The prospects for higher interest rates in 2022 should be pushing the bond market lower. However, since the late October lows, bonds have been rallying lows in a counter-intuitive move. The stock and bond markets have become choppy, but the trend in stocks has shifted to the downside and bonds to the upside.

Risk-off conditions cause investors and traders to run for the cover of safe-haven markets. The US bond market is the most liquid in the world. Moreover, the world’s leading economy offers debt instruments that move higher and lower based on bids and offers in the market via a transparent auction process. US interest rates remain at historic lows, with the short-term Fed Funds rate at zero to twenty-five basis points. Further out along the yield curve, quantitative easing has supported bond prices since the pandemic began.

Markets are shifting gears as 2021 winds down in the final month. However, bonds have been rallying as fears over future market volatility rise.

The stock market turned lower in late November

The S&P 500 reached its most recent high on November 22 at 4,743.83.

The chart illustrates the decline to a low of 4,495.12 on December 3, a 5.24% correction. The index that reflects a broad range of US stocks closed at the $4,538.43 level on December 3, not far above the December 3 low.

A more hawkish Fed and new virus variant are weighing on stocks

The outbreak of a COVID-19 variant and the prospects for higher interest rates in 2022 weighed heavily on stocks. The virus spreads from South Africa to other countries, including the US. Meanwhile, rising cases in Europe caused some countries to introduce new shutdowns to prevent the spread of the virus.

In late November, US President Joe Biden announced the nomination of Fed Chairman Jerome Powell for a second term. The choice indicates the administration is concerned about inflation as Chairman Powell had led the central bank throughout the pandemic. At the November FOMC meeting, the Fed announced the immediate tapering of quantitative easing at a rate of $15 billion per month, $10 billion in government debt securities, and $5 billion in mortgage-backed securities. At $15 billion per month, QE would wind down to zero by mid-2022, setting the stage for liftoff from a zero percent short-term Fed Funds rate.

In testimony before Congress, in the wake of his nomination, the Fed Chairman went one step further, saying he supports accelerating the tapering to combat rising inflationary pressures. He retired the term “transitory” from the central bank vocabulary, as the economic condition appears more structural. While the Fed and Treasury had blamed rising prices on pandemic-inspired supply chain bottlenecks, a root cause has been the flood of liquidity and waves of government stimulus that have eroded fiat currencies’ purchasing power.

Bonds compete with stocks for capital. Higher interest rates tend to weigh on stocks as many investors turn to fixed-income securities.

Higher taxes are causing end-of-the-year tax-loss selling

Paying for the unprecedented stimulus since early 2020 is another issue weighing on stocks. The US national debt recently surpassed the $29 trillion level. Each 25-basis point increase in the Fed Funds rate will cost the US government another $75 billion, increasing the debt thanks to the compounding of money.

Moreover, the administration plans to increase taxes on corporations and wealthy Americans in 2022. Higher tax rates will likely cause taxpayers to liquidate portions of their portfolios to pay Uncle Sam. When it comes to corporations, higher taxes could lower stock buyback programs, increasing the impact of tax-related sales. In the short-term, liquidation of profitable positions to take advantage of lower capital gains tax rates could continue through December.

The bottom line is higher taxes will weigh on corporate profits and cause wealthy individuals to sell more shares than in the past years. Natural buying from retirement accounts could be overwhelmed with tax-related selling, leading to a substantial correction in all leading stock market indices.

