understanding each cost will help you make an informed decision and ensure that the benefits of investing in a gold IRA outweigh the costs.

1. Setup Fees: A setup fee is a one-time charge to cover the cost of opening and setting up the account, which can range from $50 to $200. This fee is important to consider as it will impact the upfront cost of your investment. For example, if the setup fee is $200, this will be an immediate expense that must be taken into account.

2. Purchase Fees and Commissions: These fees are applied when making a purchase and can range from 1% to 5% of the total value of the purchase. This means that if you purchase $50,000 worth of gold, a 5% purchase fee would be $2,500. It's important to consider these fees as they can significantly impact the overall cost of your investment.

3. Annual Fees: Annual fees are charged for ongoing maintenance and management of the account and can range from $100 to $300 per year. This can include account statements, tax forms, and other necessary paperwork. For example, if the annual fee is $300, this will be a recurring expense that must be taken into account when determining the overall value of the investment.

4. Storage Fees: Storage fees are a cost to consider for the storage of your precious metals. These fees can range from $75 to $200 per year and will depend on the type of storage you choose. Some gold IRA companies may offer free storage for a certain amount of gold, such as when purchasing more than $25,000 worth of gold. It's important to consider these fees as they can impact the overall cost of your investment, especially if the amount of gold you are storing is large.

5. Miscellaneous Fees: Miscellaneous fees can include wire transfer fees or other administrative charges and can range from $0 to $100. For example, if a wire transfer fee is $50, this will be an additional expense that must be taken into account.

On average, expect to pay $200 to $600 per year in fees for a gold IRA, with the actual amount depending on the specific gold IRA company and custodian you choose. Before making a decision, it's important to carefully consider the costs and determine if the benefits of investing in a gold IRA outweigh the expenses. The minimum investment requirement for a gold IRA can range from $2,000 to $50,000, not including fees, so it's crucial to factor in the size of your investment and the overall value of the account when determining the cost-benefit analysis. Keep in mind that the value of the gold IRA must be higher than the maintenance fees in order for the account to maintain or increase in overall value.

IRA-eligible Gold

When considering investing in a gold IRA, it is important to understand the strict guidelines set forth by the Internal Revenue Service (IRS) in regards to eligible precious metals. While personal collections may include a wider range of precious metals, the IRS mandates that only specific coins, bars, and bullion meet investment-grade standards of purity and quality to be considered eligible for a gold IRA.

To comply with IRS regulations, gold IRA investments must meet the requirement of fineness, which measures the percentage of gold in a metal alloy. This requirement is set at a minimum of .995 fineness for eligible gold IRA investments. Popular examples of eligible gold bullion coins include the American Gold Eagle, Canadian Gold Maple Leaf, and the Australian Gold Kangaroo.

In terms of gold bars, they must be minted by a NYMEX or COMEX-approved refiner and meet the required fineness standards. It's worth noting that some gold IRA companies may have additional requirements and restrictions on the type of precious metals they will accept, so it's crucial to research and fully understand the guidelines of your chosen gold IRA company.

By carefully selecting only eligible precious metals, you can ensure the proper compliance and protection of your gold IRA investment. Thus, it is essential to take the time to understand the specific guidelines set forth by the IRS and your chosen gold IRA company to make an informed investment decision.

Gold IRA reviews

When evaluating the quality of a gold IRA company, reading reviews from current and former clients is a crucial step. Reviews provide insight into the company's reputation, customer service, and overall performance, and are a valuable tool in determining if the company is a good fit for your investment needs. Here are some factors to consider when evaluating gold IRA reviews:

- Number of reviews: The number of reviews is an indicator of the company's established client base. A larger number of reviews gives you a more comprehensive representation of customer experiences, providing a better understanding of the company's performance.

- Review scores: The overall star or point rating is a quick reference to the company's performance, but it should not be the only factor considered. It's important to also look at the specific content of the reviews.

- Source of reviews: Third-party review sites, such as the Better Business Bureau (BBB), Trustpilot, and Trustlink, are typically more reliable sources of reviews, as they are less likely to be biased. It's essential to consider reviews from multiple sources to get a comprehensive view of the company's reputation.

- Content of reviews: The specific mentions in the reviews, such as fees, customer service, and overall satisfaction, provide a more in-depth understanding of the company's performance. Additionally, it's crucial to evaluate the consistency of the reviews over time, as it gives you a sense of the company's stability and reliability.

In conclusion, reading reviews is an important step in choosing a gold IRA company. By considering the number of reviews, review scores, source of reviews, and content of reviews, you can gain a better understanding of the company's reputation and performance, and determine if it is the right fit for your investment needs.

Overview of The Best Gold IRA Companies

How To Evaluate The Best Gold IRA Companies

1. Reviews: Evaluating the experiences of current and former clients is a critical step in choosing a gold IRA company. This provides valuable insight into the company's reputation, customer service, and overall performance. To get the most comprehensive understanding of a company, it's essential to read reviews from multiple sources such as the Better Business Bureau (BBB), Trustpilot, and Trustlink, which are less likely to be biased. When analyzing reviews, consider the number of reviews received, the overall rating, and the specific details mentioned by reviewers. For example, a company with a large number of positive reviews mentioning their excellent customer service is likely to be highly responsive and helpful. Additionally, if multiple reviewers mention a positive experience with the company's fees, it's an indication that the company provides a fair and transparent pricing structure.

