Zoom (ZM) is among the top technology companies investors sought to gain exposure to during the pandemic. When everyone was forced to work from home, Zoom's video conferencing platform saw absolutely incredible demand.

Now, since the pandemic, Zoom has been able to keep an impressive number of companies and individuals that signed up for its services. This has meant that the kind of cash flow deterioration many expected hasn't materialized, with the company able to reinvest in its offerings and provide even more value to its end customers.

In addition to this reality, Zoom has also seen a bump in investor interest (and its stock price, shown above). And with some analysts now jumping aboard Zoom as a top investment opportunity, with Baird analysts commenting on Zoom's stake in AI darling Anthropic this past week, perhaps this is the growth stock investors are looking for.

Let's dive into what to make of this recent analyst note, and why Zoom looks more attractive than it has in some time.

Strong Bull Case Gets Even Stronger

Again, I've been of the view that Zoom's impressive rise in terms of its revenue and earnings/cash flow growth isn't a one-off pandemic success. Many in the markets appear to agree with this view, with ZM stock performing well in recent weeks.

However, the sharp uptick investors benefited from this past week (though this move was later accompanied by some selling pressure thanks to macro concerns) is notable. This move suggests to me that Baird analyst William Power is onto something, with his view that Zoom's $51 million investment in Anthropic could be the game-changing move investors want to see.

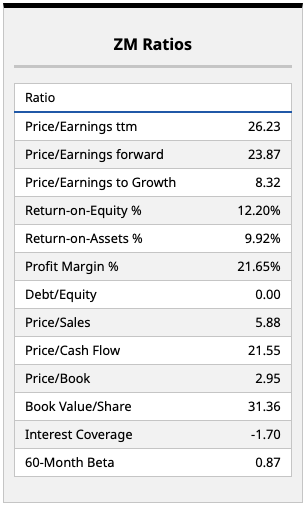

Fundamentally, Zoom does appear to have both the cash flow and balance sheet capacity to support such investments. Indeed, many market participants are clamoring for companies like Zoom with excess balance sheet capacity to put this capital to work in investments that can grow as fast as possible. For some companies, that may mean reinvesting in their core business. For others, it may mean taking a slice out of other larger, higher-growth AI stocks.

I agree that this Anthropic investment could turn out to be a major deal for shareholders down the road. Companies like Zoom that can front-run future IPOs and get in on the ground floor with a name like Anthropic can be meaningful for long-term investors. Indeed, for those who believe this whole AI narrative isn't overblown, Zoom's dramatic entrance into the world of AI (at least from an investment angle) should be considered as key to this stock's thesis.

What Do Other Analysts Think?

We know that Baird's Power is very bullish on Zoom's long-term upside potential. I agree with his views and commentary around this tech company's improved growth potential following this key investment.

However, I also think it's important to see what the 27 analysts who cover Zoom think of this company. The good news is that there is some upside currently baked into Zoom's price target from this group, with around 5% upside from here if analysts are correct.

Now, many of the price targets put in place on ZM stock were set before this stock's recent run-up, driven in part by the aforementioned analyst note on this stock. I think that if we see additional news flow on a potential expansion of this investment, or other investments made in this space, we could see another rally that takes Zoom even higher.

That said, I also acknowledge that we may be seeing some investing anxiety or caution, given where AI valuations have gotten recently. It all depends on the market's view of these AI companies, and how soon profitability will come.

In my view, Zoom is one of those companies with strong underlying fundamentals that's being partly driven by an exogenous AI tailwind. I like that setup better than investing directly in many top AI stocks, so this name is one I'd recommend investors keep an eye on here.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)