- Grain and oilseed markets are weather derivatives at their core, and in the case of the US HRW wheat market that weather is an ongoing drought across the Southern Plains growing region.

- Fundamentally the market has been, is, and should continue to be extremely bullish based on inverted futures spreads.

- Seasonally Kanas City wheat (both cash and futures) tends to rally through the spring, though this year could see an extended move if weather patterns don't change.

Pour yourself a nice wheat beer or wheated whiskey, and let’s talk about the crop that’s not. Last weekend I had the privilege of speaking at the South Dakota Corn Growers Association 37th Annual Corn Conference, and one of the last questions I was asked had to do with wheat. My good friend and emcee of the event Mike Pearson wanted to know if the recent reported increase in winter wheat planted acres[i] would weigh on the US hard red winter (HRW) wheat market. I actually laughed out loud and replied something to the effect, “It doesn’t matter if the US planted 50 million acres or 100 million acres, the crop isn’t there.”[ii]

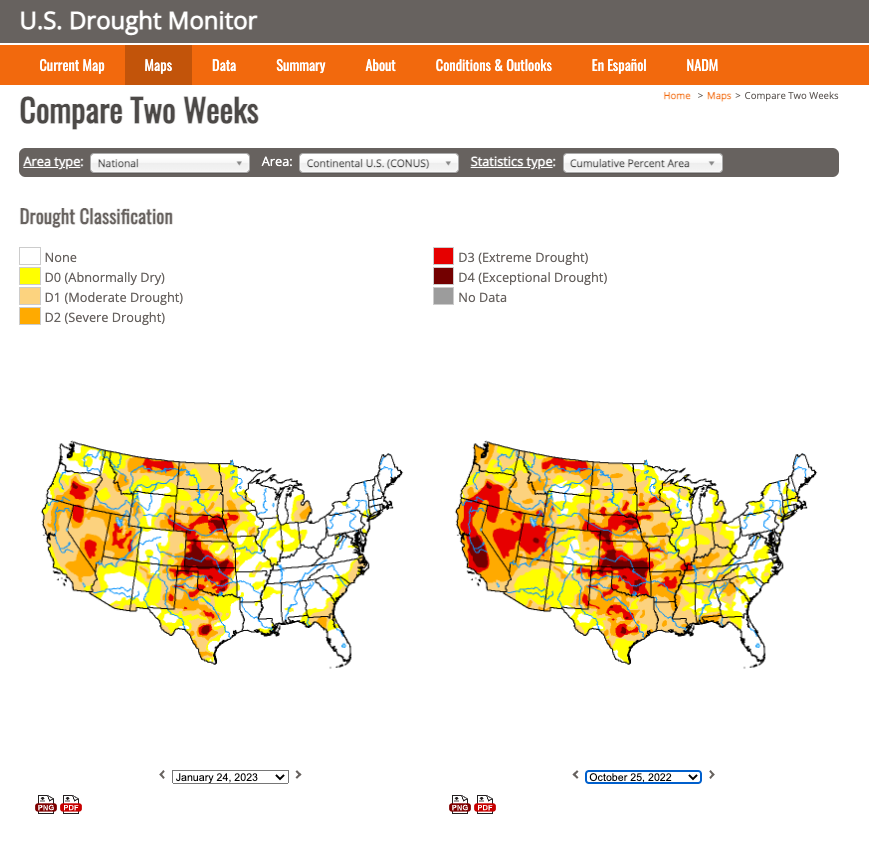

Where did it go? A look at the latest US Drought Monitor Map shows much of the US Southern Plains HRW growing area continues to show extreme to exceptional drought readings. I say ‘continues’ because if we go back three months to late October 2022, roughly the end of the 2023 winter wheat crop planting season, we see the situation was much the same as it was this week for the two largest HRW producing states of Kansas and Oklahoma. I’ve talked to folks in the area, and many of them tell me they’ve not seen a situation like this in all their years of farming. But in the next breath we all agree wheat, the cockroach of the grain world, could still find a way to produce something.

