Insurance services company Assurant (NYSE:AIZ) announced better-than-expected revenue in Q4 CY2025, with sales up 7.9% year on year to $3.35 billion. Its non-GAAP profit of $5.61 per share was 1.9% above analysts’ consensus estimates.

Is now the time to buy Assurant? Find out by accessing our full research report, it’s free.

Assurant (AIZ) Q4 CY2025 Highlights:

- Net Premiums Earned: $2.71 billion vs analyst estimates of $2.68 billion (5.8% year-on-year growth, 0.8% beat)

- Revenue: $3.35 billion vs analyst estimates of $3.30 billion (7.9% year-on-year growth, 1.4% beat)

- Pre-tax Profit: $283.5 million (8.5% margin)

- Adjusted EPS: $5.61 vs analyst estimates of $5.50 (1.9% beat)

- Market Capitalization: $11.79 billion

"Our 2025 performance underscores the position of strength from which Assurant continues to operate, delivering our ninth consecutive year of profitable growth. The strength and resilience of our results reflect the power of our diversified business model and our relentless focus on serving clients and creating value for shareholders. Sustained investments in innovation have transformed our operations and product offerings, supporting our partners, driving efficiencies, and elevating the customer experience. The results are clear: new and expanded partnerships with leading global brands; differentiated, technology‑enabled solutions; and continued growth in attractive, expanding markets – including the recent launch of Assurant Home Warranty – all underpinned by strong financial outperformance,” said Assurant President and CEO Keith Demmings.

Company Overview

With roots dating back to 1892 when it was founded by a Civil War veteran, Assurant (NYSE:AIZ) provides specialized insurance products and services that protect major consumer purchases like mobile devices, vehicles, homes, and appliances.

