- USDA's January data dump includes quarterly Grain Stocks from December 1, a set of monthly Supply and Demand estimates, and the annual Winter Wheat and Canola Seedings report.

- Most of the ag industry won't sleep Wednesday night as they are too excited to see any and all the imaginary numbers USDA will release.

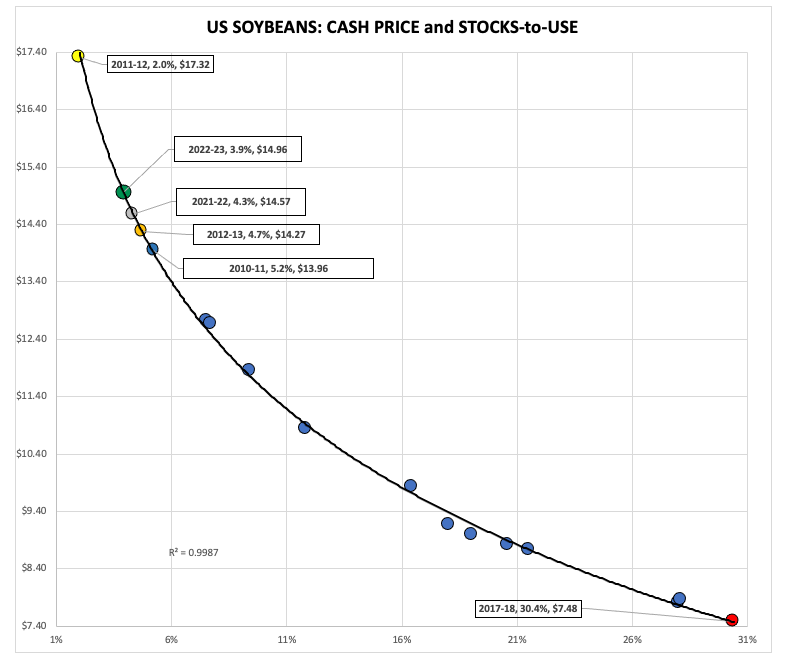

- The reality is if we apply simple economic principles of price correlating to supply and demand, we can know any hour of any day what market fundamentals actually are.

While discussing markets on RFD-TV this morning with my friend Marlin Bohling, the discussion came up that expected quarterly stocks of corn and soybeans as of December 1 are expected to be larger than previous years when USDA releases its latest set of reports Thursday, January 12. Marlin raised the question, why then are cash prices so much higher than what we’ve seen the last couple marketing years? The answer is a look at stocks, or supplies, covers only half the topic of supply and demand. I reminded him that we were both old enough to recall when 1.0 billion bushels (bb) of corn ending stocks was considered large, now it would create a global panic.

This is why I focus on stocks-to-use for the various grain markets, but not the imaginary numbers created by USDA estimates. I use basic economic principles instead, meaning a market’s cash price, it’s intrinsic value, shows us the relationship between supply and demand. Based on this, I can pull the cash price into a continuous chart and show what that day’s available stocks-to-use calculation is. Let me be clear, this is not a guess about ending stocks-to-use, a useless exercise given the unknowns of real supply and demand numbers all while Chaos Theory reigns.

The reality is, regardless of what countless market reporters and commentators tell you, nobody knows what supplies are or what demand will be. Nobody. We are dealing with a set of unknown variables, but despite that we can still come up with an Unknown Variable Solution to available stocks-to-use by understanding the connection between the cash price and supply and demand.

