Gold as a Macro Asset

Gold is a globally traded macro asset that responds primarily to shifts in real interest rates, currency dynamics, inflation expectations, and geopolitical risk. Its role in the global financial system is closely tied to capital preservation, purchasing power protection, and hedging against monetary and political uncertainty.

Within the broader metals complex, gold behaves differently than industrial metals such as copper, which are more directly influenced by growth expectations and manufacturing demand. While silver shares some characteristics with gold, it also carries meaningful industrial exposure, making gold the purest expression of macro driven precious metals demand.

Recent price action in gold has been supported by a combination of declining real yields and a growing structural bid from global central banks. As expectations for eventual policy easing have increased, the opportunity cost of holding non yielding assets such as gold has fallen, improving its relative attractiveness. At the same time, central banks in countries including China, Russia, and several emerging market economies have continued to accumulate gold reserves as part of a longer term diversification strategy away from heavy reliance on US Treasuries and dollar denominated assets. This shift reflects concerns around geopolitical risk, financial sanctions, rising sovereign debt levels, and the desire for reserve assets that are no one else’s liability. Together, these forces have reinforced gold’s role as a strategic macro asset and helped sustain the strong upside momentum observed in recent months.

What the Market Has Done

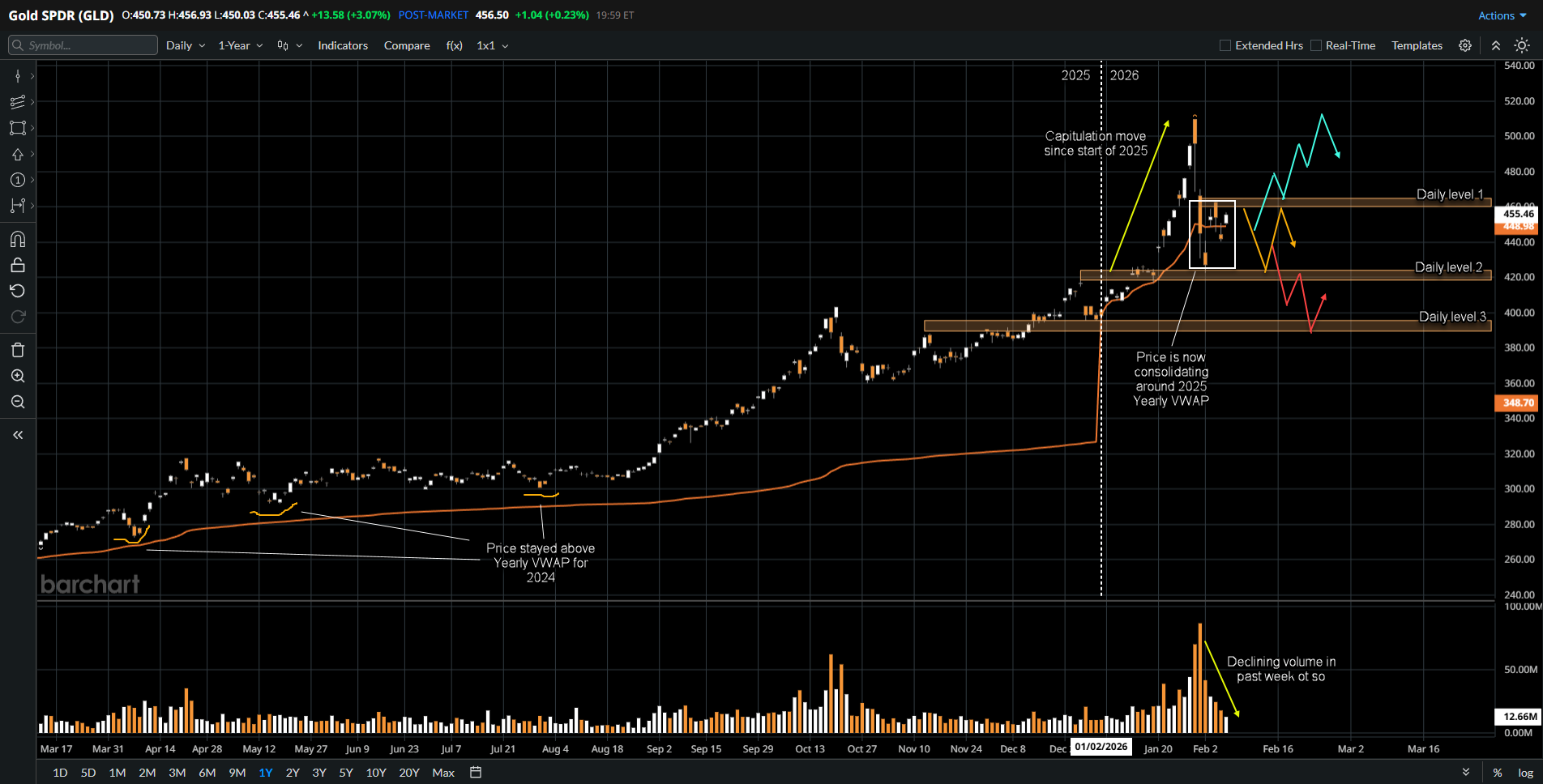

- Gold remained in a sustained uptrend throughout the whole of 2025, with GLD consistently trading above the yearly VWAP. This structure signaled strong higher timeframe participation and persistent demand for gold exposure.

- At the end of October, gold reached a capitulation high, with GLD printing an all time high at 403.30. This move was followed by a sharp pullback to 360.12 as profit taking emerged and macro expectations temporarily stabilized after a strong 2024 driven rally.

- From the 360.12 low, gold entered a slow grind higher, with GLD steadily recovering and revisiting the highs of the capitulation move near 403.30 by the end of December 2025. This recovery reflected continued macro support and renewed interest in gold as a defensive asset.

- At the start of 2026, gold entered a parabolic advance, with GLD rallying rapidly to 509.70 during January, representing a 29.3 percent increase. This acceleration was driven by heightened geopolitical risk, aggressive repositioning, and renewed demand for inflation and policy hedges.

