Avis Budget Group (CAR) isn’t exactly a confidence-inspiring name right now, with CAR stock losing roughly 22% in the past six months. It’s also starting the new year off on the wrong foot, down more than 6%. Adding to the skepticism, the Barchart Technical Opinion indicator rates CAR as a 100% Strong Sell. It doesn’t get more emphatic than that. However, certain data points suggest a surprise may be on the horizon.

Here's the breakdown: Avis is scheduled to release its next earnings report on Feb. 18 after the market close. Now, I’m not going to sit here and pretend that I know what the company is going to deliver — your guess is as good as mine. However, what we can say is that certain trading patterns within the options market have signaled that Avis posting an earnings surprise represents a non-trivial possibility.

First, let’s consider options flow, a screener that focuses exclusively on big block transactions. So far this month, the cumulative flow favors the bulls, especially thanks to the Feb. 4 session’s net trade sentiment of $562,800 above parity. Also, in January, the biggest transactions overwhelmingly favored the optimists. For example, on the 15th, net trade sentiment stood at almost $197 million.

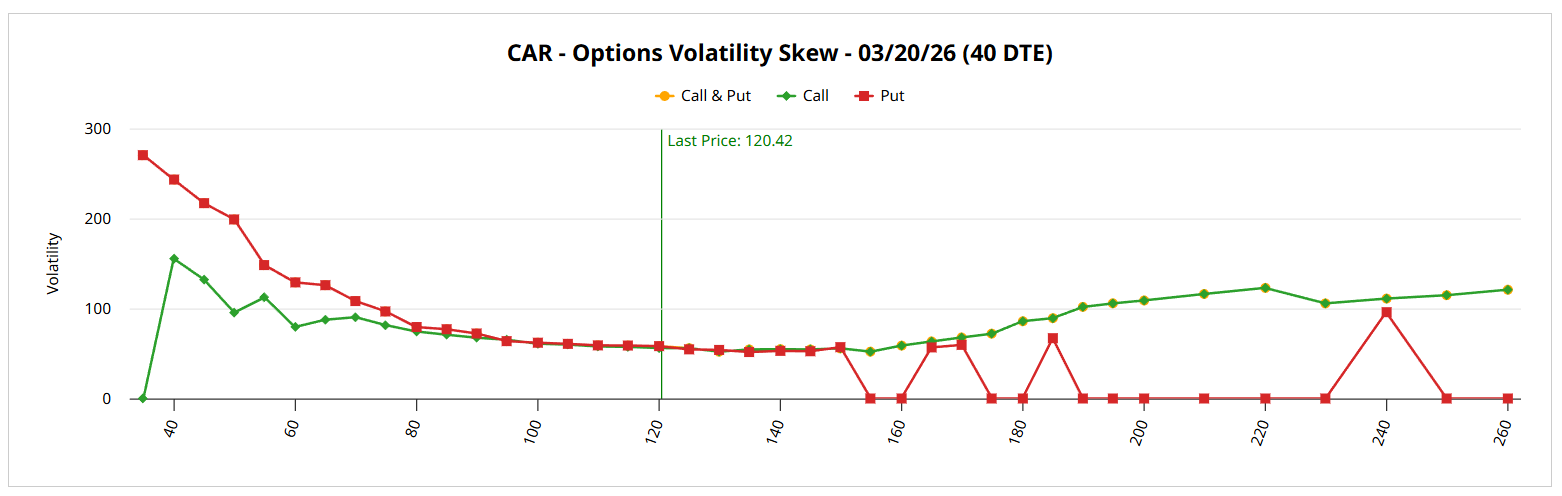

Second, volatility skew, which showcases implied volatility (IV) across the strike price spectrum of a given options chain, reveals that the prioritization among smart money traders is to protect against upside volatility rather than to hedge against downside risk. Colloquially, we might say that sophisticated market participants believe that upside in CAR stock is possible.

Truthfully, though, the matter is more nuanced. Essentially, the volatility skew is stating that there’s a greater penalty for calling the upside swing wrong than there is for failing to adequately hedge against downward volatility. Stated differently, what is absolutely possible is that the far out-the-money (OTM) calls could be placed cynically.

What’s fascinating is that, whether they realize it or not, the smart money traders could be onto something.

