I Tested Barchart's Option Screener for 30 Days — Here's What Happened

How accurate are option screeners? Well, if you’ve wondered the same thing, I can’t blame you. That’s why a month ago, I ran Barchart’s Option Screener against five of the biggest names for some of my favorite option strategies. The idea? I want to see which trades would end up being profitable, and which ones would not.

Today, it’s almost 30 days later, a few days before the expiration date. So what did we find?

Well, let’s go back a month, September 3, 2025. I visited the profile pages of the most traded companies at the time and extracted the default screeners for a selection of income-generating strategies.

For covered calls, I looked at Nvidia and Apple. For naked puts, I focused on Tesla.

And for credit spreads, I tested bear calls on Amazon, and bull puts on Alphabet.

Now, if you’re unfamiliar with the strategies I mentioned, don’t worry. I will explain each of them - so be sure to stick around until end because I’m sure you’re bound learn something to help you in your day to day trading.

Let’s get into it!

Covered Calls

Let’s start with one of the easiest and one of my favorites: covered calls.

A call option is a contract that gives the buyer the right but not the obligation to buy a specific asset or underlying stock or commodity at a specified price or strike price before or at a specified time or expiration date. All options represent 100 shares of the underlying stock.

A covered call strategy generates income by collecting premiums from selling call options on the stocks or ETFs you already own. The goal? You want the stock to stay below the strike so your shares don’t get called away.

But if the stock does trade above the strike price at expiration, you will be assigned, which means you’ll be selling your 100 shares. It’s not so bad - don’t worry, you’ll still get 100 times your strike price in cold hard cash delivered to your brokerage account.

Now, Barchart’s default covered call screener includes several important details like IV, return percentages, and probabilities.

Nvidia

So, let’s start with Nvidia by clicking on the Covered Call under Options Strategies here, then changing the expiration date to October 3, because it’s about a month away, and changing the Strike Selection dropdown to show all recommended trades.

And there we have it, a list of covered call trades for Nvidia.

The first thing I want to point out are these figures: the probabilities of profit. But the figure assumes that your shares are called away. Now, if you’re anything like me, you don’t want that to happen. So, what can you use as a measure of probability that you don’t get assigned?

The answer is right here: delta.

If you’re unfamiliar, delta is an options Greek that tells us the relationship between the option’s value or premium and the asset’s price, or, more exactly, how much an option’s premium is expected to change for every $1 move in the price of the underlying asset.

Long calls have positive delta, meaning if delta is 0.20, and the underlying moves up by $1, the premium moves up by 20 cents.

Short calls on the other hand, have negative delta - because this is the other side of the trade. So, if the short call has a -0.20 delta, your position is expected to decrease by 20 cents for every $1 increase in the underlying asset.

But I’d say delta is better used as a shorthand predictor of the probability of the option expiring in the money.

That same -20 delta option corresponds to roughly a 20% chance of the option expiring in the money - therefore, there’s an 80% chance of it expiring -out of the money,- which is the typical goal when selling covered calls.

Now, it’s not a 100% accurate predictor because delta is a moving target. It factors things like how close the option is to the current stock price, time to expiration, and volatility. That’s why I prefer to use it when trading covered calls. By the way, delta can be expressed as a decimal, like 0.20, or as a full number, like 20, but they mean the same thing.

Now, your risk appetite will be different, but as a general rule, negative 20-delta covered calls and above are considered safer from assignment - but again, nothing is set in stone.. Just to be clear, when I say above negative 20, that means negative 19, 18, etc.

Let’s have a look at this 190-strike call here.

It has a -15 delta that trades for $1.17 per share. Above that, the premiums go lower. That’s because risk and reward go hand in hand. Higher risk means higher premium. Lower risk, means lower premium.

Now, if we jump to October 1, we can see Nvidia is now trading at $185.71. That means - all the trades - starting from the $190 strike are out of the money. This is what you want. It means you wouldn’t get assigned on any of the trades right here.

