/Tesla%20Charging%20Station%20Black%20Background.jpg)

Tesla (TSLA) has bounced perfectly off the 50-day moving average in recent days in what could be seen as a bullish sign.

The Barchart Technical Opinion rating for TSLA is an 8% Sell with a weakening short term outlook on maintaining the current direction.

Rather than just buying the stock, investors can use the options market to find smart ways to trade Tesla stock with an attractive risk to reward ratio.

The following bullish options plays give different ways to play the stock depending on an investor’s risk/reward preferences.

Option Trade Idea 1: Sell A Bull Put Spread

A bull put spread is a defined risk option strategy that profits if the stock closes above the short strike at expiry.

To execute a bull put spread an investor would sell an out-of-the-money put and then but a further out-of-the-money put.

Running the standard Barchart Bull Put Spread Screener shows these results for TSLA:

Let’s use the first line item as an example. This bull put spread trade involves selling the October expiry 283.33 strike put and buying the 276.67 strike put.

Selling this spread results in a credit of around $2.80 or $280 per contract. That is also the maximum possible gain on the trade. The maximum potential loss can be calculated by taking the spread width, less the premium received and multiplying by 100. That give us:

6.66 – 2.80 x 100 = $386.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 72.54%.

The probability of the trade being successful is 52.3%, although this is just an estimate.

The spread will achieve the maximum profit if TSLA closes above 283.33 on October 21 in which case the entire spread would expire worthless allowing the premium seller to keep the $280 option premium.

The maximum loss will occur if TSLA closes below 276.67 on October 21 which would see the premium seller lose $386 on the trade.

The breakeven point for the Bull Put Spread is 280.53 which is calculated as 283.33 less the $2.80 option premium per contract.

Option Trade Idea 1: Sell A Naked Put

Naked options are hugely risky and should only be considered by very experience traders. The potential losses are unlimited, up to the point of the stock reaching $0.

That’s unlikely to happen in the case of TSLA, but naked puts could still suffer significant losses if the stock has a large drop in price.

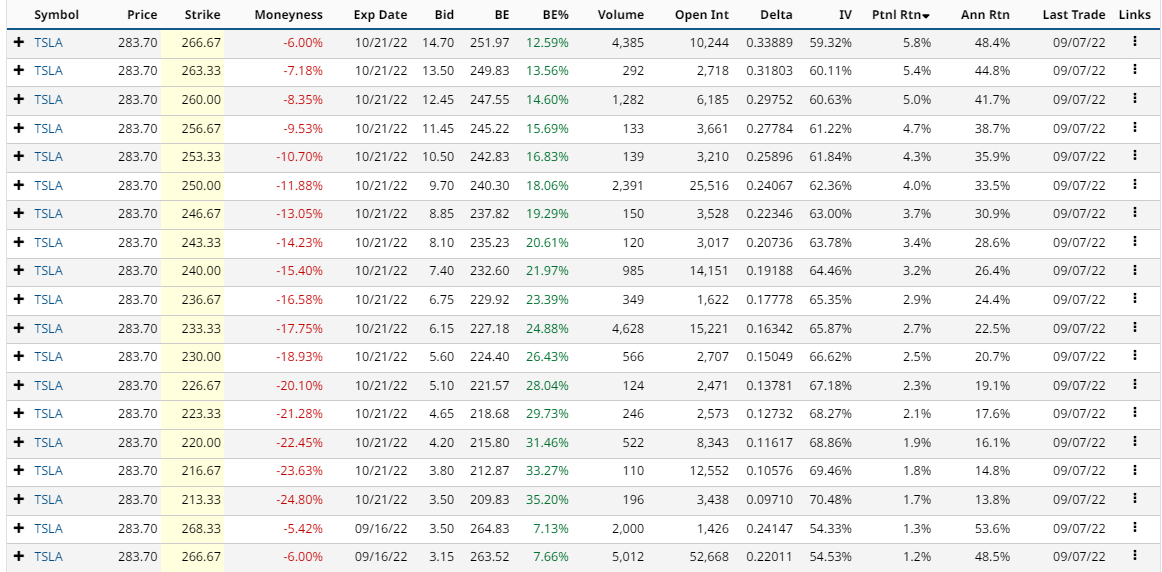

Naked puts should be traded with extreme caution, and only by large traders. That being said, let’s look at the results of Barchart’s Naked Put Screener for TSLA stock:

Once again, let’s take the first line item as our example. A naked put is a mildly bullish strategy, it will make money if the stock rallies, stays flat or doesn’t drop by too much.

The first example is selling the 266.67 strike put option. Doing this, the trader would receive a credit of around 14.70 or $1,470 per contract. That’s theirs to keep no matter what happens to the stock over the course of the trade. However, the investor does have an obligation to buy 100 shares of the stock at 266.67 if the stock drops below that level.

With a naked put, the idea would be to try and avoid assignment, by closing early or adjusting.

If TSLA stays above 266.67 and the put expires worthless, the trader makes a 5.8% gain in just over one month. That works out to be 48.4% on an annualized basis.

The breakeven price for this naked put is calculated by taking the strike price minus the option price. In this case that would be 266.67 – 14.70 = 251.97.

The maximum loss would occur if TSLA went to 0 on October 21, which would see the trade lose $25,197.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

For a bull put spread, setting a stop loss of 25% of maximum risk is a good idea. In the case of the TSLA example above, that would be a loss of around $96.

For the naked put, a stop loss of 25% of the premium received would be also prudent. In the example above, that would involve closing the trade if the loss was around $367.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, Sept 7, 2022.

More Stock Market News from Barchart