How to Control $18,000 of Stock for Just $200

What if you could buy $18,000 worth of stock for just $200? Would you do it? Well, you can’t exactly, but you can almost do exactly that. With the options market, you can create synthetic positions on stocks or ETFs for a fraction of the cost of what it would be to buy the underlying outright.

Options can create passive income, be used as a hedge against losses, and, - as mentioned, - of course, mimic a stock position at a fraction of the price. These are called synthetic positions, and they can be very powerful tools in the right hands. They allow traders to replicate the risk and reward profile of an underlying position with a fraction of the capital you’d normally need.

In this article, I’ll be covering what synthetic positions are, why they’re helpful, and of course, break down the strategies.

Synthetic Position

But before I dive in, let’s make sure we’re all on the same page.

Options are financial derivatives. They’re contracts that allow you to buy or sell a specific asset at a specified strike price at or before a specified expiration date. When you’re buying an option, you pay a premium. If you’re selling, you get the premium, which is usually expressed on a per share basis. One option contract represents 100 shares of the underlying asset.

Options can be used for directional bets for speculation, asset protection, or income generation.

Now, with options, we can replicate the desired result of the underlying - like a stock or ETF.

Synthetic positions typically mimic holding an underlying asset, but they can also replicate an option strategy. They allow traders to mimic the risk and reward profile of the target position with less capital or different risk characteristics.

Now, let’s start with the most common synthetic setups.

Synthetic Long Stock

First is the synthetic long stock, an options strategy that mimics owning an underlying asset. This strategy involves buying a long call and selling a short put with the same strike price and the same expiration date.

What this does is basically anchor you to the strike price in the same way your purchasing price does when you buy a stock. The only difference is that you only pay for the long call, and the short put essentially subsidizes the purchase price. That means you get control of 100 shares while paying a fraction of the cost of the stocks themselves.

If the stock increases in value and exceeds your long call strike price, the option is now in the money, and your position begins to generate a profit. Like with holding a stock, your maximum profit is unlimited.

Now, if it doesn’t work out and the stock goes down instead, here’s the twist. If the stock price goes below your short put strike price, that option will now be in the money, and on or around expiration, you’ll now buy 100 shares of the stock at your strike price - which you can either - keep - or sell at the current market, and take a loss.

So, let’s explore these concepts using a live example with Nvidia. Let’s say you’re bullish and think there’s a big chance it will reach new highs in the near future.