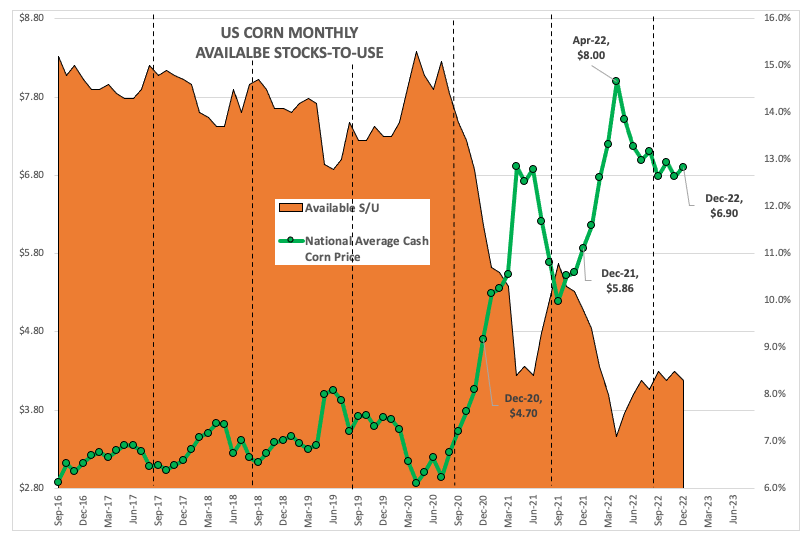

At the end of December 2022, a cash index for corn was calculated near $6.9050, correlating to a month-end available stocks-to-use figure of 8.3%. The end of November saw this same cash index near $6.7850 correlating to available stocks-to-use of 8.5% meaning supply and demand tightened during December. A look back shows us numbers for the end of December 2021 of $5.8650 and 9.8% and December 2020 of $4.7025 and 11.6%. Simply put, demand has continued to strengthen in relation to supplies, and the imaginary numbers don’t matter. The cash market tells us so.

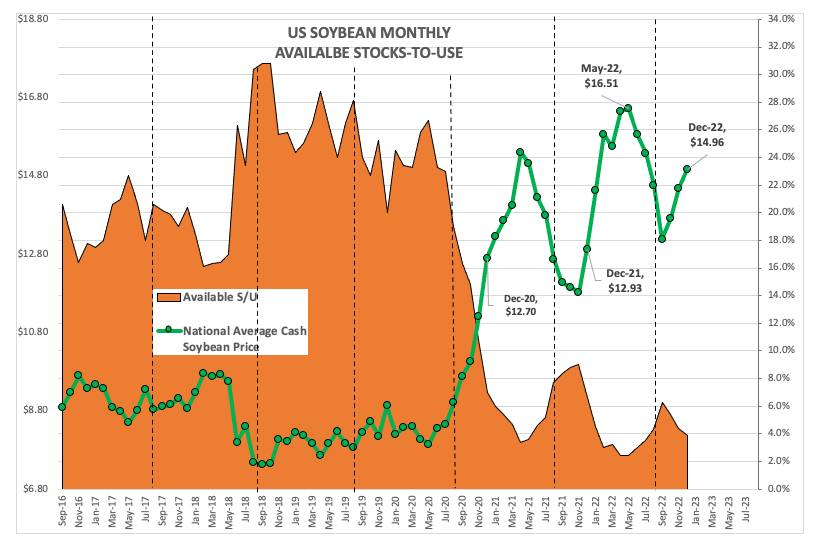

The track record is even more dramatic in soybeans where the end of December 2022 had the cash index calculated near $14.96. This correlated to an available stocks-to-use of 3.9% as compared to the end of November $14.49 and 4.4%. Further back shows December 2021 finishing with a cash price of $12.93 and 6.6% and December 2020 showing $12.70 and 7.0%. Did the US grow a smaller soybean crop in 2022 than what is being reported or has demand been running stronger than projected? Every answer is a guess, though the continues strength of national average basis (cash minus nearby futures) continues to indicate short supplies are the issue.

It used to be amusing thinking about how economists choose to follow what amounts to nothing but guesses from a government agency (Though I was informed by one such economist at a meeting many years ago that at least they are educated guesses. Those were his exact words.) rather than applying basic economic principles of a supply and demand curve in relation to market price. But now I just shake my gray-haired head in disbelief.

As for the argument that global merchandisers and investment traders rely strongly on these numbers is beyond ludicrous. Does anyone actually believe the entities in charge of buying soybeans for China’s insatiable appetite for soybeans are waiting to see the imaginary data from USDA before deciding on purchases? How about domestic exporters? Do they put everything on hold until USDA’s shows its latest guess about production? The answer to both is a resounding ‘absolutely not’. What about investment traders who could have millions, if not billions of dollars in a market at any given time? Do you think they are risking everything on nothing more than an overhyped game of Keno? No. They are not. All the above have up to the minute private research numbers and use basic economics, as well as accounting for some of the political issues I discussed last time.

The reality is one shouldn’t take Thursday’s hullabaloo too seriously, though I know the majority will. When all is said and done, the real fundamentals of the market aren’t going to change all that much, if at all, and the world will continue to turn regardless.

More Grain News from Barchart

- Cocoa Prices Consolidate Below Monday's 11-Month High

- Sugar Erases an Early Rally on Increased Brazil Sugar Production

- Arabica Coffee Falls Sharply on Improved Global Supply Outlook

- Wingstop: Buy the Stock or its Franchise Opportunity?

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)