On December 21, in a piece on Barchart, I chronicled how the asset class was digesting a turbulent 2022. In that article, I pointed out, “Supporters point to Bitcoin’s bust and boom history, comparing the FTX debacle to Mount Gox’s 2014 bankruptcy. When the Mount Gox dust settled, Bitcoin’s dizzying rise continued, and many new cryptocurrencies burst on the scene.”

In early 2023, the odds of another boom following on the heels of the November 2021 through December 2022 bust could be developing. Bitcoin and Ethereum have posted impressive gains over the past weeks.

Bitcoin takes off on the upside and approaches critical technical resistance levels

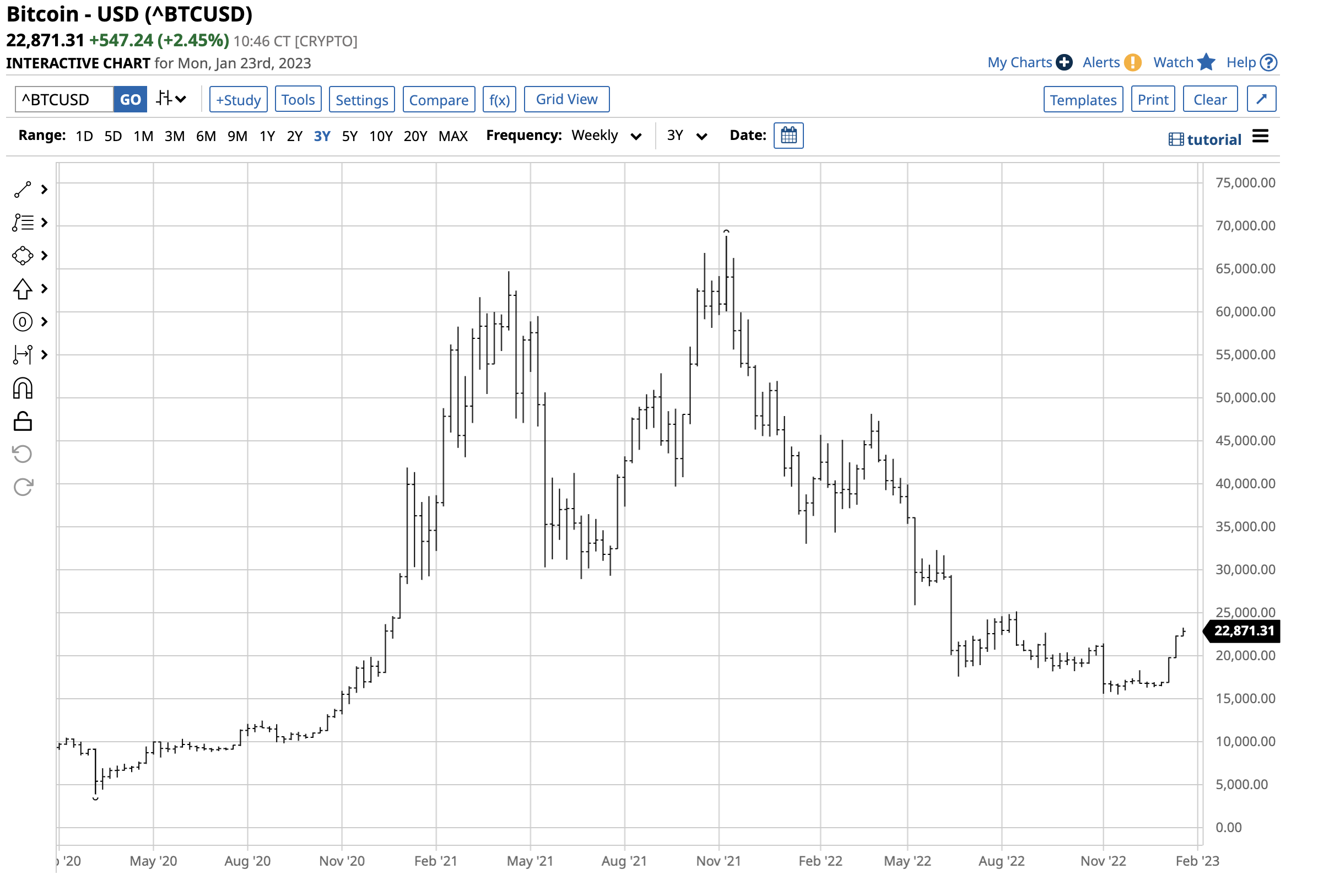

Bitcoin’s decline from the November 2021 $68,906.48 record peak to the November 2022 $15,516.53 low took the leading cryptocurrency 77.5% lower.

