/TempraMed%E2%80%99s%20VIVI%20pen%20is%20the%20world%E2%80%99s%20first%20temperature%20controlled%20medication%20storage%20solution%20that%20is%20already%20adopted%20by%20individuals%2C%20pharmacies%2C%20%26%20healthcare%20providers%20across%20the%20US.png)

This is sponsored content. Barchart is not endorsing the websites or products set forth below.

- TempraMed’s FDA-registered devices target more than 160 million global users of temperature-sensitive injectable medications, such as insulin, representing a USD$30 billion market opportunity.

- The company has sold more than 120,000 units to date and is guiding toward approximately $19 million in revenue in 2026 as distribution and payer adoption expand.

- TempraMed’s latest addition, VIVI Cap Smart, adds a connected data layer that logs injection timing and dosage, creating a pathway to recurring software revenue and higher customer lifetime value.

As an internationally renowned diabetes care and technology expert, Dr. Diana Isaacs sees firsthand how people who depend on insulin struggle to keep their temperature-sensitive medication safe once it leaves the pharmacy.

In practice, that often means improvised storage. Patients load insulin into coolers, add ice packs, and hope for the best. Others take no precautions at all, leaving medication in cars, beach bags, or backpacks for hours at a time. Both approaches carry risk.

“I see a lot of people getting coolers and putting ice packs in them and then putting the insulin in them,” said Dr. Isaacs, who serves as Director of Education and Training in Diabetes Technology at the Cleveland Clinic Endocrinology and Metabolism Institute. “That’s really not ideal because the insulin can actually freeze, and that can ruin the insulin.”

Exposure to heat is just as damaging. When insulin is left in uncontrolled environments, it degrades and loses potency, meaning it may not work as intended, or at all, she said.

Dr. Isaacs’ stated mission is “to utilize the latest technology and innovations to improve the lives of people with diabetes.”

One company at the centre of that mission is TempraMed Technologies Ltd. (CSE: VIVI | FSE: 9DY), a global leader in temperature-controlled medication storage solutions that work 24/7 without external power or user intervention.

Its FDA-registered products, supported by eight global patents, use space-grade thermal insulation technology and are designed for daily use by the millions of people who depend on temperature-sensitive medications every day.

A simple idea with a large economic footprint

According to industry data referenced by TempraMed, (VIVI.CN) more than 160 million patients worldwide rely on temperature-sensitive medications each day, supporting a total addressable market of approximately USD$30 billion.

Separately, industry estimates indicate more than USD$35 billion worth of medication is wasted globally each year due to temperature excursions across manufacturing, distribution, and storage. That figure does not fully account for last-mile losses at the patient level, where medications such as insulin are frequently exposed to unsafe conditions during routine handling and use.

For TempraMed Founder and CEO, Ron Nagar, that last-mile gap represents a large, addressable commercial opportunity.

“As an electrical engineer, not a chemist, I didn’t set out to develop a new drug to address the issue,” Nagar said. “I focused on building a device that solves the problem without adding any hassle to the already complex daily life of a person managing diabetes or other chronic health issues,” said the medical device serial entrepreneur.

The result has been a line of passive, reusable devices designed to protect injectable medications once they enter daily patient use. Rather than relying on ice packs, batteries, or active cooling, TempraMed’s products apply proprietary thermal insulation and materials science to maintain drug stability in real-world conditions.

The company’s flagship product, VIVI Cap, is designed for insulin and GLP-1 injection pens, replacing the standard pen cap with a reusable device that protects medication during daily activities such as commuting, travel, outdoor exposure, and extended time away from refrigeration. The product is cleared for long-term use and engineered to work without user intervention or electrical charging.

“We are one of the only companies with FDA-registered products accepted by payers and HMOs for protecting temperature-sensitive medication. Next to our proprietary, patented products, there are no comparisons … From a competition standpoint, our technology is fully patented for the next 20+ years, so it would be very difficult to replicate.” — Julia Becker, VP of Capital Markets, TempraMed Technologies Ltd.

TempraMed has also extended the platform to emergency medications with VIVI Epi, a protective device for epinephrine auto-injectors used for the emergency treatment of severe allergic reactions, and VIVI Med, for medication vials, biologics, and other critical therapies that fall outside the insulin-pen format. In all use cases, stability is directly tied to efficacy in acute situations, making reliable protection critical for patients, caregivers, schools, and first responders.

