With volatility remaining stubbornly high, investors might be more interested in generating income rather than capital gains.

Financial stocks have typical paid reasonable dividends, but in this era of low interest rates (maybe not for much longer), yields are quite low.

Thankfully, as sophisticated investors, we can generate an additional income from holding banks stocks by using options. The strategy is a known as a covered call which involves selling call options against a stock position.

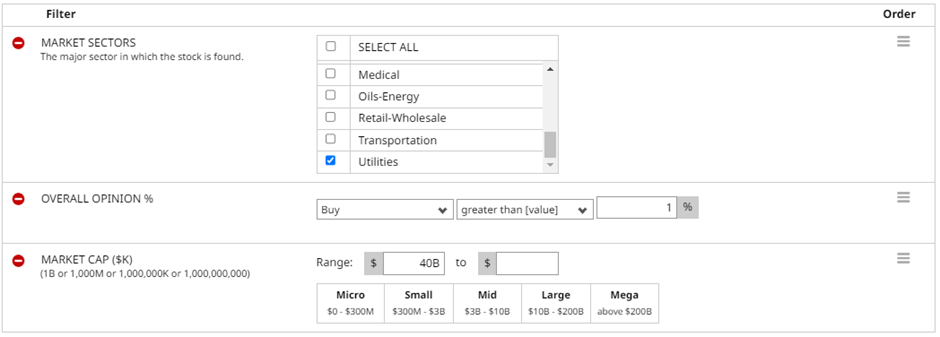

Let’s firstly check which bank stocks have a Buy or Hold Rating. To do this go to the Stock Screener and use these Parameters:

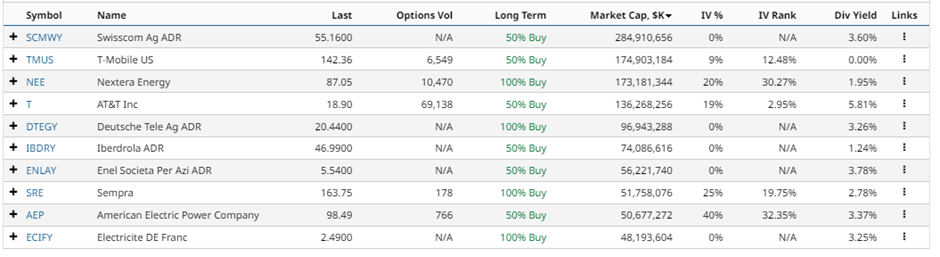

Looking at the table below, AT&T (T) is one name that stands out, so let’s use that in our Covered Call Screener.

AT&T Covered Call Example

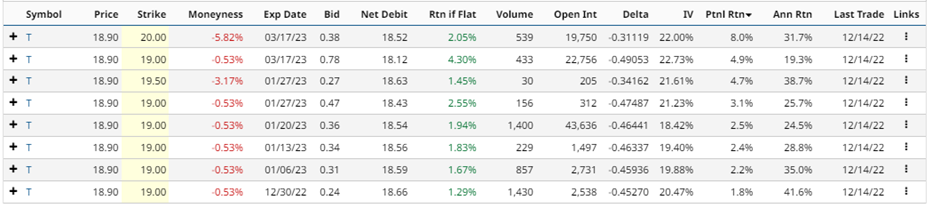

When running the Covered Call Screener for AT&T, we find the following results:

Let’s evaluate the first AT&T covered call example. Buying 100 shares of AT&T would cost $1,890. The March 17, 20-strike call option was trading yesterday around $0.38, generating $38 in premium per contract for covered call sellers. Selling the call option generates an income of 2.05% in 92 days, equalling around 8.05% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 20?

If AT&T closes above 20 on the expiration date, the shares will be called away at 20, leaving the trader with a total profit of $148 (gain on the shares plus the $38 option premium received). That equates to an 8.00% return, which is 31.70% on an annualized basis.

The company is also due to pay a dividend in January, likely to be around 0.2775.

Barchart Technical Opinion

The Barchart Technical Opinion rating is a 40% Buy with a weakest short term outlook on maintaining the current direction.

Implied Volatility

Implied volatility is at 22.33% compared to a 12-month low of 18.42. Some traders may prefer implied volatility to be higher before starting a covered call trade.

Company Profile

AT&T Inc. is the second largest wireless service provider in North America and one of the world's leading communications service carriers.

Through its subsidiaries and affiliates, the company offers a wide range of communication and business solutions that include wireless, local exchange, long-distance, data/broadband and Internet, video, managed networking, wholesale and cloud-based services.

With assets like HBO, CNN and TNT, AT&T's acquisition of Time Warner has created new kinds of online videos and opened up avenues for targeted advertisements.

The company is also focusing on streaming services with AT&T TV and HBO Max. This is likely to create other avenues to monetize content as it expands 5G coverage across the country.

Utilities stocks are a common component of most investment portfolios and now you know how to generate an income from your AT&T position.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Retreat as FOMC Signals Higher Interest Rates

- Unusual Activity in Tesla Stock Shows Investors are Bullish

- Imax Corp May Get a Boost from Avatar Sequel

- Stocks Move Lower After Fed Raises Rates Half a Point

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)