Occidental Petroleum (OXY) stock has tumbled 10% this past week to $62.60 as of Friday, Dec. 9. and now looks attractive to value buyers. In addition, out-of-the-money short puts and calls provide good income plays to investors. This is because investors fear oil prices could tumble next year and they are upset that California may try to limit raise taxes on oil companies based on their profits.

But value investors are very impressed with the company's Nov 8 earnings release for Q3 ending Sept. 30. Occidental Petroleum highlighted its $3.6 billion in free cash flow (FCF) and share buybacks. It spent $1.8 billion on share repurchases during the third quarter and $2.6 billion year-to-date (YTD).

This was after OXY also paid off $1.3 billion in debt and spent $9.6 billion in debt reduction so far this year. In other words, the company is awash in cash flow and shareholder equity payments.

And, as a good citizen, the company is ramping up its commercial efforts to reduce carbon through its unique Direct Air Capture (DAC) and Sequestration plant in southern Texas. It devotes several slides in the investor presentation about this novel effort, which has yet to show a profit.

Why OXY Is Cheap Now

On Dec. 6, 2022, the WSJ reported that the CEO of Occidental Petroleum, Vicki Holub, called California's move to levy penalties on oil companies “ridiculous.” Even though the CA legislators want to set a maximum profit margin for oil refiners she said that the industry expects higher oil prices next year. In addition, she said that supply chain issues and a severe lack of truck drivers have made it harder for producers to ramp up output.

This means investors can expect that FCF will remain elevated next year. For example, analysts now project that earnings per share (EPS) will fall from $10.01 this year to $7.87 in 2023. But that still means that at $62.60 on Dec. 9, the stock is still cheap at just under 8x earnings (7.95x). That is well below its historical over 21.7x earnings, according to Seeking Alpha over the past 5 years, and 20.6x according to Morningstar.com.

Even if OXY stock were to rise to half of that metric the price would be $78.70 (i.e., 10x $7.76 EPS), or 25.7% over today's price.

Moreover, OXY has made its dividend per share every year in the last 33 years and it has paid out 13 cents for the past 4 quarters. That means it will likely soon declare a dividend increase next month. Assuming it raises the dividend by 3 cents to 16 cents or 64 cents annually, that means its dividend yield is 1.0% on a forward basis. That yield can be enhanced by shorting out-of-the-money (OTM) puts and calls.

Covered Calls and Short Puts as Income Plays

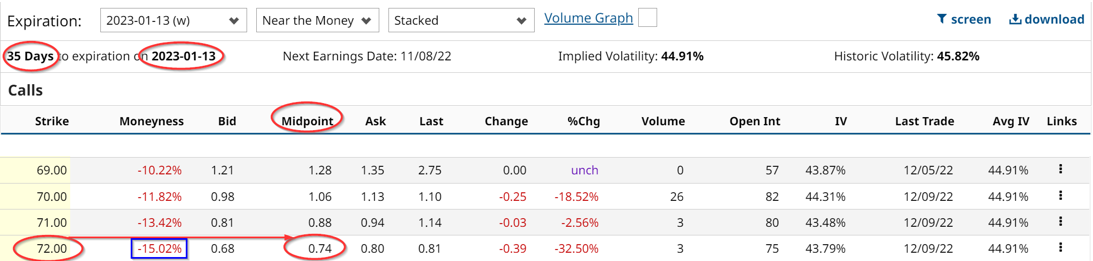

The Jan. 13 call option prices at the $ for OXY stock trade at the $72 strike price (below our $78 target price) still have an attractive premium of 74 cents per call option contract.

That means that the investor in covered calls can sell a call option contract for $72 by paying $6,260 for 100 shares at today's price of $62.60. That represents an ample immediate yield of 1.18% or 14.2% annualized. Moreover, even if OXY rises to $72 in 35 days as of Jan. 13, the investor will make a 15% capital gain. If the stock rises to a point less than $72, the investor gets to keep the unrealized gain as well.

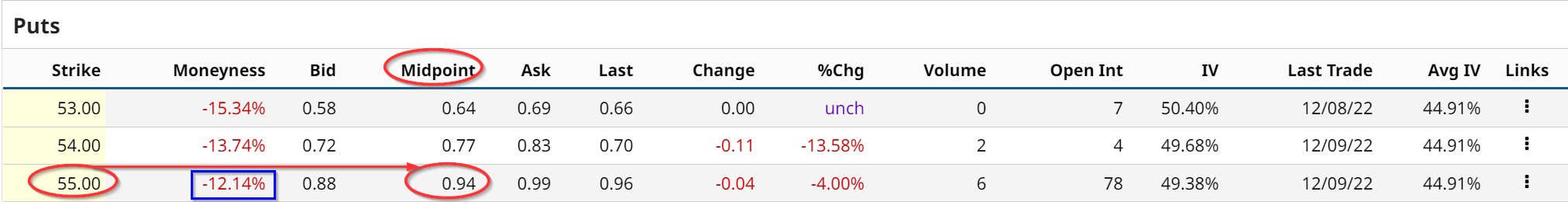

Moreover, cash-secured puts for Jan. 13, 2023, are also attractive with high premiums. For example, the $55 strike price, which is 12% below the present price, trades for 94 cents at the midpoint.

This means that the investor who puts up $5,500 in cash or margin with a brokerage firm that could be used to buy 100 shares of OXY stock at $55, and then puts in an order to “sell to open" 1 put contract $55.00 will immediately receive $94.00. That represents a 1.71% yield or 20.5% annually. This shows that investors in OXY short puts and calls can receive extra income and still have the ability to own the shares or buy them more cheaply.

More Stock Market News from Barchart

- The Fed, CPI and Other Key Themes For This Week

- NRG Energy Is Attracting Value Buyers with Its 4.68% Yield, 6x P/E and Option Income Plays

- Stocks Retreat as Strength in U.S. PPI Boosts Bond Yields

- Chinese Tech Investors Pivot to Hong Kong from U.S. Exchanges

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)