/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

Alphabet (GOOG) (GOOGL) stock is sliding this morning after a slight YouTube miss and aggressive capex guidance overshadowed the company’s overall better-than-expected financials for its fiscal Q4.

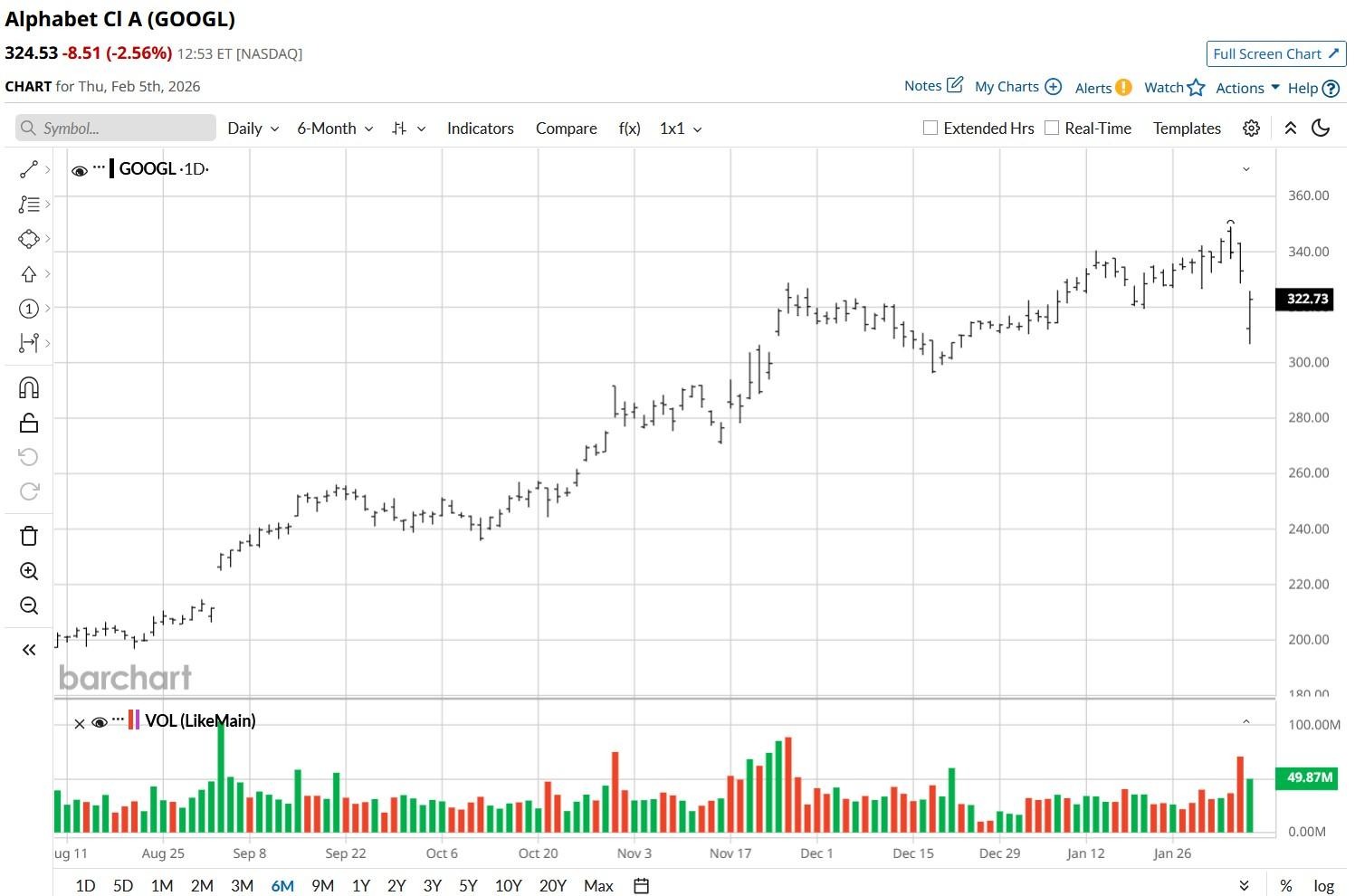

The post-earnings dip made GOOGL slip below its 50-day moving average (MA) today, signaling that downward momentum may sustain in the near term.

Despite the recent decline, however, Google shares remain up more than 100% versus their 52-week low.

Why Capex Guidance Doesn’t Warrant Selling Google Stock

In its earnings release, Alphabet said its capital expenditures could soar to nearly $185 billion this year — more than double what it spent in 2025. At first glance, this headline number sure looks concerning, but a closer look reveals the company is actually spending into strength, which warrants sticking with GOOGL stock.

Google Cloud brought in $17.7 billion in the fourth quarter, up a remarkable 48%, reinforcing that Alphabet isn’t just building data centers blindly, it’s responding to a massive $240 billion backlog.

