A put ratio spread is an advanced option trade and generally not suitable for beginners, but it can have its place within an option portfolio.

It is generally considered a neutral strategy, although it has the ability to make a profit in up, down and sideways markets.

Yes, it can make money no matter which way the market goes, the key is the timing!

The strategy involves buying a number of put options and selling more put options further out-of-the-money.

The trade is placed when the trader thinks the underlying stock will be stable or slowly move lower and finish around the short put strike at expiry.

A fall in implied volatility will benefit the trade and it can also be profitable if the stock moves up early in the trade.

The big risk with the trade is a sharp move lower early in the trade.

Let’s look at an example using Twitter (TWTR).

Twitter Ratio Spread Example

We could buy the September 16 put with a strike price of 37 for around $1.00 and sell 2 of the September 16, 34-strike puts for around $0.55.

As we are selling 2 contracts at $0.55 the trade results in a net credit of $0.10.

This is the maximum gain above a stock price of 37. Basically, all the puts would expire worthless and the trader keeps the $10 premium.

A tent-shaped profit zone exists between 31 and 37 with the maximum gain occurring at 34 and is around $310.

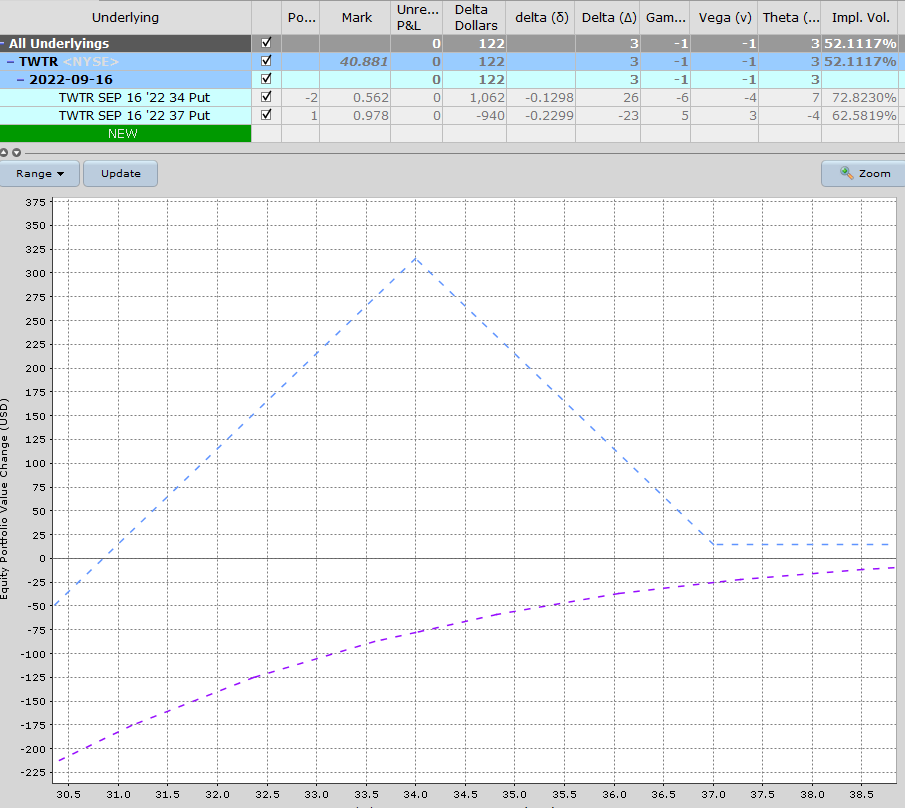

This is what the trade looks like as of today:

You can see the main risk in the trade is a drop in price early on. The blue line is the profit and loss at expiration and the purple line is the T+0 line. T+0 just means “today”.

So, we don’t want the stock to get into the profit tent too early.

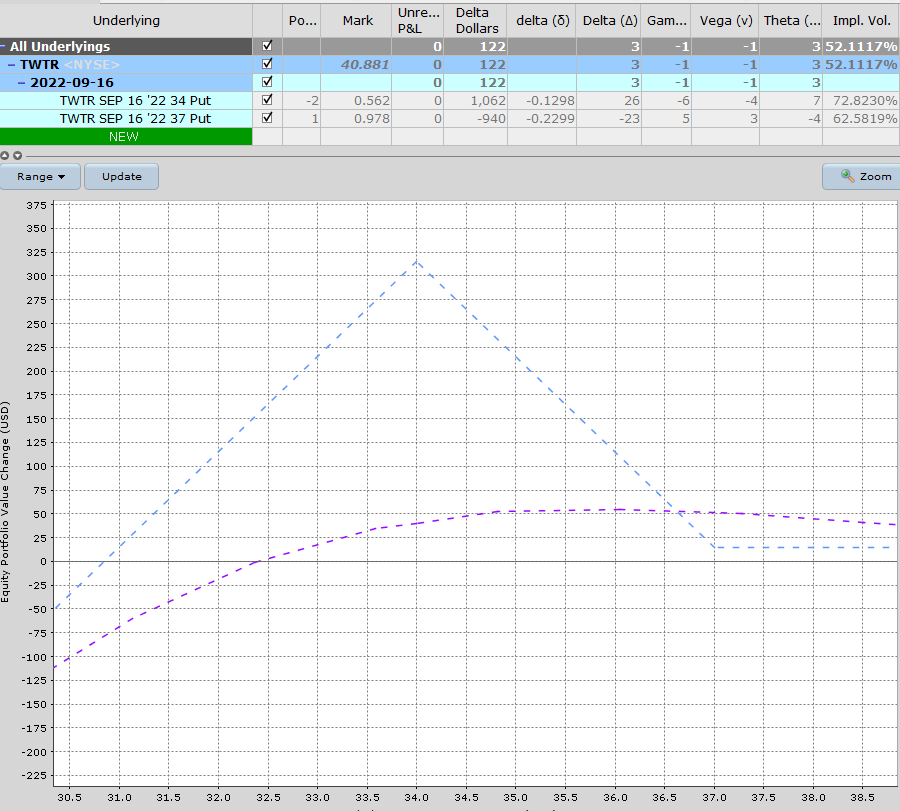

What about in two weeks’ time? How does the trade look then?

Looking a lot better between say 33 and 36.

One advantage of this trade type is it takes advantage of option skew. Notice the contract we are buying has lower volatility (62.5%) than the contract we are selling (72.82%). Buy low, sell high.

Company Details

Twitter is a global platform that connects a user to a network of people, news, ideas, opinions and information. A user can tweet his/her take on any subject in real time, which can be retweeted by others. Tweets are limited to 280 characters.Twitter uses an asymmetric follow model, which means that the relationships between users may not be reciprocal. A user can be followed by other users who may know him/her by name but not personally, such as celebrities and politicians. Twitter enables users to search and discover content in which they are interested including tweets that may have attachments like links, media, photos and other applications. The company measures number of users through the monetizable daily active users (mDAU) metric. mDau is defined as 'Twitter users who logged in or were otherwise authenticated and accessed Twitter on any given day through Twitter.com or Twitter applications that are able to show ads.

The Barchart Opinion rating is a Hold. Short term, the outlook is Bearish.

Summary

This strategy should move fairly slowly, unless there is a sharp drop in the stock price.

As the trade involves naked options, it is not recommended for beginners.

You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

A stop loss of $100 might make sense in this scenario. If Twitter is below 34 near expiry, there will be assignment risk

If you have questions on this strategy, please let me know.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in some of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, August 24, 2022.

More Stock Market News from Barchart

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)