Three-month nickel forwards on the LME reached the highest price since May 2014 in 2021. In early 2022, the price probed above the $25,700 per ton level, the highest price since May 2011. Each LME contract contains six tons of nickel with a minimum 99.80% purity conforming to B39-79 standards. Nickel forwards settle each day, making the contracts attractive for producer and consumer hedging. Nickel forwards are far less liquid than the LME’s copper, aluminum, and zinc contracts. Meanwhile, nickel’s profile has been rising as it is a critical metal in electric vehicle production. The iPath Nickel Subindex ETN product (JJN) tracks nickels price.

Nickel demand is rising

Nickel is a nonferrous metal used to make coins, wire, and it is critical in gas turbines and rocket engines as it is corrosion resistant even at high temperatures. Nickel is also used to make a variety of alloys for armor plating, nails, and pipes. Copper-nickel alloys are also used in desalination plants which convert seawater into fresh water.

Batteries contain nickel, including rechargeable nickel-cadmium batteries and nickel-metal hydride batteries that power hybrid vehicles. As the world addresses climate change, the demand for EVs is rising, increasing global nickel requirements.

Nickel’s price is increasing

The most severe inflationary pressures in over four decades have boosted most commodity prices, and nickel is no exception.

The chart highlights after trading to a low of $10,865 per ton in March 2020, the nickel price has more than doubled, reaching its latest high of $25,705 per ton in February 2022. Three-month LME nickel forwards reached the highest price in over a decade since May 2011, but there is still room for the metal’s price to rise.

The long-term chart shows that the all-time high in the forward nickel market came in May 2007 at $51,800 per ton, nearly double the price at the most recent high.

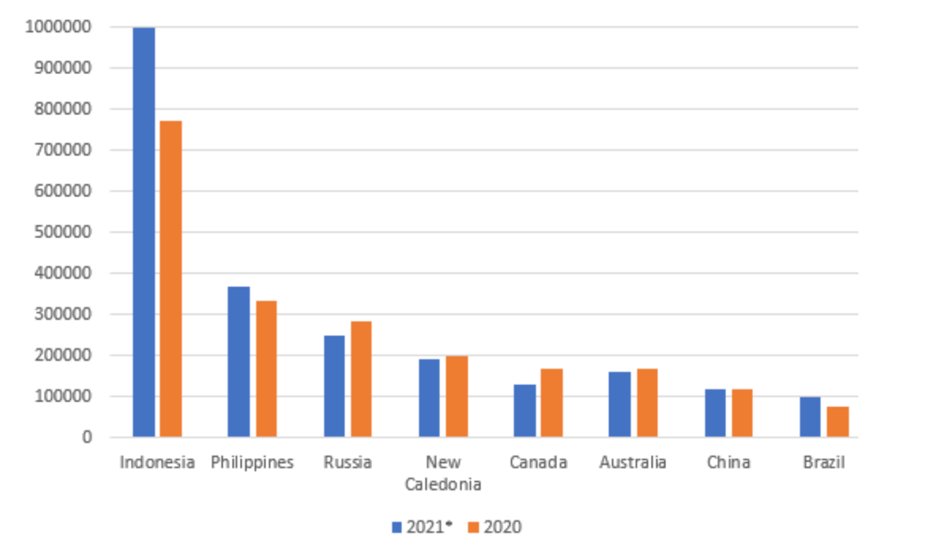

Russia is the third-leading nickel producer with the fourth largest nickel reserves

The world’s leading nickel producer is Indonesia. The Philippines is second, and Russia is third.

Source: USGS

Russia has the fourth largest nickel reserves with around 6.9 million tons or 7% of the worldwide total. Russia’s Norilsk Nickel is one of the top nickel mining companies, with its mines in the Norilsk region above the Arctic Circle in Siberia, Russia. Norilsk is a region with some of the world’s largest nickel, copper, and palladium deposits. Platinum group metals, including platinum, palladium, and rhodium, are byproducts of Russian nickel production as the metals are in nickel ores. Nickel and platinum group metals are critical for addressing climate change.

The war in Ukraine is bullish for nickel as it could create supply shortages when the demand is rising

On February 24, Russia invaded Ukraine. Russia’s President Putin considers Ukraine Western Russia, while Europe, the US, and many other countries believe it is a sovereign Eastern European country. The fighting has been fierce, and the US and Europe slapped the Russians with significant sanctions, isolating President Putin and his country from the financial world. The Russians are likely to retaliate with embargos and other measures. Russia’s position as the world’s third-leading nickel producer could create shortages over the coming months as the demand continues to rise. Nickel’s price reached the most recent high on February 24 at $25,705 per ton, the day Russia attacked Ukraine.

The JJN ETN rises and falls with the nickel price

Inflation, addressing climate change, and the war in Ukraine create a potent bullish case for nickel’s price. The most direct route for a risk position in nickel is via the London Metals Exchange, the world’s leading nonferrous metals exchange. The iPath Nickel Subindex TR ETN (JJN) is an alternative for market participants looking to participate in the nickel market. At $33.41 per share, JJN had over $31.9 million in assets under management and traded an average of 37,495 shares each day. The ETN charges a 0.45% management fee.

The chart illustrates the rally from $14.67 in March 2020 to $33.60 per share on February 24 as the JJN ETN product more than doubled. JJN does an excellent job tracking the nickel price.

The all-time high in nickel came in 2007 at $51,800 per ton. The current environment favors a continuation of the bullish trend as sanctions on Russia,

and retaliatory embargos could create a worldwide shortage. Moreover, even if the war in Ukraine ends, the demand for battery metals will continue to support higher nickel prices.

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Oracle%20Corp_%20logo%20on%20phone-by%20WonderPix%20via%20Shutterstock.jpg)

/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)