/CPU%20Chip.jpg)

Tower Semiconductor (TSEM) just grabbed the spotlight in the semiconductor sector with a strategic collaboration with NVIDIA Corporation (NVDA), aimed at advancing artificial intelligence (AI) data center infrastructure through next-generation silicon photonics.

Under the deal announced on Feb. 5, Tower will scale AI infrastructure deployments with 1.6T data center optical modules optimized for NVIDIA’s networking protocols, potentially doubling data rates and addressing one of the most critical bottlenecks in AI-driven computing, high-speed interconnectivity.

The announcement sparked a sharp rally in TSEM shares, reflecting heightened investor appetite for companies positioned at the intersection of AI, data center growth, and advanced semiconductor technology. As the stock reacts to this news, is now the right time to buy TSEM, or is the excitement already priced in?

About Tower Semiconductor Stock

Tower Semiconductor is a semiconductor foundry specializing in high-value analog and mixed-signal integrated circuit technologies, including silicon photonics, RF CMOS, SiGe, CMOS image sensors, and power management solutions. Headquartered in Migdal HaEmek, Israel, the company serves diverse end markets, from automotive and industrial to AI infrastructure and communications. Tower Semiconductor’s market cap is around $15.4 billion.

Over the past year, TSEM has delivered exceptional stock performance, reflecting strong investor interest in its strategic positioning within the semiconductor industry. The stock has delivered a robust 179.7% returns over the past 52 weeks.

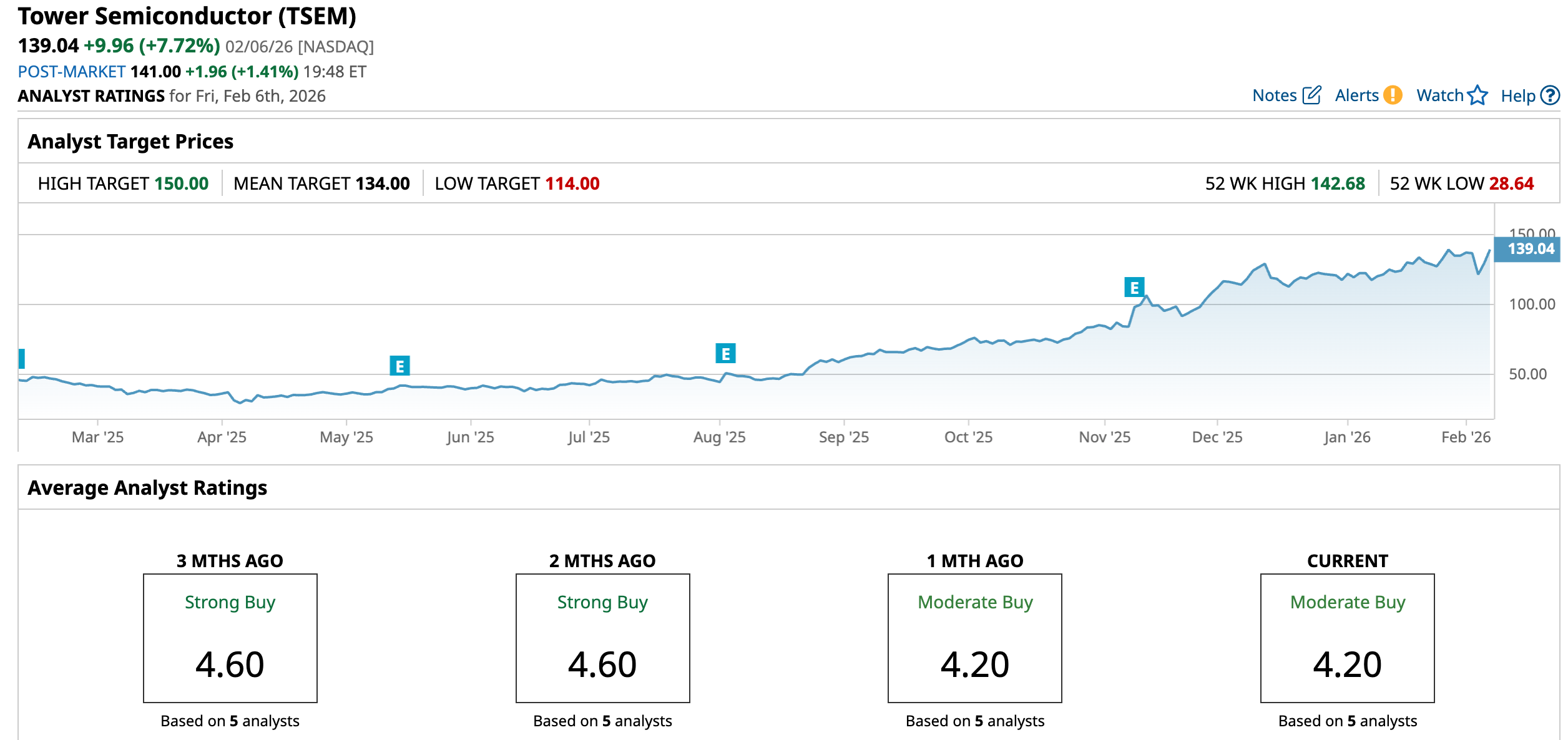

Moreover, in 2026, TSEM continued to trade near elevated levels, maintaining much of its gains. The shares recently reached a new 52-week high of around $142.68 on Feb. 3, underscoring elevated investor appetite for the company’s role in next-generation semiconductor technologies.

