It will not be long before the CME’s delists random-length lumber futures fade into history. Few market participants will miss the old contract as the low open interest and volume caused the exchange to roll out a more useful contract to encourage hedging activity. The exchange has high hopes for the new contract, but so far, it has not attracted much interest.

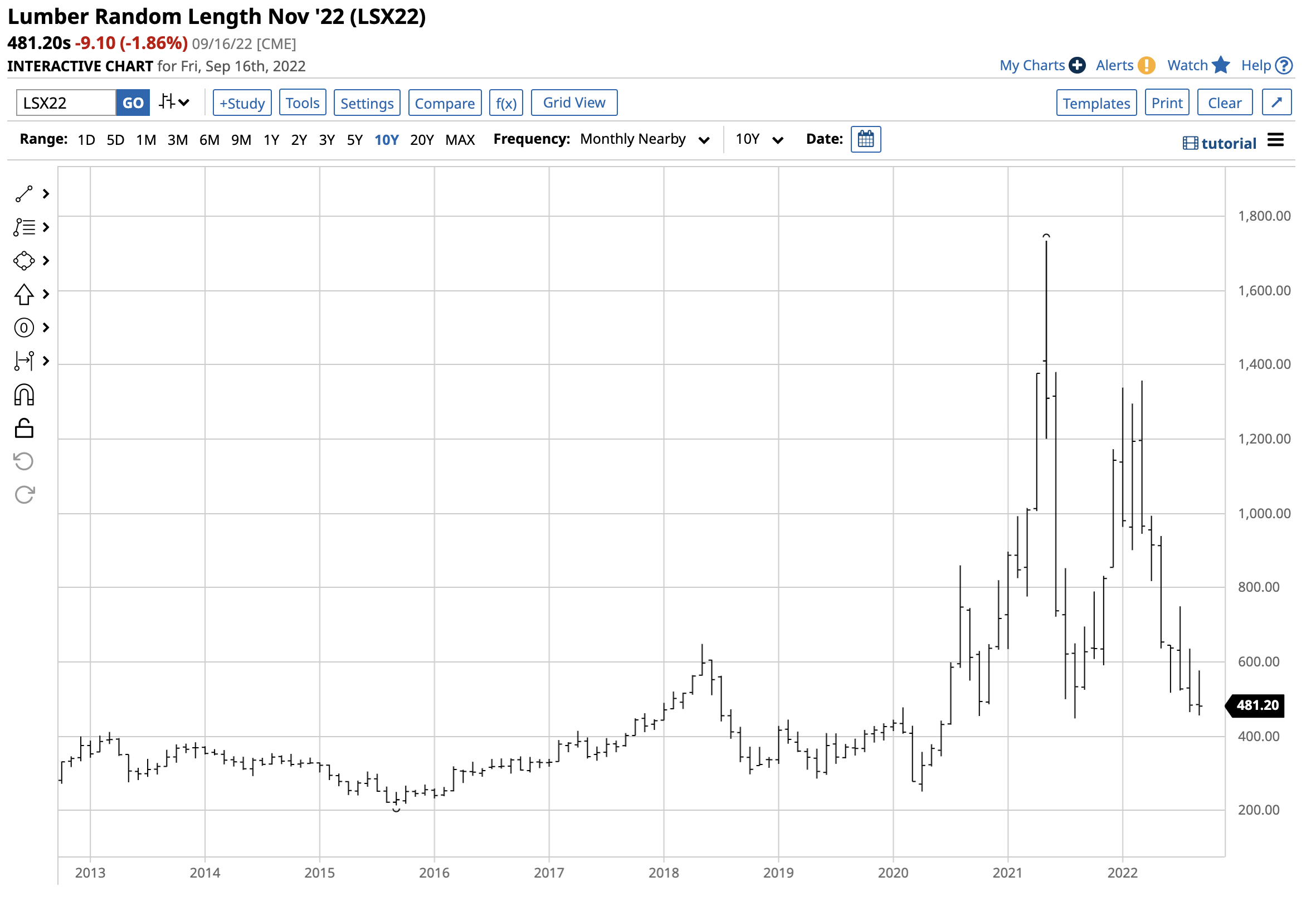

Lumber is a critical ingredient for infrastructure and a primary requirement for new home building. The lumber market signaled rising inflation in 2020 and 2021 with rallies to dizzying levels. At the $500 level, the price remains near the pre-2018 record peak below the $500 level.