Sure, the premiums may seem smaller, but remember, income generation is about consistency. We want repeatable trades with a high chance of profit. That’s why taking a smaller profit is often better than losing my 100 Nvidia shares due to assignment.

But not all stocks are the same. Just because you pick a -15 delta, doesn’t mean that a -15 will work on every stock.

Apple

Let’s take Apple for example. On September 3, Apple stock was trading at $238.47. This 255-strike short call has -15 delta, same as the one with Nvidia.

However, if we fast-forward to October 1, the stock is now trading at nearly $257, which makes any covered calls with strikes above $257, like the 260, 265, and 270-strike calls, safe from assignment. However, the 255-strike call had a -15 delta - which means, this trade would have been in the money.

So that’s two different underlyings with similar delta, but one turned out ok, and the other didn’t.

What you’ll find is that when selling covered calls, different underlyings will perform differently against their delta figures. So what might work with Nvidia might not work with Apple, or any other company. That’s where experience comes in and the only way to get that, is by trading. If you’re not so experienced, I recommend starting with a paper trading account, and use a trading journal to see which trades work best for you.

Naked/Cash-Secured Puts

Now, let’s move on to short puts, also called naked or cash-secured puts.

A put option is a contract that gives you the right but not the obligation to sell an asset at a specified price, known as the strike price, at or before a specified time, known as the expiration date.

On the other side of the trade, you, the seller of the put, undertakes the obligation to buy the asset should the buyer exercise their right.

Regardless, you receive a premium at the start of the trade in exchange for the risk.

The goal of a naked put is for the underlying to trade above the strike price, allowing you to keep the entire profit. Or, in some cases, the objective is to earn income while waiting to buy the stock at a preferred price.

One thing about short puts, delta is positive. This is because as the underlying moves up, so does the position. So, a 20 delta short put means a 20% chance of the option expiring in the money and an 80% chance of expiring out of the money.

Tesla

Now, let’s take a look at some real world examples, starting with Tesla.

As of September 3, the stock was trading at $334.09. Based on the screener, trades with a 20 delta and 80% probability of profit start with at the 300-strike short puts.

Fast forward to October 1, Tesla’s now trading at $454.39. So, all of the trades on this screen would likely expire out of the money in two days from now, letting you keep the full premium.

And that’s pretty amazing, because, if you look at this example, last month’s 370-strike short put at the very bottom that was 10% in the money and had a 53.25% chance of profit, and came with a $39.40 per share premium or $3,940 total per contract. If you had sold that, you’d likely keep that nearly $4,000 profit in full.

Again, this highlights the relationship between risk and reward, and how each profile changes depending on the underlying and the current market conditions.

Bear Calls

Now, let’s head over to bear calls - one of my favorites to use in a neutral to bearish market. A bear call spread, also called a call credit spread, is made up of two call options. It involves selling a call and buying another call with a higher strike price at the same time, on the same underlying asset, with the same expiration date.

In this setup, the premium you receive from selling the short call will be higher than what you paid for the long call, meaning you get a credit right from the get-go. You also get to keep that credit in full as long as the stock trades below the short call strike at expiration.

However, if it exceeds the long call strike, your trade ends at a maximum loss, but it’s limited. I discuss bear calls at length in this video, so be sure to check it out.

Also, you can access the bear call spread screener by clicking Vertical Spreads right here, and then click the Bear call tab.

