/computer%20board%20micro%20chip%20green.jpg)

Qualcomm (QCOM) reported positive free cash flow and made large return of capital payments to shareholders in the year ending Sept. 25. Its high total yield, composed of buybacks and dividends, in Q4 represented almost 3.92% of its total market value on an annualized basis. That bodes well for QCOM stock going forward.

The mobile telecom chip company reported that it made $841 million in dividend payments as well as $500 million in share buybacks or $1.341 billion during its fiscal Q4. On an annualized basis that works out to 3.94% of its $136 billion market value.

In fact, in the last year alone the company has made $6.34 billion in total shareholder return payments, representing 4.66% of its $136 billion market cap.

The quarterly dividend of 75 cents per share works out to a dividend yield of 2.45% (i.e., $3.00/$122.51 per share). In addition, the $500 million in buybacks represents a buyback yield of 1.47% (i.e. $2.0 billion/$136 billion). That is why the total yield to shareholders.

Valuation is Cheap

QCOM stock is now at bargain levels, given that analysts project that earnings will rise 21% next year from $10.23 to $12.40 per share. So, at $122.51 per share today the stock trades for just 9.8x times the projected earnings next year.

This makes the stock a bargain going forward, with its 3.9% total yield as well. For example, its average forward P/E (price-to-earnings) multiple over the past 5 years has been over 17.8x. That represents a potential upside of 81% in the stock. Even if it were to recover half of that the stock could move to $171 per share, up from $122.51 today).

We can use that to set a strike target in options trading.

Option Income Plays

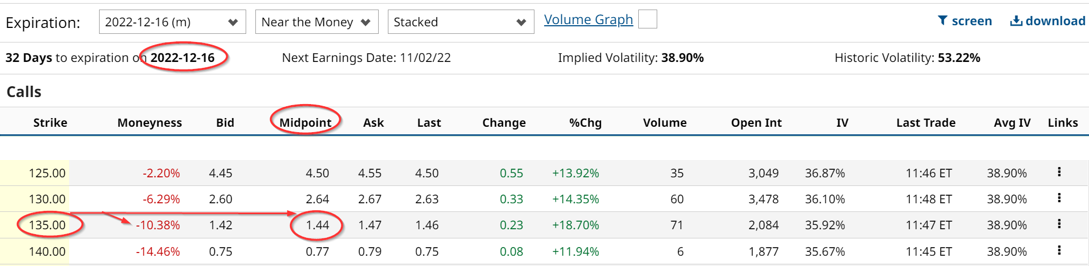

Two ways to play this that are conservative are to sell out-of-the-money (OTM) covered calls and short cash-secured OTM puts. For example, the Dec. 16 Calls at $135.00 which is 10% over today's price, trade for $1.44 per call contract.

That represents a 1.17% yield for the covered call investor who sells 1 contract at the $135 strike price, or an annualized rate of 14.1%. That is a pretty good return for most investors. Moreover, even if the stock rises to $135 by Dec. 16, the investor gets to keep the 10% upside in the stock as well.

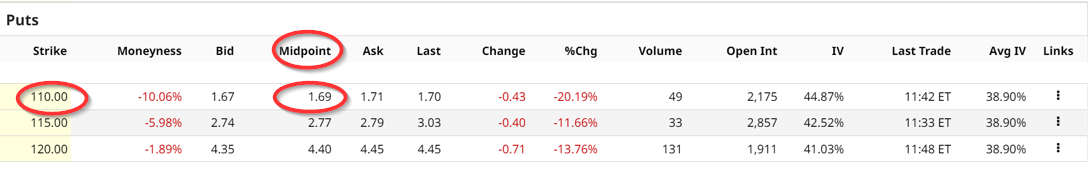

In addition, the investor could also sell puts at the $110 strike price, or 10% lower than today, and collect $169 per contract (after securing $11,000 with the brokerage firm.

That represents 1.536% on the $11,000 potential cost of the puts (if the stock falls to $110 by Dec. 16). In other words this is an even better ROI as it works out to an annualized 18.4% return. However, there is no possibility of any capital gain here. That is why investors often do both covered calls and short puts on an OTM basis in undervalued stocks like QCOM.

More Stock Market News from Barchart

- These 3 Dividend Aristocrats Are Rated 100% Buy

- China’s Alibaba Group May See a Turnaround

- Tech Stocks Sag on Higher T-note Yields

- Markets Today: Stocks Modestly Lower as Bond Yields Climb on Fed Comments

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)