Specifications, Statistics, and Uses

Soybean meal is a by-product of soybeans. Just like gasoline and heating oil are by-products of crude oil. After their fall harvest, soybeans are crushed to remove the oils from the soybean. The majority of that soybean oil is used in food but also has uses in industrial oils, soaps, and biodiesel. After the crushing and extraction of soybean oil, the soybean hulls are left, and then the soybean meal production begins. Typically 1 bushel (60 lbs.) of soybeans will yield 48 lbs. of soybean meal.

98% of soybean meal is a protein supplement in animal feeds. It has been estimated that, of soybean meal provided to animals in the US, 48 percent will be fed to poultry, 26 percent to swine, 12 percent to beef cattle, 9 percent to dairy cattle, 3 percent to fish feed, and about 2 percent to pet food.

Soybean meal has consistent seasonal demand each year. During the summer months, livestock is grass-fed in open pastures. The livestock has gained weight as the summer ends, but more is needed for processing. During the fall season, many ranchers sell their herds to feedlots, where they will stay until a heavier weight. Part of the reason for selling the herd in the fall is the shortage of grass during winter. While livestock is in feedlots during the winter, soybean meal is consumed to gain weight faster due to the protein content. Another benefit of the soybean meal is that the feedlots are usually cold due to winter weather. This cold can cause livestock to shiver, resulting in weight loss as the body tries to stay warm. Once livestock reaches a certain weight, it is then sent off to be processed for human consumption.

Because of the annual sale of livestock to feedlots every fall season, a seasonal pattern of demand is created for soybean meal that we will discuss.

Fundamentals

In a previous article, “Beefing Up the Bull with Soymeal,” I discussed some events leading up to the current uptrend in the soybean meal market. Since writing the article:

- The drought in the world’s largest producer of soybean meal, Argentina, has continued to stress their soybean crops.

- China, the world’s largest pork producer, with 450 million pigs in 2022, has announced it will relax its zero-tolerance Covid restrictions on its citizens.

- The geopolitical event in Ukraine is showing no evidence of receding.

- The United States Department of Agriculture (USDA) will release its most influential report of the year on January 12, reflecting that the corn and soybean supply forecast will be cut again.

Technicals

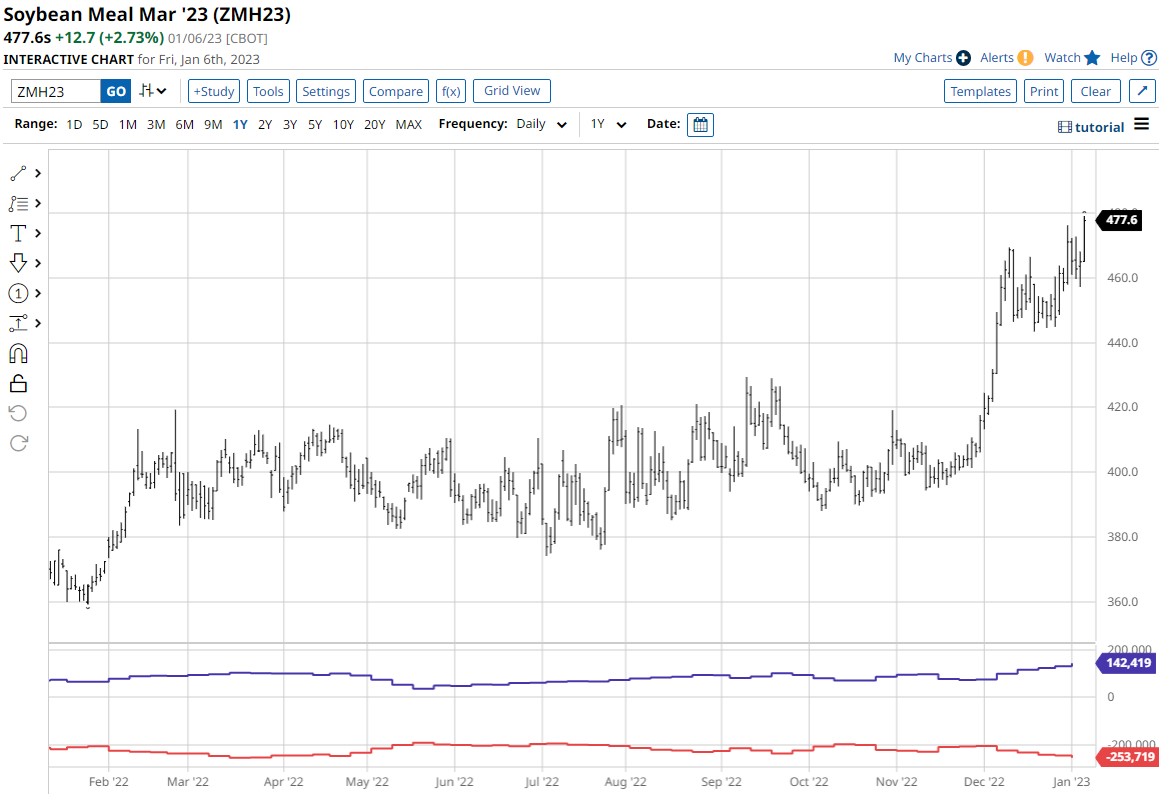

As we look at the monthly nearby futures chart for soybean meal, there are some obvious resistance points above the current price:

1 - 2022 high of 494.7

2 - June 2014 high of 509.4

3 - The all-time high from September 2012 of 541.8

These resistance points will take on some significance as we discuss upcoming events and the excessive participation of managed money.

The daily and weekly uptrend from its seasonal lows is still intact.

