In my January 5 article on Base Metals in Q4 and Beyond on Barchart, I wrote:

As we move into 2023, the short-term path of least resistance in the base metals is higher. Many of these metals are critical for green energy initiatives, which will likely support the prices. Moreover, as China emerges from its COVID-19 lockdowns and protocols, economic growth in the world’s leading base metals-consuming country could cause rallies. I am bullish on the prospects of the nonferrous metals sector heading into 2023.

Nearby COMEX copper futures closed 2022 at $3.8105 per pound. On January 24, the red metal was above $4.20 and trending higher.

A correction leads to a bullish trend since July 2022

In March 2022, nearby COMEX copper futures rose to a record $5.01 per pound high.

The long-term chart dating back to the late 1960s shows after probing above $5, copper futures corrected 37.1% to a $3.15 low four months later in July 2022. The long-term trend remained higher as copper futures made higher lows and higher highs since 2001.

From a short-term perspective, March copper futures have been moving higher since the week of July 15, 2022.

China is critical for the path of least resistance of copper prices

While rising interest rates and a two-decade high in the U.S. dollar index weighed on copper in mid-2022, China’s COVID-19 lockdowns and its slowing economy were the primary culprits pushing copper and other nonferrous metals and commodities lower.

China is the world’s most populous country with the second-leading global economy. China is the demand side of many commodity markets’ fundamentals, and copper is no exception.

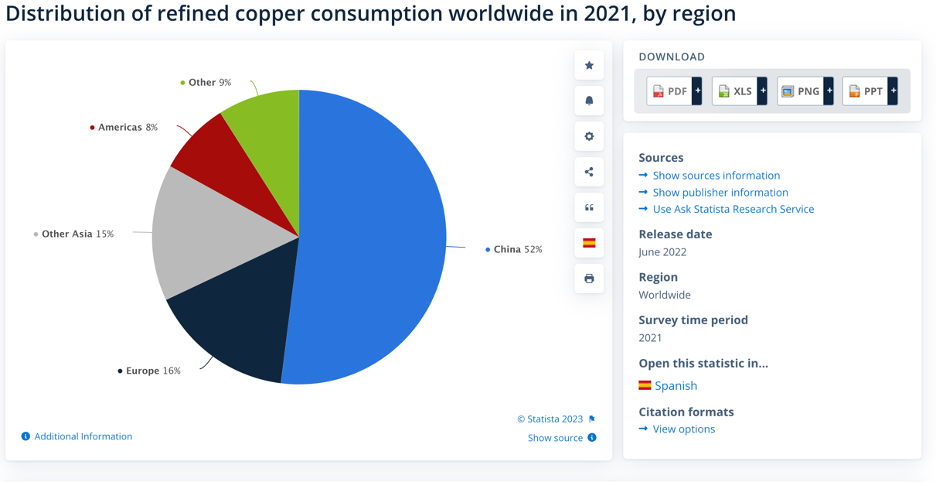

Source: Statista

As the chart shows, China consumed 52% of the world’s refined copper in 2021.

As China emerges from its COVID-19 protocols in 2023, copper demand will likely increase.

Green energy requires the metal

Goldman Sachs’ analysts called copper “the new oil” because of its requirements in electric vehicles, wind turbines, and other green initiatives. As the U.S., Europe, and many other countries work to lower their carbon footprints, copper plays a significant role.

A combination of more demand from the green energy sector and a return of Chinese demand tightens copper’s balance sheet when supplies struggle to keep pace with rising requirements.

A deficit over the coming years- Inventories are declining

It takes the better part of a decade to bring new copper mines online. Moreover, many new projects are in challenging countries like the Democratic Republic of Congo, with its long history of corruption. Chile, the world’s leading copper producer, is experiencing a decline in copper output. Meanwhile, inventories on the London Metals Exchange have been moving lower.

