/Amazon%20Delivery%20Truck.jpg)

Amazon (AMZN) stock has been under the pump since August, dropping from 145 to 92.

When a quality company has a big drop like this, I like to use a strategy called a diagonal put spread.

This option strategy is an advanced strategy because it utilizes options over different expiration periods and different strike prices.

The strategy involves selling an out-of-the-money put for a near term expiry and then buying a put for around the same price using a later expiry.

The idea with the trade is that the stock might fall a little bit more, but should stay above the short strike price.

Let’s look at an example using Amazon.

Amazon Diagonal Put Spread Example

The trade I’m looking at is selling a November 18 put with a strike price of 87 and buying a December 2 put with a strike price of 85.

As of yesterday’s close, the November 18 put could be sold for around $1.65 and the December 2 put could be bought for 1.90.

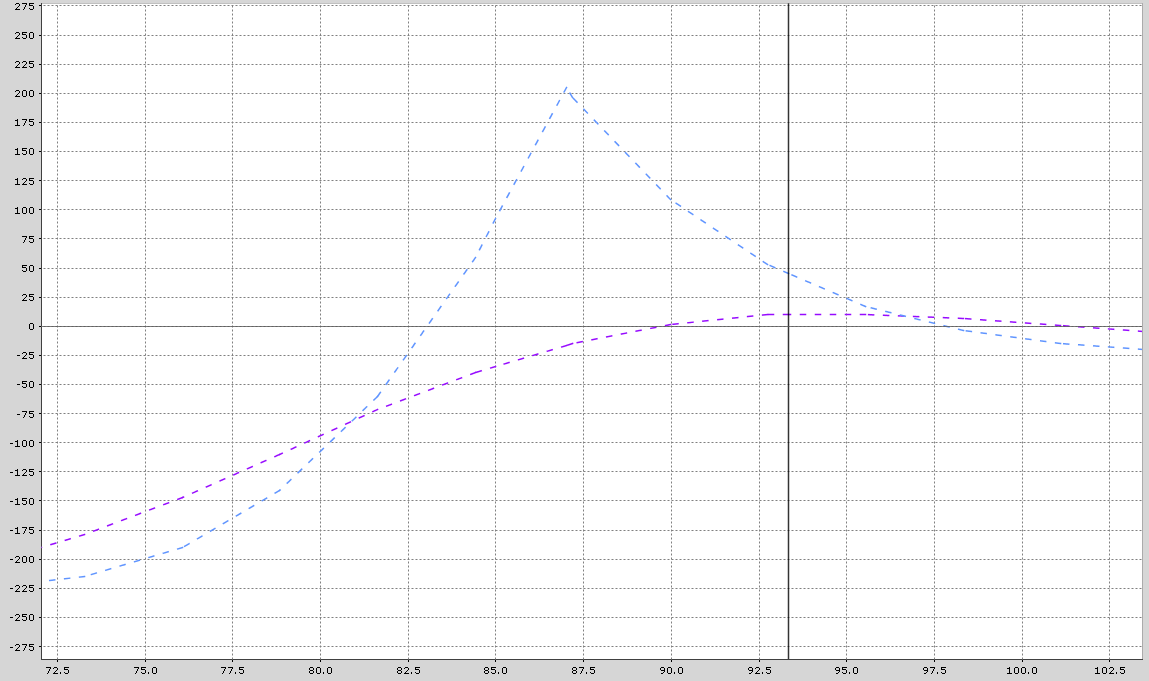

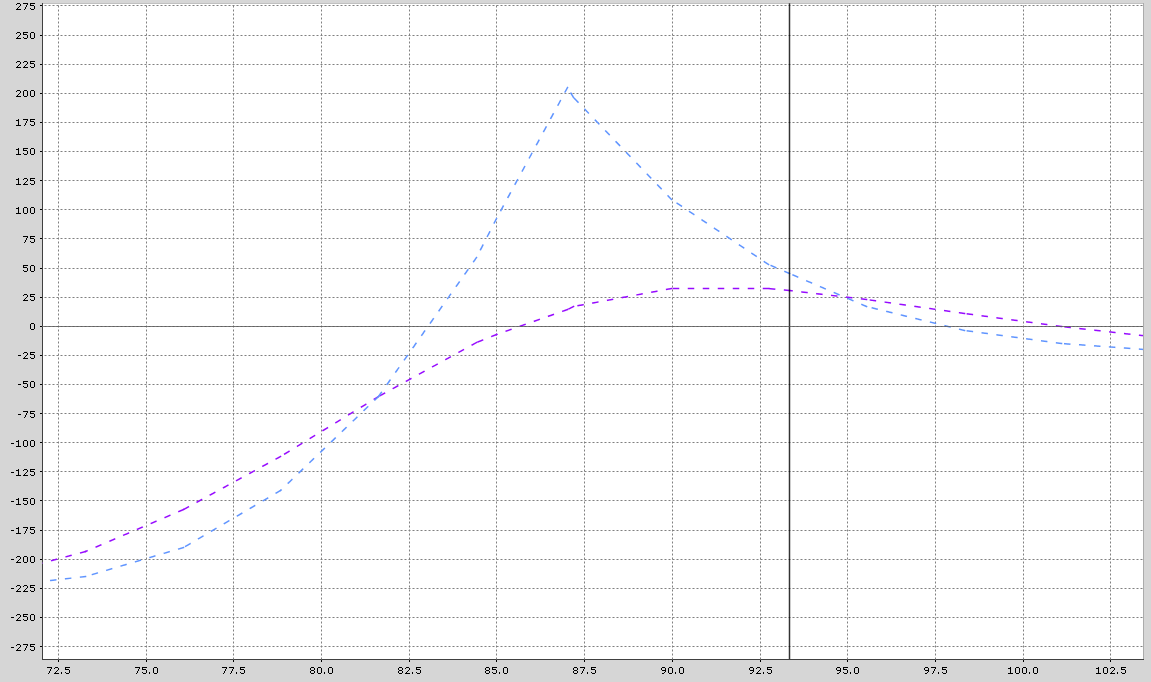

The net cost on the trade would be $25 and that is the most the trade could lose on the upside.

The risk on the trade is on the downside with a potential maximum loss of $225. This is calculated by taking the difference in the spread (2) multiplied by 100 and adding in the cost of the trade (25).

The maximum potential gain is around $200 which would occur if AMZN closes right at 87 on November 18.

The trade has a nice profit zone in between 83 and 97.

Aiming for a return of around 10-15% makes sense and I would set a similar stop loss.

The worst-case scenario is a sharp drop in AMZN stock early in the trade. For this reason, if the stock drops below 87 in the next few days, I would also consider closing the trade early to minimize losses.

The initial trade set up has a delta of 1 meaning the position is roughly equivalent to owning 1 share of AMZN stock. Note that this delta number can change significantly as the stock starts to move.

