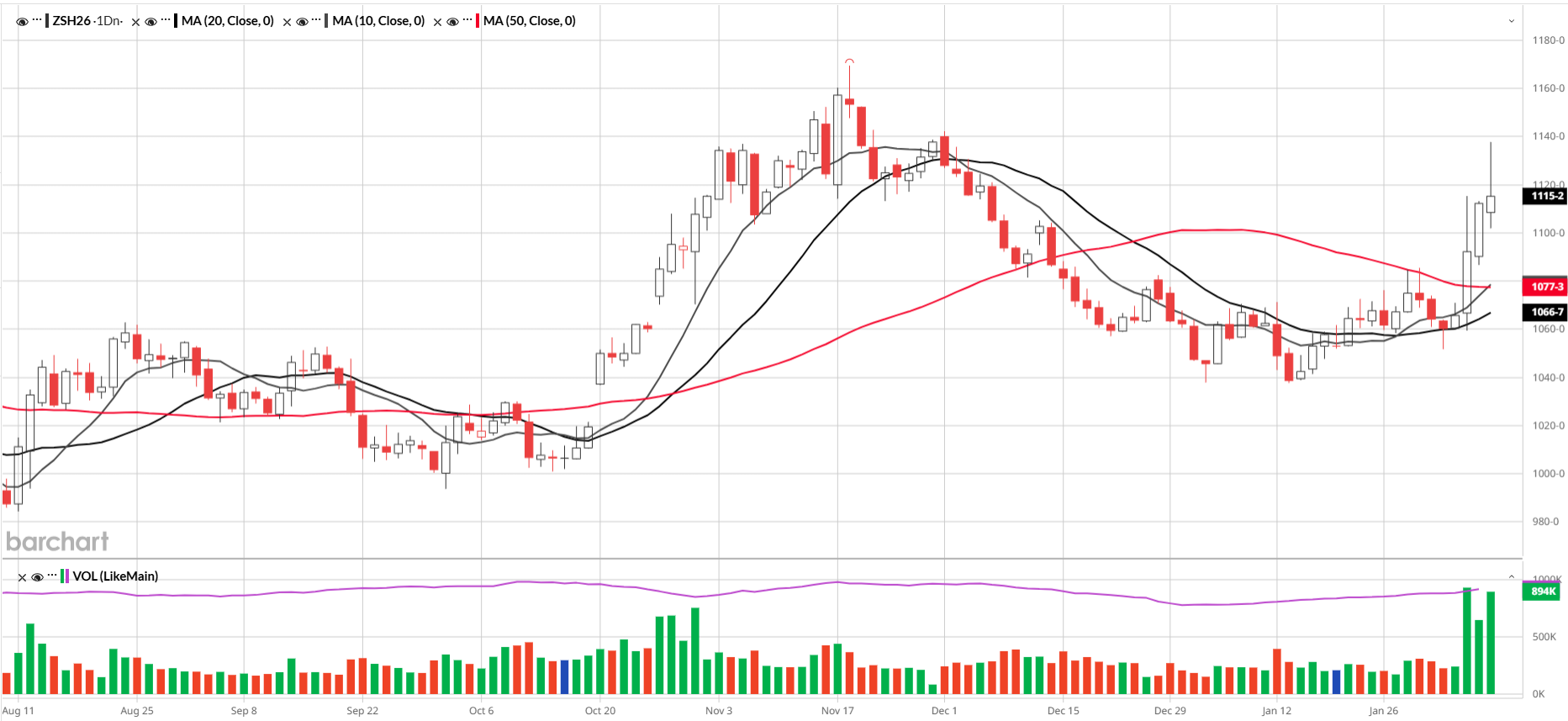

March soybeans traded as much as 48 ½ cents higher on Wednesday but faded as the day went on, closing at 1092 ¼. Soybeans rallied hard again yesterday, and today March soybeans traded up to 1137 ¾ but closed up just 2 ½ cents to 1114 ¾. November beans closed today at 1095 ¼, down 3 ¼. Although soybeans failed to keep their gains, they did close positive in the March contract. The rally was because President Trump said that China agreed to buy more US soybeans during their call on Wednesday. China already held up its agreement to buy 12 mmt by the end of February and is considering increasing the purchase amount by another 8 mmt to 20 mmt for 2025-26. After the APEC Summit in November, China agreed to buy 25 mmt annually through 2028.

.