The chart highlights the decline and the early November 2022 spike lower as FTX went under. Bitcoin established a bottom in November 2022 and recovered to a high of $23,309.06 in January 2023, a 50.2% rise from the low.

Bitcoin moved above its first technical resistance level at the early November 2022 $21,466.76 high. The next technical upside target stands at the August 2022 $25,198.76 peak. While Bitcoin ended the pattern of lower highs and lower lows with the move to over $23,300, it has lots of technical work ahead as the chart has many resistance levels established as the price plunged.

Ethereum has done even better on a percentage basis since the 2022 low

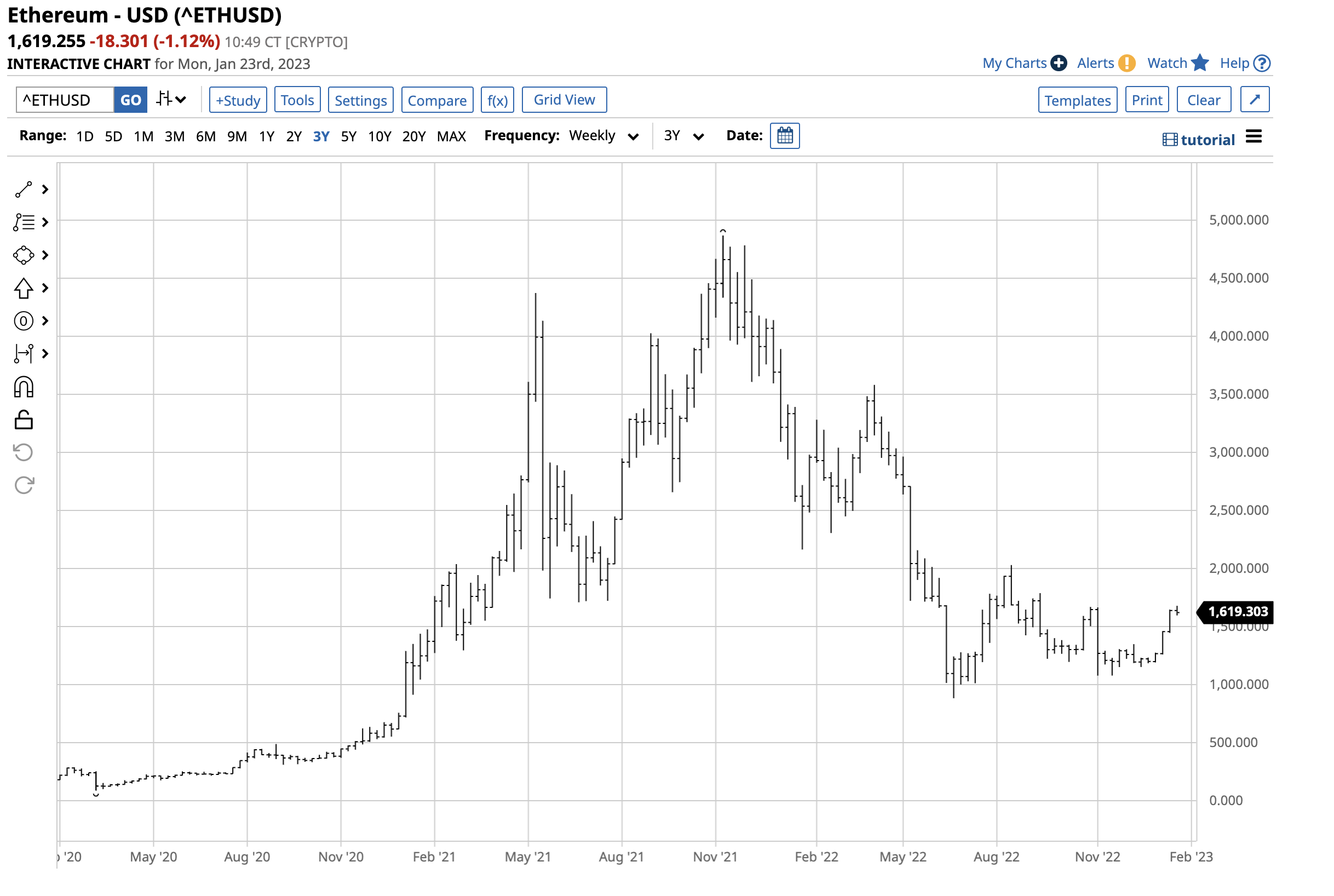

Ethereum’s decline from the November 2021 $4,865.426 record peak to the June 2022 $883.159 low took the second-leading cryptocurrency 81.8% lower.

