From Farm Fields to Global Macro Signals

Soybean futures are a globally traded agricultural contract that reflects supply and demand conditions across food, feed, and energy markets. Soybeans are a core input for animal feed and cooking oil, and they also play a role in renewable diesel production. Because of this, prices are influenced not only by crop fundamentals but also by macroeconomic and policy developments.

Key macro drivers include weather conditions in major growing regions, currency movements, trade policy, and energy markets. A stronger US dollar can pressure export competitiveness, while rising crude oil prices can support soybean oil demand. Traders closely monitor a small set of high impact reports, including USDA WASDE reports, weekly export sales, quarterly grain stocks, and planting and yield updates during the growing season.

On the global stage, Brazil and the United States are the largest exporters, while China remains the dominant importer. Changes in Chinese buying patterns often create outsized price reactions, particularly when trade relations or policy guidance shifts. Recently, the market has been responding to improving trade tone, firm energy prices, and concerns that South American supply growth may be less aggressive than previously expected. Together, these factors have helped stabilize sentiment after months of balance.

What the Market Has Done

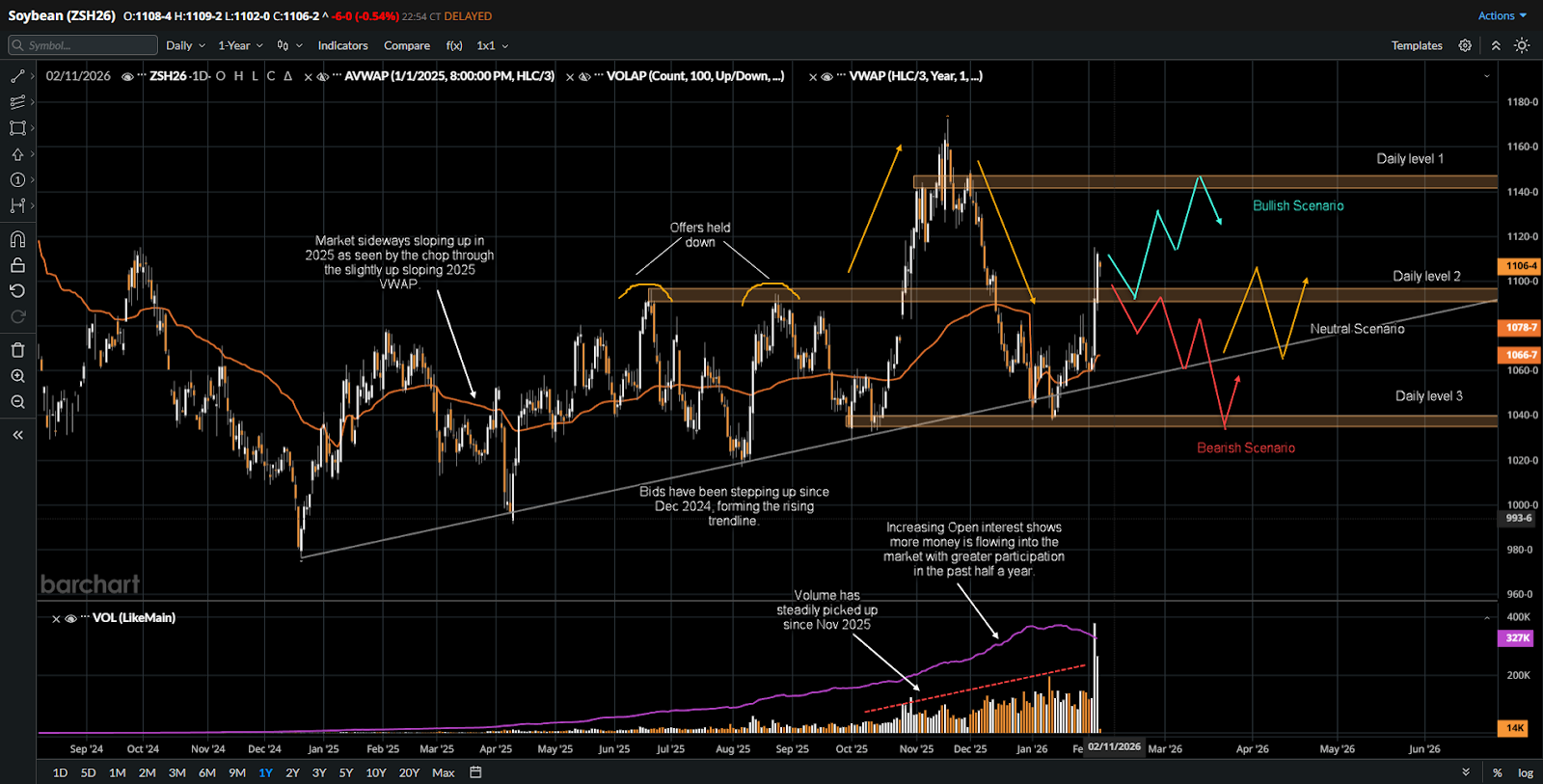

• The market traded in an upsloping sideways range through most of 2025, as seen by price crossing the 2025 VWAP both ways, reflecting broadly balanced conditions.

• Offers consistently held at 1094 from July 2025 onward, establishing that level as a clearly defined area of supply.

• In late October 2025, price broke above 1094 and rallied into the 1161 to 1162 area. The breakout was driven by a combination of bullish USDA data and macro tailwinds. The October WASDE report trimmed US ending stocks and slightly reduced yield assumptions, while weekly export sales showed stronger than expected purchases from China. At the same time, adverse weather headlines out of southern Brazil raised early concerns about planting delays, and a broader risk on environment lifted the grain complex through mid-October to mid-November.

• Responsive sellers entered near 1161 to 1162 as the market transitioned from expectation to realization. December 2025 pressure followed headlines pointing to accelerating Brazilian planting progress, improving South American weather forecasts, and confirmation that Brazil was on pace for a record soybean crop. A firmer US dollar and year end position squaring further weighed on prices, pushing the market back below 1092 to 1095 and down toward 1040, which aligned with the rising trendline and a prior swing low.

• Open interest and volume have risen steadily since October 2025, signaling increased participation, fresh money inflows, and growing institutional involvement on both sides of the auction.

