Why 90% of Options Traders Lose Money - And How You Can Beat the Odds

If you’ve been trading long enough, I’m sure you’d have heard the phrase, “Nine out of ten traders lose money.”

But have you ever wondered why?

Option trading comes with risks, yes, but did you know there’s tools and probability metrics that can help investors tilt the odds in their favor? These tools and metrics help investors get better chances of winning trades. Of course, you’ll also see and hear of countless stories online about people making FOMO trades or as they say, try to catch a falling knife.

Is it just human psychology? Lack of experience? Or a combination of both?

Well, the reasons run far deeper than that. And if you want to have any success at options trading, you’ll need to know these reasons, how to recognize them when they start affecting your own trades, and what to do to mitigate the damage.

That’s why I’m going to cover why 90% of options traders lose money and how to avoid becoming another statistic.

The Allure of Easy Money

Now, let’s start with the basics. And when I say basic, I mean the very basic: why do people trade options, or stocks, or futures, or any financial instrument for that matter?

The answer is simple: easy money, right? Why work a 9 to 5 that pays you $20 an hour when you can make a thousand times that in just a few short minutes or hours of trading?

There’s no shortage of these “success stories” online from social media gurus, financial influencers, and even on Reddit. They post screenshots of thousands, sometimes millions in profit and you think, “If they can do it, so can I.” So you start exploring the different instruments and their derivatives.

Options, in general, offer leverage - a chance to increase exposure - therefore, profit - without necessarily increasing the initial capital requirements. Think of it as trading stocks on speed.

So, it’s not surprising that a lot of people jump into options trading, not realizing that it goes far beyond just what you see in your YouTube shorts and TikToks.

The Problem: Knowledge Gap

And this is where the first, most common cause of options trading losses comes in: the knowledge gap.

Many of us jump into options without fully understanding the concepts behind the trades.

Most would be familiar with the common definition of “an option is a contract that gives the buyer the right but not the obligation to buy or sell the stock at a specified strike price at or before a specified expiration date.”

It sounds simple, right? But then, this definition doesn’t cover what constitutes a premium, what happens when you get assigned, what volatility or time decay is, how certain news affects options pricing, or what strategies are available to you. All of these - and more - can make or break your trades.

Here’s a quick but very realistic example: Let’s say you’re new to options trading, and you see that option prices on Palantir are high on October 30, so you decide to sell a naked call. You at least know that as long as Palantir stock doesn’t trade above your strike price, you keep the premium.

So, with the stock trading at just around $194, you sell a 197.50-strike Palantir naked call that expires in 8 days, thinking that the short days to expiration or DTE will work in your favor. Even better, it has a 64% chance of expiring profitably.

But what you failed to realize is that Palantir is releasing its much-anticipated third-quarter financials in a few days, well before the contract expires.

That’s why premiums are high. That’s why on the next trading day, October 31, you see Palantir stock shoot up to $200. The next day, November 3, it reached as high as $207.

Imagine that: you just bet that Palantir won’t reach $197.50 before November 8. Two trading days later, it’s up by $10 more.

Then, you check the headlines, realize that Q3 financials were just released, and you see the details for yourself.

77% growth in US revenue, 63% growth overall, record-setting total contract values, and margins of 40%. By any measure, those are excellent results.

So what do you do? You panic, buy to close the call option at a higher price, and take a big loss to avoid an even bigger one.

But here’s the thing - volatility is a double-edged sword.

Sure enough, Palantir shares plummeted following the release. And you just got an expensive lesson.

The Fix: Due Diligence

The great thing is, the fix to lack of knowledge is simple. You just need to learn everything you can about options trading.

And for those of you saying, “that will take forever,” well, I did say simple, not fast.

The truth is, options trading is just like any other skill, and it rewards those who are willing to make the time to learn its ins and outs.

Barchart has several comprehensive guides on options trading, including metrics, Greeks, and individual strategies. We also have a bunch of videos that cover many topics related to options trading. Take the time to learn it, and it can save you thousands of dollars on the line.

For the PLTR example I provided earlier, the specific fix is knowing how an upcoming earnings call can affect a particular stock.

