Scientific instruments company Waters Corporation (NYSE:WAT) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 6.8% year on year to $932.4 million. The company expects next quarter’s revenue to be around $1.20 billion, coming in 64.5% above analysts’ estimates. Its non-GAAP profit of $4.53 per share was in line with analysts’ consensus estimates.

Is now the time to buy Waters Corporation? Find out by accessing our full research report, it’s free.

Waters Corporation (WAT) Q4 CY2025 Highlights:

- Revenue: $932.4 million vs analyst estimates of $928.6 million (6.8% year-on-year growth, in line)

- Adjusted EPS: $4.53 vs analyst expectations of $4.51 (in line)

- Adjusted EBITDA: $337.6 million vs analyst estimates of $381.6 million (36.2% margin, 11.5% miss)

- Revenue Guidance for Q1 CY2026 is $1.20 billion at the midpoint, above analyst estimates of $732.4 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $14.40 at the midpoint, beating analyst estimates by 0.6%

- Operating Margin: 29%, down from 33.5% in the same quarter last year

- Free Cash Flow Margin: 13.5%, down from 21.5% in the same quarter last year

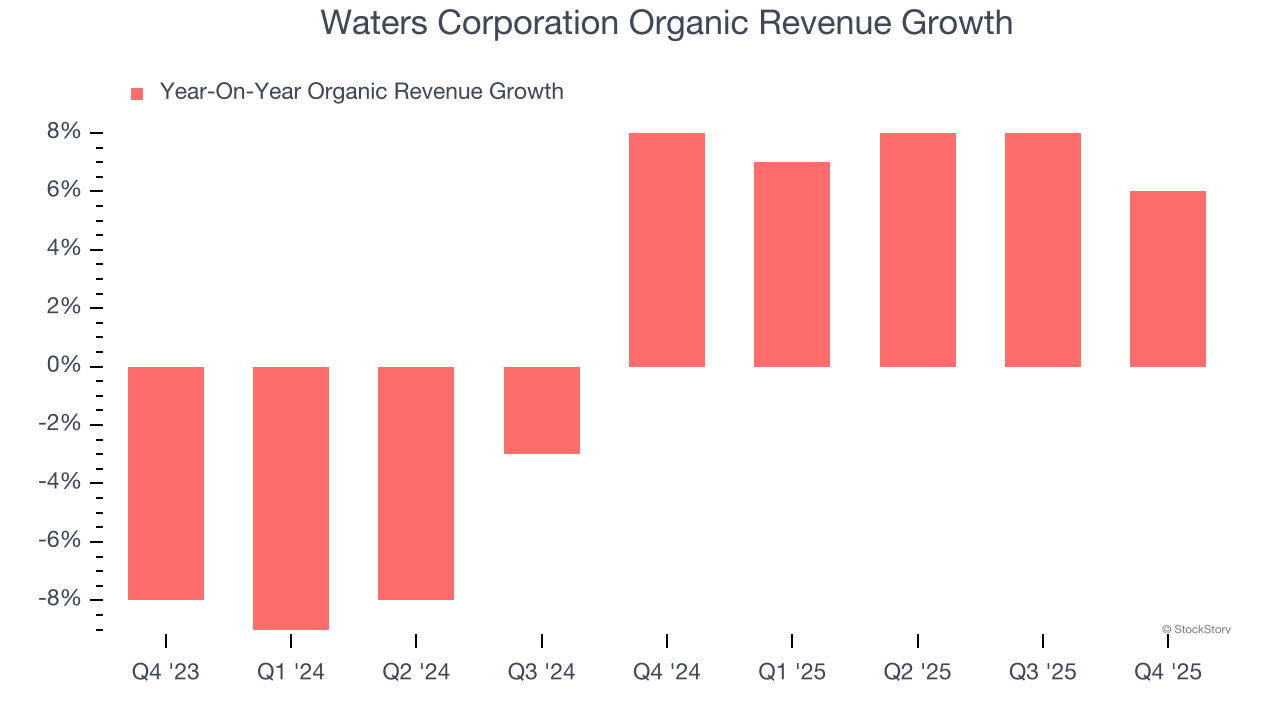

- Organic Revenue rose 6% year on year (miss)

- Market Capitalization: $22.7 billion

"Our team delivered industry-leading results in 2025, achieving high single-digit revenue growth and double-digit adjusted EPS growth. We expect this momentum to continue into 2026, driven by strong execution of the multi-year instrument replacement cycle, continued contribution from pioneering innovation, and our Waters-specific idiosyncratic growth drivers," said Udit Batra, Ph.D., President & Chief Executive Officer, Waters Corporation.