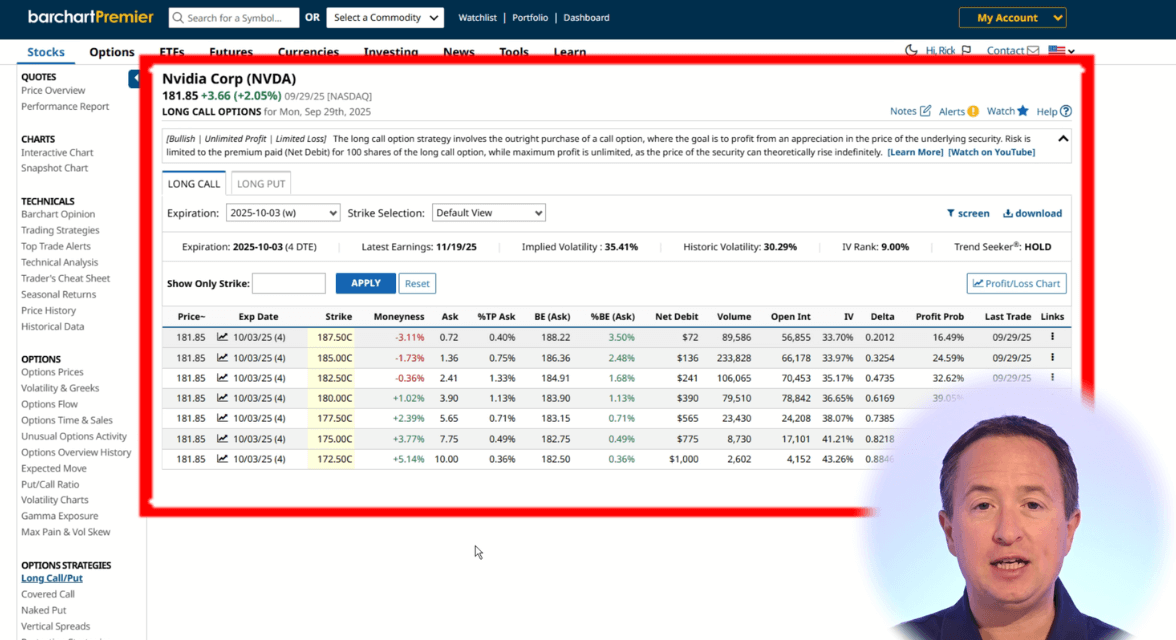

So, look at creating a synthetic long position on Nvidia. First thing you need to do is go to Barchart.com, search for Nvidia, and then go to the stock’s profile page. From there, look to the left side of the screen and click Long Call/Put under Option Strategies.

You’ll be brought to the option screener for long calls, where you’ll find trades for the nearest expiration date, along with other information like probabilities, percentage returns, and Greeks.

The first thing you need to do is consider the expiration date. Let’s say you want to enter a synthetic long on Nvidia that expires in about 3 months. For that, we can pick December 19, 2025, or 81 days away.

Then, you need to decide on your strike price. Synthetic long stocks are usually at-the-money to closely mirror the behavior of the underlying stock. This will give you nearly identical gains and losses as if you owned the shares outright.

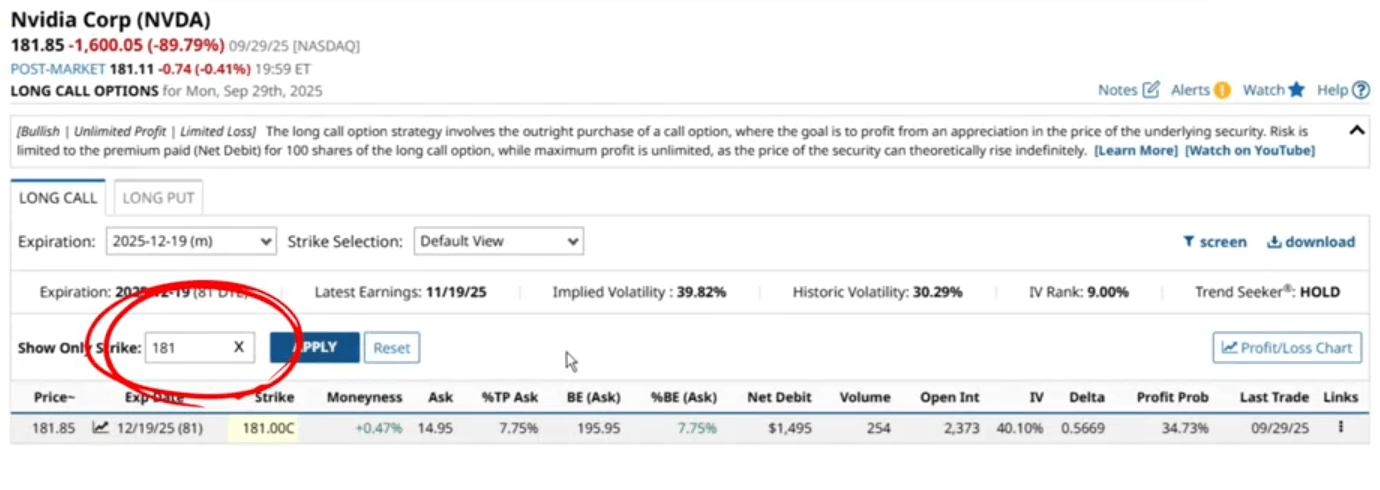

Since Nvidia is trading around $181 today, let’s look at a 181-strike long call by typing 181 here and click apply.

This 181-strike call costs $14.95 per share or $1,495 total per contract. You can also see the other trade metrics and figures.

Now, that’s it for the long call. But what about the short put?