2. Pricing: The fees and minimum investment requirements charged by gold IRA companies are a crucial factor to consider when making a decision. While some companies may charge higher fees, the services they offer may justify the costs. To determine the best value, it's essential to compare the fees and minimum investment amounts of different companies and assess the value they provide. For instance, a company that charges higher fees but provides more comprehensive services and support may be a better choice than one with lower fees but limited support. A good example of a company that offers a fair pricing structure is one that offers transparent fees, with no hidden charges, and a competitive buyback program.

3. Rollover and Buyback Programs: Rollover and buyback programs are essential services offered by gold IRA companies that allow the transfer of funds from conventional IRAs into gold IRAs and the liquidation of gold investments, respectively. A reputable gold IRA company should handle these processes efficiently with minimal complications for the investor. It's crucial to research the rollover and buyback policies of different companies and ensure that they comply with tax and withdrawal regulations. A good company will offer a smooth rollover process, with clear guidelines, and competitive buyback rates when it's time to liquidate your investments. For example, a company that offers flexible rollover options and competitive buyback rates, with a streamlined process, is a good choice for those looking to invest in gold.

4. Focus on Education: A gold IRA company should be dedicated to educating its clients about the ins and outs of investing in precious metals. This includes information on how gold IRAs work, the different types of metals that are eligible for investment, and the risks and rewards associated with this type of investment. A reputable company will provide unbiased, professional, and up-to-date information through a variety of channels such as in-person consultations, webinars, informational brochures, and online resources. Good companies will also have knowledgeable representatives available to answer any questions or concerns that clients may have. For example, a company that offers in-depth educational resources, with knowledgeable representatives, and regular webinars, is a good choice for those looking to learn about gold IRA investment.

5. Strong Customer Support: A gold IRA company should have a dedicated customer service team in place to assist clients with any questions or issues that may arise. These teams should be available during regular business hours, responsive to client inquiries, and able to provide knowledgeable answers and guidance. Additionally, customer service representatives should be able to maintain confidentiality and provide a high level of professionalism in all interactions. For example, a company that has a responsive customer service team, available during regular business hours, and provides personalized and professional support, is a good choice for those looking for a gold IRA company with strong customer support.

6. Storage options: Storage options are an essential aspect to consider when choosing a gold IRA company. A reputable company should provide secure storage options for its clients' precious metals. One way to ensure the safety of your investment is by choosing a company that partners with a third-party depository that has been approved by the IRS. It is important to evaluate the reputation and fees of the depository and make sure that it is fully insured and has multiple levels of security, such as 24-hour surveillance, secure transport, and stringent access control measures.

Gold IRA FAQ

Q: What is IRA gold?

A: IRA gold refers to physical precious metals, such as gold, silver, platinum, or palladium, that are eligible for investment through an Individual Retirement Account (IRA). The eligibility of these metals is determined by the Internal Revenue Service (IRS) and they have specific guidelines regarding the type, weight, and purity of the precious metals that can be included in a precious metals IRA. This is to ensure that the precious metals held in the IRA are of sufficient quality and are a viable long-term investment.

It is important to note that not all precious metals meet the IRS guidelines for investment in an IRA, therefore, it is crucial to thoroughly research and understand these guidelines before investing. For example, the gold used for IRA investment must have a purity of at least .995 and must be stored in an IRS-approved depository.

Q: What are the best precious metals for IRAs?

A: The best precious metal for an IRA is subjective and depends on the individual investor's investment goals, risk tolerance, and personal preferences. There is no one metal that is inherently better than another, as each precious metal has its own unique advantages and disadvantages in the market.

For example, gold is often seen as a hedge against inflation and is a widely recognized form of investment, making it a popular choice for IRA investment. On the other hand, silver is more liquid than gold and is often used as a speculative investment. Platinum and palladium, while less well-known than gold and silver, have industrial uses and can offer a higher potential for appreciation, but also carry a higher level of risk.

The best precious metal for an IRA will depend on the individual's investment objectives, risk tolerance, and overall financial situation. It is recommended to consult with a financial professional to help determine the best investment strategy.

Q: What is a gold IRA company?

A: A gold IRA company is a financial services firm that specializes in the setup, administration, and management of precious metals IRAs. These companies act as custodians for the account holder's assets and are responsible for ensuring compliance with IRS regulations. They provide a range of services including account setup, purchase and storage of precious metals, and account management.

In addition to these core services, a good gold IRA company would also provide educational resources and professional advice to help the investor make informed decisions about their investment. They would offer rollover and buyback services to help transfer funds from conventional IRAs into gold IRAs and to facilitate the liquidation of gold investments, respectively.

Q: Are gold IRAs worth it?

A: Whether a gold IRA is worth it for an individual investor depends on various factors such as their financial situation, investment goals, risk tolerance, and personal preferences. It is important to weigh the potential benefits and drawbacks before making a decision.

On one hand, gold, along with other precious metals, has been historically known to offer a hedge against inflation and economic uncertainty. The value of precious metals tends to be less affected by market fluctuations and can help to protect the value of an individual's retirement savings during times of economic instability. Additionally, a gold IRA can provide diversification to an investment portfolio, thereby reducing overall risk.

However, it is also important to consider some potential drawbacks of investing in a gold IRA. Precious metals, including gold, can be considered illiquid investments, meaning that it can be difficult to sell the assets quickly for cash. Additionally, the cost associated with setting up and maintaining a gold IRA, such as storage and insurance fees, can also be a consideration. It is important to note that investing in a gold IRA is not a guarantee of returns, and the value of the investment can fluctuate depending on various factors such as supply and demand, economic conditions, and market trends.

On the date of publication, Barchart Reach did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)