Company Overview

Founded in 1958 and pioneering innovations in laboratory analysis for over six decades, Waters (NYSE:WAT) develops and manufactures analytical instruments, software, and consumables for liquid chromatography, mass spectrometry, and thermal analysis used in scientific research and quality testing.

Revenue Growth

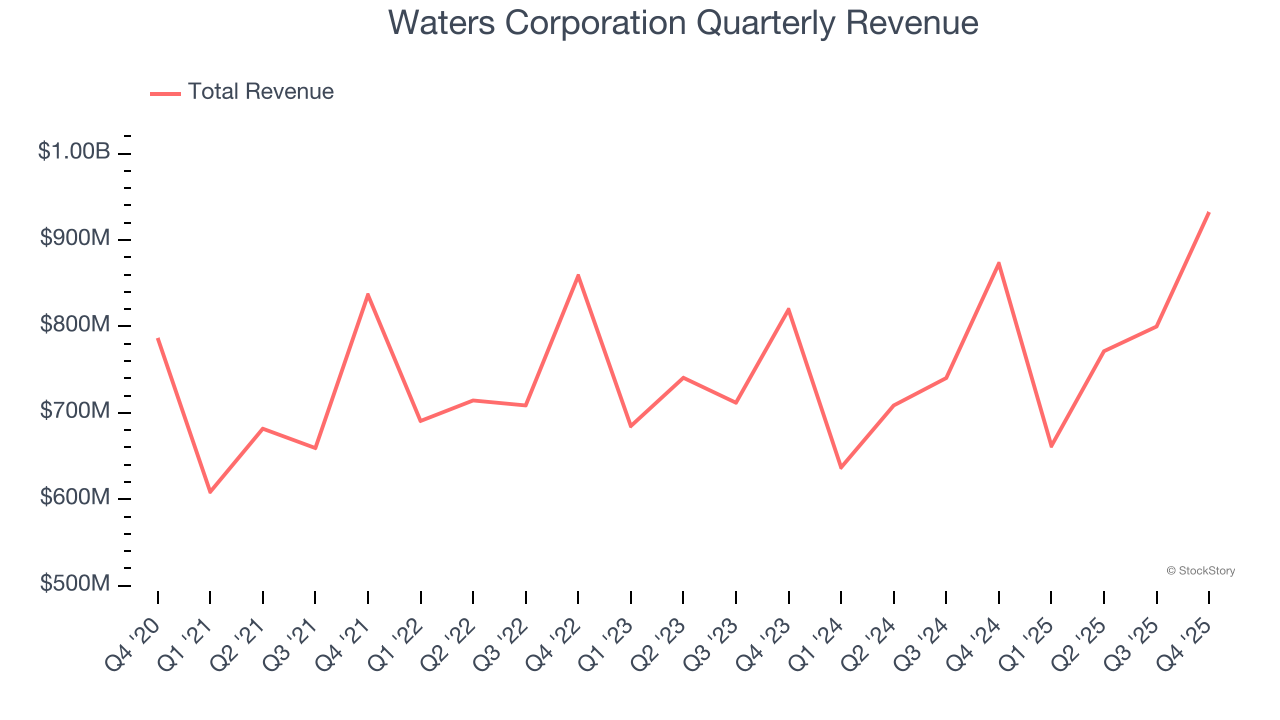

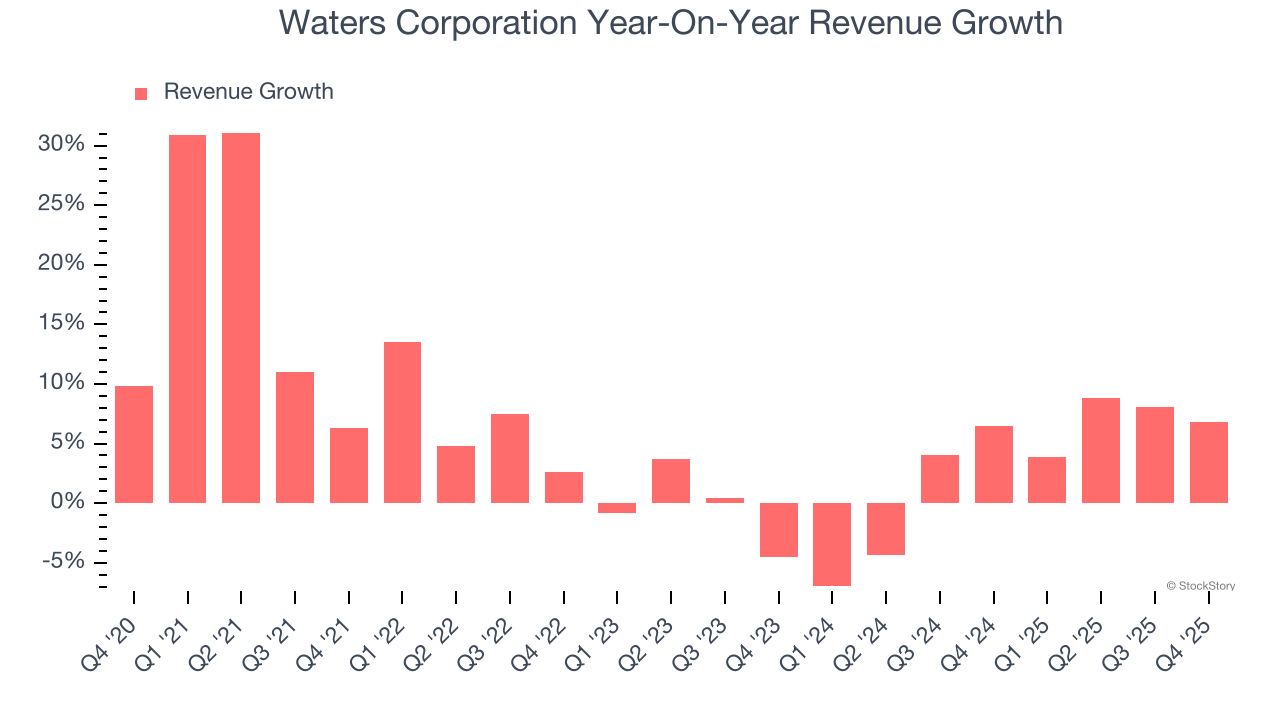

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Waters Corporation’s sales grew at a mediocre 6% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Waters Corporation’s recent performance shows its demand has slowed as its annualized revenue growth of 3.5% over the last two years was below its five-year trend.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Waters Corporation’s organic revenue averaged 2.1% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Waters Corporation grew its revenue by 6.8% year on year, and its $932.4 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 82% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.5% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

