Marathon Petroleum Corp (MPC), the oil and gas pipeline, storage, and refinery company, has a huge 2.43% dividend yield and a 21% buyback yield. This gives MPC stock a 23.4% total yield for shareholders. That is pushing the stock higher from its present low levels.

Marathon Petroleum should not be confused with Marathon Oil Corp (MRO). MPC is an integrated downstream oil refining and marketing company, along with oil storage and pipeline operations

Right now MPC pays $2.32 per share in dividends per share annually. That gives MPC stock an annual dividend yield of 2.43% based on its price of $95.47 as of Sept. 28.

Moreover, the company is conducting huge buybacks.

The buyback Yield is High at 21%

In Q2 Marathon ramped up its share buybacks to $2.846 billion. That represents over 100% of its $2.5 billion in cash flow from operations. On top of that, the company spent $330 million on dividends.

As a result, if Marathon keeps this up, its buybacks will reach $11.38 billion annually, or 23.9% of its $47.6 billion market capitalization. During its Q2 conference call, Marathon Petroleum said $4.1 billion of its shares had been repurchased since the last call. In addition, it announced a new $5 billion stock repurchase authorization.

Therefore, if MPC spends $5 billion during Q3 and Q4 its total buybacks will be $10 billion annually. That represents 21% of its $47.6 billion market cap, a huge buyback yield.

This gives MPC stock a total yield of 23.43% (i.e., 21% buyback yield plus 2.43% dividend yield). Marathon could hike its dividend per share with these huge buybacks. It is also likely hoping to push the stock higher.

Where This Leaves Investors in MPC Stock

So far this year MPC stock is up almost 50% YTD from $63.99 where it closed in 2021. But in the last month, it is down almost 10%.

The stock could easily make this up if the company keeps buying shares at these depressed levels.

In addition, enterprising investors should consider selling out-of-the-money (OTM) covered calls and cash secured OTM puts.

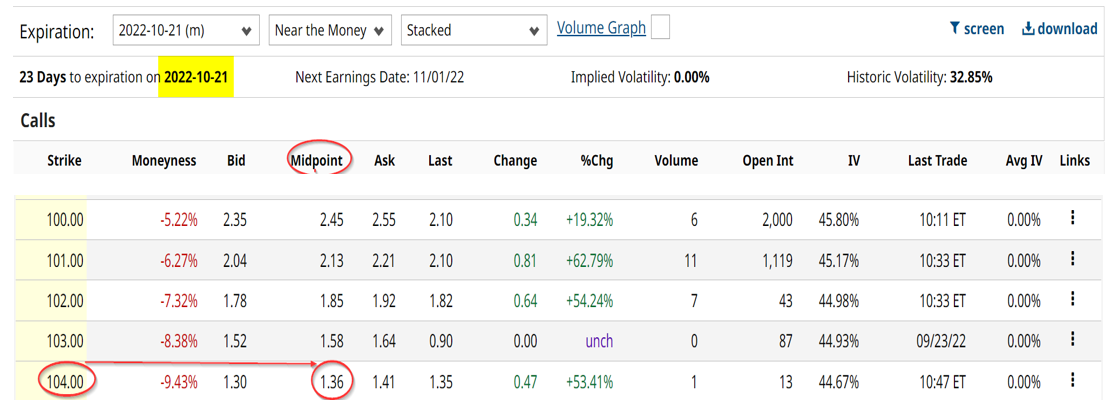

For example, the Oct. 21 call option chain shows that the $104 strike price provides a premium of $1.36 per call contract.

That provides a 1.42% return on today's price of $95.64. That is a very good monthly return on top of the 2.43% annual yield. Moreover, MPC stock would have to rise to $104 by Oct.21 before the call would be exercised. That would provide an additional 8.7% capital gain. The total return in just 23 days would be 10.16% if this happens.

Investors could actually make more with cash-secured puts, but if the stock rises there would be no capital gain available unless the investor held long shares.

This shows that investors can make good money with MPC stock now, both from its total yield and from covered call income plays.

More Stock Market News from Barchart

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)