My Barchart quarterly report on the precious metals sector of the commodities market, published on January 13, 2026, stated that, “Platinum eclipsed the 2008 high of $2,308.80 per ounce in Q4 2025.”

I concluded the report with the following:

The trend is always a trader’s or investor’s best friend, and it remains bullish in January 2026. The higher the price rises, the greater the odds of a correction.

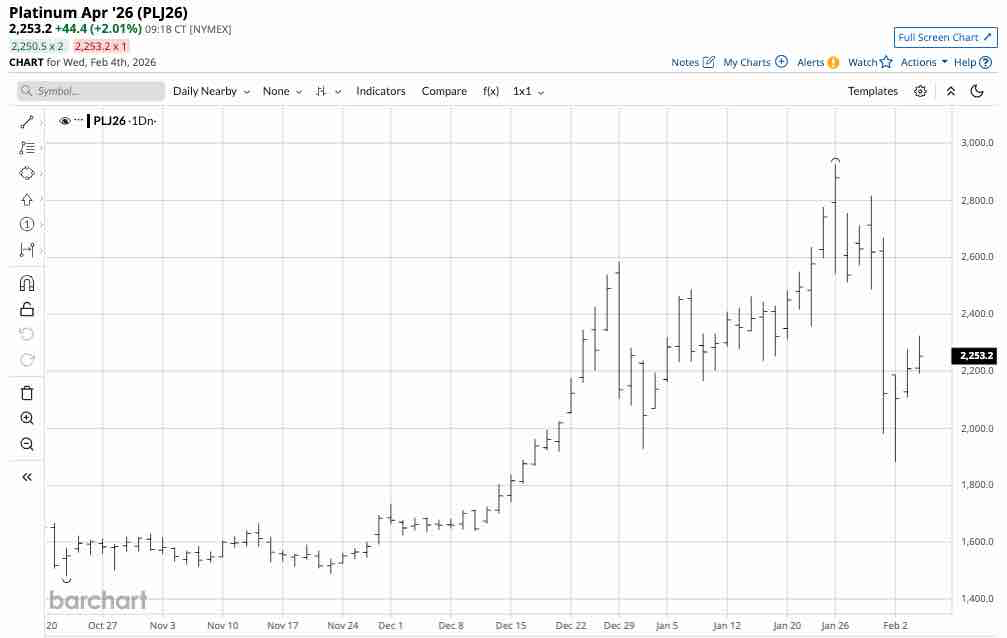

Platinum futures rose nearly $900 per ounce from the 2025 closing price level, and were nearly $550 higher than the price on January 12 on January 26. However, the risk of a correction rose with the price, and nearby platinum futures traded below $1,900 on February 2 and around $2,250 on February 4.

Lots of volatility in the platinum futures market

After settling at $2,044.20 on December 31, 2025, the nearby continuous NYMEX platinum futures contract rallied 43%, reaching $2,925.00 on January 26, 2026.

The daily chart highlights the choppy trading pattern that took platinum futures 35.7% lower from the January 26 high of $2,925 to the February 2, 2026, low of $1,882.00 per ounce. Platinum was back above the $2,250 level on February 3, over $360 high in one volatile day.

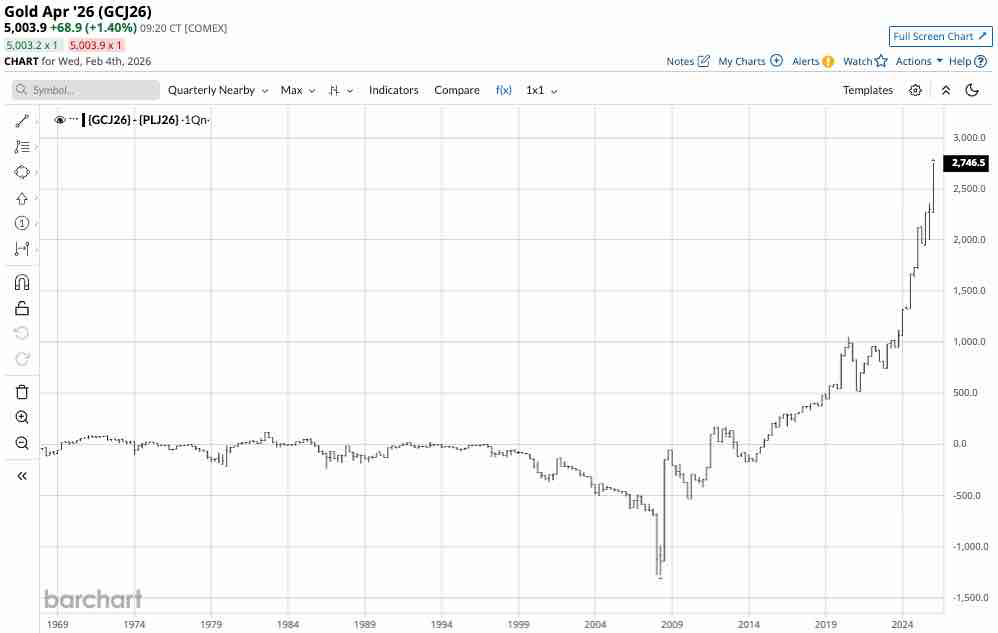

Platinum remains inexpensive compared to gold

Platinum was once considered “rich person’s gold” as it commanded a premium over the leading precious metal.