Amazon

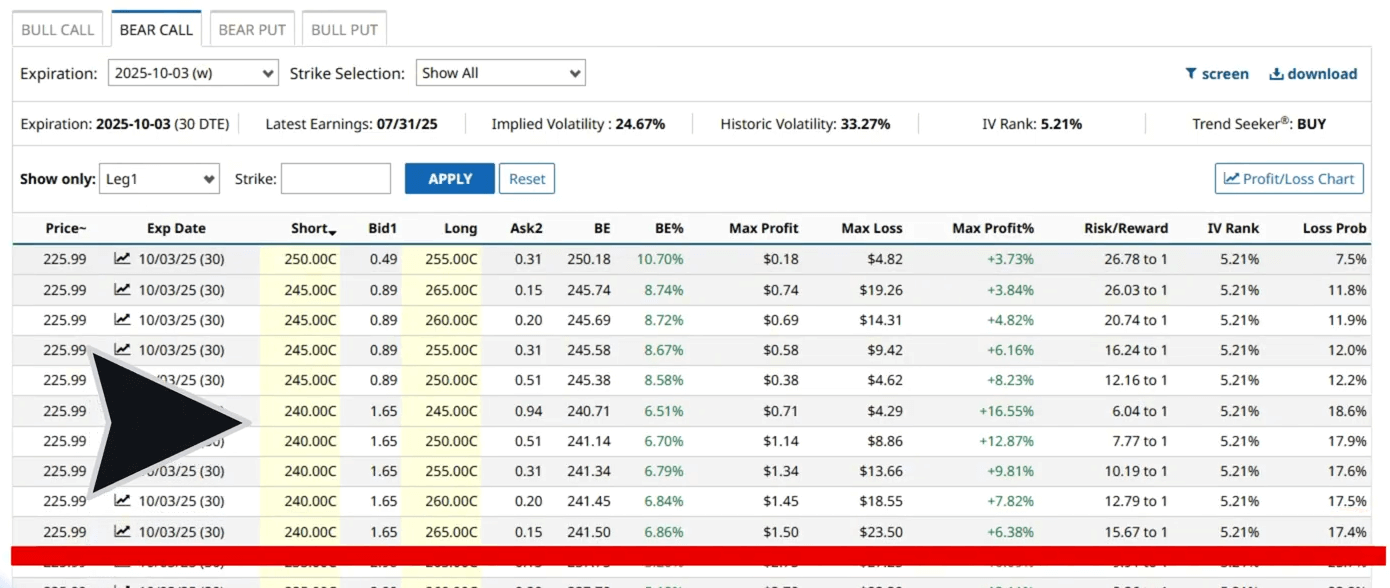

With that out of the way, let’s check out Amazon. On September 3, the stock was trading at $225.99.

Now, you’ll notice that the default display provided for bear call spreads is different from that of covered calls and naked puts. Specifically, this screener now has risk/reward ratios and loss probability. So, let’s use loss probability as the metric to watch, with around 20% as the “safe” level.

In this case, trades that start with a 240-strike short call have less than 20% probability of losses. So those are the trades right here. If we jump to October 1

Amazon is now trading at $219.73, well below the $240 strike. So, if you had chosen any of the trades on this screen, you’d likely keep the premium in full.

Of course, you might pick trades with higher or lower probabilities of loss based on the underlying, your own experience, and appetite for risk.

Bull Put

Another strategy I like is the bull put. A bull put, also known as a short put spread or put credit spread, is like the bear call. It earns you money right off the bat - but in this case, you sell a put option and then buy another one on the same underlying asset, and expiration, but - at a lower strike price.

It’s like a bear call but in reverse, so in this case, you want the stock to trade above your short put strike so you can keep the full credit. I also covered this strategy in my credit spreads video, be sure to check it out up here for more.

