Silicon Laboratories (SLAB) stock experienced a dramatic surge on Wednesday after Texas Instruments (TXN) announced an all-cash agreement to acquire the wireless chip specialist for approximately $7.5 billion, agreeing to pay $231 per share, a significant premium over the company’s recent trading levels. The market’s reaction was swift; Silicon Labs shares jumped as much as 48.9% intraday, reflecting investor enthusiasm over the deal’s size and strategic implications.

Texas Instruments is aiming to build a global leader in embedded wireless connectivity. The deal combines TXN’s strengths in analog, embedded processing, and manufacturing with SLAB’s mixed-signal and wireless expertise, expanding TXN’s portfolio.

TXN plans to leverage its 300mm U.S. wafer fabs and 28nm process technology to support Silicon Labs’ offerings and drive efficiencies. TXN expects the transaction to generate $450 million in annual manufacturing and operational revenue within three years after closing, which is targeted for the first half of 2027.

Is it too late to buy Silicon Labs stock, or does the deal still offer a compelling reward from here? Let’s discuss.

About Silicon Laboratories Stock

Silicon Laboratories is a fabless semiconductor company that designs and delivers analog-intensive mixed-signal solutions, with a strong focus on wireless microcontrollers, IoT connectivity chips, sensors, and related software and tools used across industrial automation, smart home, and commercial electronics markets. The company is headquartered in Austin, Texas. Silicon Labs currently has a market cap of $6.7 billion.

Silicon Laboratories’ share price has shown pronounced volatility over the past year, shaped by broader semiconductor sector headwinds and periodic company-specific developments ahead of the Texas Instruments acquisition announcement. During this time, 52-week returns were largely muted, while year-to-date (YTD) performance through Feb. 3 stood at roughly 4.5%.

That dynamic shifted decisively after Texas Instruments announced the acquisition deal on Feb. 4. On the day, SLAB surged 48.9%, clearing prior highs as the market rapidly priced in the takeover premium. The sharp rally lifted 52-week returns to almost 36.8% and pushed YTD gains to about 56%.

The stock is currently trading at a significant premium to its industry peers at 212.36 times forward earnings.

Modest Financial Performance

Silicon Laboratories reported its fourth quarter and full year 2025 results on Feb. 4, for the fiscal year ended Jan. 3. The company delivered strong year-over-year (YOY) top line growth, with full-year revenues of $785 million, up 34% from the prior year. Both end markets contributed to the expansion, as Industrial & Commercial revenue rose about 31% and Home & Life revenue increased roughly 38% compared with 2024. However, Silicon Labs reported a full-year net loss of $64.9 million, compared to a net loss of $191 million in the prior year.

Nevertheless, on a non-GAAP basis, operating income came in at $25 million and non-GAAP earnings per share of $0.92, ahead of analysts’ estimates.

In the fourth quarter alone, revenue climbed to $208 million, up 25% YOY driven by broad demand across both segments, with Industrial & Commercial up about 37% and Home & Life up around 12% versus the same period in 2024. On a non-GAAP basis, Silicon Labs delivered positive results with operating income at $21 million and non-GAAP EPS of $0.56, beating expectations.

Analysts predict EPS to be around $0.64 for fiscal 2026, and $2.14 for fiscal 2027, indicating 162.8% and 234.4% increases, respectively, from the prior-year periods.

What Do Analysts Expect for Silicon Laboratories Stock?

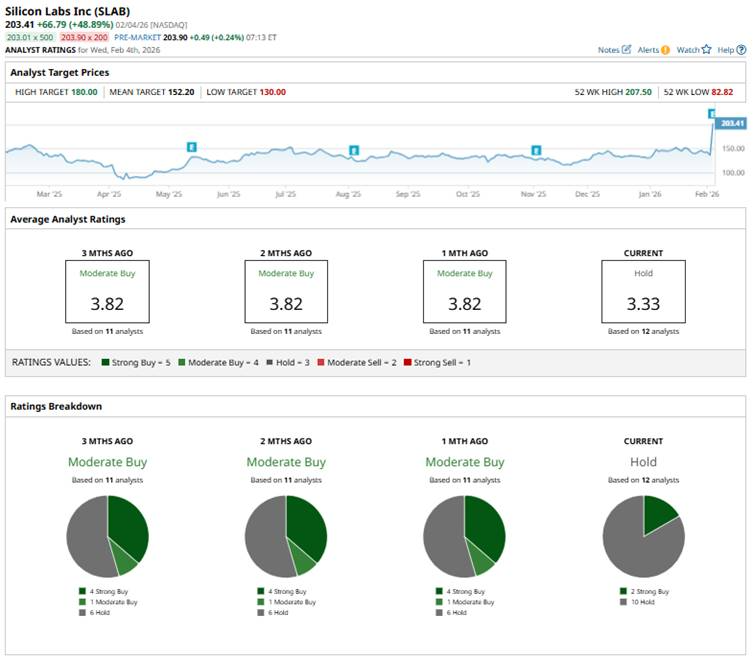

Following the announcement of the acquisition deal, Silicon Laboratories saw analyst downgrades, primarily shifting ratings to “Hold.”

On Feb. 4, Needham analyst N. Quinn Bolton downgraded Silicon Laboratories from “Buy” to “Hold.” Plus, KeyBanc analyst John Vinh downgraded Silicon Laboratories from “Overweight” to “Sector Weight.”

Overall, SLAB has a consensus “Hold” rating, indicating a cautious stance. Of the 12 analysts covering the stock, two advise a “Strong Buy,” and 10 analysts are on the sidelines, giving it a “Hold” rating.

SLAB has already surged past the average analyst price target of $152.20, and the Street-high target price of $180.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)