Comparing the old lumber contracts with the new ones

The CME’s traditional random-length lumber futures have a contract size of 110,000 board feet. The delivery procedures are outlined in the CME’s rulebook in chapter 201.04.

The new physical lumber contract calls for delivery of 27,500 board feet, with the delivery procedures also outlined in the rulebook’s chapter 201.04. The new contract will be fulfilled with a truckload of boards instead of a full railcar, which is about one-quarter the volume, delivered to Chicago instead of a remote Canadian rail junction. The new specs allow for eastern species of spruce, pine, and fir instead of only varieties that grow in western North America.

Not much activity yet but a premium for the new futures

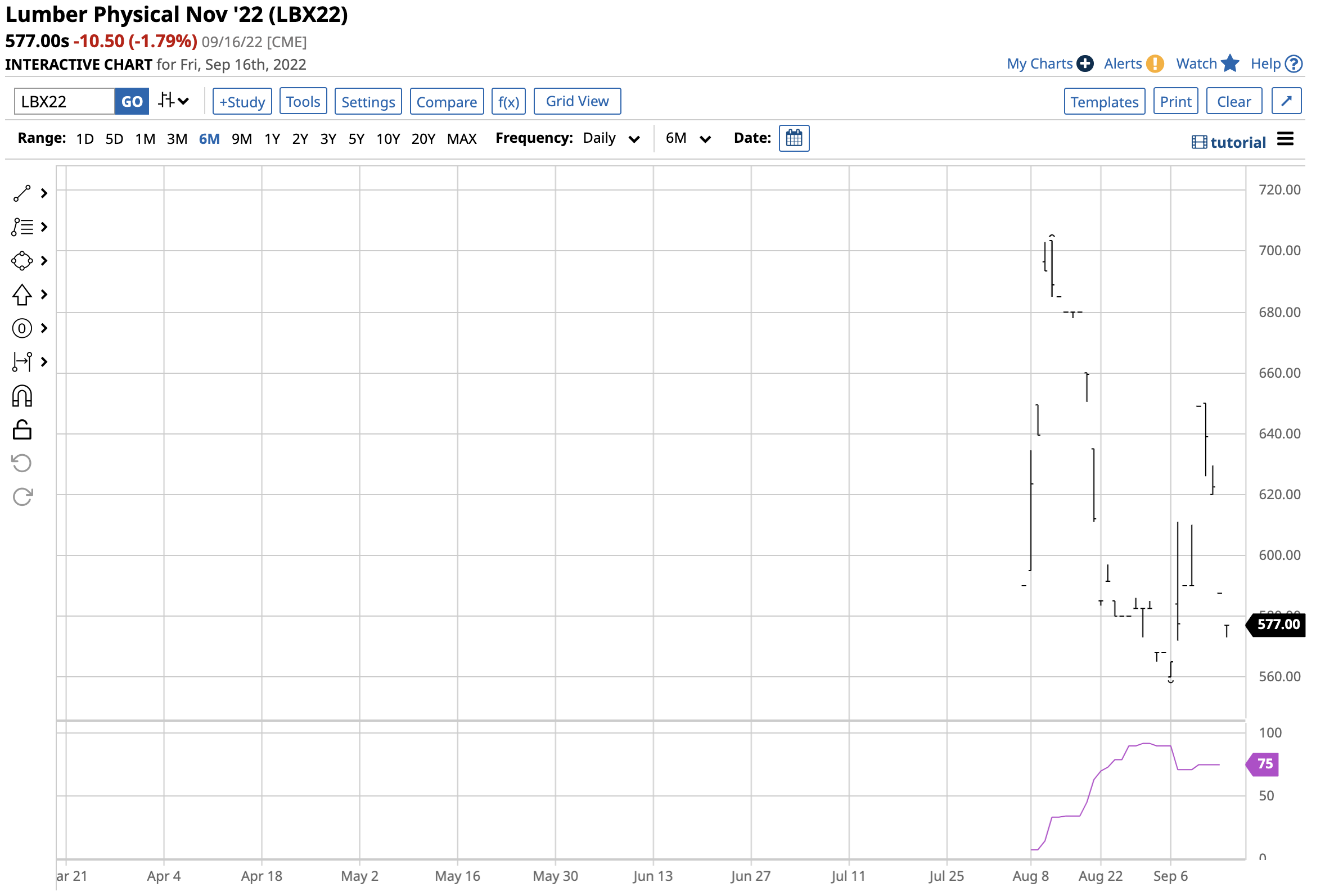

One of the ways to measure the success of the new lumber contract is to compare its open interest against the old contract. Open interest is the total number of open long and short positions, identifying the number of open risk positions set by hedgers and other market participants.

