Copper’s Role as the Economy’s Barometer

Copper is widely known as Dr. Copper because of its unique ability to reflect the state of the global economy. The metal is essential for electrical wiring, plumbing, and the manufacturing of electronics and electric vehicles, making it a critical commodity for industrial growth. Heavy consumers include China, the United States, and Europe, with China often leading demand due to its vast infrastructure projects and manufacturing base. Because copper is used in so many industries, its price movements often anticipate shifts in economic growth or slowdown.

While concerns about a slowing Chinese economy and inflation pressures have created some uncertainty, copper prices have shown resilience and even strength since August 2025. This seeming contradiction reflects the complexity of factors influencing the market. On one hand, softer signals from China’s growth outlook and a restrictive global monetary policy backdrop have limited upside momentum. On the other hand, ongoing supply disruptions from key mining regions and expectations for longer-term industrial demand, especially linked to green energy infrastructure, have provided strong underlying support. Additionally, investors may be positioning for future recovery phases or structural demand shifts, which keeps the market trending upward despite near-term macro challenges.

What the Market Has Done

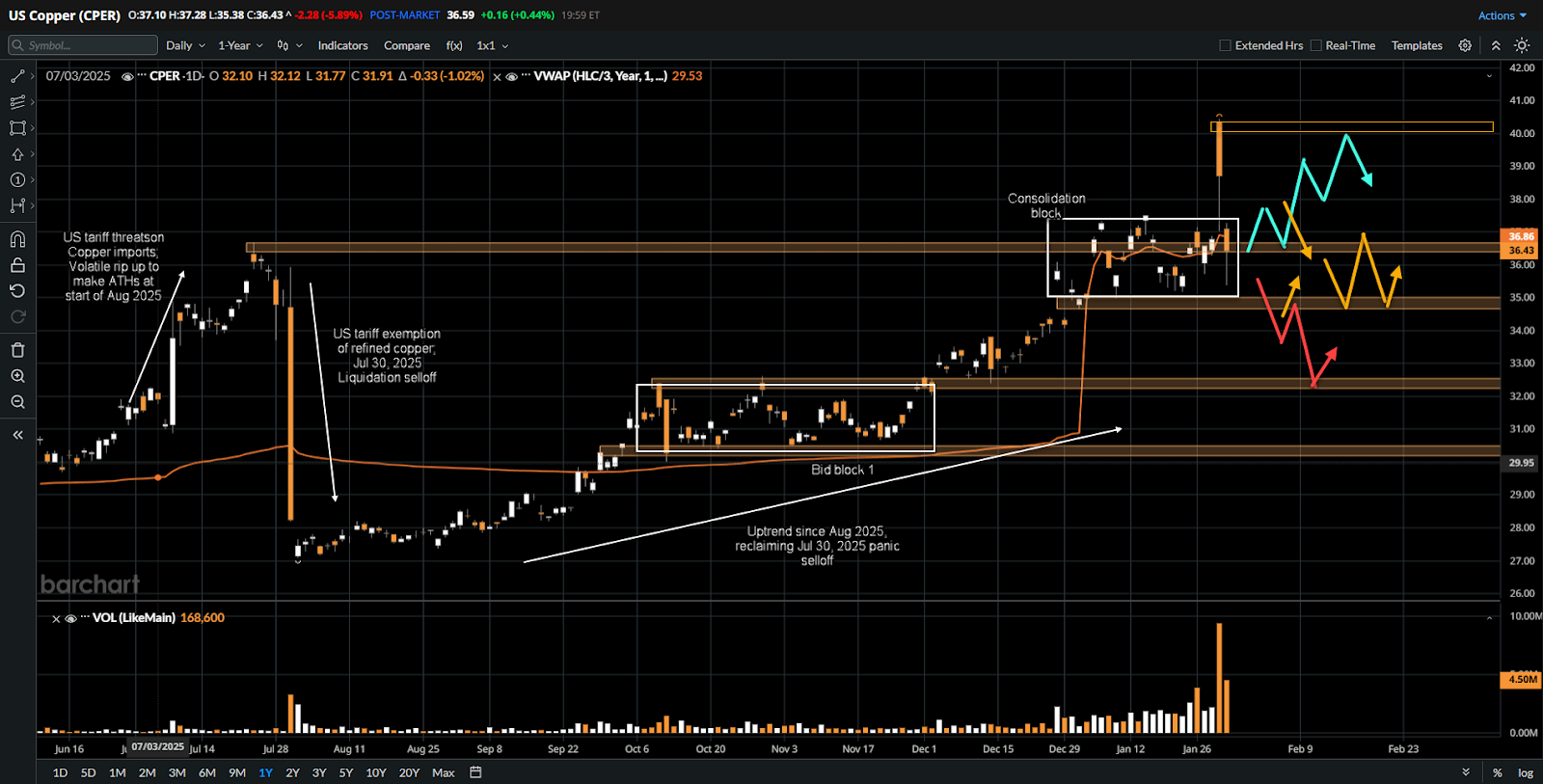

• Copper prices experienced a large and volatile move upward, reaching all-time highs on July 7, 2025. This surge was primarily driven by the U.S. announcing a 50% tariff on certain copper imports, which sparked panic buying and stockpiling by U.S. consumers ahead of the tariff implementation. Supply disruptions at major mines and strong demand from sectors like artificial intelligence and green energy added further upward pressure. Speculative trading intensified the move, but later in July, tariff exemptions and profit-taking caused a sharp selloff.

• Following this peak, a violent selloff occurred on July 30, 2025. It was triggered by the White House’s unexpected exemption of refined copper from the 50% tariff. Traders who had anticipated tariffs on all copper imports were caught off guard. This caused the massive price premium between U.S. (COMEX) and London (LME) markets to collapse, leading to a record one-day drop of over 22% in COMEX futures.

• Since early August, the market has been in an upward trend, successfully reclaiming the losses from the July 30 selloff.

• Between October and November, copper prices consolidated in a range between 30.4 and 32.4, forming a significant bid block labeled Bid Block 1. This base provided support before the market resumed its uptrend, breaking past the July 2025 all-time highs.