Revenue Growth

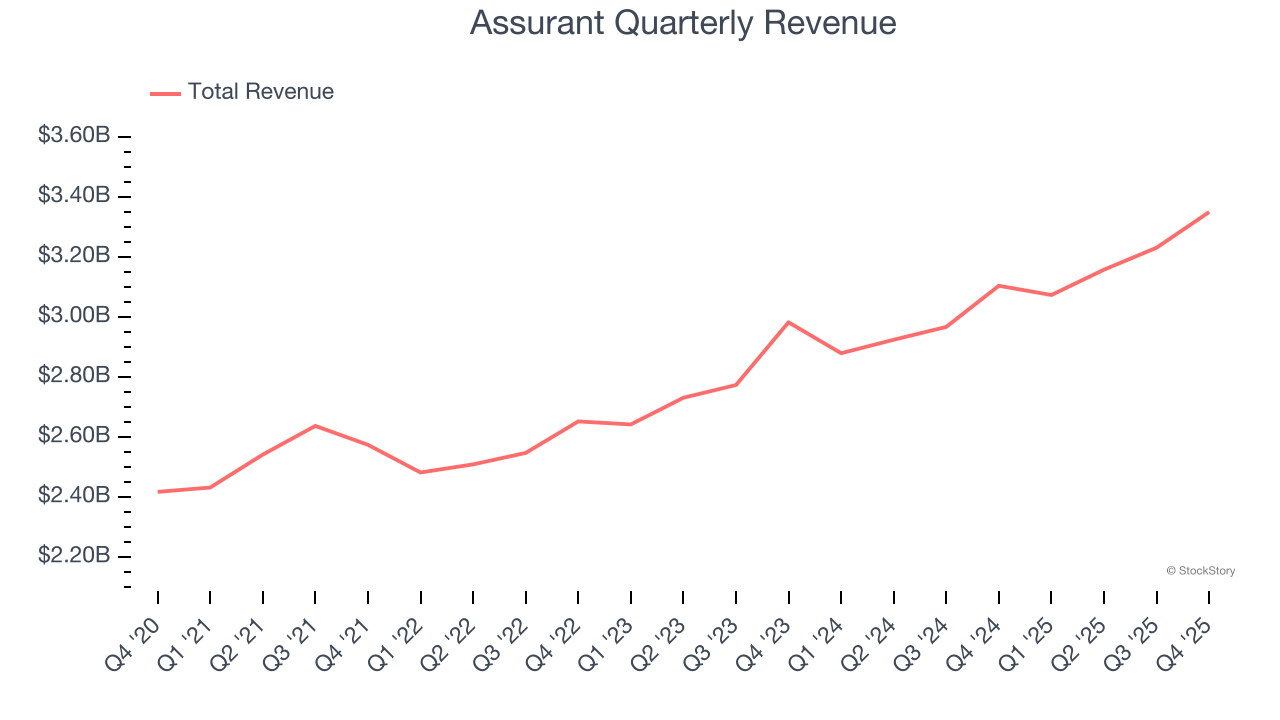

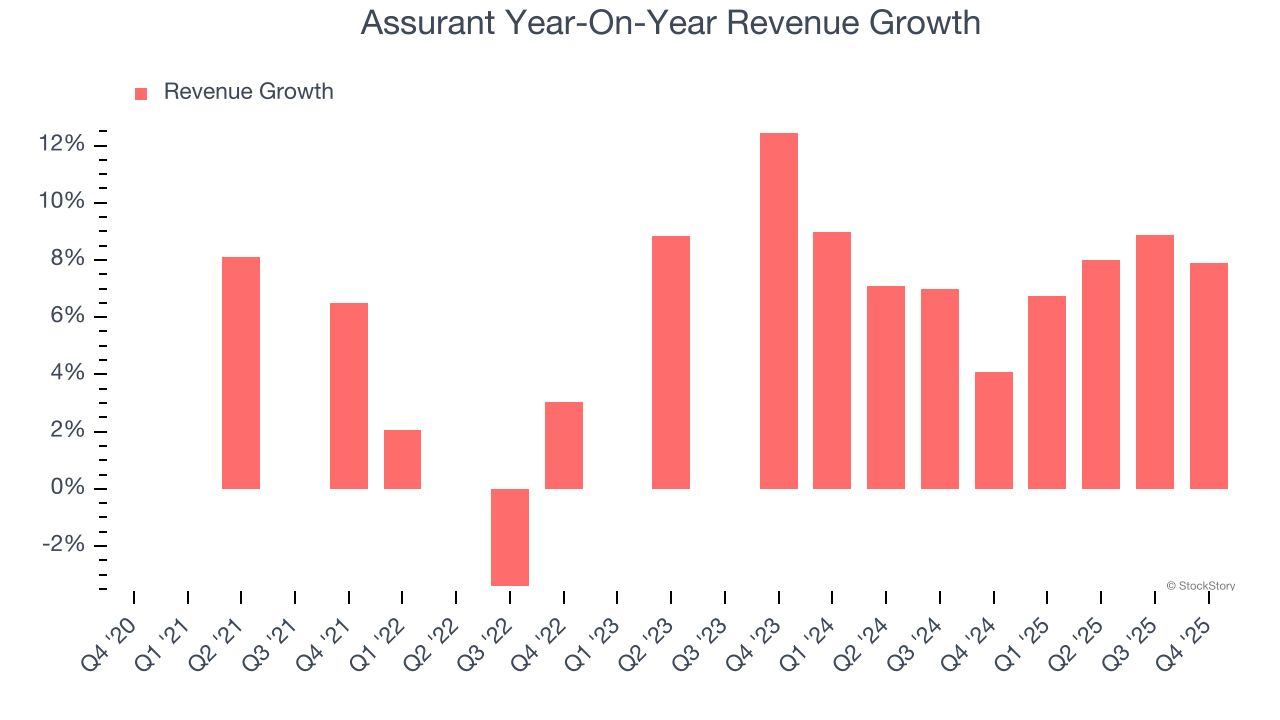

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, Assurant grew its revenue at a tepid 6% compounded annual growth rate. This was below our standard for the insurance sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Assurant’s annualized revenue growth of 7.3% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Assurant reported year-on-year revenue growth of 7.9%, and its $3.35 billion of revenue exceeded Wall Street’s estimates by 1.4%.