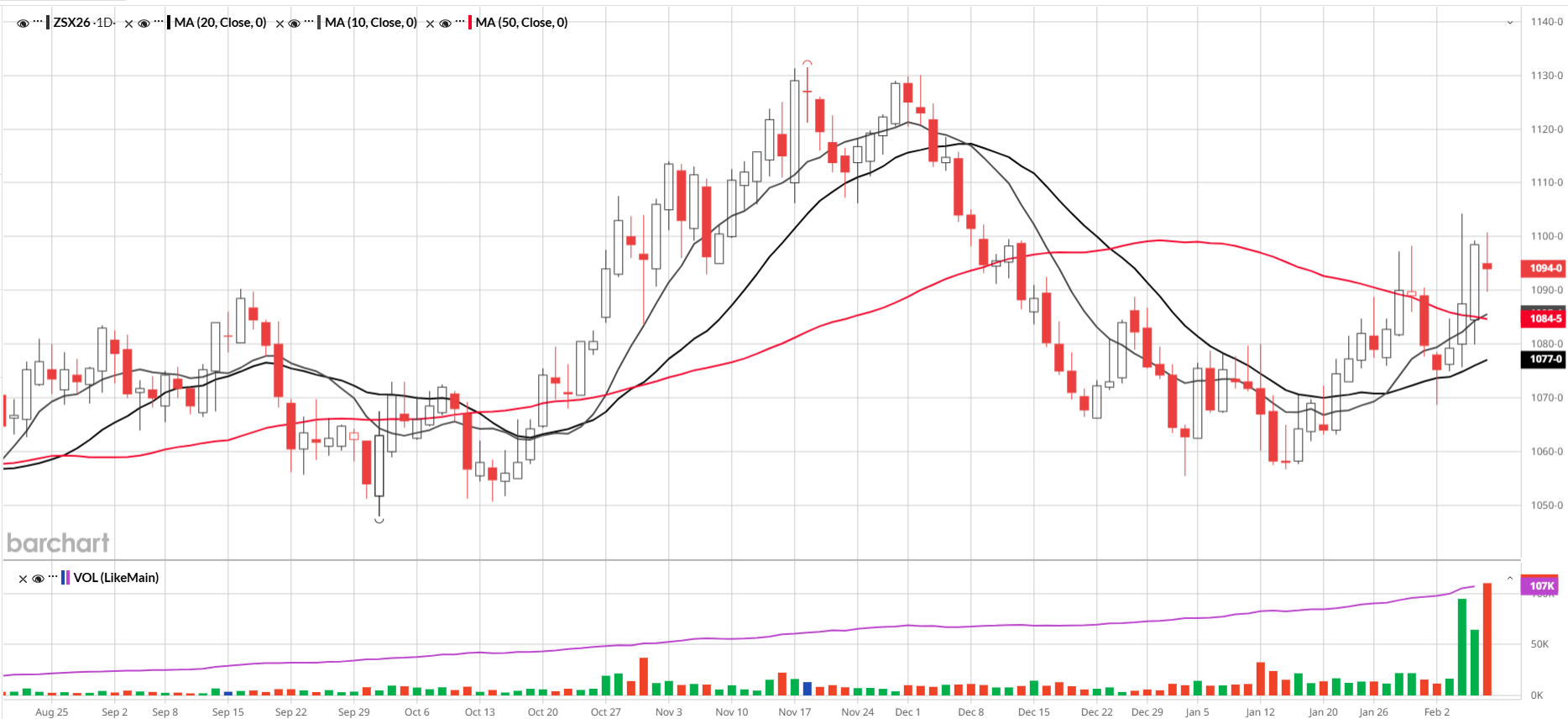

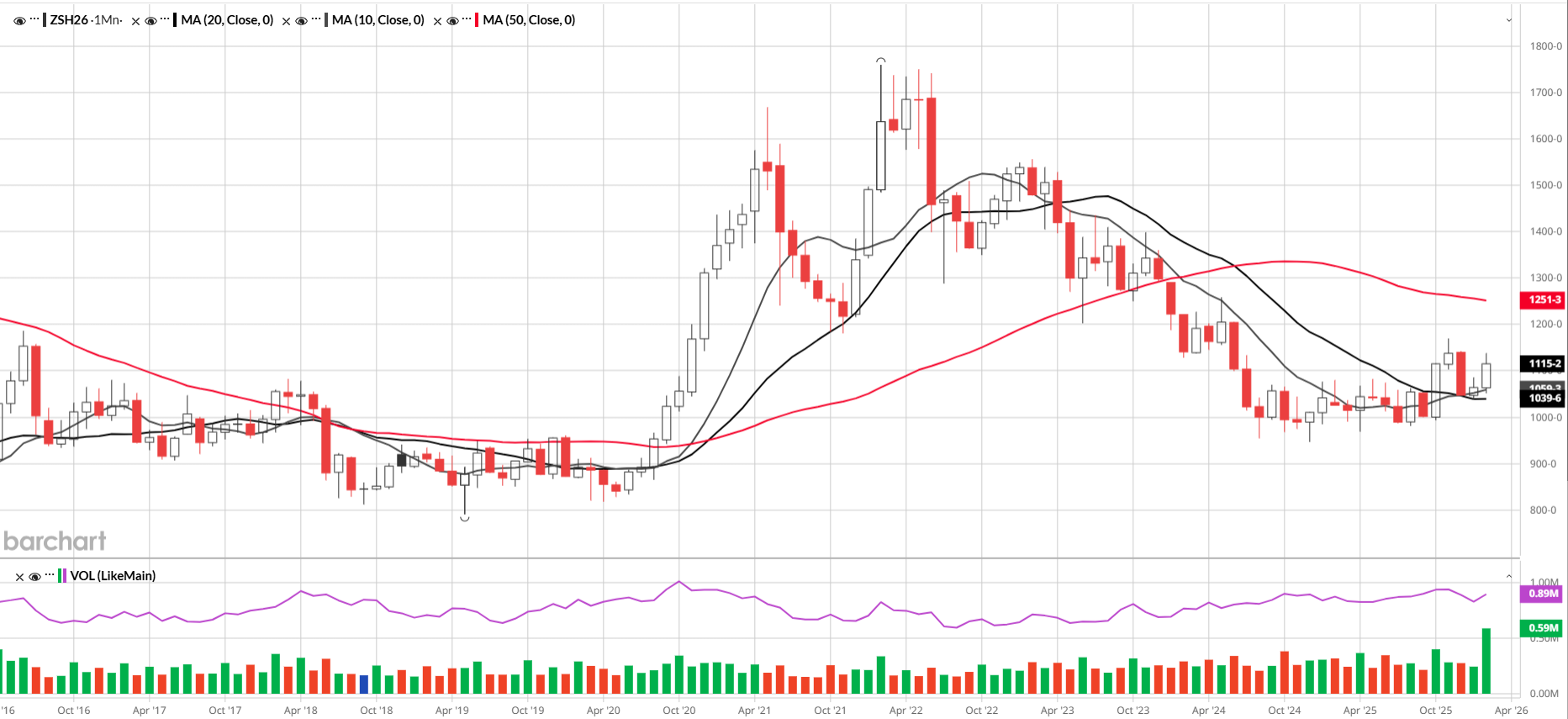

The typical export window follows more closely with harvest, usually winding down towards January. Brazil is in the middle of harvest now, but China can buy soybeans from Brazil much cheaper than from the US. As of today, the March-May spread is at 49.89% of full carry, while the May-July spread is at 38.7% of full carry. The March-May spread was 43.1% on January 23rd, and the May-July spread was 47.5%. The federal crop insurance price set last February was $10.54. Depending on the basis in your area, it may be a good idea to contract 10-15% of your production with an elevator. There’s still a case to be made for soybeans trading higher from here. Soybeans don’t like to stay at 1100 for long historically, implying a move up to 1200 or back down to 1000. The initial move higher on Wednesday was the highest volume for soybeans in 10 years, and soybeans are trading above the 10, 20, and 50-day moving averages. Funds are long 28k contracts after adding 11.5k contracts, shown on today’s COT report. And open interest was up 17k contracts yesterday. Fundamentally, the move higher seems overdone, however, it’s hard to ignore the volume and strong charts on daily, weekly, and monthly timeframes. The next WASDE report is scheduled for Tuesday, February 10. Consider the following opportunities:

If you’re looking for protection, consider the following strategies:

NOVEMBER ’26 SOYBEANS

BUY 1 NOVEMBER ’26 1100 PUT 57 ½

SELL 1 NOVEMBER ’26 1050 PUT 33 ¾

Price: 23 ¾ DEBIT Cost: $1,187.50 DEBIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

NOVEMBER ’26 OPTIONS EXPIRE 10/23/26 (259 DAYS)

MAXIMUM LOSS: LIMITED

NOVEMBER ’26 SOYBEANS

