Uniform rental provider Vestis Corporation (NYSE:VSTS) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 3.2% year on year to $663.4 million. Its GAAP loss of $0.05 per share was $0.03 below analysts’ consensus estimates.

Is now the time to buy Vestis? Find out by accessing our full research report, it’s free.

Vestis (VSTS) Q4 CY2025 Highlights:

- Revenue: $663.4 million vs analyst estimates of $664.7 million (3.2% year-on-year decline, in line)

- EPS (GAAP): -$0.05 vs analyst estimates of -$0.02 ($0.03 miss)

- Adjusted EBITDA: $70.38 million vs analyst estimates of $69.05 million (10.6% margin, 1.9% beat)

- EBITDA guidance for the full year is $300 million at the midpoint, above analyst estimates of $295.8 million

- Operating Margin: 2.5%, down from 4.4% in the same quarter last year

- Free Cash Flow was $28.3 million, up from -$10.6 million in the same quarter last year

- Market Capitalization: $965.9 million

“Our first quarter results reflect a solid start to our fiscal 2026 and strong execution against our business transformation plan focused on unlocking operating leverage while elevating the customer experience,” said Jim Barber, President and CEO.

Company Overview

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE:VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.69 billion in revenue over the past 12 months, Vestis is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

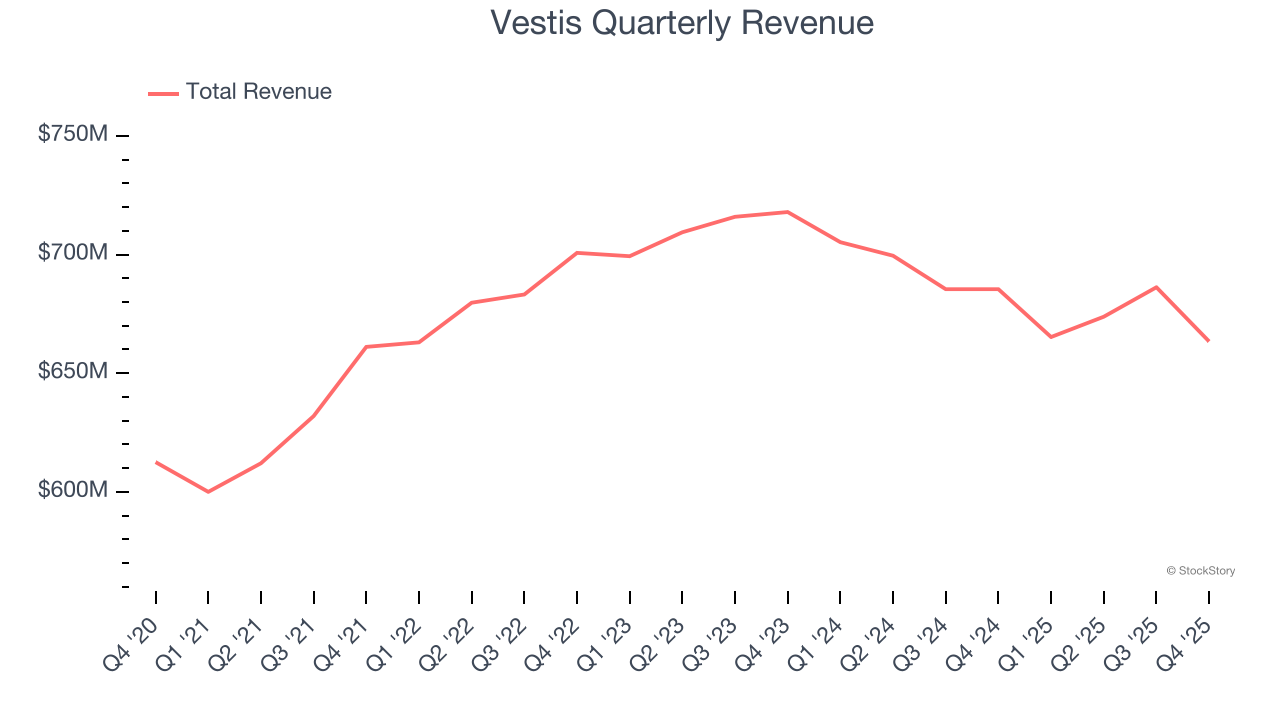

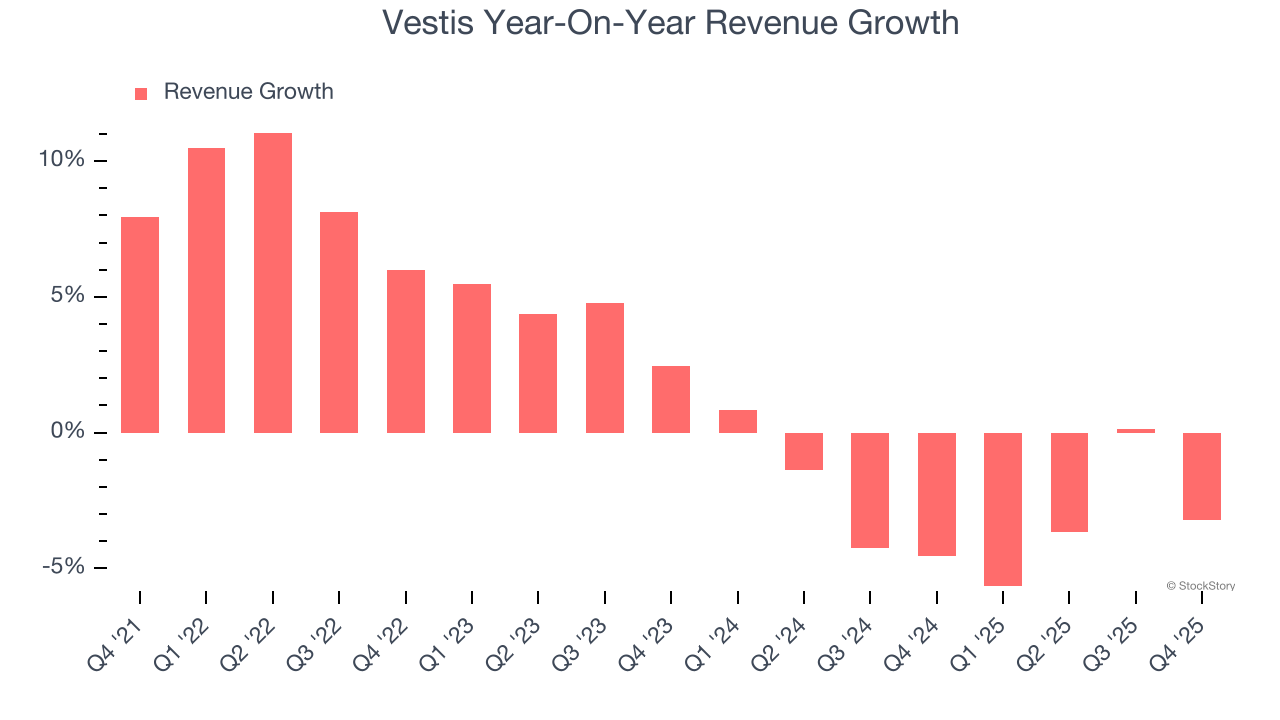

As you can see below, Vestis grew its sales at a sluggish 1.8% compounded annual growth rate over the last four years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Vestis’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.7% annually.

This quarter, Vestis reported a rather uninspiring 3.2% year-on-year revenue decline to $663.4 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 1.7% over the next 12 months, similar to its two-year rate. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

