There were bids of $240 in the North today, and dressed bids of $378. However, workers voted to strike at the JBS plant in Greeley, Colorado, which weighed on futures prices today along with the overall risk-off tone in the markets this week. April Live Cattle and May Feeders began the day limit down before working their way back some during the rest of the day. April live cattle closed at 235.650, -6.15, while May feeder cattle closed at 356.600, -7.150.

Friday’s Cattle Inventory report came out bullish as expected, with the US beef cattle herd shrinking 0.35% to 86.2 million, which is the smallest herd size in 75 years. Calves and cattle on feed were down 3 percent from last year to 13.8 million head. Beef replacement heifers were up 1% from a year ago. You could say that heifer retention has started, but it’s not yet meaningful. Texas heifer expansion was up 8.3% from 600,000 to 650,000, showing that the expansion is all from Texas. Texas added 50,000 head, while the entire US only added 41,700 heifers. The Corn Belt and the Plains are struggling with herd expansion due to dry weather. The calf crop for 2025 was down 2% from 2024 at 32.9 million head, compared to ~33.5 million previously. People are looking for expansion, but the market shows supply is still tight and should remain that way for some time. Tyson executives said on Monday that they expect a shortage of cattle on US pastures to last roughly two years, through at least 2026 and 2027. The calf crop numbers for 2025 in Friday’s report show the lowest calf crop since 1941 and 2% lower than in the 2014/2015 bull market.

Feedlots continue to feed cattle to heavier weights, in addition to more beef-on-dairy crosses. The latest report shows dressed carcass weights for all grades of cattle at 949 lbs, which is 27 lbs above last year. This is helping with the supply shortage and lower slaughter counts. As the weather gets warmer, that weight buffer should start to decline some in addition to increased demand.