Establishing the Trading Parameters of CAR Stock

While we now have some understanding of the possible thinking behind CAR stock options, we’re still at a loss as to how this translates into actual output. For that, we may turn to the Black-Scholes-derived Expected Move calculator. Wall Street’s standard mechanism for pricing options projects that CAR may land between $105.55 and $135.30 at the end of the March 20 expiration date.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where CAR stock might symmetrically fall one standard deviation away from spot (while accounting for volatility and days to expiration).

This dispersion is insightful because it lays out the likely trading parameters of CAR stock. Basically, the model is saying that in 68% of cases, we would expect CAR to trade within the prescribed range. That’s a reasonable assumption because it would take an extraordinary catalyst to drive a security past one standard deviation.

Nevertheless, it’s also fair to say that, at this point, we have effectively reached the limit of first-order analyses or the freely available information that the Wall Street machinery provides. Essentially, it’s not controversial to state that CAR stock will land one standard deviation away from spot with inputs provided by IV — since IV itself stems from actual order flows.

However, this assessment also means that we must cover a peak-to-trough spread of over 28%. It’s like a search-and-rescue (SAR) operation where CAR is a shipwrecked survivor. While the distress signal went out in a large patch of the Pacific Ocean, that’s still a lot of water to cover.

Given that we have limited resources, we can’t dedicate a full-on search for this one survivor. At some point, we have to use probabilistic math to maximize our resource expenditure — and that’s exactly where the Markov property comes into view.

Using Science to Narrow Down the Probabilistic Framework

Under Markov, the future state of a system depends only on the present state. Stated differently, forward probabilities should not be calculated independently but be assessed in context. In the above SAR analogy, where the shipwrecked survivor may be found will depend heavily on ocean currents. Obviously, different current categories — such as choppy waters versus calm waters — will likely influence drift patterns.

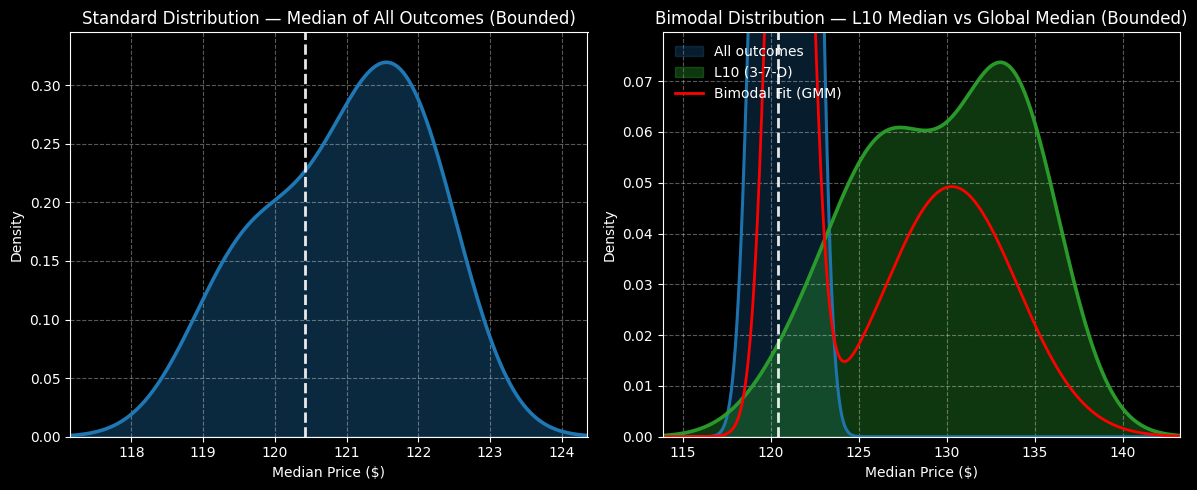

So, here’s how the Markov property is relevant to CAR stock. In the last 10 weeks, CAR printed only three up weeks, leading to an overall downward slope. There’s nothing special about this 3-7-D sequence, per se. However, what we are asserting is that the 3-7-D is a specific kind of ocean current. Therefore, a shipwrecked survivor would likely drift differently in such currents than if another type of water movement category were involved.