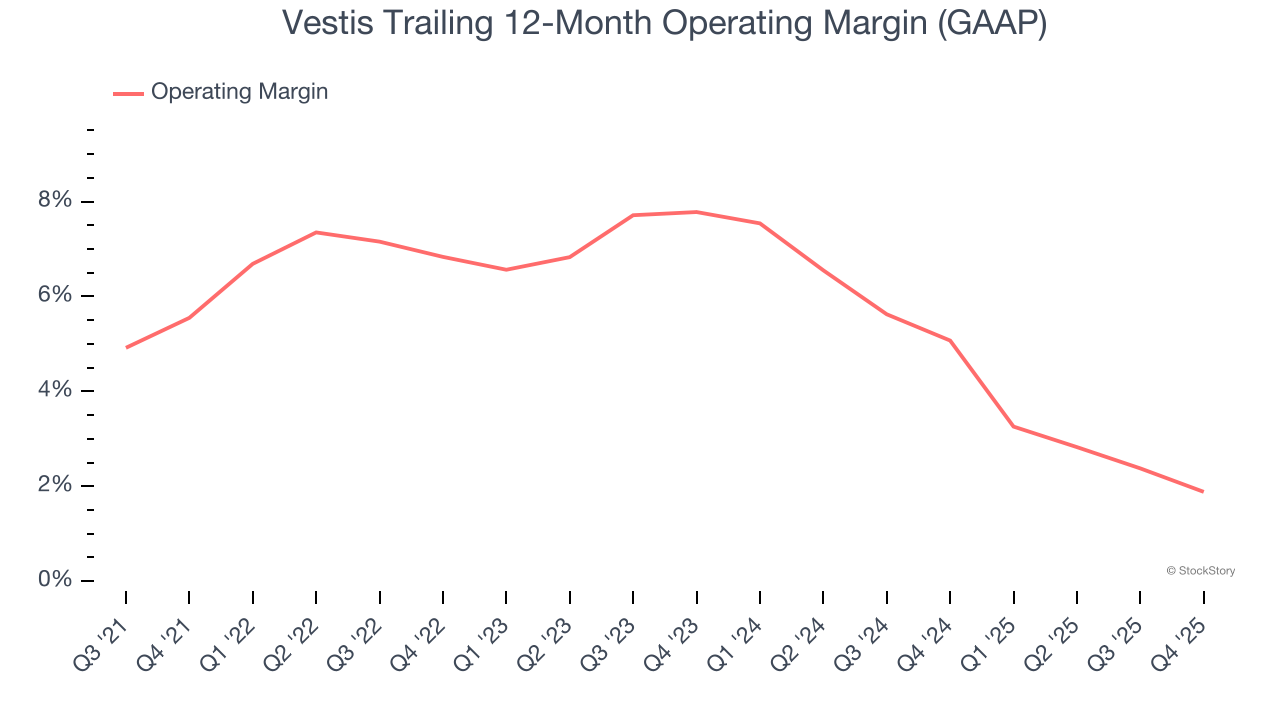

Vestis was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.5% was weak for a business services business.

Looking at the trend in its profitability, Vestis’s operating margin decreased by 3.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Vestis’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Vestis generated an operating margin profit margin of 2.5%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

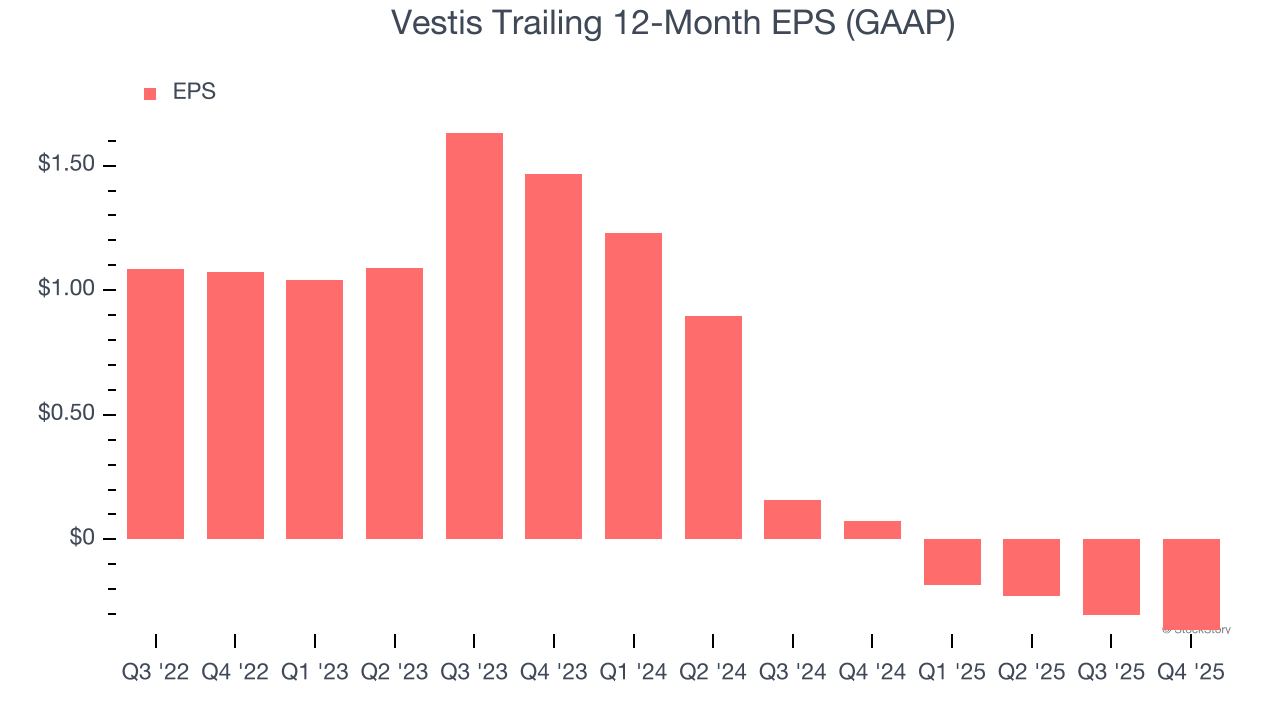

Vestis’s full-year EPS turned negative over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Vestis’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Vestis, its two-year annual EPS declines of 49.9% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Vestis reported EPS of negative $0.05, down from $0.01 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Vestis’s full-year EPS of negative $0.36 will flip to positive $0.03.

Key Takeaways from Vestis’s Q4 Results

While revenue was just in line, EBITDA beat and EBITDA guidance also exceeded expectations. Overall, this was a solid quarter. The stock traded up 4.2% to $7.63 immediately after reporting.

So should you invest in Vestis right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)