Bitcoin is not for the faint of heart. Even those who bought the leading cryptocurrency at below $1 per token in 2010 have been on an emotional rollercoaster for years. The thrill of new highs and fear from price plunges have been routine. Any trader knows that a risk position is long or short at the current market price, not the original execution price.

In 2021, Bitcoin experienced two breathtaking rallies that took the price to new record highs and over a trillion-dollar valuation and two severe and brutal price corrections. Greed and fear are emotions that drive market participants’ behavior and prices, and Bitcoin is the poster child for the two emotions.

Bitcoin is the grandfather of the cryptocurrency asset class with over 17,200 tokens. As of January 31, Bitcoin’s market cap was over 41.6% of the value of the entire asset class. At below the $38,000 level, the Bitcoin market was worth $717.9 billion, with the asset class’s market cap at the $1.725 trillion level.

At the end of January, Bitcoin was in the fear cycle as the price has plunged from the mid-November 2021 high.

Bitcoin halves in value from the November 10 high to the January low

Trading or investing in Bitcoin in 2021 was like riding a psychotic horse through a burning barn. Few markets exhibit wild price swings like the leading cryptocurrency.

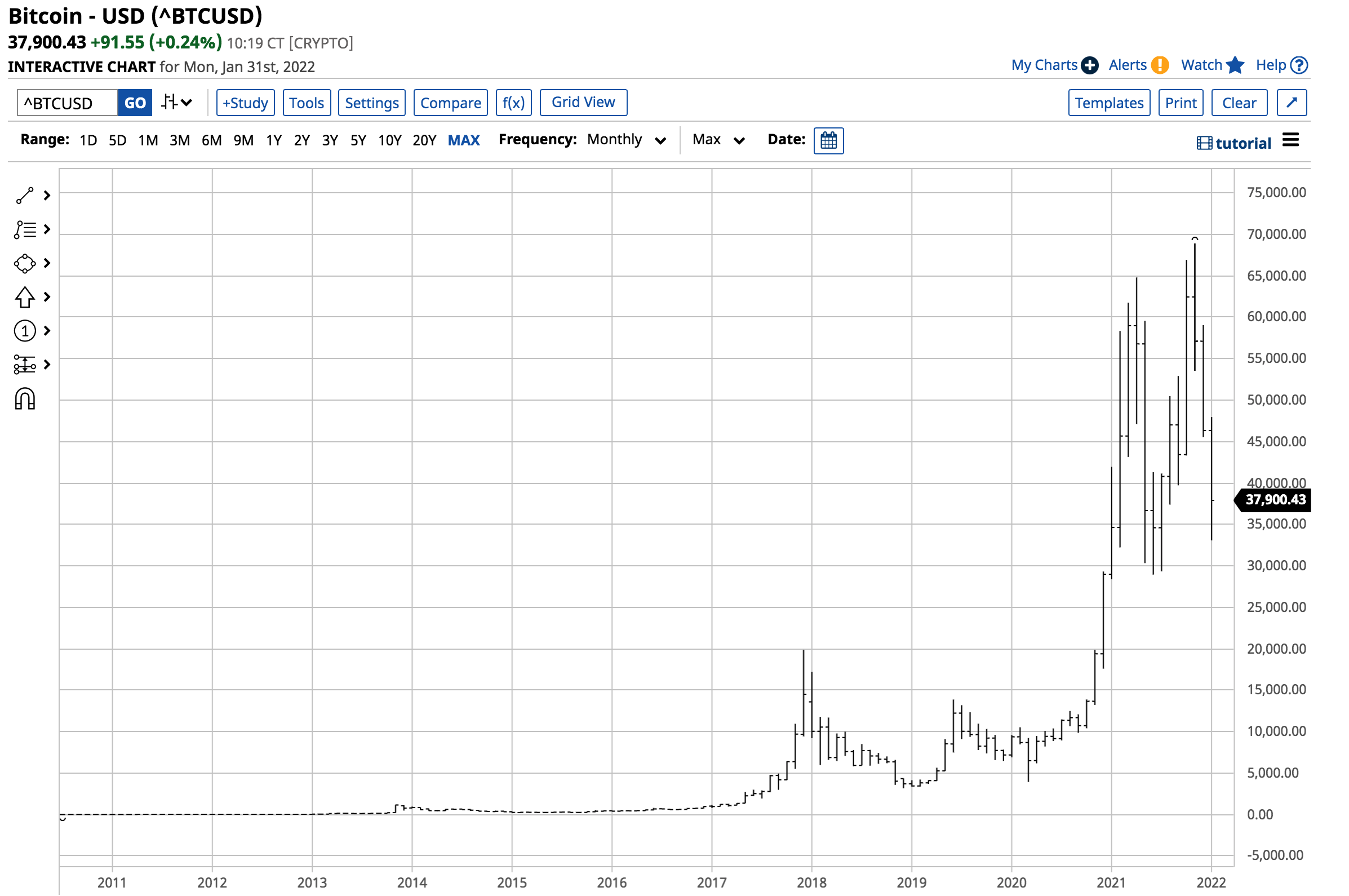

The chart shows Bitcoin ended 2020 at $28,986.74 per token. The price rose to $64,789.27 in April 2021, a 123.5% gain in four months. The price then plunged to $28,957.79 in June, a 55.3% correction. After more than halving in value, bitcoin proceeded to explode to an even higher high, trading at $68,906.48 in November 2021, a 138% rally from the low. The most recent decline took Bitcoin to $33,076.69 in January 2022, a 52% plunge. Bitcoin more than halved in value before more than doubling in value over the period. Bitcoin is close to a significant bottom at the most recent low if the pattern continues.

Critical technical support is just below the $30,000 per token level

The long-term chart shows that Bitcoin’s pattern of higher lows and higher highs remains intact at the $37,900 level on January 31, 2022. Critical technical support stands at the June 2021 $28,957.79 low. A decline below that price would negate the bullish pattern and open the door for a drop to levels not seen since late 2020.

As we move into February 2022, Bitcoin remains a bullish bucking bronco. February 2021 was a very bullish month for Bitcoin as the price gained over $23,700 from the January 2021 close to the February 2021 high.

The recent move is business as usual for the leading cryptocurrency