Alphabet

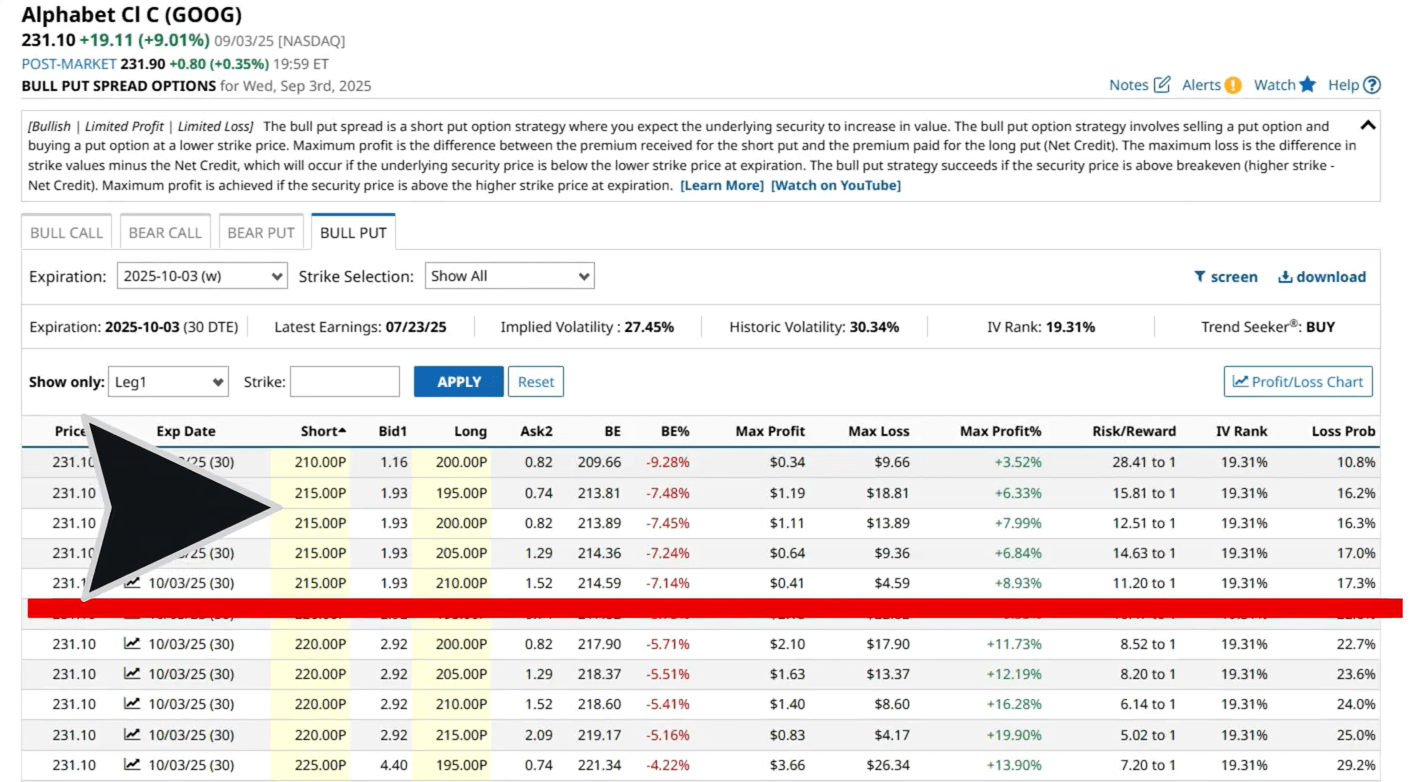

Now, let’s take an example of a bull put. Here’s an example with Alphabet, and on September 3, the stock was trading at $231.10.

On the bull put option screener, trades with lower than 20% loss probabilities start at the 215-strike short put. So, these trades right here. The rest of the trades have up to a 34% chance of loss for the 225-220-strike put spread, which is a bit high for me, but might be acceptable to other traders.

Fast forward to October 1. Alphabet is now trading at $240.68. So, all the trades on the September 3 screen are out of the money, which means if you’d selected any of them, you’d likely keep the full premium. But this doesn’t mean you can pick all the trades on the screen. Pay attention to the probabilities!

Final Thoughts

So, does this mean Barchart’s Option Screener is the most accurate tool for trading options?

You might have noticed you're reading this on the Barchart website, and the associated video is on our YouTube channel. So, it may not surprise you to hear me say yes to that question.

Barchart’s Option Screener is a powerful tool. Even the default screeners present some of the most accurate trades I’ve seen, and you have practically endless customizability when you further dive into the screener’s full functionality.

However, I need to acknowledge that no tool is 100% foolproof. When markets change, events can shift sentiment overnight, which can result in larger-than-expected moves in the underlying.

That’s why I think trading options based on your own experience, combined with Barchart’s powerful option screener, will give traders an edge.