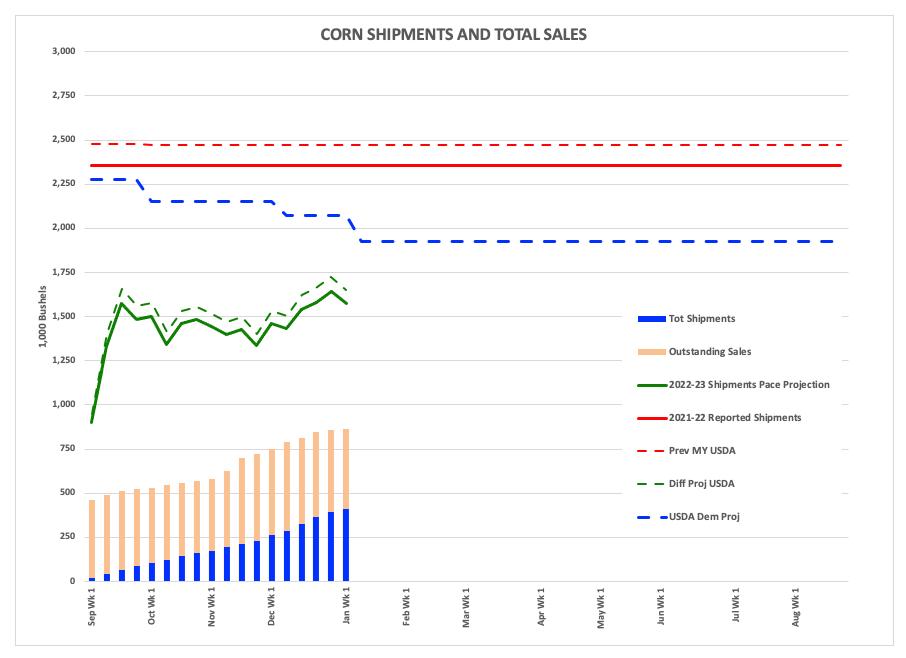

- 2022-2023 US corn total export sales are running 47% behind last marketing year's pace for the same week.

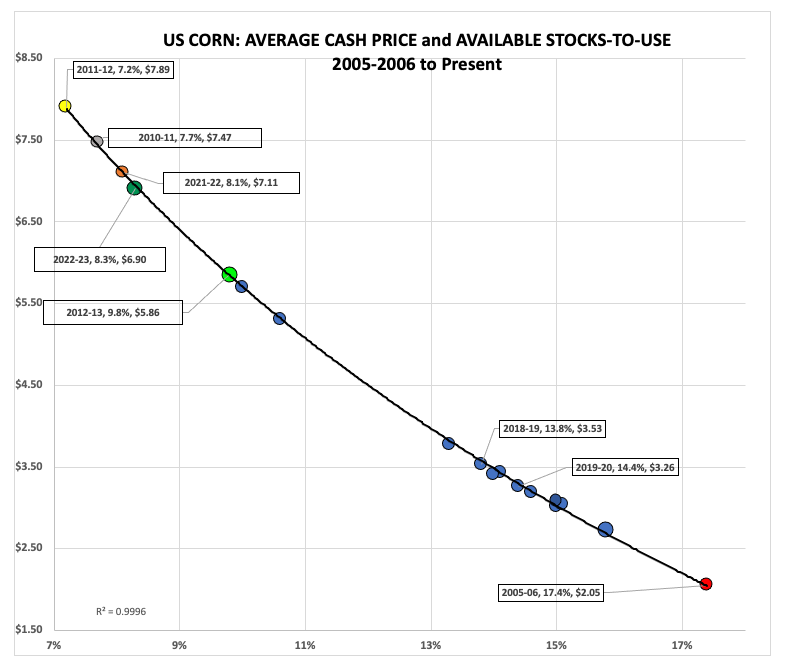

- Much of this could be due to the tightest December available stocks-to-use situation since 2012.

- History shows once US corn production increases again, export demand comes back.

The best part about my job these days is I don’t have to listen to most of the nonsensical chatter in the industry, particularly surrounding USDA data dumps like what occurred this past Thursday. From what I’ve seen, though, the industry hasn’t changed or learned much over times based on a few observations:

- Everyone still wants to talk about USDA’s ending stocks guesses. That’s it, ending stocks. Rather than the big picture of stocks-to-use. And rather than using USDA’s estimates, it isn’t that hard to use real economic information of cash price (see my recent discussion on the matter).

- Disbelief when USDA makes substantial revisions to production via acres, yield, etc. in its January reports. Or better yet, going back to the previous marketing year and adjusting some numbers (e.g. wheat feed demand for 2021-2022).