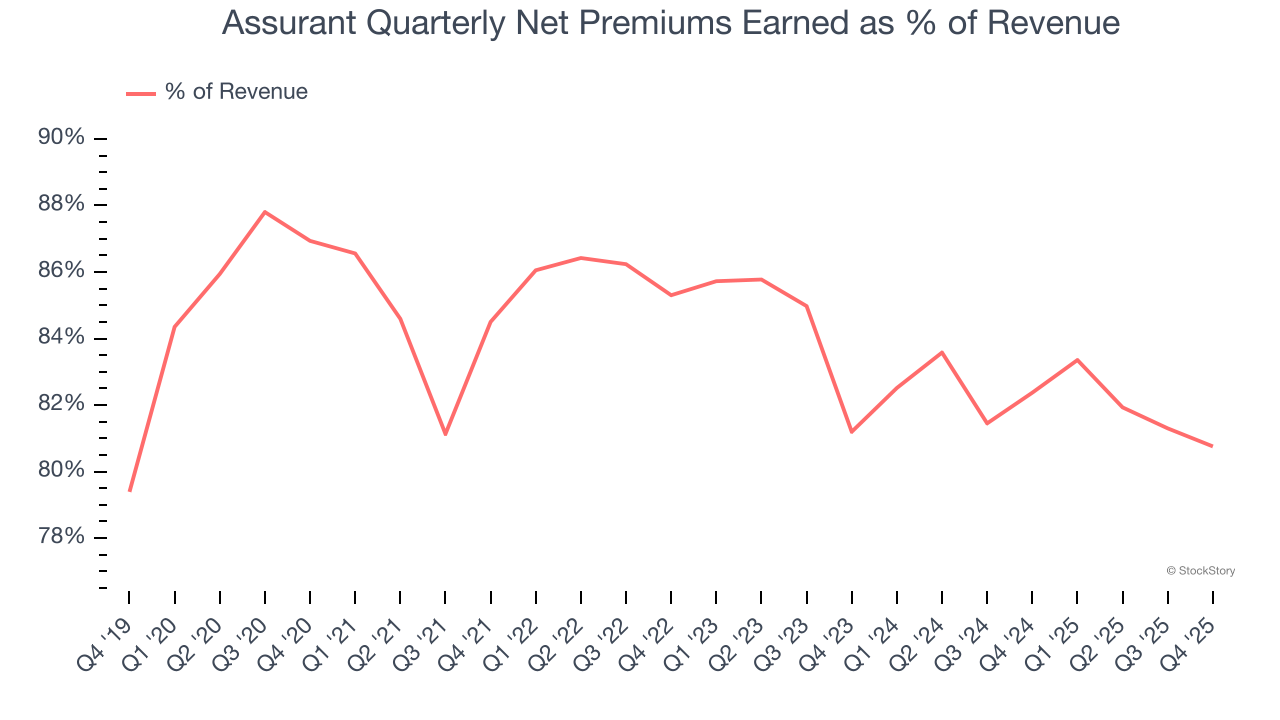

Net premiums earned made up 83.6% of the company’s total revenue during the last five years, meaning Assurant barely relies on non-insurance activities to drive its overall growth.

Net premiums earned commands greater market attention due to its reliability and consistency, whereas investment and fee income are often seen as more volatile revenue streams that fluctuate with market conditions.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Net Premiums Earned

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

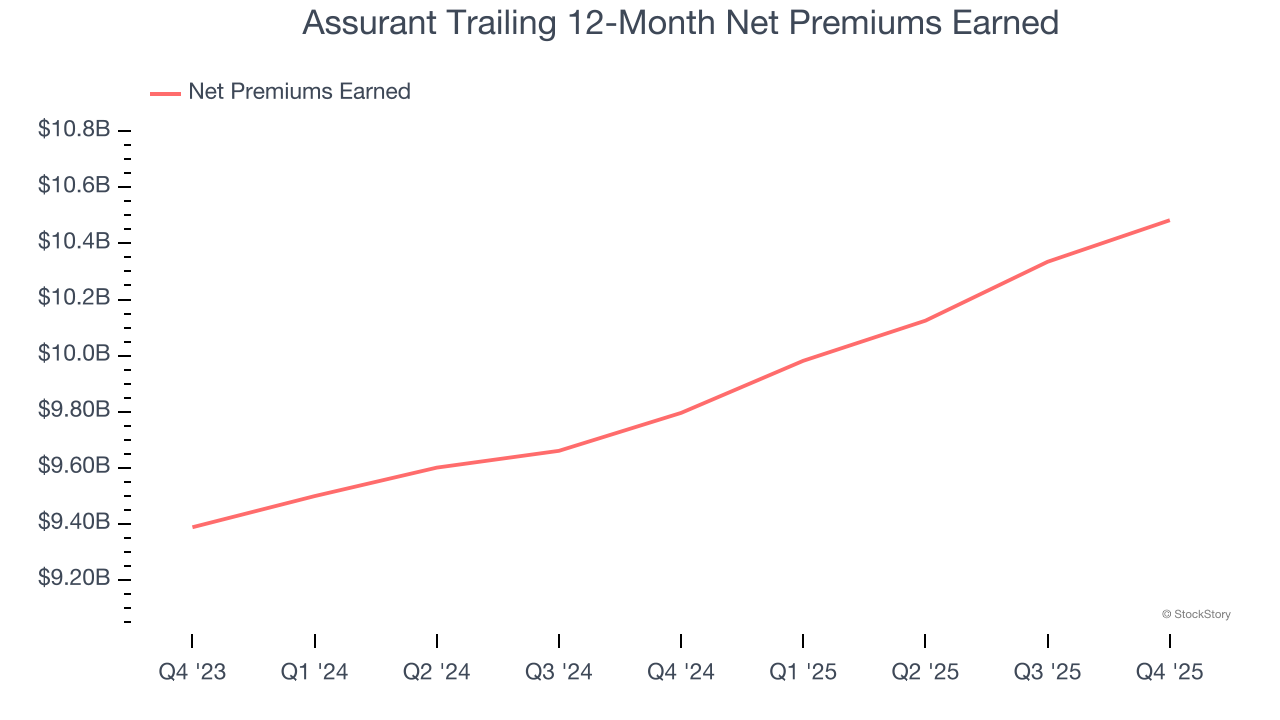

Assurant’s net premiums earned has grown at a 4.8% annualized rate over the last five years, worse than the broader insurance industry and slower than its total revenue.

When analyzing Assurant’s net premiums earned over the last two years, we can paint a similar picture as it recorded an annual growth rate of 5.7%. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these supplementary streams affect the bottom line, their contribution can fluctuate. Some firms have been more successful and consistent in investing their float over the long term, but sharp movements in the fixed income and equity markets can play a substantial role in short-term performance.

In Q4, Assurant produced $2.71 billion of net premiums earned, up 5.8% year on year and in line with Wall Street Consensus estimates.

Key Takeaways from Assurant’s Q4 Results

It was good to see Assurant narrowly top analysts’ revenue expectations this quarter. We were also happy its net premiums earned narrowly outperformed Wall Street’s estimates. On the other hand, its EPS slightly beat. Zooming out, we think this was a mixed quarter. The stock remained flat at $235.15 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)