As Sundar Pichai, the company’s chief executive, has noted previously, “The risk of under-investing is far greater than the risk of over-investing in AI infrastructure.”

Citi Reiterates GOOGL Shares as Top Pick for 2026

In a post-earnings interview with CNBC, Ron Josey, a senior Citi analyst, urged long-term investors to look past the knee-jerk reaction, reiterating Google shares as one of his top picks for 2026.

According to him, Alphabet is the only tech titan with a vertically integrated artificial intelligence (AI) stack — from in-house TPU chips to the world’s most dominant consumer platforms.

While the market fears the cost of artificial intelligence, Google is already seeing a 78% reduction in Gemini serving costs, Josey revealed.

A 0.26% dividend yield and billions authorized for share repurchase make the AI stock even more attractive as a long-term holding.

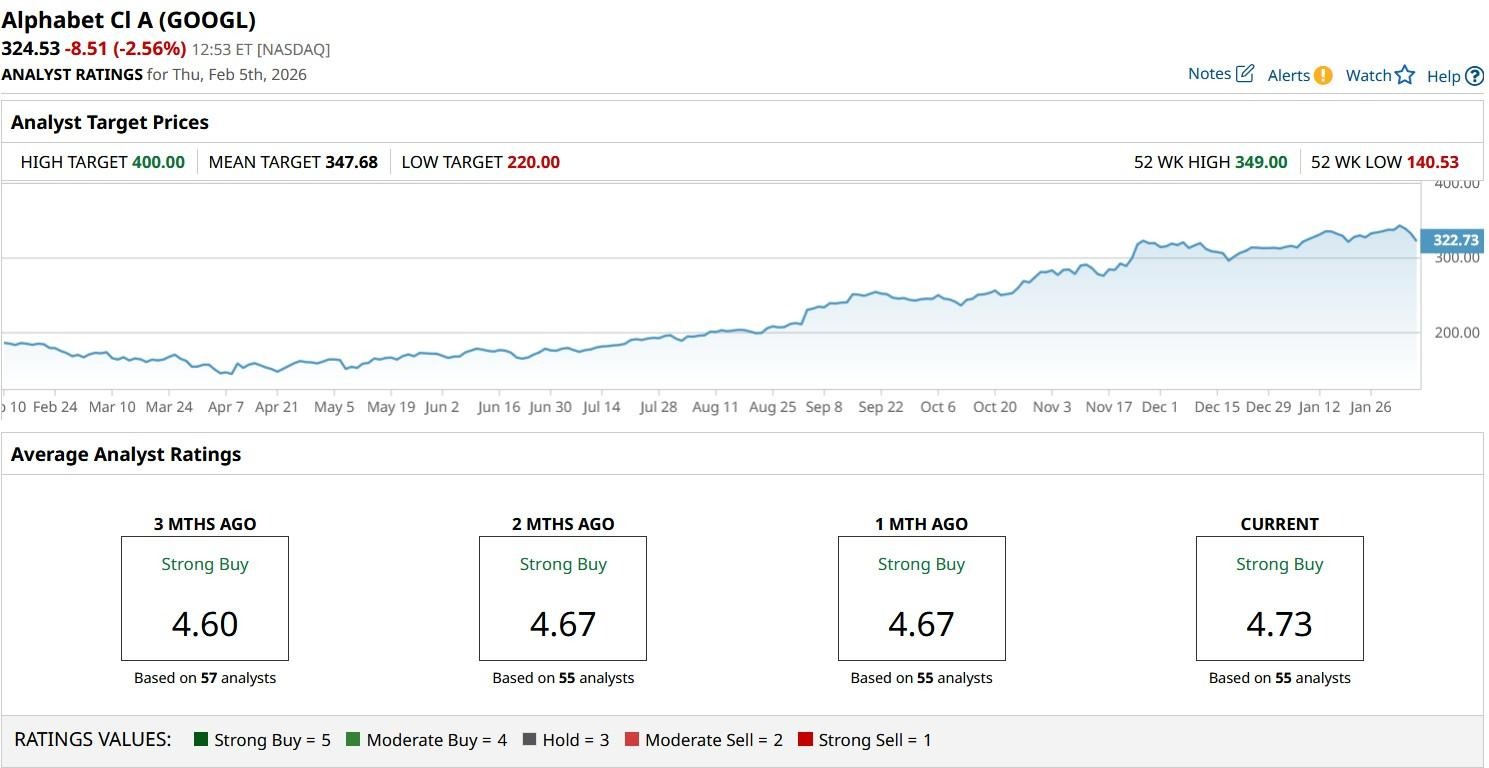

How Wall Street Recommends Playing Alphabet

Other Wall Street analysts also agree with Citi’s bullish view on Alphabet, especially since it remains decisively above its 100-day MA, indicating the broader uptrend is still intact.

According to Barchart, the consensus rating on GOOGL shares sits at a “Strong Buy” currently, with price targets as high as $400 signaling potential upside of nearly 25% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)