- The parabolic move was followed by a swift capitulation, with GLD pulling back sharply to 422.55 and retracing approximately 78 percent of the January advance. This move reflected long liquidation and a reset in positioning after an unsustainable rate of ascent and possibly a potential resolution to the conflict in the Middle East.

- Over the past week, buyers have responded near the 422.55 area, forming daily level 2, while sellers have remained active near 463.10, forming daily level 1. Gold has auctioned two-way within this range as the market attempts to re-establish value.

- Volume has declined during this rotation, indicating reduced participation and hesitation as traders wait for clearer signals from both macro data and price acceptance.

What to Expect in the Coming Weeks

Key levels to monitor in GLD, as a proxy for gold, remain the 461 and 423 areas, corresponding with daily level 1 and daily level 2.

Neutral Scenario:

- If volume remains subdued near the edges of the 461 to 423 range, gold is likely to continue auctioning two-way.

- This would suggest further consolidation as the market works to re establish value following January’s parabolic move and subsequent capitulation.

Bullish Scenario:

- If buyers begin stepping up bids within the current range and volume expands, gold could attempt a break above the 461 area.

- If price breaks above and sustains acceptance above 461, the market may rotate higher to revisit the all-time highs near 509.70.

Bearish Scenario:

- If buyers fail to hold the 423 area, additional long liquidation could develop.

- A sustained move below daily level 2 would open the door for a rotation lower toward the 390 area, aligned with daily level 3.

Conclusion

Gold remains supported by longer term macro themes including central bank accumulation, shifting rate expectations, and geopolitical uncertainty. At the same time, the technical structure reflected through GLD shows a market in balance after an aggressive and unsustainable parabolic rally. Whether gold resolves higher or lower will depend on how price behaves around key acceptance levels and whether volume returns with directional intent. Traders should focus on alignment between macro catalysts and technical confirmation as the market works through this repricing phase.

For traders looking to express views in the metals markets such as gold, futures offer a more precise and capital efficient alternative to ETFs like GLD. Futures provide centralized pricing, deep liquidity, and transparent execution that exchange traded products cannot always match. EdgeClear delivers direct access to global futures markets with trader focused platforms built for serious market participation. Learn more at edgeclear.com.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional if necessary before engaging in futures or derivatives trading.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)