The stock’s strong performance was further reinforced by the recent partnership with NVIDIA to scale 1.6T AI data-center optical modules, which triggered significant price movement with overall 6.4% intraday gains on Feb. 5. The stock is up by 18.4% year-to-date (YTD).

The stock is trading at a premium valuation, compared to industry peers, at 52.69 times forward earnings.

Modest Financial Performance

Tower Semiconductor released its third-quarter 2025 earnings on Nov. 10, 2025. For the quarter ended Sept. 30, revenue came in at approximately $396 million, up about 6.8% year-over-year (YOY), and up 6% sequentially from the prior quarter.

On the bottom line, the company posted a net profit of $53.6 million in Q3 2025, nearly on par with last year’s $54.6 million in Q3 2024. Its adjusted EPS for the quarter was $0.55, compared with $0.57 in Q3 2024. Tower Semiconductor reported a gross profit of $93 million, effectively flat YOY versus Q3 2024.

Also, management provided forward guidance with confidence, forecasting fourth-quarter 2025 revenue of about $440 million ±5%, which would represent a 14% YOY increase and an 11% sequential rise if achieved.

Additionally, Tower Semiconductor is committing an additional $300 million to expand capacity and next-generation capabilities for its silicon photonics and SiGe businesses, including a Fab 3 expansion while keeping the facility fully utilized. As part of this plan, the company is extending its Newport Beach site lease by up to 3.5 years beyond 2027.

Analysts predict EPS to be around $1.85 for fiscal 2025, flat compared to the prior year, but rise 32.4% to $2.45 in fiscal 2026. Tower Semiconductor is scheduled to release its fourth quarter and fiscal year 2025 earnings on Feb. 11.

What Do Analysts Expect for Tower Semiconductor Stock?

Last month, Benchmark raised its price target on Tower Semiconductor to $150 from $120 while reaffirming a “Buy” rating. The firm highlighted Tower’s strong leadership in RF infrastructure connectivity and its dominant market share in key connectivity technologies. Benchmark expects this leadership to remain durable over the next few years, supported by Tower’s flexible manufacturing approach and capacity expansion.

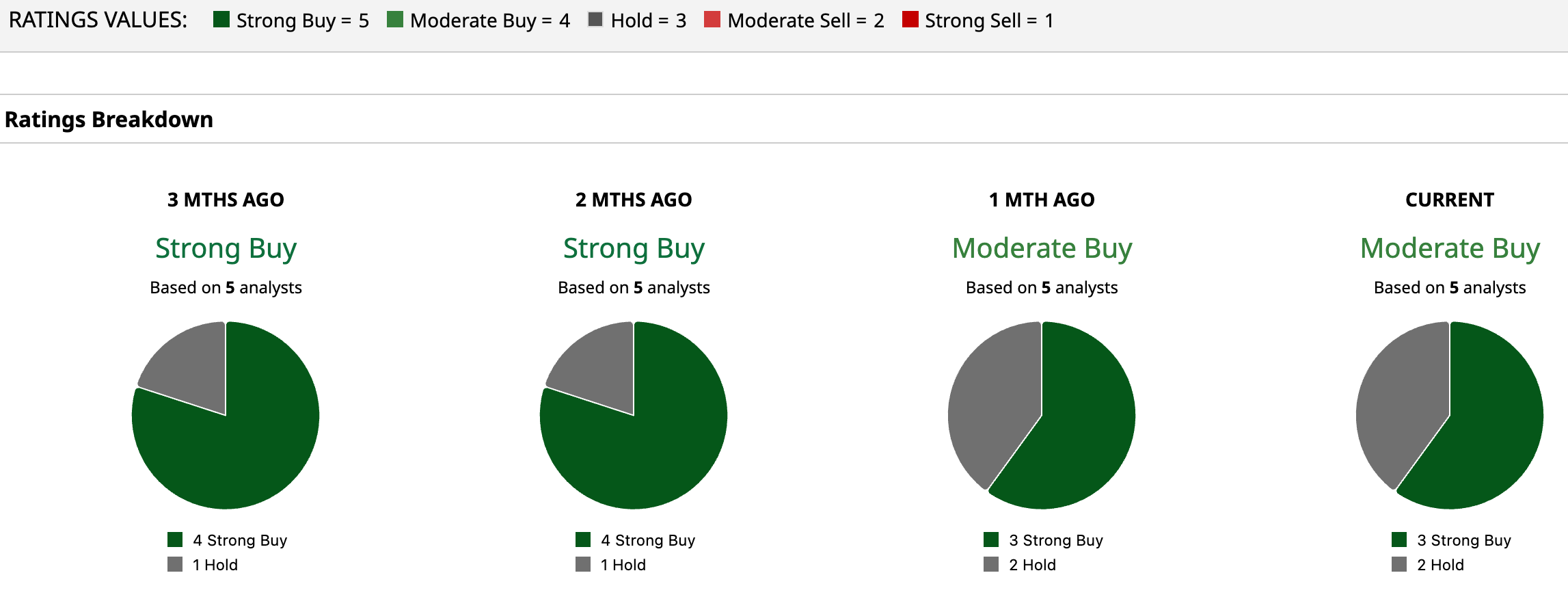

TSEM stock has a consensus “Moderate Buy” rating overall. Out of five analysts covering the stock, three recommend a “Strong Buy,” and two suggest a “Hold.”

TSEM is already above the average analyst price target of $134, the Street-high target price of $150 suggests 7.9% upside ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)