Seasonality

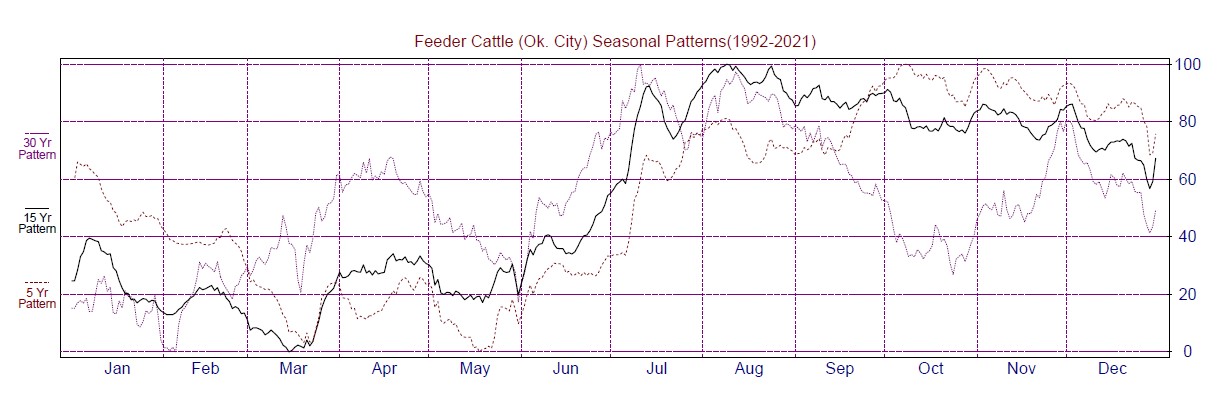

Source: Moore Research Center, Inc. (MRCI)

MRCI research shows the seasonal low for soybean meal is during September or October. This year the seasonal low arrived approximately a month early, and MRCI has found that when markets make an early seasonal low, the move’s duration and strength usually are extended.

Live cattle are grass fed until a certain weight and then sold to feedlots, usually in the fall when the grass is less available. Once the livestock enters the feedlots, they are called feeder cattle. It’s here where the soybean meal, loaded with protein, is used to help the cattle gain weight faster and will then be sold to meat packers.

Notice how the soybean meal seasonal low comes in September or October, and then prices rally as demand rises for the feed, only to peak out in March or April.

In contrast, the feeder cattle prices peak in late August to September and steadily decline into March or April. After the meat packers purchase the cattle, the cattle inventory falls, and the prices tend to rally from the March and April lows.

Comparing the seasonality of feeder cattle and soybean meal shows why there is a higher demand for soybean meal each fall when cattle need more protein in the feedlots.

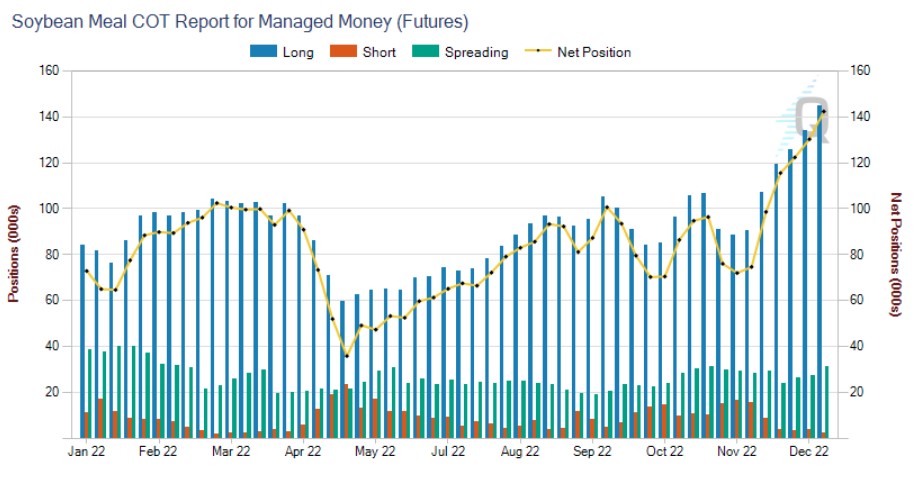

The Commitment of Traders (COT) Report

The COT report illustrates how the commercial users (red line) of soybean meal purchased contracts during the seasonal low. Managed money (blue line) trading systems soon realized the uptrend forming and began aggressively buying the market. The additional buying in October and November by the commercials as prices declined was confirmation that this move would be substantial.

Source: CMEGroup

The COT report can be analyzed from a net and actual position view. The above chart shows the number of long positions held by managed money (blue bars), currently 145K contracts, compared to just 2.5K short positions.

At this time, managed money has a historically high number of long positions, leading to a potentially overcrowded situation. With the overhead price resistance we noted on the monthly chart, this could cause a cascading in price if these funds decide to exit the market quickly.

Summary

Another factor approaching is the March futures contract’s first notice day (FND), occurring on February 28. FND is the first day to announce intentions to take delivery of the commodity. Any long positions held after this day in the March contract would be subject to this delivery; short positions are excluded from FND rules.

Also, soybean meal typically has a seasonal high near the beginning of March.

With such an overcrowded long position by the funds and approaching seasonal highs and the overhead resistance on the charts, we could see a precipitous drop in soybean meal prices.

It’s too early to be shorting the soybean meal market, but it may be too late to join this current trend if you haven’t already held a position.

Monitoring the trend makes it possible for a seasonal trade to develop if it turns down. Be aware that the volatility will increase as these funds either exit their longs or roll over their positions.

More Grain News from Barchart

- Sunday Scaries: What I'm Watching This Week in the Grain Markets

- Friday Wheats Stall and Close Red

- New Highs for Soymeal on Friday Soy Rally

- Corn Limits Weekly Loss with Friday Gains

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)