All products are built around the same core materials science and thermal-control architecture, allowing the company to address multiple injectable categories without redesigning the underlying technology. That common platform reduces development risk, supports margin consistency, and enables faster expansion into adjacent use cases.

With those products already on the market, TempraMed has been able to move beyond proof of concept and into commercial scale, setting up the next phase of the business around distribution, payer access, and recurring revenue.

Traction before the capital markets noticed

TempraMed entered public markets in late 2025, but it didn’t arrive as a concept story.

The company has already sold more than 120,000 units globally, primarily in the U.S., with a customer rating of 4.8 out of 5 and roughly 30% repeat purchase behaviour. Its two flagship products, VIVI Cap for insulin and GLP-1 pens and VIVI Epi for epinephrine auto-injectors, are carried by major retailers and healthcare distributors, including CVS, Walgreens, Walmart, McKesson, and Target.

More importantly, TempraMed has crossed a validation threshold many early medical device companies never reach: it has been accepted by major U.S. payers.

“We have already validated our product in the market, and now we are investing in our B2B strategy, which can capture significant market share quickly. We already have the device at two U.S. payers, Humana and Optum,” Nagar said. “They have both of our products in their catalogues for their clients, and partnerships like this will help us scale and grow our business faster and more effectively.”

Julia Becker, TempraMed’s VP of Capital Markets, said: “We are one of the only companies with FDA-registered products accepted by payers and HMOs for protecting temperature-sensitive medication. Next to our proprietary, patented products, there are no comparisons … From a competition standpoint, our technology is fully-patented for the next 20+ years, so it would be very difficult to replicate.”

That distinction matters. Large payers require alternatives for nearly everything they list. TempraMed’s lack of substitutes is a signal of both product differentiation and IP strength.

From one-time sales to recurring revenue

The company’s next phase is not just about selling more devices. It’s about changing the economics of the business.

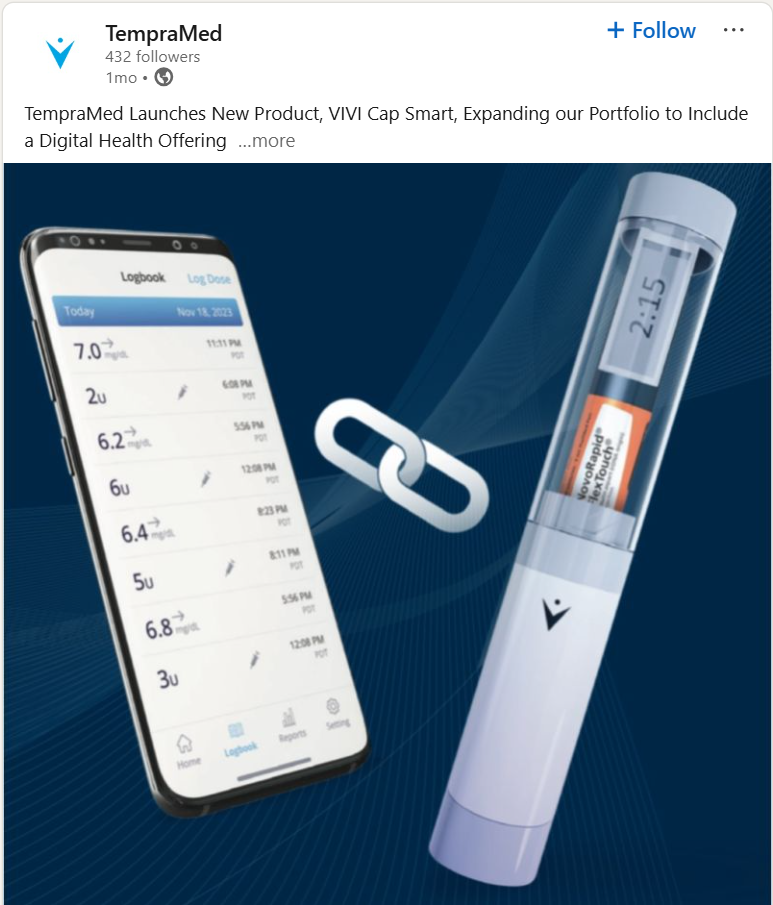

In December, TempraMed launched VIVI Cap Smart, adding a connected layer to its existing platform. For the first time, insulin and GLP-1 pens, like Ozempic injectors, that fit VIVI Cap can log injection timing and dosage, with data uploaded to the cloud and shared with healthcare providers.