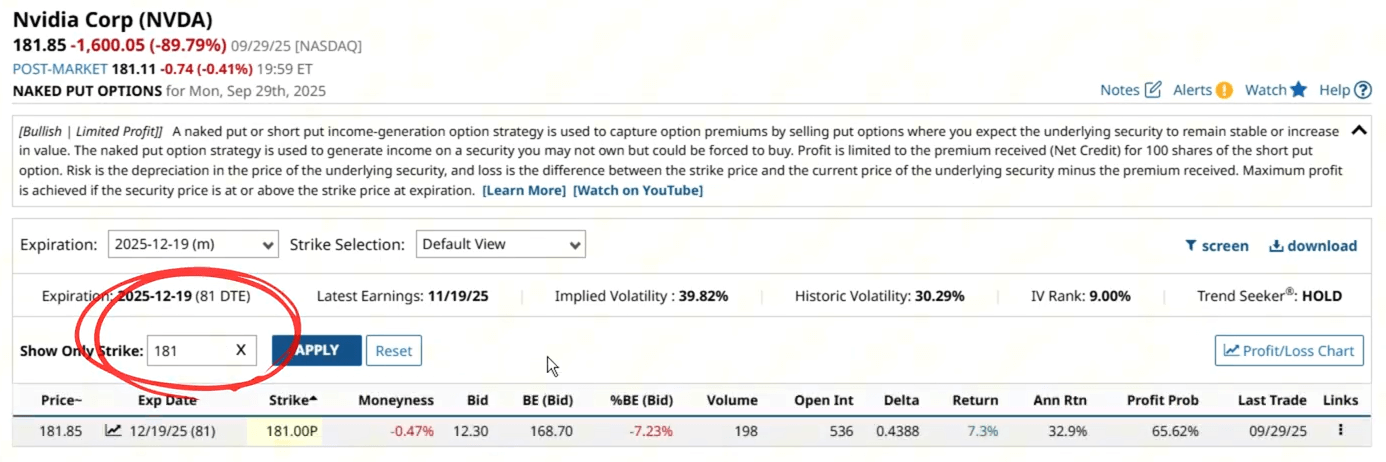

Well, you can simply click on Naked Put, and you’ll be brought to the naked put screener page for trades that expire on December 19. Now all you need to do is type 181 on the strike search again, and you have your trade list.

And according to the screener, you can sell a 181-strike put on Nvidia and receive $12.30 per share, or $1,230 per contract.

Since you paid $1495 for the call and collected $1230 for the put, this brings your total net debit to $265 per contract. That means, instead of paying $18,100 for 100 shares of Nvidia stock, you’ll only pay $265 for that very same exposure to those same 100 shares.

Now, before you run off to your brokerage, remember, when you’re selling puts, your brokerage will require you to maintain enough cash or margin to cover the potential purchase of the shares if you’re assigned on the short put. Because remember, the synthetic replicates both the upside and the downside of the underlying.

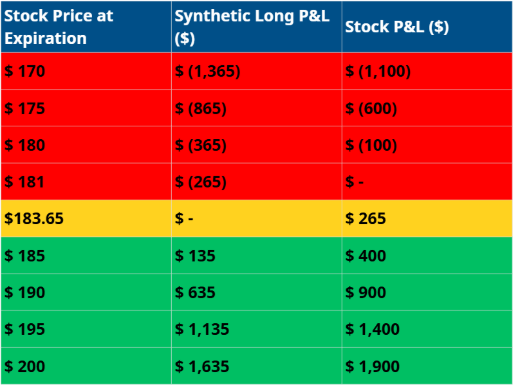

Now, let’s see how this plays out if Nvidia rallies. Suppose the stock jumps to $200 before expiration. Your 181-strike call now has an intrinsic value of $19 per share, calculated by taking the current trading price minus the strike price.

OPTION INTRINSIC VALUE = MARKET PRICE - STRIKE PRICE

That means your call option is worth at least $1,900. You could exercise the option, buy 100 shares at $181, and immediately sell them at $200, making you a $1,900 gross profit per contract. And since you initially paid a net debit of $265 per contract, your net profit works out to $1,635.

But exercising isn’t usually the most efficient way to capture value, because options also carry extrinsic value, or the part of the premium that accounts for factors like time to expiration, implied volatility, and market demand.