The chart highlights at the $1,619.255 level on January 23, 2023, Ethereum recovered 83.3% from the 2022 low. Ethereum shifted from a “Proof-of-work” to a “Proof-of-stake” protocol, which helped the crypto with the second highest market cap outperform Bitcoin since the most recent lows.

The market cap is back near the $1 trillion level

The cryptocurrency asset class’s market cap peaked at over $3 trillion in late 2021. After plunging to around one-quarter of that level in 2022, the value was over $1.04 trillion on January 23. Bitcoin and Ethereum account for the lion’s share of the market cap, with Bitcoin’s over $441 billion at 42.2% and Ethereum’s over $198 billion at 19.0%. Together, the two leading cryptocurrencies’ value is over 61% of the asset class’s value, with over 22,330 other cryptocurrencies floating around in cyberspace. Meanwhile, Bitcoin and Ethereum are the only two cryptos with market caps above the $67 billion level.

Regulation could help the asset class, but ideological devotees will resist too much government intervention

Cryptocurrencies’ ideology transcends borders, and devotees believe they will replace fiat currencies that derive value from the full faith and credit of the countries that issue legal tender. Cryptos remove the power of the purse from governments and return it to individuals as prices are established by bids and offers in the marketplace. Governments routinely manipulate currency markets via monetary policies that impact the money supply.

Meanwhile, governments guarantee some fiat currency deposits in financial institutions, while cryptos lack deposit insurance from agencies like the U.S.’s FDIC. The high-profile FTX bankruptcy has caused many regulators and legislators to focus on the potential for systemic risks caused by failures in the burgeoning asset class. Therefore, heightened regulation is likely on the horizon. Leading cryptocurrency platforms and stakeholders will seek a say in the regulatory environment. FTX’s Sam Bankman-Fried and his colleagues made significant political contributions, likely influencing the regulatory and legislative landscape.

Since cryptos are ideologically opposed to government intervention, there will likely be a significant debate about the regulatory environment. However, as volatile assets, the SEC, CFTC, and legislative bodies will seek to protect against systemic risks with coordinated regulatory policies. Increased reporting and supervision could cause a lower potential for FTX-like scandals and bankruptcies.

If history is a guide, the boom has head-spinning potential

Cryptos have become the most volatile asset class, and the price variance has a magnetic effect on market participants. Bitcoin was at five cents in 2010; anyone who spent $1 to buy twenty Bitcoins thirteen years ago was sitting on $458,000 at $22,000 per token. At the November 2021 high, that $1 investment was worth more than $1.3 million. While the risk of loss is always a function of potential rewards, even the most conservative investors would put up a buck to make hundreds of thousands or a million dollars.

Bitcoin, Ethereum, and cryptos have another highly attractive angle; they are the children of blockchain, the widely embraced financial technology innovation. Moreover, while the prices plunged from the late 2021 highs to the 2022 lows, cryptos have experienced similar percentage moves and price volatility over the past decade. Price carnage over the past years has led to new highs in Bitcoin, Ethereum, and many other cryptos. Therefore, the current recovery could be a launchpad for another boom period where prices take off on the upside, and volatile insanity returns to the asset class.

Last week, JP Morgan CEO Jamie Dimon called Bitcoin a “pet rock” and said, “Crypto is a decentralized Ponzi scheme” and a “hyped-up fraud.” It is not the first time the head of one of the world’s leading financial institutions or other high-profile financial gurus warned against the asset class. However, Bitcoin and other cryptos have many high-profile supporters and have experienced significant past rallies in the face of negative comments.

Bitcoin, Ethereum, and cryptos are recovering in early 2023, and time will tell if they blast off on the upside over the coming weeks and months. Anyone dipping a toe in the asset class should realize that the risk is a function of the potential rewards and only risk capital you are willing to lose.

More Crypto News from Barchart

- Should Investors Worry About Insider Selling for Nvidia (NVDA)?

- Unusual Options Volume for Bit Mining (BTCM) Both Compels and Concerns

- 3 Factors to Watch as Investors Gauge the Cryptocurrency Market in 2023

- Pick Your Asset: Silver, Oil, Tesla, or Bitcoin

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)