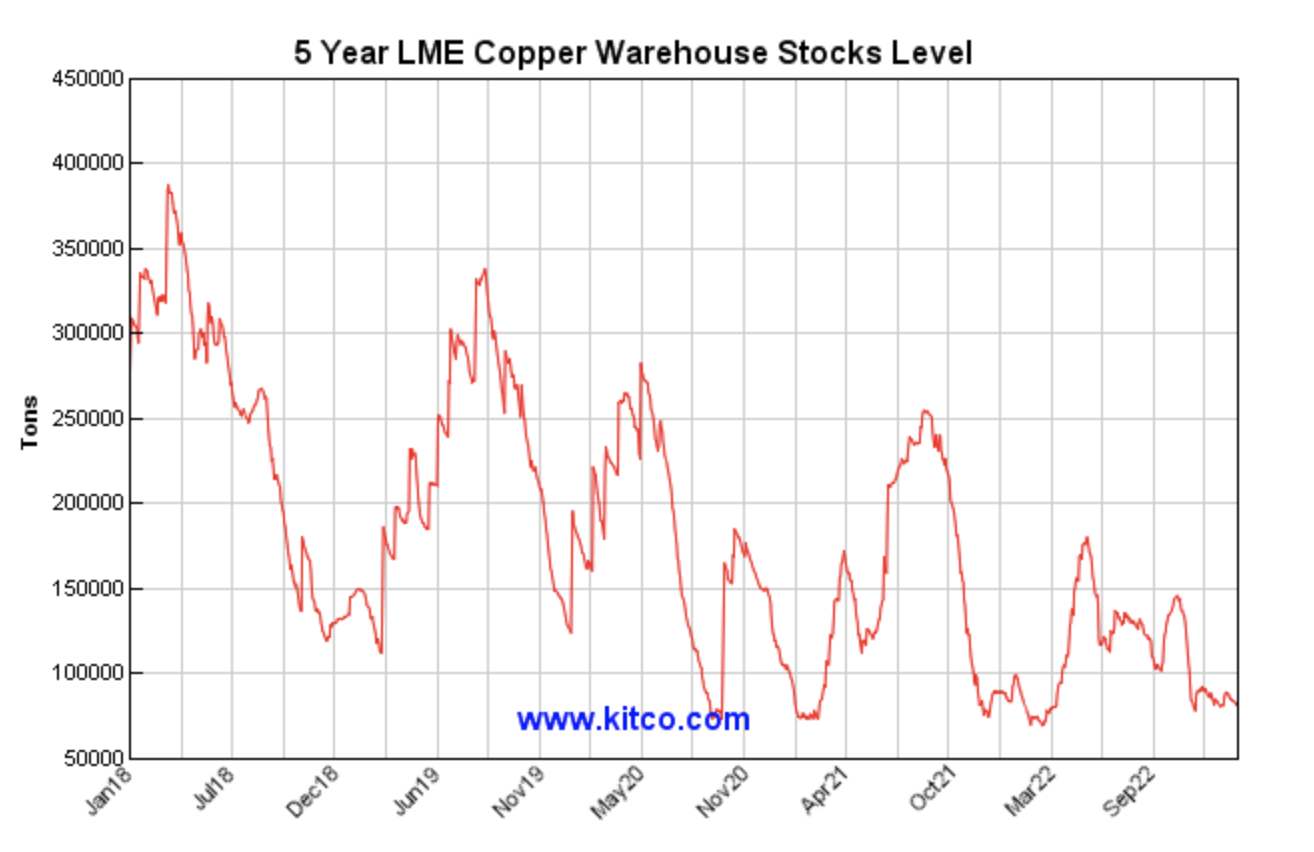

Source: LME/Kitco

The chart shows the five-year trend of declining copper inventories. As of January 23, LME stocks stood at 78,300 metric tons.