Below is the payoff graph with the blue line representing the profit or loss at expiration and the purple line being the trade as of today.

This is how the trade could look in around two weeks time.

So, provided AMZN stock stays above 87 in the next two weeks, the trade should be ok. As the trade requires the stock to not drop too much, this would not be an appropriate strategy for bearish traders.

Amazon Company Details

The Barchart Technical Opinion rating is a 100% Sell and ranks in the Top 1% of all short term signal directions. Long term indicators fully support a continuation of the trend. The market is in highly oversold territory. Beware of a trend reversal.

Amazon.com is one of the largest e-commerce providers, with sprawling operations spreading across the globe. Its online retail business revolves around the Prime program well-supported by the company's massive distribution network. Further, the Whole Foods Market acquisition helped Amazon establish footprint in physical grocery supermarket space. Amazon also enjoys dominant position in the cloud-computing market, particularly in the Infrastructure as a Service space, thanks to Amazon Web Services, which is one of its high-margin generating businesses. Amazon has also become a household name with its Alexa powered Echo devices. Artificial Intelligence backed Alexa is helping the company sell products and services. The company reports revenue under three broad heads'North America, International and AWS, respectively. Amazon targets three categories of customers - consumers, sellers and website developers.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Plunge as Powell Remains Hawkish

- Luminar Technologies Call Options Skyrocket in Unusual Options Activity

- Options Traders Expect High Volatility for Norwegian Cruise Line (NCLH)

- Cybersecurity Stocks Outperform in Bear Market

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)