BUY 1 NOVEMBER ’26 1100 PUT 57 ½

SELL 1 NOVEMBER ’26 1050 PUT 33 ¾

SELL 1 NOVEMBER ’26 1200 CALL 17 ¾

Price: 6.00 DEBIT Cost: $300 DEBIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

NOVEMBER ‘26 OPTIONS EXPIRE 10/23/26 (259 DAYS)

MAXIMUM LOSS: UNLIMITED

If you’re bullish consider the following trade:

MAY ’26 SOYBEANS

BUY 1 MAY ’26 1130 CALL 33 7/8

SELL 1 MAY ’26 1160 CALL 21 3/8

Price: 12.5 DEBIT Cost: $625 DEBIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

MAY ‘26 OPTIONS EXPIRE 4/24/26 (77 DAYS)

MAXIMUM LOSS: LIMITED

Options are expensive, after the recent moves. Contact me for ideas in futures spreads.

If you would like to receive more information on the commodity markets, please use this link to join my email list

.

If you don't like the customer service or personal attention you are receiving from your broker, you have options, and you don't have to stay there. I can have your new account open quickly. Call me anytime 312-765-7311.

If you would like to open an account, please use this direct link

Having a Trading or Hedging Account is essential for your business to be successful. Market volatility has increased across all commodities over the last 12 months, and 2026 has already had a volatile start. Opening an account in the future, will not help you if you need access now. To be successful, you need to be able to manage risk in real time. If you are proactive now, you will have the ability to be reactive when you need to be. You can be prepared and patient at the same time. Call me or hit the direct link above.

Hans Schmit

Broker, Pure Hedge Division

312-765-7311

hschmit@walshtrading.com

WALSH TRADING INC.

311 S. Wacker Suite 540

Chicago, IL 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)