Hewlett Packard Enterprise Co (HPE) is an ideal covered call option play. There are several reasons. First, its performance so far has not been volatile. It is down just 1% in the last month and only about 10.5% YTD. That is ideal for covered call plays.

Second, the stock has an absolute low price. For example, at $13.80 today, an average investor could invest $5,520 and buy 400 shares. That means the investor cal sell forward 4 call options. That helps make the transaction profitable.

Third, the stock is cheap. HPE is an enterprise software company that is forecast to show modest revenue and earnings growth this year (ending Oct. 30, 2022) and next. For example, sales are forecast to rise 2.8% from $28.3 billion to $29.1 billion. In addition, EPS is forecast to grow 7.4% from $2.03 per share to $2.18 by October 2023.

As a result, HPE stock has a modest valuation of just 6.9x earnings this year and 6.4x next. That is very cheap for such a large and profitable software company.

Fourth, the stock has a decent dividend yield 0f 3.478%. Its dividend per share (DPS) of 12 cents per quarter ($0.48 annually) has been maintained since Jan. 2020. Moreover, its dividend coverage ratio is very low, since the 48 cents dividend represents just 23.6% of its earnings projected this year. Moreover, the company is buying back its shares.

Lastly, analysts project a target price of $17.25 per share or 25% over today's price. That gives us a potential strike price target.

Covered Call Returns

Obviously, there is no guarantee if a stock falls, but selling out-of-the-money covered calls helps hedge against the downside and provides a decent additional return on top of the dividend yield. This works for long-term value investors.

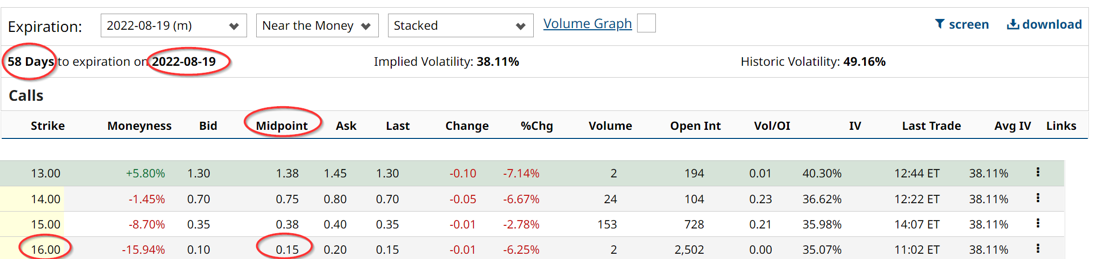

For example, look at the Aug. 19, $16.00 strike price calls. They have a midpoint price of 15 cents or $15 per call contract.

This implies that an investor with 400 shares can collect $60 for the call contract sold as a covered call if held to expiration for the next 58 days. That represents 1.087% of his $5,520 investment. But if he can do this over the next year that represents 6.3 times that 1.087% can be collected. This accumulates to 6.85% annually.

As a result, the total return from the covered calls and dividend yield adds up to a potential upside of over 10% (10.33%). Moreover, this provides downside protection to the long-term investor. In case the stock rises to $16.00, and the call options are exercised, the investor can make an additional 15.94% over today's price (i.e., $16.00/13.80-1).

So, for these five reasons, HPE looks like the typical type of covered call play that value investors like to pick.

More Stock Market News from Barchart

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)