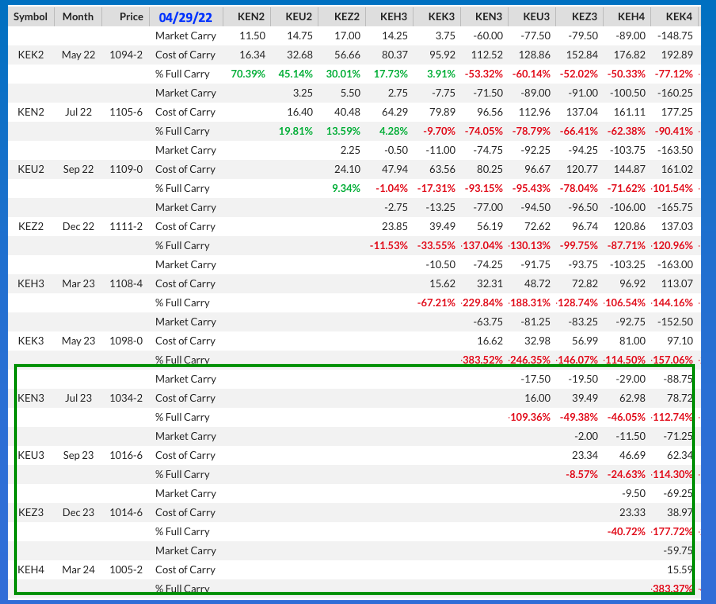

I know a lot of folks want to talk about NASS’ crop condition reports[iii], but I don’t. I’ve seen many attempts to find a correlation between fall winter wheat conditions (numbers that are absolutely made up) and the next summer’s production. The connection DOES NOT EXIST. But why would it? Again, NASS’ numbers are simply pulled from the imagination. What we do know though is the 2023-2024 Kansas City futures spreads have been inverted[iv] since at least the close of April 2022. Why? Because most of the same growing area was showing extreme drought back then as well. Based on this, it seems many wheat farmers across the US Southern Plains were living by the old saying, “Plant in the dust and the bins will bust”.

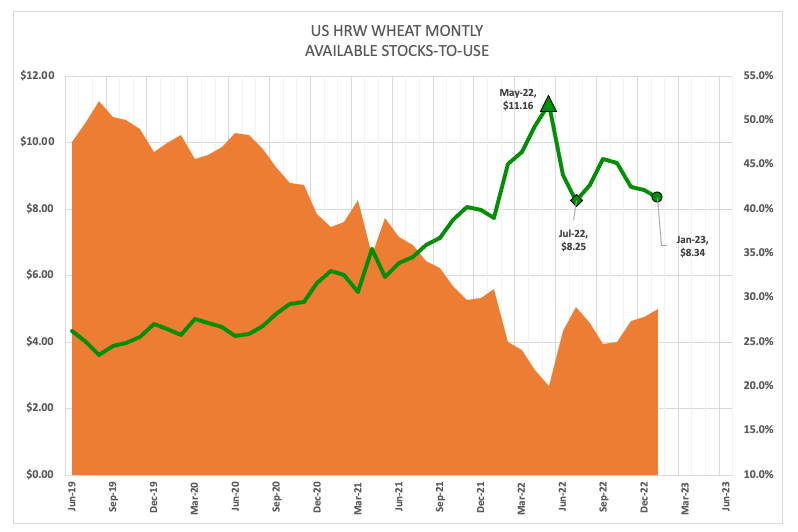

I can hear your questions from across the internet, “If new-crop HRW is so bullish, why did the cash market (KEPAUS.CM) lose 42% of its value from the May 2022 high of $13.2145 through this month?” A couple reason: First, the Wheat Reality (One bushel of wheat left over is too many) and second, The Krampus Countdown (Don’t be long wheat in December). We’ve also seen a slowdown in demand for US HRW wheat, a fact reflected in my monthly available stocks-to-use (as/u) calculation[v] based on the market’s cash index. Heading into Friday’s session this index was calculated near $8.34 correlating to as/u of 28.7% as compared to the July 2022 harvest low of $8.25 and 29%. This chart also shows us the market is at a crossroads: It could either continue in its downtrend by taking out the July low or start moving higher once again. Seasonally the national average cash market tends to rally from early September through late May, adding a total of 32% to its value along the way. If we go back to the low weekly close from late July of $7.69 and add 32%, the high weekly close would be projected at $10.15.