I could go on, endlessly it seems, but I want to focus on the fear-mongering taking place that falls along the line of, “The US is going to lose all its corn export business to Brazil!” (I don’t honestly know how many exclamation marks to put after that sentence. Feel free to advise.) Are US sales slow so far this marketing year? Yes, or as my friend Susan David described them, “Oof…” But if we look at not only this year but history, there may be more to the slowdown than meets the eye.

In the latest weekly export sales and shipments update, US corn total sales were 866 mb the week ending Thursday, January 5. This was down 47% from the previous marketing year’s 1.632 bb for the same week. Oof indeed. However, recall from my previous piece that my end of December available stocks-to-use calculation, based on a cash index coming in near $6.90, was 8.3%. This is a tight supply and demand situation; in fact it was the smallest December available stocks-to-use since December 2012 when the cash index was $6.92 and available stocks-to-use was also 8.3%.

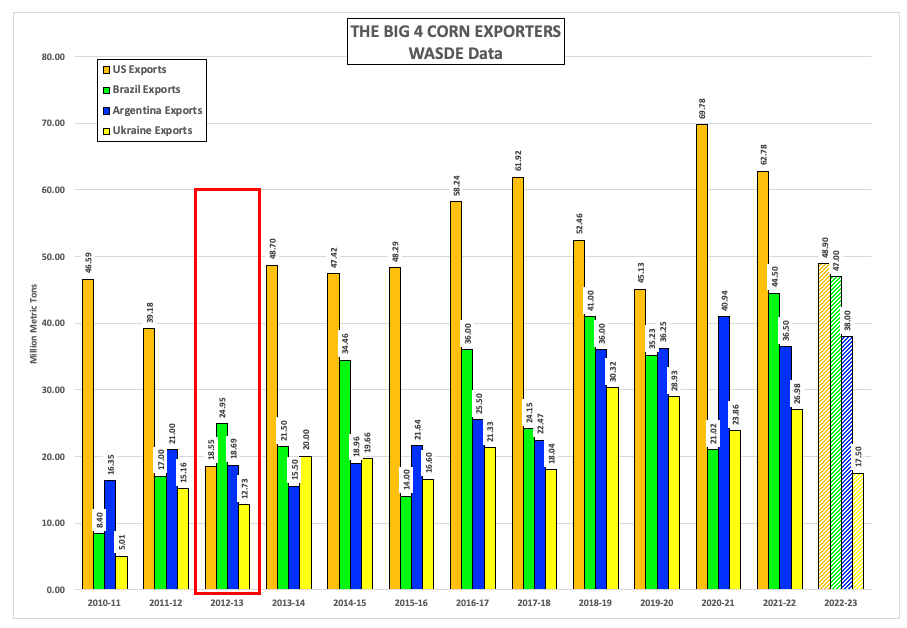

What else do we know about December 2012, besides it was the first month of Q2 of the 2012-2013 marketing year? Take a look at the chart of the world’s Big 4 Corn Exporters (US, Brazil, Argentina, Ukraine), focusing on the box around the 2012-2013 marketing year. That year saw the US reported export 18.55 mmt while Brazil shipped 24.95 mmt and Argentina moved 16.69 mmt (based on WASDE data, so take it for what it’s worth). That was the last time the US was not the global leader in corn exports, and why? Because the 2011-2012 marketing year ended with the cash index at $7.89 and correlating to available stocks-to-use of 7.2%. In other words, the US was basically out of corn. There was nothing to sell or ship. This marketing year looks to be a similar situation.

If history can be used as a guide, acknowledging the jury is still out on that topic, we can see US exports reportedly exploded to 48.7 mmt during 2013-2014and would eventually climb as high as 61.92 mmt during 2017-2018. Then, due in part to a series of trade wars tariffs export demand fell to 45.13 during the 2019-2020 marketing year. Once the US turned that page, and with an assist from Mother Nature, exports jumped to a record 69.78 mmt during 2020-2021. However, the patten since then resembles what was seen from 2010-2011 through 2012-2013, just at a higher level. The latest set of guesses pegged US exports at 48.9 mmt, a number that could continue to come down in subsequent reports. Meanwhile, Brazil’s exports are expected to climb to 47.0 mmt during 2022-2023, similar to the increase seen by the same country between 2011-2012 and 2012-2013.

Lastly, the growth in global corn demand as a whole is fascinating as we can see all four exporters have shown solid increases. The sharp drop in 2022-2023 exports from Ukraine is a lot of things, but not surprising.

The bottom line is 2022-2023 may not be the end times for US corn exports. We’ve seen this story before, and if Mother Nature starts to play nice and US production starts moving up again, it seems logical to think export demand will follow. To borrow a phrase from Field of Dreams, which ironically enough had to do with a corn field in Iowa, “Grow it and they will come.”

More Grain News from Barchart

- Cocoa Prices Firm on Dollar Weakness

- Sugar Climbs on Strength in Crude Oil Prices

- Coffee Rallies for a Second Day on Dollar Weakness

- Mixed Midday for Wheat

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)