The chart shows that as of September 15, the active month November “old” random-length lumber contract had 1,862 contracts of open interest.

The metric in the “new” physical contract stood at only 75 contracts. While the open interest in the “old” contract is low compared to many other commodity futures markets, the “new” contract has yet to gain any critical mass. The CME introduced the new smaller contract to facilitate more hedging activity, but it has not attracted the expected trading volumes so far.

Open interest in the “new” contract will undoubtedly increase when the exchange delists the “old” contract. Still, it appears that the lumber futures arena will remain highly illiquid and a benchmark price rather than an actively traded market.

Meanwhile, the benchmark prices for November delivery show a significant premium for the “new” smaller contract, as it $95.80 per 1,000 board feet above the “old” contract on September 16.

Rates weigh on wood

The hotter-than-expected August consumer price index at 8.3% and the producer price index at 8.7% higher on a year-over-year basis cemented the next Fed interest rate hike. Going into the September 20-21 FOMC meeting, the short-term Fed Funds Rate stands between 2.25% to 2.50%. The Fed’s 2% inflation target will likely cause the committee to lift the Fed Funds Rate by 75 basis points for the third consecutive time, pushing the band to 3.00% to 3.25%. However, real rates remain in negative territory, so further rate hikes are likely on the horizon if inflation remains at or near the current levels.

Meanwhile, quantitative tightening, or reducing the Fed’s swollen balance sheet, means that the central bank is pushing rates higher further out along the yield curve. At the end of 2021, the thirty-year fixed-rate conventional mortgage was below the 3% level, and on September 16, it was above the 6% level.

Higher interest rates have cooled the demand for new homes, translating into declining lumber requirements. The bottom line is a rising interest rate environment is bearish for wood’s price.

The $448 low has held in the old contract

While nearby random-length lumber futures price has plunged from the March 2022 $1,357.30 per 1,000 board feet high, they remained above a critical technical support level on September 16.

The chart shows the decline to the most recent low of $456 in September 2022. The technical support level sits just below at the August 2021 $448 bottom. So far, the lumber futures have held above the support level, but another interest rate hike on September 21 could cause wood to probe under that level. The next technical level to watch is $251.50, the April 2020 pandemic-inspired low. The lack of liquidity could push lumber lower as bids to buy often evaporate during downdrafts. Since lumber is an industrial commodity, it tends to lead other raw material prices, so it is worth watching the price action in the lumber market over the coming sessions for clues about other commodity markets.

We could see action in early 2023

Seasonal construction patterns lead to lower wood demand during the winter and a return of buying in the spring. While lumber could experience additional selling pressure that pushes the price lower over the coming weeks, a rebound could be on the horizon early next year.

Moreover, as the US economy continues to contract, the US central bank could curb its enthusiasm for rate hikes in early 2023. Many Fed economists expect the short-term rate to rise to the 4% level by the end of 2022. However, another one or two quarterly GDP declines would likely cause the Fed to slow the ascent of interest rates or even stop hiking rates to stem economic contraction. The uncertainty could lead to increased volatility in markets across all asset classes. As one of the most volatile markets, lumber could experience further explosive and implosive price movement, as we have witnessed over the past years.

Lumber continues to be a benchmark price to watch instead of a liquid trading market. The “new” physical contract has not displayed any signs that it will be more liquid than the “old” contract. Until lumber gains the crucial volume and open interest necessary to make it a trading candidate, continue to monitor the price from the sidelines, and expect lots of volatility as illiquidity exacerbates price variance. I never trade lumber, but I watch the price action like a hawk for clues about the path of least resistance of prices of the other raw material markets. If the new contract becomes liquid, I will undoubtedly dip a toe into the lumber arena.

More Softs News from Barchart

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)