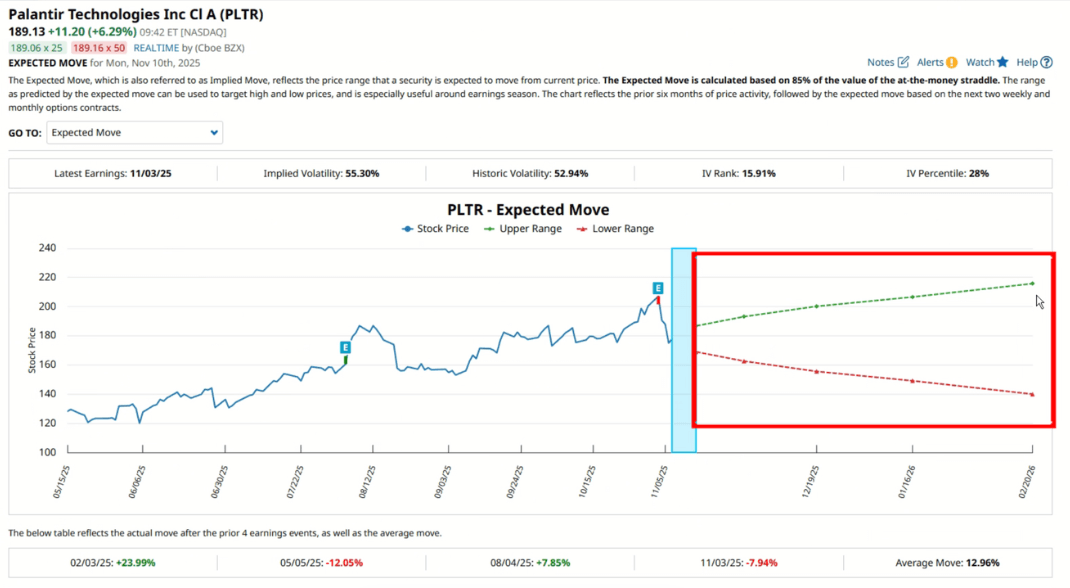

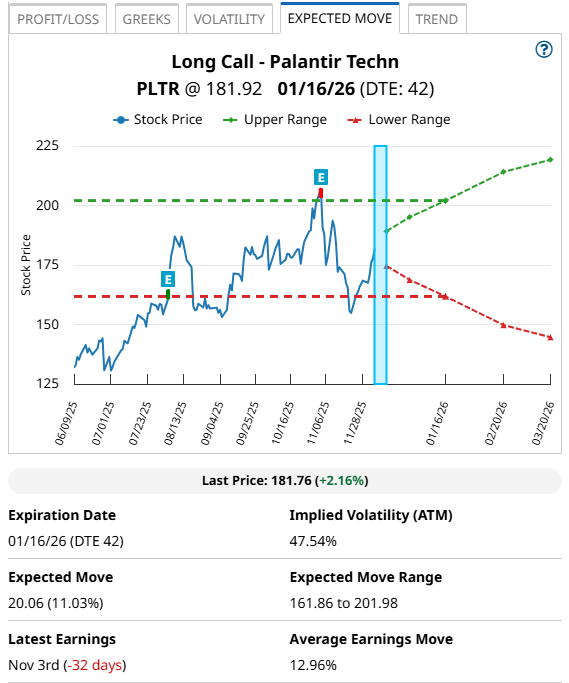

On Barchart, you can easily check how much Palantir moved on average whenever they release their financials. It also shows the expected range based on option prices. Both are pointing to a significant move during this period. All this information can be found on the Expected Moves page, or through any option screener page by clicking on the new Profit and Loss chart tool, then the Expected Move tab.

Now, they’re not 100% accurate predictors - they’re based on historical averages and volatility, after all - but it gives you quantitative and actionable metrics. If you’re armed with that information, you can adjust your strike price, choose a later expiration, or skip a trade entirely.

Because when it comes to trading, what you don’t know can - and usually will - cost you money.

The Problem: Psychology and Discipline

Of course, knowing the topic in and out is not the only requirement. Otherwise, there wouldn’t be an endless amount of traders- all with years or even decades of experience, posting about their losses.

Why do they lose money? Because they let their emotions get the best of them. Now, let’s be fair, it’s not easy to get a handle on your feelings when there could be potentially thousands of dollars on the line. Maybe you needed a vacation, and this winning trade would pay for it. Or maybe you want to retire early, and you need every trade to work out in your favor.

The point is, the allure of money is still there. But in order to succeed in trading, it’s also important to keep your emotions in check. You need to develop the right mindset and discipline along with your knowledge. To me, that means trading within a predefined plan with specific entry and exit strategies.

Here’s a quick example. Let’s say XYZ stock just shot up 20% in a day. So, the next day, you buy an out-of-the-money long call on the stock that expires in 30 days, thinking that this is your ticket to a big win.

But there wasn’t really any substance to the upward move, so a couple of days later, XYZ stock dropped from massive profit-taking, and your long call goes deeper out of the money. Now you’re looking at a 30% loss.

At this point, most disciplined traders would sell their position and take the loss, IF it fits their exit plan.

But, say you entered this trade based on FOMO or fear of missing out, and you didn’t have time to formulate a trading plan. Maybe you read up on what other traders have to say, and they’re all telling you to double down, so you do.

Then, your trade goes down another 10, 20, 30%, and now you’re left with two long calls with almost no value and a handful of days away from expiration.

And this isn’t some random anecdote I pulled out of thin air. Investors chase trends all the time, only to double down when they should have cut their losses and run. I’m sure you know of at least a few examples of this.

Fix: Disciplined Trading Plan

So how do we fix this? How do we increase the chances of a winning trade?

Well, psychology and discipline are what separates good traders from hopeful gamblers. And it’s not just about setting entry and exit plans - anyone can do that.

It’s about STICKING to the plan. That means no matter what you see on the charts or what you see on social media, you keep your trades within defined boundaries. If it means exiting early with a smaller profit or cutting seemingly promising trades because they reached your loss level, so be it.

