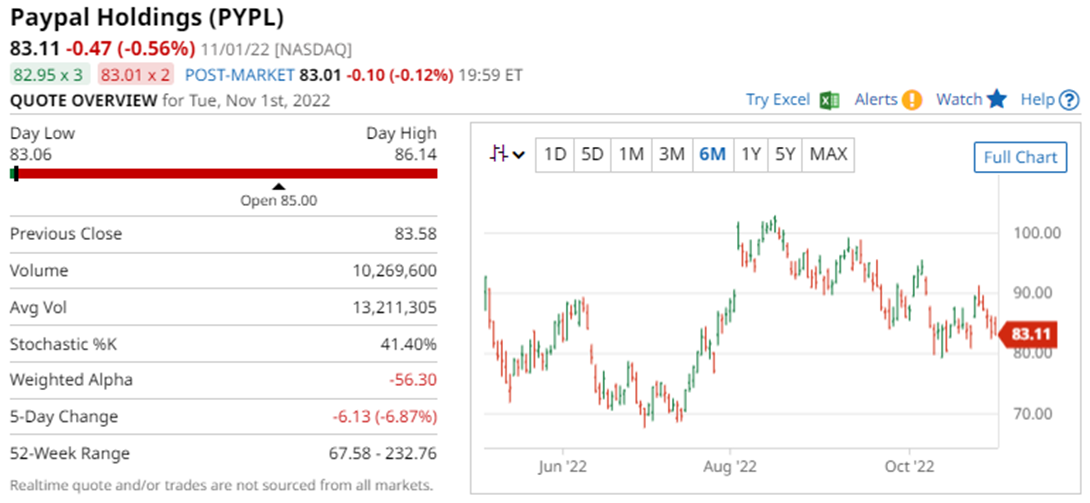

PayPal (PYPL) is due to report earnings this Thursday after the closing bell. The Barchart Technical Opinion rating is a 72% Sell with a strengthening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

PYPL rates as a Strong Buy according to 22 analysts with 2 Moderate Buy and 7 Hold ratings. Implied volatility is 66.19% which gives PYPL and IV Percentile of 82% and an IV Rank of 66%

Today, we will analyze three different ideas:

- A Short Iron Condor

- A Bull Put Spread

- A Butterfly Spread

Short Iron Condor

The first strategy is a short iron condor. An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range.

When implied volatility is high, the wider the expected range becomes. PayPal’s IV Percentile is showing 82%, which means the current level of volatility is higher than 82% of the occurrences in that last twelve months.

The maximum profit for an iron condor is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Using the November 4 expiration, traders could sell the 74-strike put and buy the 69-strike put. Then on the calls, sell the 94 call and buy the 101 call.

Yesterday, that condor was trading around $1.55 which means the trader would receive $155 into their account. The maximum risk is $345 for a total profit potential of 44.93%.

The profit zone ranges between 72.45 and 95.55. This can be calculated by taking the short strikes and adding or subtracting the premium received.

Let’s take a look at another potential option strategy.

Bull Put Spread

Traders thinking that PYPL might have a positive response to earnings could just trade the bull put spread side of the iron condor.

Trading just the bull put spread side would involve selling the November 4th 74 put and buying the 69 put. This spread could be sold yesterday for around $0.75 or $75 in total premium.

The maximum gain is $75 with total risk of $425 for a potential return of 17.65% with a breakeven price of 73.25.

The final idea we will look at is a butterfly spread.

Butterfly Spread

A butterfly spread is constructed by buying an in-the-money call, selling two at-the-money calls and buying an out-of-the-money call. The trade is entered for a net debit meaning the trader pays to enter the trade. This debit is also the maximum possible loss.

The maximum profit is calculated as the difference between the short and long calls less the premium that you paid for the spread.

Using the November 4 expiry, traders could buy the 73-strike call, sell two of the 83-strike calls and buy one of the 93-strike calls. The cost for the trade would be $290 which is the most the trade could lose. The maximum potential gain is $710 which would occur if PYPL finished right at 83 at expiration.

Conclusion And Risk Management

There you have three different trade ideas for PayPal’s earnings. All three are risk defined trades, so you always know the worst-case scenario even if PYPL makes a bigger than expected move.

Short-term trades over earnings such as these ones are almost impossible to adjust. Either the trade works, or it doesn’t so position sizing is vital.

Short-term trades also have assignment risk, so traders need to be aware of that possibility.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Fade Ahead of Wednesday’s Expected 75 bp Fed Rate Hike

- Brunswick Strikes Gold Down in Florida

- Meta Platforms (META) Bulls Attract the Spotlight of Unusual Options Activity

- Chevron's Massive Free Cash Flow Powers the Stock Higher

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)