Verizon Communications (VZ) stock has held up relatively well in this recent stock market selloff. But VZ stock put options now have relatively high premiums that are attracting income investors. They are shorting the out-of-the-money VZ puts as an attractive income play.

Right now VZ stock is cheap, at $37.77 at the close of Dec. 15, trading for just 7.29x earnings with analysts' projections of $5.18 in earnings per share (EPS) for 2022. And even though EPS forecasts for 2023 are lower at $5.09, it is still very inexpensive at 7.42x forward earnings.

On top of this, the company pays a safe $2.61 annual dividend, which it raised recently. In fact, in the past 18 years, it has consistently hiked the dividend every year. That gives VZ stock a high 6.91% dividend yield.

So, unless analysts foresee an unprecedented dividend cut, the stock is probably near a low. For example, in the last 5 years, according to Morningstar, the stock has had an average dividend yield of 4.61%. That implies that VZ could rise to $56.61 per share if it were to trade at this average yield (i.e., $2.61/0.0461=$56.61). That represents a huge 50% gain upside for VZ stock. Even if it were to rise to half of that level VZ would be worth $47.21, over almost $10 higher than today.

Shorting Puts To Buy Cheaply and Gain Income

As a result, its close-strike price put options are probably worth shorting. This is because if the stock were to fall to just $35 per share, the investor would earn a 7.46% annual dividend yield (i.e., $2.61/$35.00).

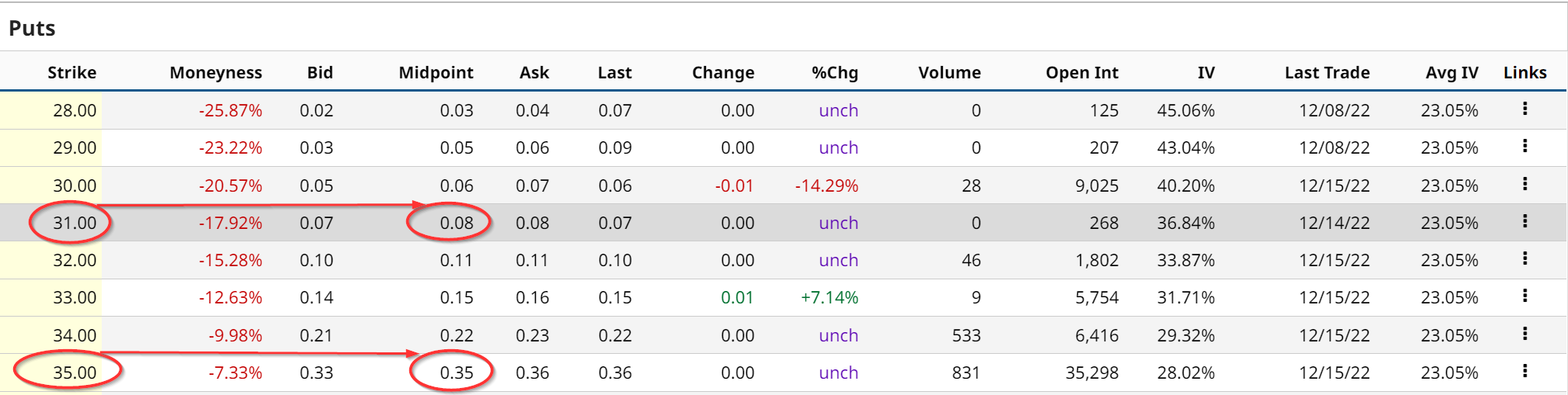

The Barchart Jan. 20 option chain shows that the $35 strike price puts trade for 35 cents per put contract, as seen below.

This means that an investor who puts up $3,500 in cash or margin at his or her brokerage firm can then “sell to open” 1 put contract and immediately receive $35 in their account per put contract. That represents an immediate yield of 1.0% ($35/3,500). This also works out to an annualized 12% yield if it can be repeated each month.

The investor may in fact wish to see VZ stock fall to $35.00 in order to buy the shares cheaply and earn a yield of 7.46% on their 100 shares. But just in case they are worried that the stock could fall even further and generate an unrealized loss, they could hedge by buying long puts at $31.00 for $8.00 (see above) per contract. That lowers their overall return to 0.77% (i.e., $27/$35), or 9.26% annualized.

This is a profitable way to generate income from VZ stock even without owning the underlying shares. The short put option does not provide a potential upside if the stock rises. But in case it falls, the investor will have a break-even point of $34.65 per share, which is 6.8% below today's price.

More Stock Market News from Barchart

- Markets Today: Stock Indexes Extend Thursday’s Rout on Recession Fears

- Pre-Market Brief: Stocks Retreat As Recession Fears Weigh On Sentiment

- Stocks Sharply Lower on the Outlook for Higher Global Interest Rates

- FAANG Stocks Lose Their Leadership as Share Prices Fall

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)