We should expect elevated volatility in a market that routinely has more than halved and doubled in value over a few months. However, fear and greed make the dips challenging to stomach, and the rallies provide a false sense of delight. If Bitcoin can hold the January 2022 low, the decline would be smaller on a percentage basis than the drop from April through June 2021. Meanwhile, there are no guarantees in markets that experience extreme price variance. Bitcoin is not for the faint of heart. Traders and investors must adjust their risk-reward expectations to reflect the price variance in volatile markets.

Buying on carnage has been the optimal approach

Even though the price corrections have been scary, the historical trading pattern suggests that each significant correction since 2010 has created a golden buying opportunity. Few, if any, assets in our lifetime have provided the capital appreciation as Bitcoin. It is always a challenge to buy a market that is a falling knife. In Bitcoin, the optimal approach has been to let the knife fall, the price half, and buy as the price consolidates not far from the recent low.

The chart illustrates that Bitcoin remains in a bearish trend as of January 31. However, there are precise levels where technical support should contain the selling. The first level stands at the June 2021 $28,957.79 low. If Bitcoin follows the same pattern, there is approximately $8,950 downside risk with the upside potential at more than $31,000 at $37,900 per token. A better than 3:1 reward-risk ratio based on technical support and resistance levels favors buying on the dip around the current level and lower. Technically, Bitcoin needs to remain above the $30,000 level, but there are never any guarantees.

Only invest what you can afford to lose- The potential for vast rewards comes with commensurate risks

The most critical factor for success in markets is approaching markets with a plan that reflects appropriate risk-reward horizons based on a market’s price variance. Sticking to the plan is crucial for financial survival.

In the world of cryptocurrencies, any purchase must reflect the potential for a total loss. Governments and regulators are not supporters as cryptocurrencies challenge the control of the worldwide money supply and traditional financial institutions’ role in the global economy. Therefore, any investor dipping a toe into cryptos on the long side must realize and appreciate that 100% of their investment is at risk. Ray Dalio, a world-leading hedge fund manager, once said that governments have the power to “kill” Bitcoin and the asset class.

Meanwhile, the potential for vast rewards if the trend over the past years continues comes with commensurate risks; there is never any free lunch or risk-free trades in markets. I favor the upside in Bitcoin at the $37,900 level but realize that asset could become worthless if Mr. Dalio’s warnings prove prophetic.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)