Many watch the VIX, but the bonds are the flight to quality market

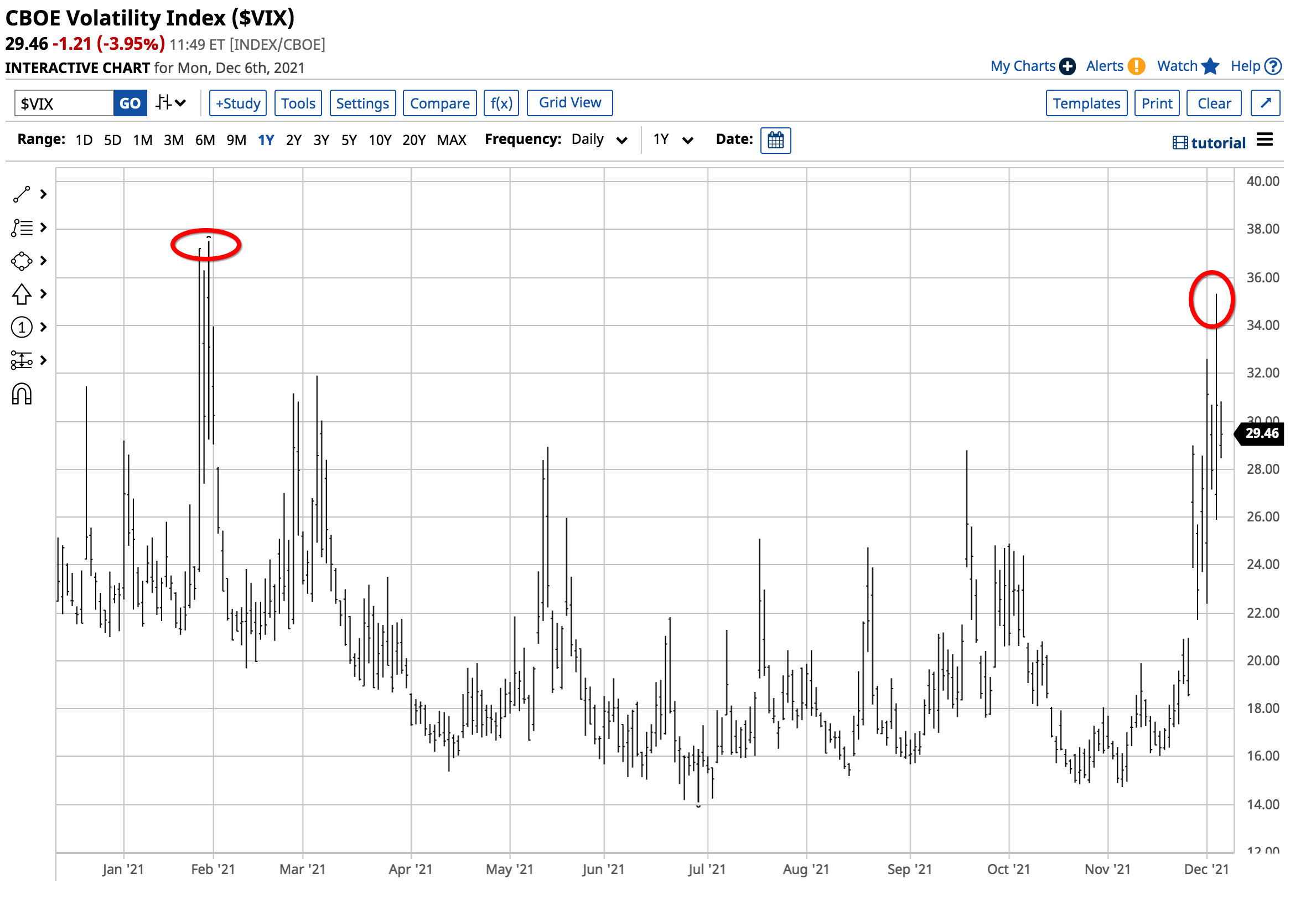

The VIX index reflects the implied volatility of put and call options on S&P 500 stocks. Since options are price insurance, a correction often causes investors and traders to flock to the options market for protection against adverse price moves. Over the past weeks, the VIX moved to its highest level since February 2021.

The chart of the VIX index shows the move to a high of 35.32 on December 3, the highest level since the week of January 29, 2021. The high in the VIX in 2021 was at 37.51 during the week.

Many market participants view the VIX as a fear index as the stock market tends to take an elevator lower during corrections. However, when investors and traders look to move to the sidelines, they often seek the safety of the bond market as a haven during turbulent periods.

The long bond futures and TLT have been rallying in a sign investors, and traders are moving to the sidelines.

Logically, the prospects for rising interest rates should push bond prices lower. However, the selling in stocks had the opposite impact over the past weeks.

The chart of the March US 30-Year Treasury bond futures shows the rise from a low of 155-23 on October 21 when inflationary fears peaked to a high of 164-12 on December 3 as the stock market fell and market participants sought safety in bonds.

The iShares 20+ Year Treasury Bond ETF product (TLT) is a highly liquid tool that follows US Treasury bond prices. At the $153.40 level on December 6, TLT had over $19.246 billion in assets under management. The ETF trades an average of over 17.9 million shares each day and charges a 0.15% management fee.

The chart shows the rise from $141.45 on October 11 to $155.12 on December 3, a 9.66% increase in the ETF tied to Treasury bond prices.

The Fed seems determined to raise rates to battle inflation, and another high reading in November CPI would likely accelerate QE tapering. However, the central bank is also likely to be sensitive to turbulence in the stock market and funding the US debt. The central bank will find itself between a rock and a hard place if the stock market continues to fall. The legacy of the pandemic and the monetary and fiscal policy tools that stabilized economic conditions could continue to create lots of volatility in stocks, bonds, and markets across all asset classes in 2022. Fasten your seatbelts for a wild ride over the coming weeks and months.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)