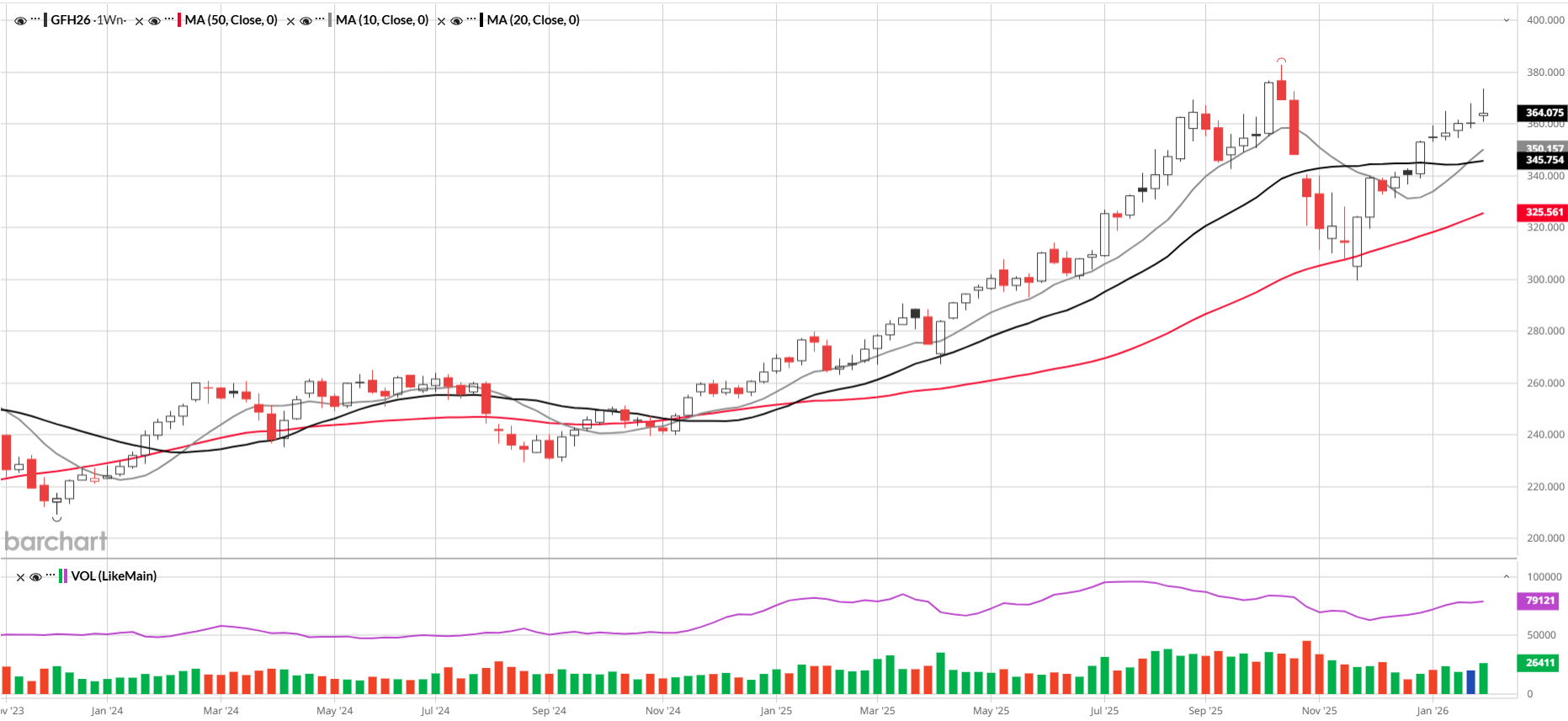

May feeders are trading at a steep discount to the CME Feeder Index at 375.16. The feeder index should be steady going forward, and futures prices should continue to move higher, with some more pullbacks possible along the way. Bearish chart formations have been eliminated fairly quickly recently. Fat cattle could see 250 in the April contract, and feeders should continue to be strong, but headline risk increases the closer prices get to new all-time highs.

Even with today’s drop in price, cattle prices are still fundamentally very bullish, and the market should continue to trade higher. Consider the following opportunities:

MAY ’26 FEEDER CATTLE

BUY 1 MAY ’26 360 CALL 12.62 ½

SELL 1 MAY ’26 380 CALL 5.40

Price: 7.225 Cost: $2,612.50 DEBIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

MAY’26 FEEDER CATTLE OPTIONS EXPIRE 5/21/26 (105 DAYS)

MAXIMUM LOSS: LIMITED

MAY ’26 FEEDER CATTLE

BUY 1 MAY ’26 360 CALL 12.62 ½

SELL 1 MAY ’26 376 CALL 5.82 ½

Price: 6.80 Cost: $3,400.00 DEBIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

MAY’26 FEEDER CATTLE OPTIONS EXPIRE 5/21/26 (105 DAYS)

MAXIMUM LOSS: LIMITED

SEPTEMBER ’26 FEEDER CATTLE

SELL 1 MAY ’26 330 CALL 10.15

BUY 1 MAY ’26 300 CALL 4.07 ½

Price: 6.075 Cost: $3,037.50 CREDIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

SEPTEMBER ’26 FEEDER CATTLE OPTIONS EXPIRE 2/31/26 (231 DAYS)

MAXIMUM LOSS: LIMITED

.

Contact me for trades in Live Cattle.

If you would like to receive more information on the commodity markets, please use this link to join my email list

If you would like to receive more information on the commodity markets, please use this link to join my email list

If you would like to receive more information on the commodity markets, please use this link to join my email list

.

If you don't like the customer service or personal attention you are receiving from your broker, you have options, and you don't have to stay there. I can have your new account open quickly. Call me anytime 312-765-7311.

If you would like to open an account, please use this direct link

.

Having a Trading or Hedging Account is essential for your business to be successful. If you’re a rancher dealing with rising input costs, labor shortages, and shrinking margins, you’re not the only one. While you can’t fully control your costs, you can control how you protect your revenue. Market volatility has increased across all commodities over the last 12 months, and 2026 has already had a volatile start. Opening an account in the future, will not help you if you need access now. To be successful, you need to be able to manage risk in real time. If you are proactive now, you will have the ability to be reactive when you need to be. You can be prepared and patient at the same time. Call me or hit the direct link above.

Hans Schmit

Broker, Pure Hedge Division

312-765-7311

hschmit@walshtrading.com

WALSH TRADING INC.

311 S. Wacker Suite 540

Chicago, IL 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)