The quarterly chart of nearby COMEX gold minus nearby NYMEX platinum futures ({GCJ26}-{PLJ26}) shows that from the late 1960s through 2008, platinum’s price was mostly higher than gold’s price. Since 2015, the value proposition has flipped, with gold steadily gaining on platinum, reaching an over $2,745 per ounce premium in early 2026. Platinum is historically inexpensive compared to gold, but it has continued to get more inexpensive over the past sixteen years.

An industrial and precious metal

While gold has industrial applications, it is primarily a financial metal and a means of exchange held by central banks and governments worldwide as a reserve asset. Platinum is also a financial metal, but it has far more industrial applications than gold. Moreover, gold production is widespread, while platinum output comes primarily from two countries, South Africa and Russia. In Russia, platinum production is a byproduct of nickel output in Siberia’s Norilsk region.

While gold and platinum share industrial and financial applications, platinum’s role in the global financial market is extremely limited compared to gold’s growing profile as a reserve asset.

Platinum is a lot less liquid than gold

The worldwide platinum market is far less liquid than gold, starting with annual gold production of over 3,000 tons and annual platinum output of between 170 and 200 metric tons. Each COMEX gold futures contract contains 100 ounces, while NYMEX platinum futures contracts contain 50 ounces. Open interest is the total number of open long and short positions in a futures market. As of February 3, 2026, COMEX gold open interest of 409,694 contracts, totaling 40,969,400 ounces. At $5,000 per ounce, the value is around $204.85 billion. Platinum open interest of 73,590, totaling 3,679,500 ounces at $2,250 per ounce, had a total value of $8.279 billion. The bottom line is that platinum is a far less liquid market than gold.

Lower liquidity can cause increased volatility when significant trends develop. Illiquid conditions can cause bids to purchase to disappear as prices decline or offers to sell to evaporate during rallies, causing substantial price variance and price gaps on charts. In the current environment, the potential for increased volatility in the platinum market is high.

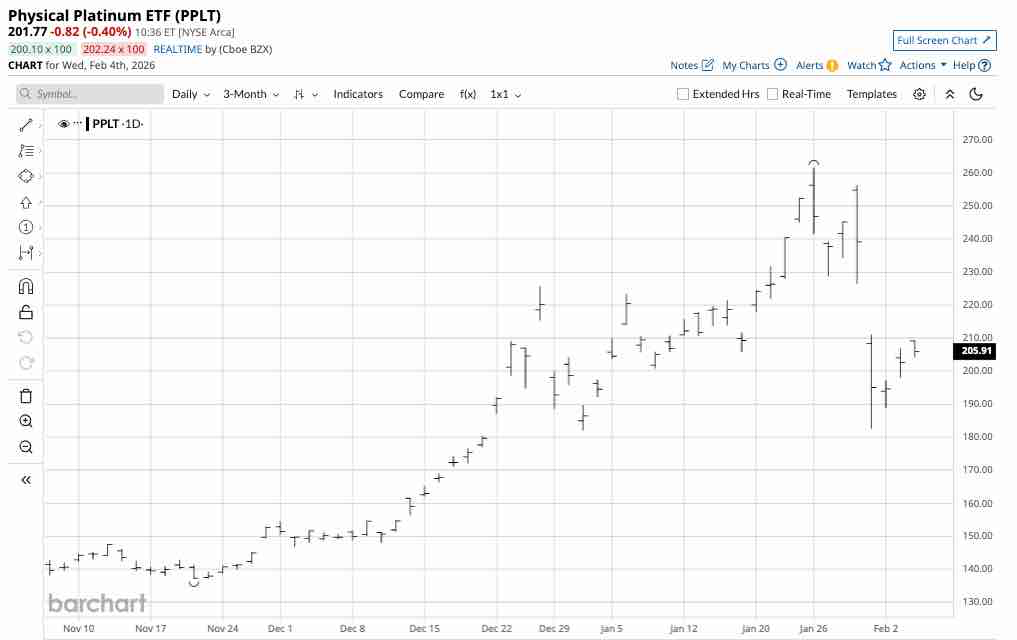

Buying platinum on dips could be optimal- PPLT is the most liquid platinum ETF

After reaching its latest all-time high on January 26, 2026, platinum futures plunged by 35.7% in only six trading sessions before recovering by nearly 20% the day after it reached its latest low. Given its extremely volatile trading conditions, buying platinum on price weakness rather than strength has been optimal throughout the rally, and this is likely to continue. While it is challenging to buy any precious metal when it is plunging, as we witnessed on January 29 in gold and silver markets, purchasing on weakness has consistently been an optimal strategy.

The most direct route for a risk position or investment in platinum is the physical market for bars and coins. However, physical platinum and other precious metals often involve substantial premiums for buyers and discounts for sellers. The NYMEX futures have a delivery mechanism, making them an alternative for physical buyers. Meanwhile, the Aberdeen Physical Platinum ETF (PPLT) is a liquid product that owns physical platinum and trades on NYSE Arca, allowing market participants to include platinum exposure in standard equity accounts. At $202.45 per share, PPLT had over $3.231 billion in assets under management. PPLT trades an average of over 1.544 million shares daily and charges a 0.60% management fee.

Platinum futures rallied 43% from the end of 2025 to the January 26 high, and fell 35.7% to the February 2 low.

PPLT tracked platinum futures prices rising 40.3% from $186.43 at the end of 2025 to $261.62 on January 26. PPLT declined by 30.2%, falling to $182.62 per share on January 30.

PPLT does an excellent job tracking platinum futures prices, but it can miss highs or lows when the U.S. stock market is closed. Time will tell if the most recent correction is a golden buying opportunity for platinum, but buying on price weakness has been optimal over the past months, and I expect that trend to continue.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)