Chevron (CVX) reported strong earnings on July 29 putting it at $11.6 billion vs. 3.08 billion a year ago. Moreover, the oil and gas company generated a huge amount of free cash flow (FCF), which it highlighted in its earnings release.

For example, it produced $10.6 billion in FCF, which means that over 91% of its upstream and downstream operating earnings were converted into free cash flow. That is a very high conversion rate and shows that the company is able to generate large amounts of cash for its shareholders.

For example, in Q2 the company paid down $3.7 billion in debt during the quarter and covered its dividend with $2.8 billion in dividend payments. In addition, Chevron was able to buy back $2.5 billion of its shares as well as pay $2.8 billion for acquisitions.

CVX Stock a Bargain

This puts CVX stock on a forward price-to-earnings (P/E) multiple of just 8.8 times for this year. Assuming earnings slow down next year, the multiple rises slightly to over 10x earnings. But that is not that expensive, especially given how much FCF it is producing.

Moreover, the dividend yield at today's price of $161.65 is very attractive at 3.51%. Chevron has been raising its dividend every year for the past 6 years. It is very likely to continue doing so. It has already made three dividend payments of $1.42 per share and the fourth is scheduled to be announced in October. After that shareholders can likely expect a dividend hike.

But there is one other way to make income through a profitable covered call income play.

Covered Call Play

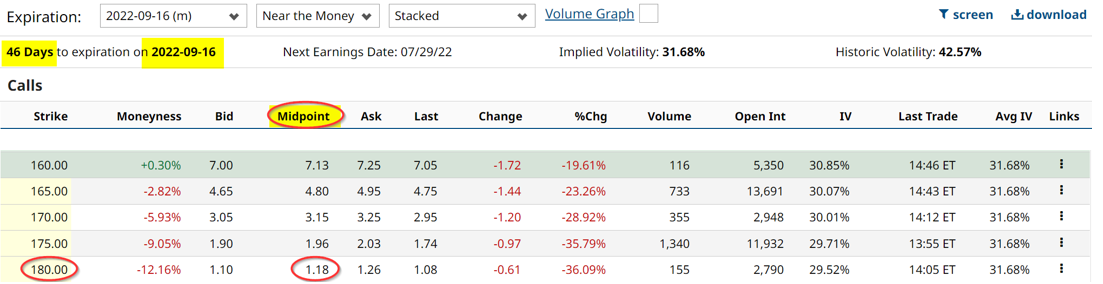

Investors can make extra income in CVX by selling out-of-the-money covered calls. For example, look at the Barchart table below.

The call options that expire on Sept. 16, 2022, at the $180 strike price will provide $1.18 per share. Here is how that works. The investor buys 100 shares of CVX for $16,092 at $160.92. Then the investor sells one call contract (representing 100 shares) and receives $118 immediately. As a result, assuming the stock does not rise to $180 by the Sept. 16 expiration date, the investor can repeat the same covered call play again.

This represents a gain of 0.73% and if it can be repeated every 46 days or roughly 8 times annually, the annual return is 5.84%. In addition, if CVX stock rises to $180 per share the investor gets to keep the additional 11.86% capital gain.

So, including the annual 3.51% dividend yield, the investor can possibly make another 5.84% in covered call income. Each time this is done, the return could change depending on the actual rate of return at the time when the covered call option is sold out of the money. But it looks like a great way to enhance the investors' overall return.

More Stock Market News from Barchart

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)