• In the past week, the market rallied and broke back above 1094 following renewed optimism around US export demand. Weekly USDA export sales came in above expectations, with China identified as a major destination. The rally was further supported by trade related headlines suggesting China was considering large scale purchases of US soybeans, with market estimates referencing volumes as high as 25 million metric tons following statements from President Trump highlighting agricultural exports as a key focus in ongoing US China trade discussions. These developments improved sentiment and prompted short covering above the long defended 1094 level.

What to Expect in the Coming Week

• The key level to watch remains 1094, identified as daily level 2, which was where sellers previously held their offers in July to October 2025.

Bullish Scenario

• The market may test back down toward 1094, which is the daily level 2, and find responsive buyers before continuing to auction higher.

• If acceptance builds above this level, price could rotate toward the 1140 area, which is the daily level 1 and a zone where sellers previously responded.

Bearish Scenario

• If the market is unable to sustain trade above 1094, longs may begin to liquidate, causing prices to rotate back below that level.

• Buyers are expected near the rising trendline, but if this area fails to attract meaningful response, the market could extend lower toward 1040, which is the daily level 3.

Neutral Scenario

• Buyers may respond at the trendline, but if there is insufficient interest to sustain trade above 1095, two-way consolidation is likely.

• In this case, the market would work to re-establish value following the large and volatile move seen over the past week.

Conclusion

Soybean futures are approaching a technically important inflection point as price tests acceptance above a long-defended supply level. Rising open interest and volume suggest growing engagement, while macro drivers such as trade expectations, energy prices, and global supply dynamics continue to shape sentiment. Sustained trade above 1094 would support a higher auction toward prior resistance (daily level 1), while failure to hold this level would reinforce the broader rotational framework that has defined much of the past year. Traders should remain flexible and attentive to headlines, as recent price action has shown heightened sensitivity to headline driven developments.

For market participants evaluating ways to gain exposure to agricultural markets such as soybeans, futures provide features such as centralized pricing, transparency, and capital efficiency that differ from exchange traded products. Futures brokers like EdgeClear offer access to global futures markets and a range of execution and platform options designed to support active market participation. Traders should evaluate whether futures are appropriate for their experience level, objectives, and risk tolerance before choosing a brokerage or trading product. Consider exploring futures trading at edgeclear.com to take your trading to the next level.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional if necessary before engaging in futures or derivatives trading.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)