Selling cash secured puts on stocks an investor is happy to take ownership of is a great way to generate some extra income. A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock. The goal is to either have the put expire worthless and keep the premium, or to be assigned and acquire the stock below the current price. It’s important that anyone selling puts understands that they may be assigned 100 shares at the strike price.

Why Trade Cash Secured Puts?

Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. If the investor was strongly bullish, they would prefer to look at strategies like a long call, a bull call spread, or a poor man’s covered call. Investors would sell a put on a stock they think will stay flat, rise slightly, or at worst not drop too much.

Cash secured put sellers set aside enough capital to purchase the shares and are happy to take ownership of the stock if called upon to do so by the put buyer. Naked put sellers, on the other hand, have no intention of taking ownership of the stock and are purely looking to generate premium from option selling strategies.

The more bullish the cash secure put investor is, the closer they should sell the put to the current stock price. This will generate the most amount of premium and also increase the chances of the put being assigned. Selling deep-out-of-the-money puts generates the smallest amount of premium and is less likely to see the put assigned.

BAC Cash Secure Put Example

Yesterday, with Bank of America (BAC) trading at $37.49, the February put option with a strike price of 36 was trading around $1.47. Traders selling this put would receive $147 in option premium. In return for receiving this premium, they have an obligation to buy 100 shares of BAC for $36. By February 17, if BAC is trading for $35, or $30, or even $10, the put seller still has to buy 100 shares at $36.

But, if BAC is trading above $36, the put option expires worthless, and the trader keeps the $147 option premium. The net capital at risk is equal to the strike price of 36, less the 1.47 in option premium. So, if assigned, the net cost basis will be $34.53. That’s not bad for a stock currently trading at $37.49. That’s a 7.99% discount from the price it was trading yesterday.

If BAC stays above $36, the return on capital is:

$147 / $3,453 = 4.26% in 86 days, which works out to 17.86% annualized.

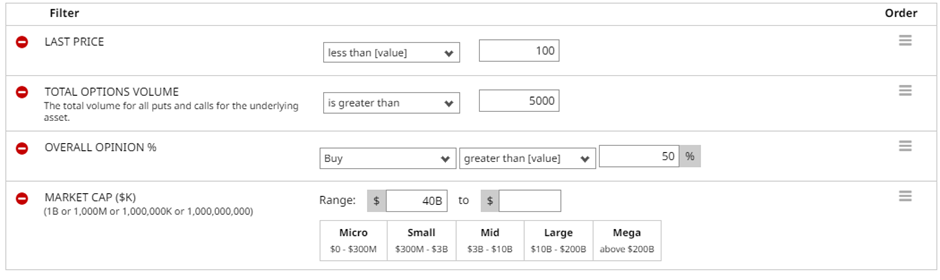

Either the put seller achieves a 17.86% annualized return or gets to buy a highly rated stock for an 8% discount. You can find other ideas like this using the Naked Put Screener. Below you can see some parameters that you might consider for running this screener. Feel free to tweak them as you see fit.

Company Details

The Barchart Technical Opinion rating is a 56% Buy with a Strengthening short term outlook on maintaining the current direction.

Of 18 analysts covering BAC, 10 have a Strong Buy rating,1 has a Moderate Buy rating and 7 have a Hold rating.

Implied volatility is currently 27.04% compared to a 12-month high of 47.67% and a low of 25.41%. The IV Percentile is 10% and the IV Rank is 7.31.

Bank of America Corp. is one of the largest financial holding companies in the U.S. It has 5 business units: Consumer Banking, comprising Deposits & Consumer Lending businesses, provides credit, banking and investment products and services. Global Wealth & Investment Management, comprising Merrill Lynch Global Wealth Management and U.S. Trust, Bank of America Private Wealth Management, offers wealth structuring, trust and banking needs and specialty asset management services. Global Banking, including Global Corporate Banking, Global Commercial Banking, Business Banking and Global Investment Banking, provides lending-related products and services, integrated working capital management and treasury solutions, and underwriting and advisory services. Global Markets offers sales & trading, market-making, financing, securities clearing, settlement and custody, and risk-management services. All Other comprises ALM activities, equity investments, the international consumer card business, liquidating businesses, etc.

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own. If you end up being assigned, you can start selling covered calls against the stock holding. You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Risk averse traders might consider buying an out-of-the-money put to protect the downside.

If you have any questions, feel free to reach out to me by email or on Twitter. Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Is Hasbro a Buy Now That It’s Selling eOne?

- Stocks Rally on Positive Corporate Earnings and Lower Bond Yields

- Diesel Shortage Threatens to Boost Global Inflation and Undercut Growth

- Tesla Options Look Cheap Now, Especially for Short Put Investors

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)