So instead, you might just sell the call back into the market. Let’s say it’s now priced at $20.50 per share. That’s $2,050 per contract. Since you initially paid a net debit of $265 per contract, your net profit works out to $1,785.

$2,050 − $265 = $1,785

And don’t forget, you also have a short put in play. Since the stock rallied, the short put will now be worth a lot less than you paid. If you believe Nvidia will stay above the strike at expiration, you can let the option expire worthless, or you can issue a buy to close order to close that side of the trade.

But what about the downside? If Nvidia drops to $170 at expiration, your 181-strike put will be assigned. That means you’re obligated to buy 100 shares of nvidia at $181 even though Nvidia’s current price is only $170. And since you paid a $265 net debit to set up the position, your total is a net loss of $1,365. You’ll also have a call option that you can sell, but it’s premium will have eroded significantly - selling it would help reduce your net loss, but, it may be worth it, especially if the trading fees exceed the premium.

$1,100 + $265 = $1,365

And there’s your tradeoff. If you had owned the shares alone, your loss would have been only $1,100.

Let’s consider the profit and loss scenarios depending on where Nvidia might end up - at the options expiration date.

For this synthetic long stock position, the breakeven is the strike price plus the net debit or credit. In this case, it’s $183.65.

$181 + $2.65 = $183.65

As you can see, the only difference between the synthetic long stock and owning the stock outright is the $265 debit. Aside from that, the synthetic position rises dollar for dollar with the stock after it breaks even.

By the way, and this is important, regardless of what happens on your trade, you should always close your short positions before expiration. Even if the chance of a massive price swing against you is low, I find it best to avoid taking that risk, even if it means closing the short position, which cuts out a little of your profit.

So, that’s how to form a synthetic long position. In the future, I’ll cover synthetic short positions, as well as other more advanced strategies using options. So, be sure to like and subscribe to the channel so that you won’t miss it!

Advantages of Synthetic Positions

At the end of the day, why would anyone trade synthetic positions when you can just buy the real thing?

When entering into a synthetic long stock position, you get almost the same exposure without paying the full price for the 100 shares of the underlying. However, you don’t get any dividends or voting rights.

Disadvantages of Synthetic Positions

Of course, there’s no such thing as a free lunch, no is there a risk-free investment, so let’s discuss the disadvantages of synthetic positions.

First, getting into a leveraged position means your losses can also be amplified. For example, with a synthetic long stock, if you initiate the trade at a debit, your maximum loss will actually be greater than owning the stock outright, because you’re getting the full potential downside of the stock - plus - the initial debit.

This also means that your upside will be lower than an outright stock position, again, because of the initial debit.

The next potential risk is higher fees. With synthetics, you’re getting into two trades instead of one, which means trading fees might be higher. If you misjudge the fees, it might potentially affect your bottom line. You might think that closing your positions would result in a small, tidy profit, but then find out that fees have eroded it.

Then, you’ll also need to consider assignment risks. Every option strategy that has a short component puts you at risk of assignment, early or otherwise. Early assignments typically occur when the option holder has an incentive to exercise before the option's expiration, like when an ex-dividend date is approaching or when short options are in the money with very little time left for the contract, in which case the buyer may decide to lock in the intrinsic value immediately rather than hold the option any longer.

On top of that, short positions, especially short puts, typically come with margin requirements, meaning your broker will require you to maintain sufficient capital to cover your position in case you are assigned. That margin is usually locked until the trade is closed.

Then, you don’t actually get any of the benefits of stock ownership.

Lastly, synthetic positions can be complex, and traders with limited experience may struggle to comprehend the underlying concepts behind these strategies fully. This may lead to misunderstandings or underestimating the risks, payoff, and loss profiles.

Conclusion

Overall, synthetic positions can be a powerful way to have full exposure, upward and downward of an underlying - at a fraction of owning it outright. That means they can be capital-efficient ways to achieve your preferred exposure without paying the full price.

Still, they come with their own sets of risks, and the complexity behind the setups, which may lead some traders to believe that the straightforward route is better for them. If you do use them, always ensure that you understand both sides of the trade and its risks and reward profiles.