• In the past month, prices have consolidated again, this time in a tighter range between 35.3 and 37.3. There was a sharp rally last Thursday, possibly triggered by positive U.S. economic data and easing geopolitical tensions, but by Friday, the price returned within the 35.3 to 37.3 range.

What to Expect in the Coming Weeks

Key levels are the top and bottom of the current range at 37.5 and 34.5.

Bullish Scenario

• If the market can hold above the 36.5 level, which is just above the current consolidation range, there is potential to revisit all-time highs near 40.44.

• This upward move may be choppy and two-way as the market builds value at higher price levels.

Neutral Scenario

• If the market fails to break above 37.5 with strong momentum and volume, expect prices to rotate back down toward the 34.5 area, which lies within the current consolidation block range.

• Buyers are expected to respond and defend this level. A balanced two-way price action between 37.5 and 34.5 could continue to establish value.

Bearish Scenario

• If buyers cannot defend the 34.5 level or fail to reclaim it quickly after testing below, expect the market to move back toward 32.5, the high of Bid Block 1.

• Early warning signs will include offers stepping down and holding near the middle of the current consolidation range, along with increased volume and pace as prices approach 34.5.

Conclusion

Copper futures demonstrate a market balancing near-term macro uncertainties with robust supply-side challenges and long-term demand prospects. Technically, the market has maintained an uptrend since August 2025, navigating key consolidation ranges with important support at 34.5 and resistance near 37.5. The ongoing interplay between slower Chinese growth signals and supply constraints is creating price resilience. Traders should monitor these levels closely and stay attuned to both technical signals and evolving macro developments to capitalize on the dynamic copper market.

For traders interested in expressing their market views on copper and other commodities, trading futures provides clear advantages over ETFs or CFDs. Futures markets offer centralized pricing, deep liquidity, and regulated execution that deliver transparency and efficiency. Platforms such as EdgeClear provide direct access to global futures markets with reliable execution and trader-focused tools designed for those serious about market participation. Consider exploring futures trading at edgeclear.com to take your trading to the next level.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional if necessary before engaging in futures or derivatives trading.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)