Investors have been buying call options in Clarus Corp (CLAR) with huge unusual call options activity ahead of the company's earnings release on Monday, Aug. 1. A report by Barchart on the company's options activity shows that a huge volume was recorded with a large purchase of in-the-money call options.

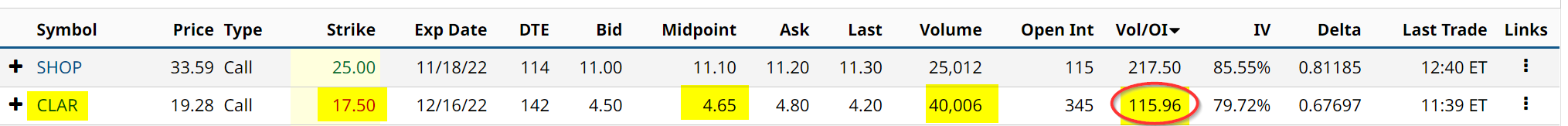

This can be seen in the table below:

This shows that over 40,000 call options were bought at the $17.50 strike price, and the price is now $4.65 at the midpoint. As the stock now trades for $19.33, up $1.17 per share today (July 27), the purchase was likely made when the stock was at $18.16, or just 3.77% over the $17.50 strike price.

Why would some fund do this?

The outdoor gear maker (including the popular Black Diamond outdoor brand) is expected to show good earnings growth of 39 cents per share, on a non-GAAP basis. That will be 80% over last year's 20-cent EPS and slightly higher than last quarter's 37 cents per share.

First of all, the investor in these call options expects to see much better results than expected. However, as long as the company can show growth that may also be a positive in this market where many companies are showing negative growth.

Second, the investor only had to pay $4.65 or less for the call options, compared to today's price of $19.33. So that represents a leverage effect of 4.15 times. They can buy exposure to over 4 times more shares than they would have with the same money buying common stock.

This works for many large investors since they might not be able to purchase a large stake in a stock like this right before an earnings announcement. After all, 40,000 options represent a potential purchase of 4 million shares, if they eventually are exercised. That represents over 2.7 times its average daily volume of trading of 1.462 million shares, according to Barchart.

Third, since the option is in-the-money (i.e., $17.50 is lower than today's price of $19.33), there is some element of safety here. In fact, the expiration period is 142 days in the future for Dec. 16, 2022. That gives plenty of time (at least through the Q3 earnings announcement) for the stock to rise to the breakeven point. That breakeven point is the cost of the option (let's assume here it was $4.65) plus the strike price. That works out to $22.15 per share or 14.59% over today's price. The truth is that since the stock is up today, the investor likely only had to pay $3.50 or so for the options, so their breakeven point is just $21.00, or just 8.6% over today's price.

In effect, by having such a long expiration period, plus being so far in the money, the investor has chosen a reasonably safe way to leverage an investment in CLAR stock for the long term.

Lastly, this stock is very cheap. It trades for just 10.6 times estimates for 2022 earnings according to a survey of 8 analysts by Seeking Alpha. For 2023, it is just 9.3x earnings. That makes it a very profitable and inexpensive growth stock.

More Stock Market News from Barchart

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)