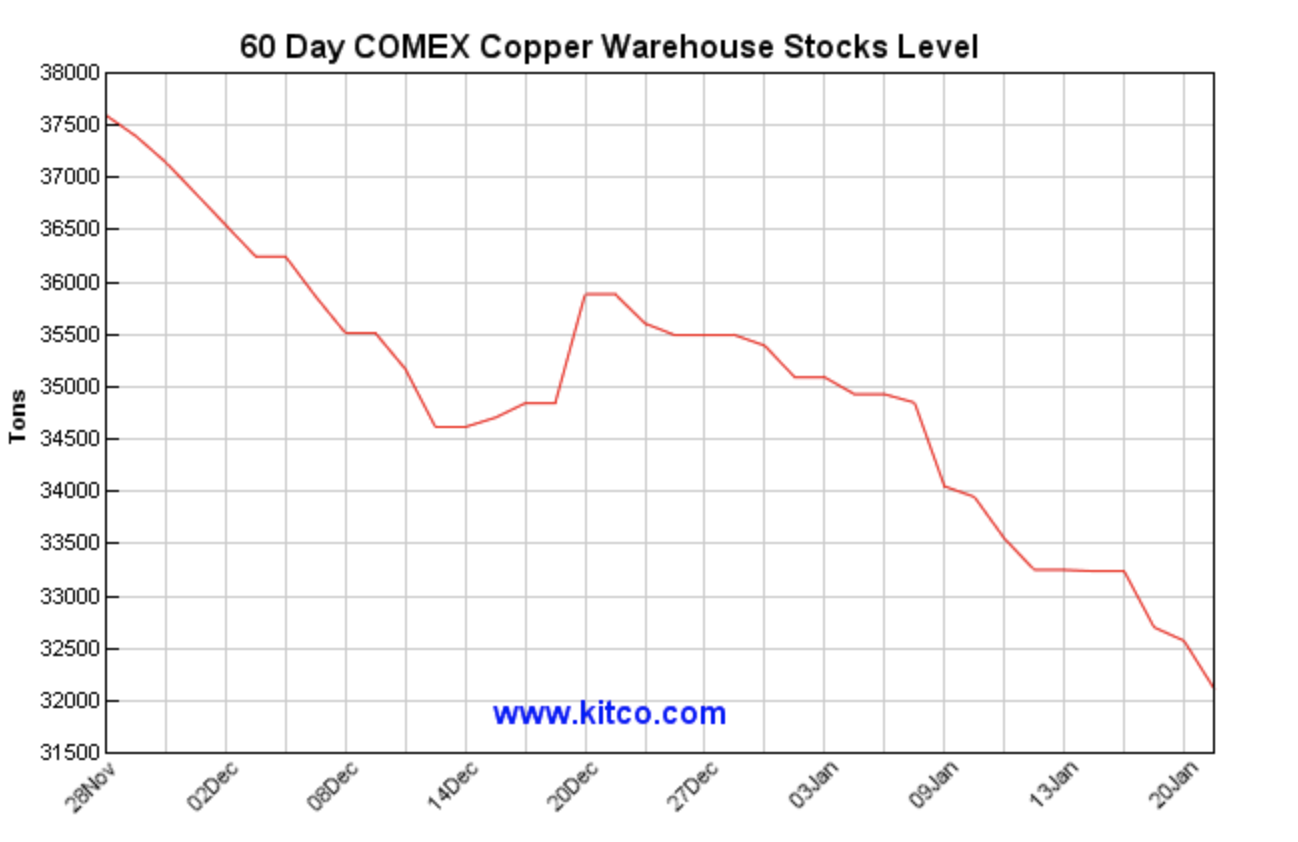

Source: CME-COMEX/Kitco

Over the past two months, COMEX copper warehouse stocks have declined from over 37,500 to just over 32,000 tons.

Increasing demand and falling production and stockpiles are the ingredients of a deficit. Copper producers are scrambling to bring new output to the market, but Goldman believes that the tight market will push the price to the 15,000 per ton level over the coming years, translating to a COMEX futures price above $6.80 per pound.

Levels to watch in the copper futures market

The high and low in 2022 at $5.01 and $3.15 on nearby COMEX copper futures are the critical technical resistance and support levels for 2023. With the futures over the $4.20 level, the first support is at the late-November 2022 $3.5410 low. On the upside, the $4.5675 high from the week of May 30, 2022, is the first technical resistance target.

The most direct route for a risk position in copper is via the LME forwards and the COMEX futures and futures options. An ETF and an ETN move higher and lower with the copper price:

- At $25.79, the U.S. Copper ETF product (CPER) had $189.85 million in assets under management. CPER trades an average of 266,544 shares daily and charges an 0.88% management fee.

- At $21.51, the iPath Series B Copper Subindex TR ETN product (JJC) had $70.83 million in assets under management. JJC trades an average of 43,680 shares daily and charges a 0.45% management fee.

CPER and JJC are alternatives to copper futures and forwards as they do an excellent job tracking the red metals’ price action.

Bull markets rarely move in straight lines. The copper bull market experienced a significant correction from March through July 2022, but the nonferrous metal appears to be back on a path to challenge the record high and set new milestones on the upside.

More Metals News from Barchart

- Stocks Post Moderate Losses Ahead of Tech Earnings

- Dollar Firms on Higher T-Note Yields

- Stocks Rally as Technology Stocks Jump Ahead of Earnings

- Dollar Gains Fade on Dovish Fed Comments

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)