/Technology%20-%20thisisengineering-raeng-yhCHx8Mc-Kc-unsplash.jpg)

Barchart's Unusual Stock Options Activity Report today shows a large put trade in Zoom Video Communications (ZM) stock in a deep out-of-the-money (OTM) short-dated strike price and expiration. This signals a bullish outlook on ZM stock as the institutional investor that likely initiated the trade was probably shorting the OTM put strike price. That means they don't expect the stock to fall to the level of the strike price.

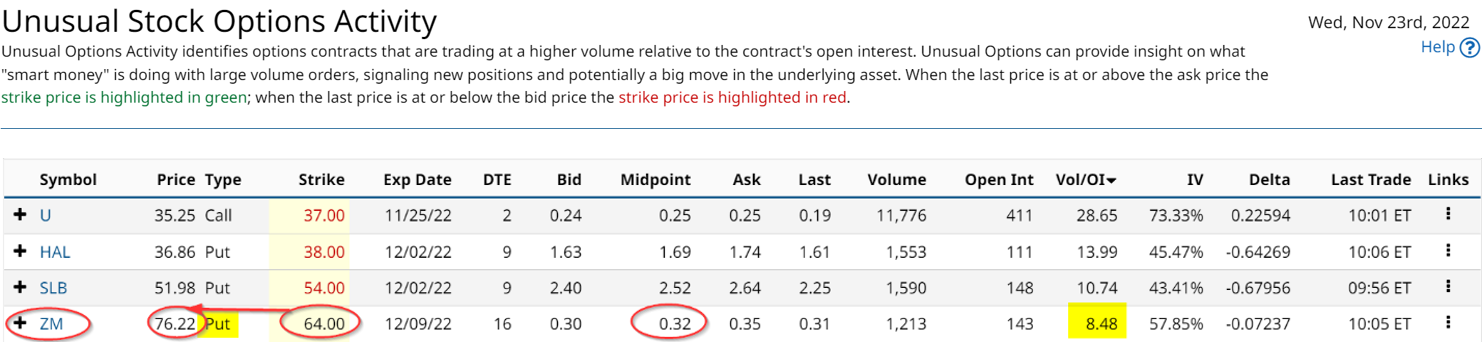

For example, the Unusual Options Activity report shows that a swath of 1,213 puts traded at 32 cents for the Dec. 9, 2022, put options at a $64.00 strike price. ZM stock is trading now at $76.22, so the put strike price is 16% below today's price to get to $64.00.

That implies that the investor who sold these puts doesn't likely expect the stock to fall 16% in the next 16 days, just over 2 weeks from now. Since they received $32 per put contract and had to put up $6,400 per put contract in cash collateral, the immediate yield is 0.5%. That results in an annualized return of just under 12% (i.e., 0.5% x 2 x 12).

In effect, for the whole trade, they put up $7.763 million (i.e., $6,400 x 1,213 contracts)and received $38,816 (i.e., $32 x 1,213 contracts), or 0.5%. Their risk is that the stock falls below $63.68 per share (i.e., $64-$0.32), or 16.45% below today's price ($76.22).

Outlook Fears

This does not seem highly likely now, given that there would have to be some sort of dire news that could come out between now and Dec. 9. The company has already reported its Q3 financials on Nov. 21. The results, although disappointing in terms of its outlook for Q4, were not this kind of dire scenario.

For example, the company reported that Q3 revenue was up 5% year-over-year (YoY) which was slightly below analysts' expectations, according to Seeking Alpha. Moreover, earnings per share (EPS) came in at $1.07 on a non-GAAP basis, which significantly outperformed analyst expectations by 23 cents or 27.3%.

But most of the negative sentiment about ZM stock relates to its outlook for the upcoming Q4 results and the full-year financials for 2022. Analysts have written that the company's expectation of 75 cents to 78 cents EPS on revenue of $1.095B to $1.105B. This is well short of Wall Street estimates of 81 cents per share forecast on revenue estimates of $1.11 billion.

However, this is just 3.7% to 7.4% lower than estimates (about 5% on average). That is not a dire scenario, and could easily just be a lowball estimate by the company in order to show outperformance with actual numbers.

The more deeper fear may be that the economy will head into a tech recession with all the tech company layoffs - the kinds of companies that tend to use Zoom video products. In fact, analysts forecast just $3.58 EPS for next year, which is 9.4% lower than the $3.95 projected for 2022.

Where This Leaves Investors In ZM Stock

Nevertheless, analysts still project higher revenue for 2023 over 2022. So maybe they are not so sure that a tech recession will deeply affect Zoom's sales. And even if the company has lower EPS next year, the stock is not super expensive at just over 21x earnings for 2023.

In the past week, ZM stock is down almost 7%. Yes, it could fall further. But will it really fall over 16% in the next 2 years to Dec. 9? Given that a lot of bad news is already discounted in the stock, and it does not seem overvalued, the likelihood of that happening is not high. That is why the investor who shorted these deep OTM puts will likely make money on his investment. If you copy his move, just be clear that there could be the likelihood that your cash-secured put could be exercised (and you would have to buy ZM stock at $64.00) if the stock falls below $64 on or before Dec. 9.

More Stock Market News from Barchart

- Stocks Push Higher on Lower Bond Yields and Mixed Economic News

- Markets Today: Stocks Little Changed After Mixed Earnings and Economic News

- Why Return to Work Could Be a Killer for Zoom Video Communications (ZM)

- How To Buy BAC Stock For An 8% Discount Or Achieve An 18% Return

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)