One thing that’s helped me formulate trading plans right from the get-go are the option Greeks. Greeks are different metrics that measure the sensitivity of option premiums to various other factors.

For example, let’s look at Delta. Delta measures how much an option’s price moves relative to a $1 move in the underlying stock. It’s also a shorthand indicator for the probability of expiring in the money.

Theta, or time decay, shows you how much value the option loses each day. Vega measures the sensitivity of your option to volatility. There are others like Rho and Gamma, though most traders stick with these three.

By the way, I made an entire video covering Greeks, so check it out if you want the full deep-dive.

Together, these metrics can help you identify potentially good trades, manage risks, and set realistic expectations.

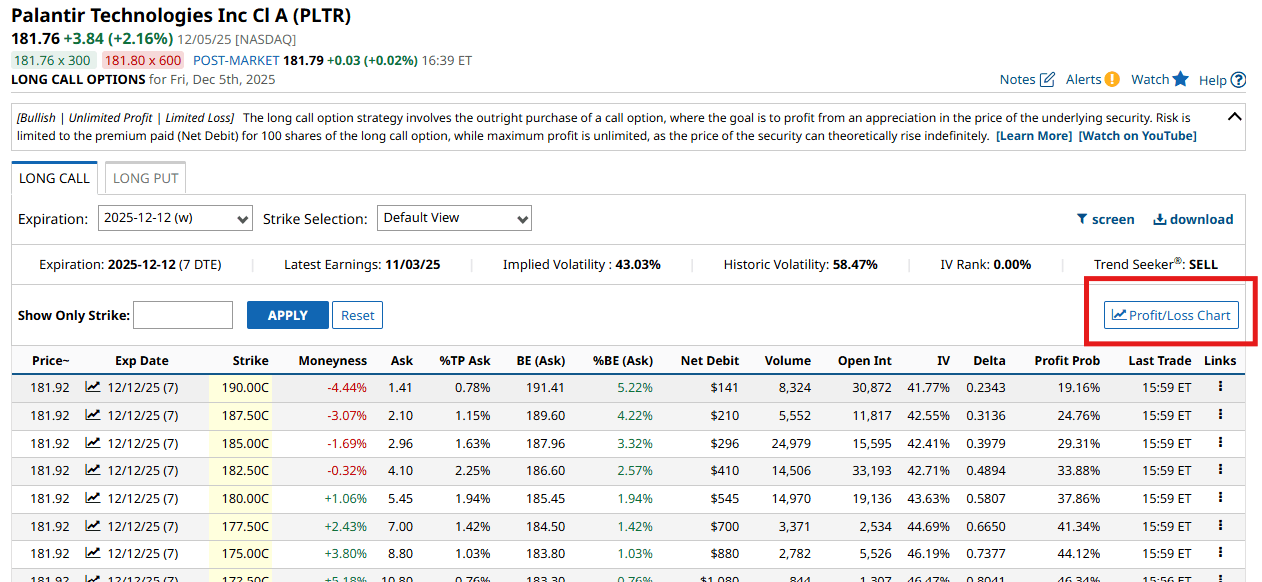

Barchart shows the Greeks in its options screener. Just go to your preferred strategy, click on the Profit/Loss Chart here, and go to the Greeks tab.

Then, you can use Barchart’s expected move tab to identify potential profit-taking and stop-loss price points.

Aside from that, you can also look at volatility metrics before, during, and when you want to end your trade.

The most common metric used by traders is implied volatility, or IV. IV is the measure of how much the market expects a stock or asset to move in the future. Think magnitude when you’re thinking of IV. Then, here’s historical volatility, which measures how volatile the stock has been in the past.

Then, combining the two, there’s IV rank, which measures the current IV's position compared to the past year, or more specifically, where it sits in the range. For example, if IV is high now compared to the past, IV Rank will also be high, meaning premiums will be higher than usual.

There’s also the IV percentile, which tells you how often IV has been lower than its current value over the past year.

So, how do you use IV rank and percentile in the context of a trade? Well, IV rank helps you identify extreme volatility conditions, while IV percentile tells you how frequently those conditions have occurred.

There’s also IV over HV, which is sometimes referred to as implied vs realized volatility. A value close to 1.0 suggests that the options market is pricing in future volatility roughly in line with recent historical or realized moves, indicating a balanced environment where neither buyers nor sellers have a strong edge.

High IV/HV ratios usually suggest options are overpriced and better suited for selling, while low ratios mean cheaper premiums that are better for buying.

All these metrics, combined with your own expertise and preferred trading styles, can help you identify good trades, monitor them as they unfold, and, if necessary, decide when to cut your losses or take your profits.

Final Thoughts

And at the end of the day, the best traders have the discipline to stick to the plan. Remember that in every trade or position you take, there is someone on the other side with the completely opposite thesis, so your edge will always come down to preparation, discipline, and mindset.

You can’t control the market, but you can control how you react to it. Practice and learn, use whatever tools, free courses, free paper accounts are available to you, then trade with a plan, manage your emotions, and let consistency - not luck - drive your results.

And with enough practice, you’ll be well on your way to earning money 90% of the time, or more, not the other way around.