Jefferies Financial Group's (JEF) latest Q3 results on Sept. 28, showed strong free cash flow and tangible book value. It now trades for less than 10x earnings and a 3.83% yield, making JEF stock appealing to value buyers.

Jefferies has good fundamentals. In addition, the stock has held up well in the in the last six months, down only 0.7%. That makes it a bargain for many risk averse value investors.

Catalysts: Dividend Hike and Vitesse Spinoff

Moreover, there are some good catalysts that could push JEF stock higher. For one, Jefferies is planning on spinning off to shareholders its oil and gas company, Vitesse Energy, by the end of the fiscal year ending Nov. 30.

In addition, Jefferies is likely to raise its dividend next quarter. This is because it has paid out 4 quarters of dividends at 30 cents per share and its has hiked its dividend annually for the past 5 years.

On top of this, Jefferies is buying back its own shares. In its fiscal Q3 ending Aug. 31, it bought back 4.3 million shares of common stock for $134.1 million, or an average price of $31.39 per share. This is equal to 1.65% of its total diluted shares and implies the share count will fall by over 6.6% annually.

Where This Leaves Investors

In other words, combined with its 3.83% dividend yield, the 6.60% buyback yield gives shareholders a total yield of 10.43%. Combined with its catalysts, this makes the stock very attractive.

Lastly, shareholders should be impressed that its tangible book value per share (TBVPS) has held up well. In Q3 it ended 1.57% higher than last quarter, at $36.79, up from $36.22 in May. This means the stock at $33.31 is just 90.5% of its TBVPS. Even on a fully diluted basis the TBVPS was $33.81 per share, the stock is still cheap.

Investors are already discounting a downturn in the economy in the stock. They assume that investment banking revenues and fees, as well as its investment management income may still be difficult. But given its yield, buybacks and spinoff, investors are getting paid to wait for the stock to move higher.

Option Income Plays

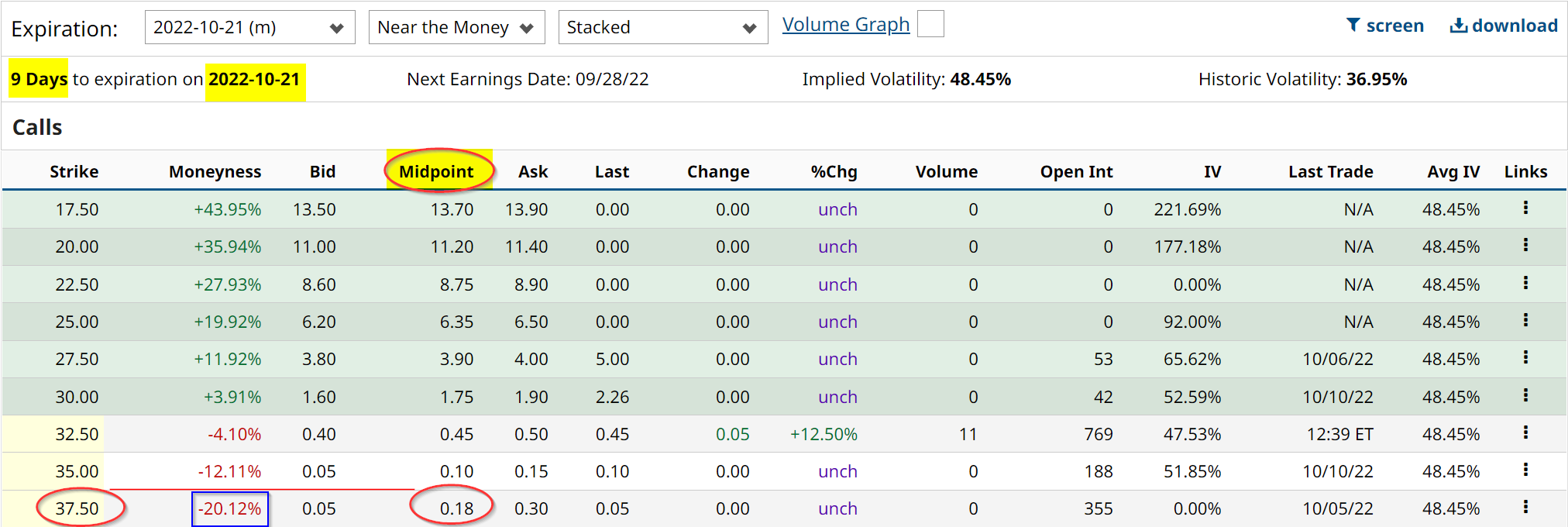

Covered calls with JEF stock look attractive here as well. The Barchart table below shows that even for the Oct. 21 expiration period, investors can reap 18 cents per contract for the $37.50 strike price.

This works out to a return of 0.54% for the next 9 days, which annualized out to a very good return. Moreover, it assumes that JEF stock would have to rise over 20% for the calls to be exercised.

This shows that investors can make additional income on top of the high yield, buybacks and potential spinoff with JEF stock.

More Stock Market News from Barchart

- Analysts Still Upbeat on TSMC Despite Tech Rout

- Stocks Post Modest Gains in Choppy Trade

- Markets Today: Stocks Slightly Higher Despite Strength in U.S. Sep PPI

- These 3 Are the Highest Yielding Dividend Kings Today

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)