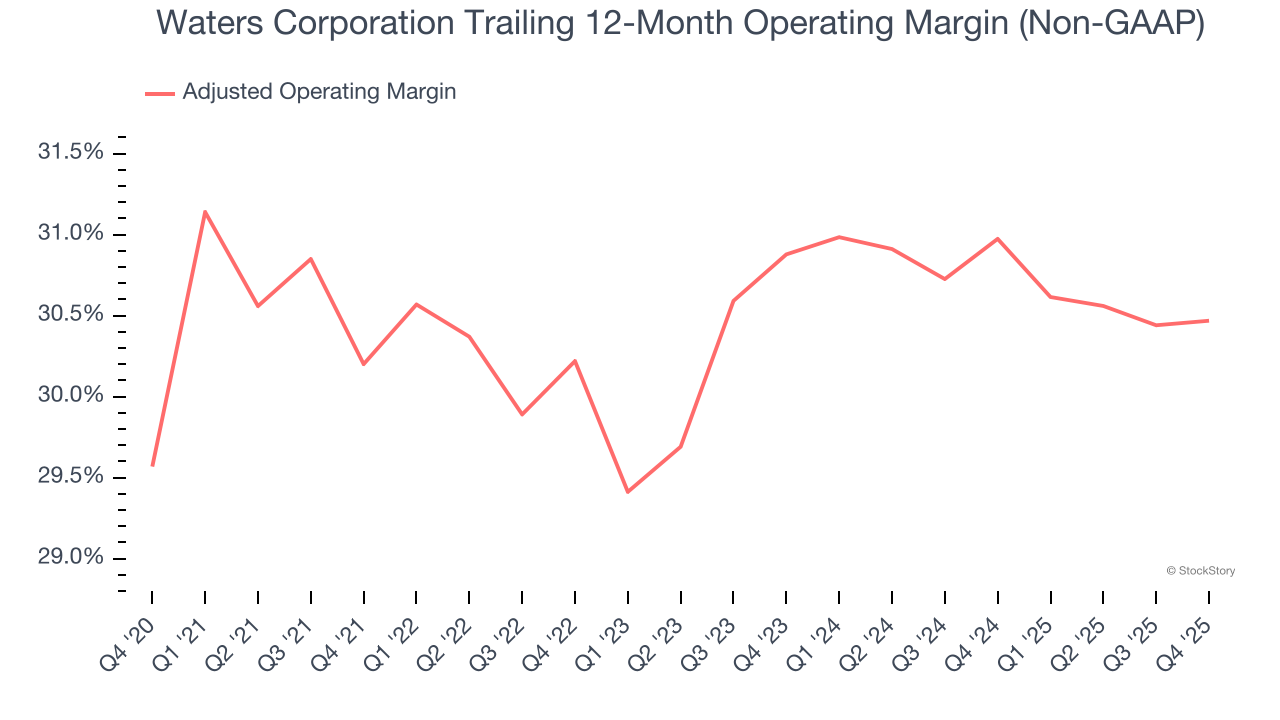

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Waters Corporation’s adjusted operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 30.6% over the last five years. This profitability was elite for a healthcare business thanks to its efficient cost structure and economies of scale.

Looking at the trend in its profitability, Waters Corporation’s adjusted operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Waters Corporation generated an adjusted operating margin profit margin of 35.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

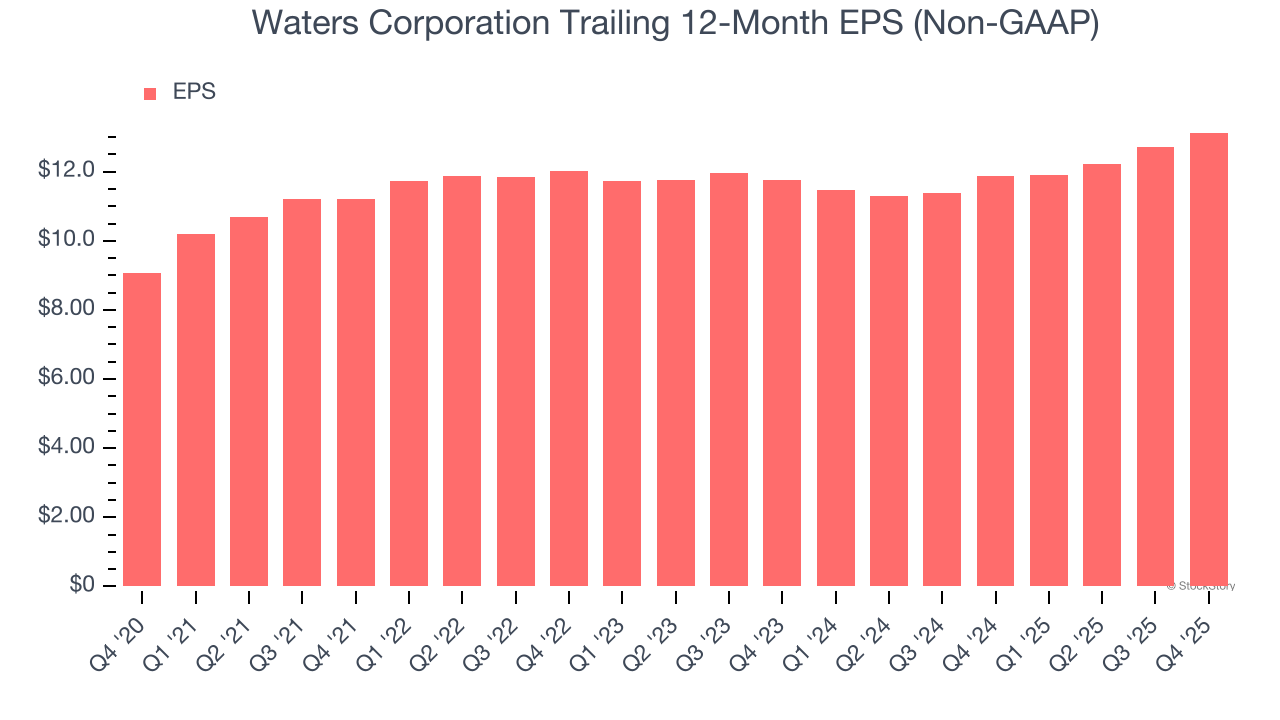

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Waters Corporation’s solid 7.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Waters Corporation reported adjusted EPS of $4.53, up from $4.10 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Waters Corporation’s full-year EPS of $13.13 to grow 9.1%.

Key Takeaways from Waters Corporation’s Q4 Results

We were impressed by Waters Corporation’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also happy its full-year EPS guidance narrowly outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, this was a weaker quarter. The stock remained flat at $329.54 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)