Domino's Pizza (DPZ) stock rose 10% yesterday (Oct. 13) as investors are returning to brand-name cash-flow producing companies that pay dividends and are buying back their stock. This company is attracting value buyers as DPZ stock still trades well below its historical value metric averages.

DPZ stock closed at $333.26 yesterday, up 10.44%. But it still looks cheap, as the company's latest earnings report on Oct. 13 shows that it is still producing large amounts of free cash flow (FCF).

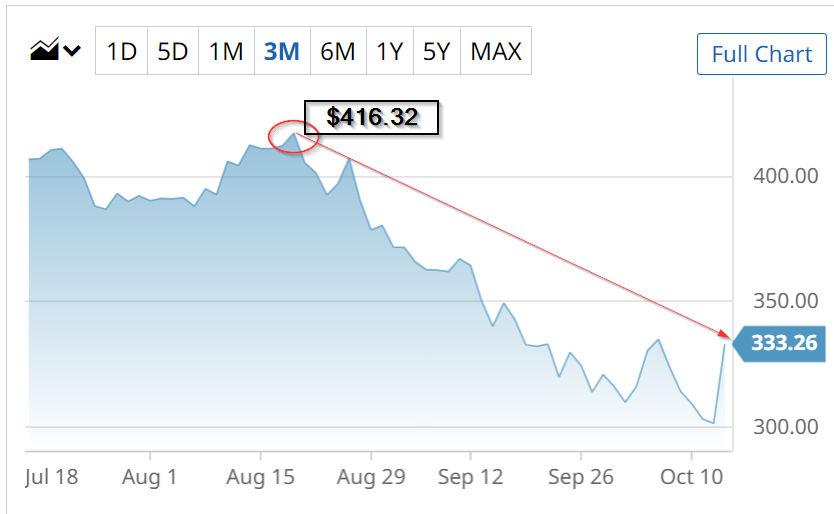

In fact, the stock is still well below its peak of $416.32 on Oct. 16, as the Barchart graph below shows.

Selling Below Historical Averages

Moreover, analysts now forecast earnings per share (EPS) will hit $12.51 this year and up to $14.75 per share next year. That puts the stock on a forward P/E multiple of just 22.6x.

This is well below the average forward multiple over the last 5 years, according to Morningstar. They report that the average multiple has been 29.9x. This implies the stock could rise another 32.3% (i.e., 29.9x/22.6x) assuming it trades at its historical average P/E multiple. That would put the stock price at $440.90 per share.

In addition, DPZ stock pays an ample dividend of $1.10 per quarter ($4.40 annually). That gives it an annual yield of 1.32%. But this metric is also at a discount to its historical averages. For example, Morningstar reports that the average dividend over the last 5 years has been 0.85%, i.e., well below 1%.

So, for example, if we divide the $4.40 annual dividend by 0.85%, the price target is $517.65 per share. This means that if the stock were to trade at its average historical yield, DPZ stock would have to rise by over 55%.

On top of this, with Domino's Oct. 11 dividend announcement, this is the fourth quarterly dividend payment announcement at $1.10 per quarter. That implies the next dividend will be hiked since Domino's has consistently raised its dividend each year for the past 8 years in a row.

As a result DPZ stock has a P/E-based price target is $440.90 per share and a dividend-based target of $517.65. The average of these is $479.28, which is 43.8% over today's price. In other words, expect the stock to drift upwards as investors get comfortable with its revenue and earnings outlook going forward.

Fundamentals Look Strong

This is underscored by the company's latest quarterly release on Oct. 13. For example, same-store sales growth in the U.S. rose 2.0%, and revenue hit $1.07 billion, $16 million higher than forecasts, according to Seeking Alpha.

Moreover, the company is still producing good free cash flow (FCF). During the third quarter ending Sept. 11, it produced $126.2 million in FCF, which was significantly higher than the past two quarters (i.e., $78.8m in Q1 and $74.4m in Q2).

This has allowed the company to keep paying its dividend as well as buying back $196 million of its shares during the quarter. That helps reduce its share count and elevates both the earnings and dividends per share for the same dollar amounts.

The bottom line here: Expect DPZ stock to keep rising as it moves closer to its historical averages.

More Stock Market News from Barchart

- Stocks Recover Losses and End Sharply Higher Ahead of Q3 Bank Earnings

- The Good News, Bad News Story That Is Domino’s

- Pinterest Outperforms Social Media Rivals

- Stocks Rebound Off Lows Despite Hot U.S. Consumer Prices

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)