“This new digitally-connected device helps customers manage their medication properly by providing a digital logbook of when you injected and how much you injected,” Becker explained. “It also increases the lifetime value of not only the device, but the customer for us, and adds a recurring revenue stream and SaaS model to our offering.”

That shift enables a subscription model layered on top of durable hardware. Instead of relying solely on device replacement every two to three years, TempraMed moves to generate additional recurring software revenue, estimated at roughly USD$60 per year per smart device, while building a growing dataset tied to adherence, outcomes, and remote patient management.

For investors, this marks the transition from a product company to a platform company.

A market that keeps expanding underneath them

TempraMed’s addressable market is defined less by diagnosis and more by delivery method.

This breadth is why TempraMed is already moving beyond pen-based devices. The product roadmap includes multi-injector boxes and broader storage solutions aimed at emergency services, military, home healthcare, and institutional use.

Management is clear about where the company sits in its growth curve.

“TempraMed is at an inflection point as we invest in our B2B strategy. From a commercialization standpoint, 2026 is going to be very fast in terms of scale and growth. We are already seeing strong adoption from payors and distribution partners,” Becker said.

TempraMed generated approximately USD$2.3 million in revenue in 2024, with projected revenue of USD$19 million in 2026, according to company guidance. Gross margins are estimated at approximately 60%, with cash-flow breakeven expected during 2026.

Manufacturing capacity currently supports up to one million units per year, equivalent to approximately USD$70 million in annual product sales, providing headroom for near-term scale without major capital expansion.

In late September 2025, the company completed a CAD$7.4 million oversubscribed public financing concurrent with its listing on the Canadian Securities Exchange and Frankfurt Stock Exchange, strengthening its balance sheet ahead of expansion. Additionally, TempraMed closed a fully subscribed CAD$2.5 million financing following the public listing, which closed in January 2026, further validating its mission and path forward.

2026 focus and execution priorities

Management characterizes 2026 as a scale-up year, with expansion across products, geographies, and customer segments.

“From a commercialization standpoint, 2026 is going to be very fast in terms of scale and growth,” Becker said.

Key priorities include:

- Expanding payer and reimbursement discussions in the U.S.

- Scaling international distribution across Europe, the Middle East, and Asia

- Broadening the product portfolio into multi-injector and institutional solutions

- Growing subscription penetration through VIVI Cap Smart

“We are anticipating approximately USD$19 million this year, almost cash-flow positive and growing,” Becker said. “This continues to grow as we scale the company.”

“This is not a high-risk, proof-of-concept idea … it’s a real business built on proven technology and real-world demand, delivering solutions that help patients with chronic conditions live more confidently every day.”

To learn more about TempraMed, visit its website. For the latest updates, follow TempraMed on social media and other online platforms: Facebook, LinkedIn, and YouTube.

Disclaimer:

“This article contains "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, statements regarding projected revenues for 2026 ($19M), projected unit sales, gross profit margins, expected cash flow positive status, total addressable market estimates, production capacity utilization, expansion plans, distribution partnerships, and business strategy of TempraMed Technologies Ltd. (the "Company").

This article does not constitute an offer to sell, or a solicitation of an offer to buy, any security and may not be relied upon in connection with the purchase or sale of any security issued by the Company. Any such offer would only be made by means of definitive investment documents, the terms of which would govern in all respects. This article is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You should consult your own attorneys, business advisers and tax advisers as to any investment and related matters.

Any projections or other estimates in this article are forward-looking statements based upon certain assumptions. Key assumptions include: market adoption rates for temperature-controlled medication storage solutions, successful execution of B2B partnerships, achieving projected production volumes, maintaining gross margins, regulatory approvals for new products, and general economic conditions. Material risk factors that could cause actual results to differ materially include: competition from alternative storage solutions, changes in healthcare regulations, delays in product development or market adoption, manufacturing or supply chain disruptions, inability to secure distribution partnerships, changes in reimbursement policies, foreign exchange fluctuations, and general economic conditions.

The forward-looking information has been approved by management as of the date of this article. Actual results may differ significantly from those presented due to factors beyond the control of the Company. The Company undertakes no obligation to update this information except as required by applicable securities laws.”

The above is sponsored content. Barchart was paid up to two thousand dollars for placement and promotion of the content on this site and other forms of public distribution covering the period of February 2026. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)