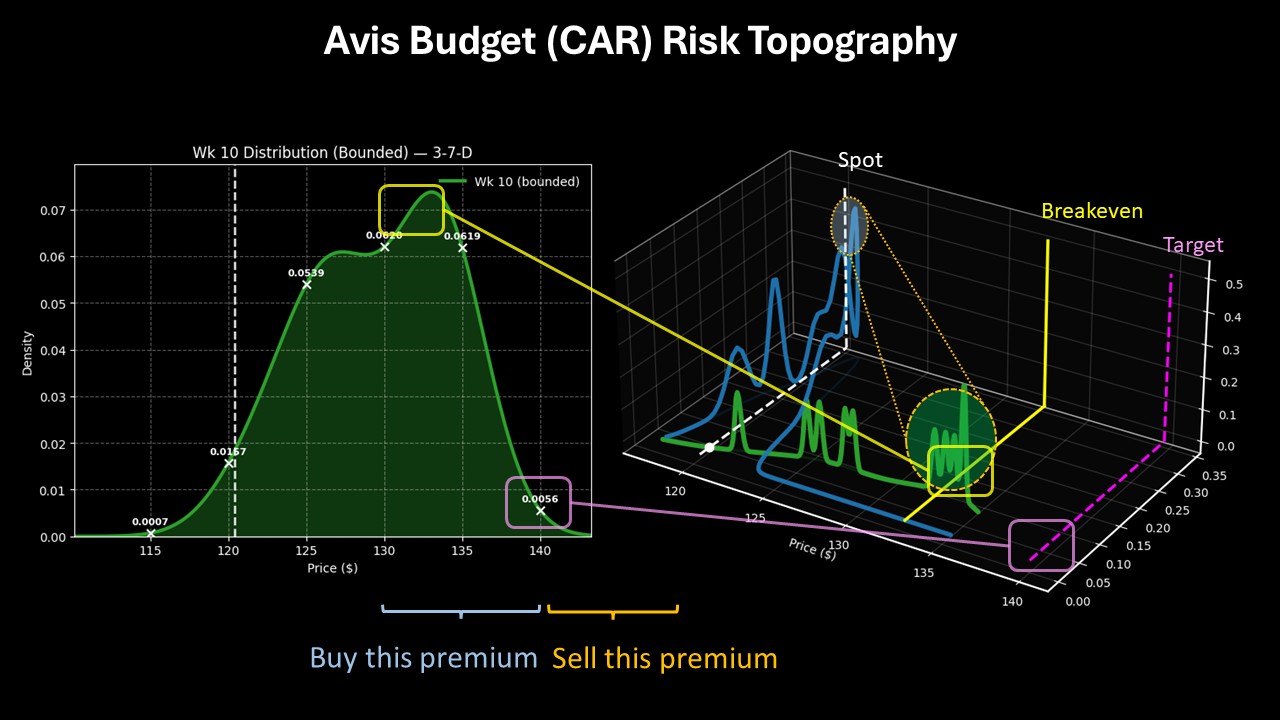

At this point, I’ve shown my hand. Through a combination of enumerative induction (via past analogs) and Bayesian-inspired inference, we’re going to estimate where CAR stock may end up. This estimation is based on the past drift patterns associated with the 3-7-D quantitative signal. Long story short, over the next 10 weeks, we would expect CAR to travel between $115 and $145, but with probability density peaking near $133.

It's important to say here that no system is perfect. Further, David Hume’s problem of induction will argue that there’s no rational, non-circular justification for believing the future will resemble the past. From a philosophical standpoint, one could argue that Markov-based analyses are “junk.” The counterargument, though, is that Markov analyses arguably offer the fewest assumptions among second-order analytics.

Sure, you can stick with the “facts” of Black-Scholes but remember, even Black-Scholes is also making a presupposition that stock market returns are lognormally distributed — which is not an absolute truth statement. The uncomfortable reality is that there is no framework that totally escapes uncertainty and assumptions in markets.

However, my premise is that the Markov property gives us the best operational tools for narrowing down uncertainty. With that condition in mind, I find myself intrigued with the 130/140 bull call spread expiring March 20. With a breakeven price of $132.85, this trade appears contextually reasonable while allowing you to stretch for the maximum payout of nearly 251%.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)