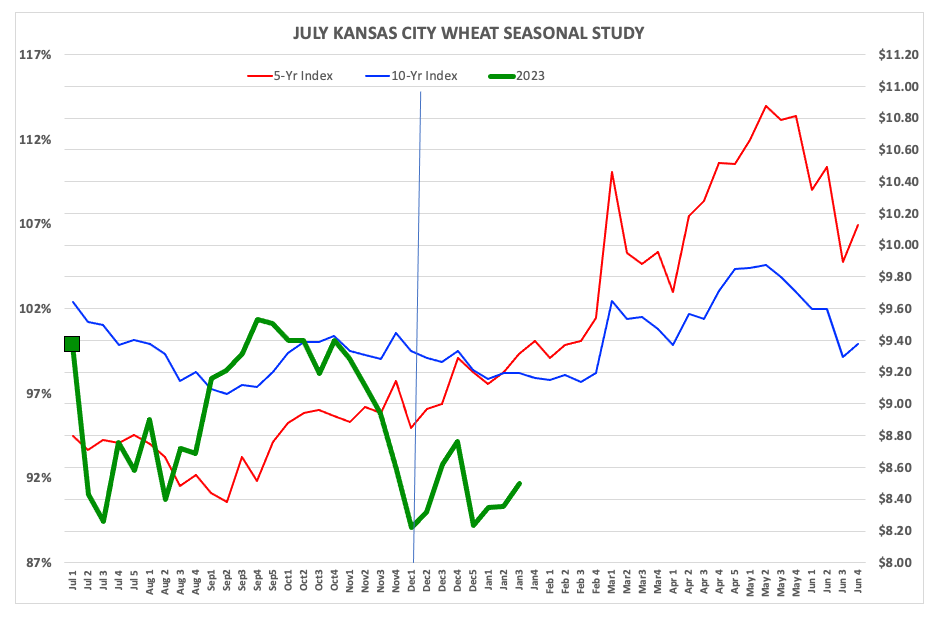

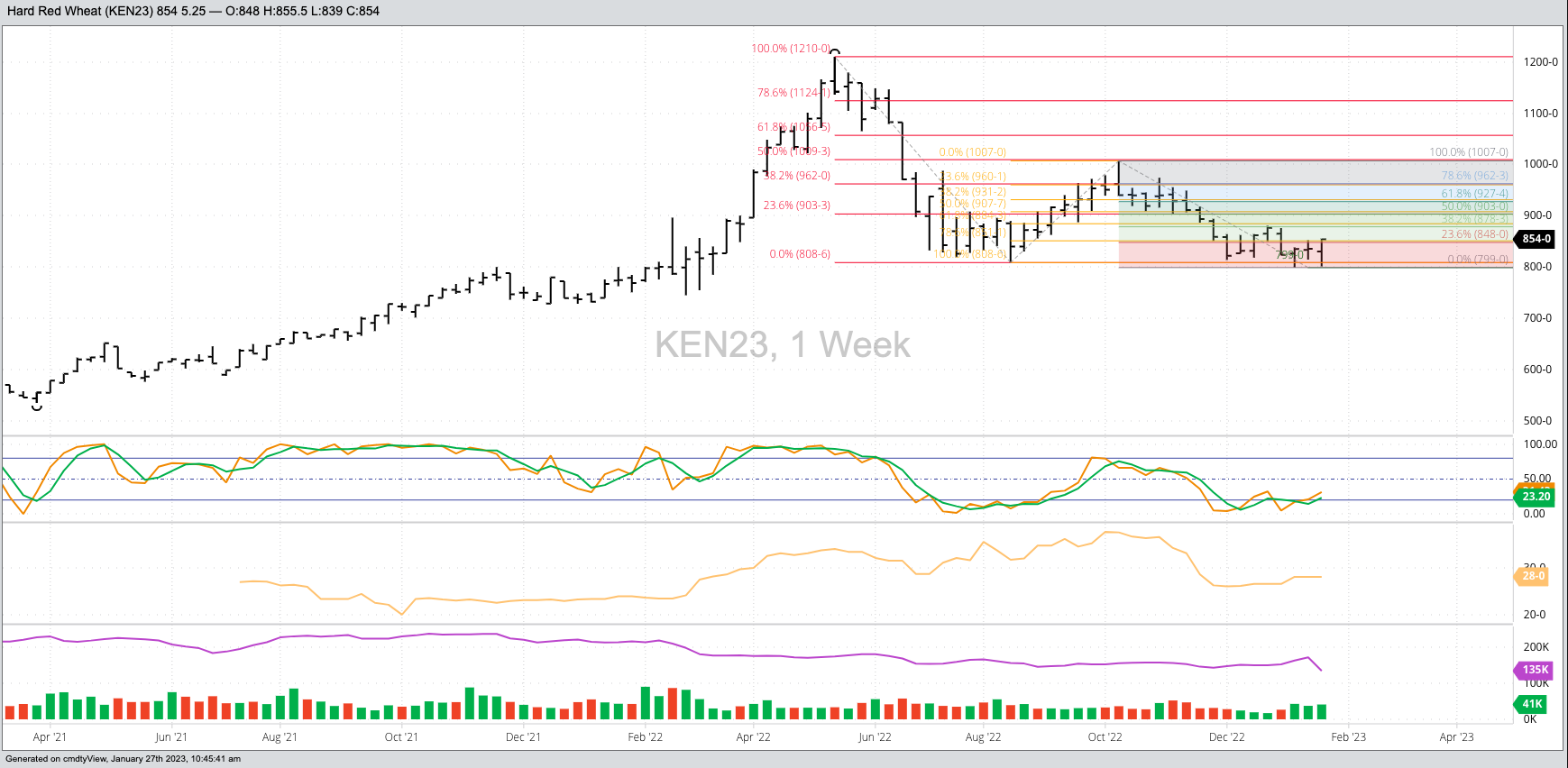

But what about new-crop July? After all, this is the crop that isn’t there. From the first weekly close of December through the second weekly close of May the July contract tends to gain 19%. The 2023 futures contract (KEN23) closed the first week of December 2022 at $8.22, projecting a possible high weekly close near $9.80 late next spring. Such a move would put the contract within sight of its October 2022 high of $10.07, a move that makes sense given the market’s continued inverted futures spreads on strong likelihood of the Southern Plains drought continuing.

Where the crop winds up going is anyone’s guess. Wheat is difficult any year, but made more so when the crop simply isn’t there.

[i] From the always entertaining and seldom informative USDA, this time the annual January Winter Wheat and Canola Seedings report.

[ii] For the record, USDA guessed all US winter wheat acres to be 37.0 million, up 11% from 2022.

[iii] I call these folks The Conditioners, and never take them seriously due to the fact NASS itself has said it only releases these weekly numbers because they are “popular”. As I’ve often said, this makes them the Kardashians of government reports.

[iv] As we all know by now, when it comes to a storable commodity like wheat an inverse is an inverse no matter how small, and inverses are always fundamentally bullish.

[v] This is no way, shape, or form related to ending stocks-to-use calculations arrived at using USDA’s imaginary estimates each month. Mine are based on the Unknown Variable Solution or solving for as/u by relating it to the intrinsic value of the market.

More Grain News from Barchart

- Friday Fading in Wheat Markets

- Mixed Friday Beans so far

- Weak Corn Trade for Friday So Far

- KC Wheat Extends Rally with 2% Gains

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)