Howdy market watchers!

What a finale to the month of January! From record heat to record cold and snow to a historic rally and historic selloff in precious metals, it has been a month to remember. As I told several clients that are trading metals, I haven’t ridden an actual bucking bull, but I’ve ridden the silver market to which they responded, I’m not sure which is worse!

That is beyond true and these times will be talked about for decades, perhaps longer, as extraordinary times, to say the least. The beginning of the week was dominated by significant buying while the end of the week was dominated by heavy selling to a magnitude seldom seen, especially by my generation. Just when one thought all was lost on Friday morning, the market began to stabilize to finish the week and the month impressively off the lows of the day. The swings are so beyond even the “new normal” every minute, it is difficult to know how to describe this level of volatility.

President Trump announced his new pick for Federal Reserve Chairman, Kevin Warsh, on Friday morning that accompanied a surge in the US dollar from its recent plunge that spilled over into the massive liquidation in the precious metals. The nomination still requires Congressional approval, but the news cycle will and has already shifted to what can be expected from the new Fed Chair as well as how Fed independence and Trump’s outspoken pressure will evolve going forward. It will be interesting to witness the pace and dialogue around Nominee Warsh’s confirmation as tensions rise between the Legislative and Executive Branches, even within the GOP.

The Fed held rates steady at this week’s FOMC meeting, awaiting more data on inflationary pressures as well as strength of the labor market. The US Producer Price Index (PPI) for December released on Friday showed higher than expected increases at 0.5 percent versus last month’s 0.2 percent that was also the forecast for the final month of 2025.

With rising tensions in the Middle East, oil prices have been firmer than the Administration would like to reduce inflationary concerns through lower energy prices. With the US ‘armada’ building off the shows of Iran, it seems that a potential skirmish is inching closer, possibly even this weekend. That should keep energy markets firm overall.

Natural gas has been explosive with colder weather and short covering that saw the February contract settle at $7.20 on expiration day. March futures are now the front-month and rallied 10 percent on Friday to $4.395, but still well off of prior month settlement. However, we are getting further into winter where forecasts will begin to see some warming although there is definitely plenty of cold ahead in February.

The Black Sea region is experiencing a major deep freeze, which helped rally the wheat market this week from concerns over winter kill. Such concerns persist for certain wheat areas in the US with limited snow cover. Having said that, I’m cautious to put too much trust into a sustained rally in the wheat market unless the news cycle continues to feed the bull.

March KC wheat touched $5.50 exactly overnight on Thursday, coming within ¼ cent again on Friday with plenty of choppiness in between. Futures did bounce back decently into the close with a finish at $5.45. The July KC wheat harvest contract traded to a high at $5.73 on Friday, just near the 200-day moving average, and closed the week at $5.67.

US wheat exports have been nearly 20 percent above last year, but have slowed in recent weeks.

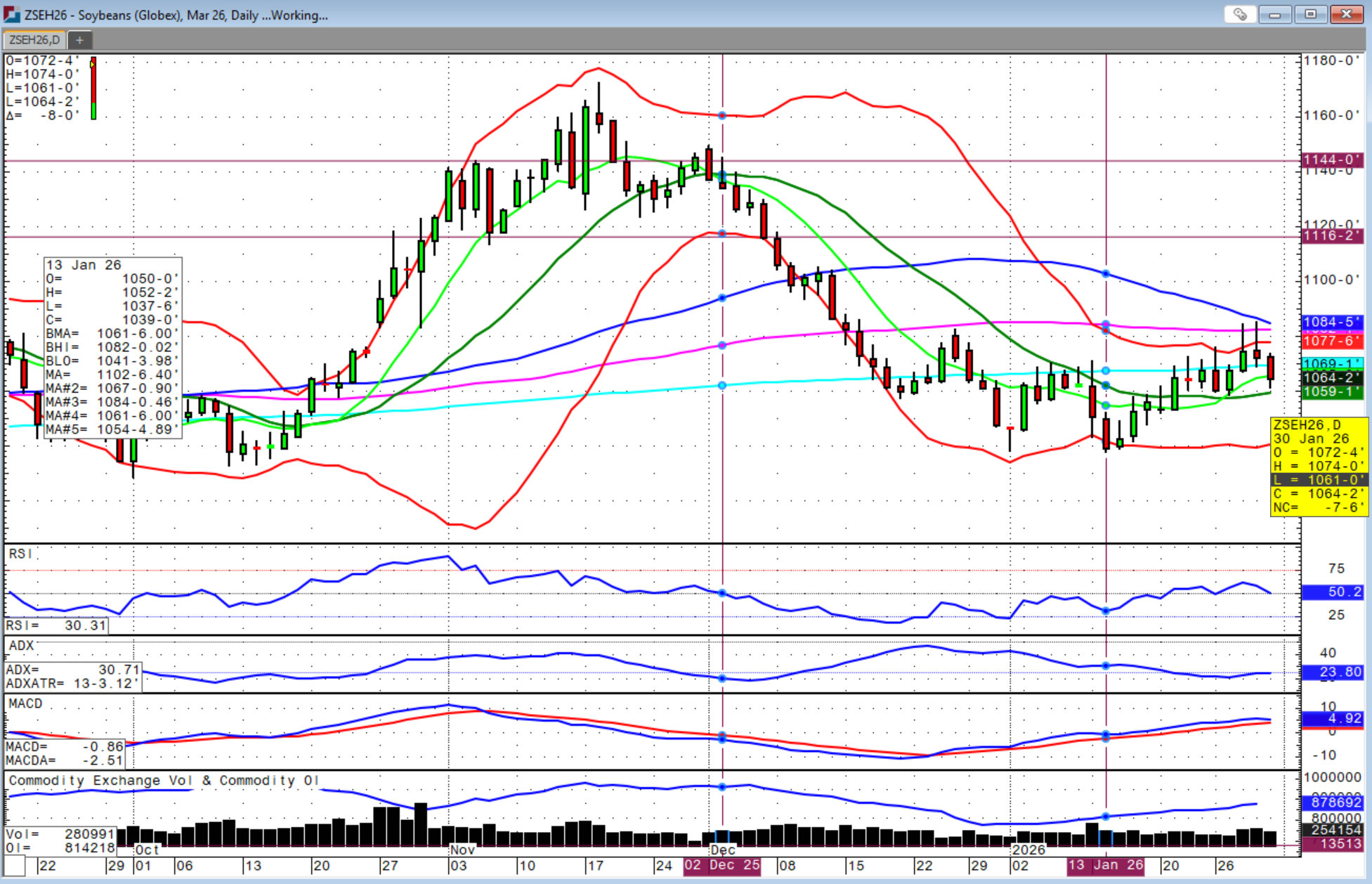

March corn closed the week at $4.28 while March soybeans finished at $10.64, and desperately need a bounce next week to avoid further selling pressure. This week has been dominated by heavy selling pressure on rallies as the grains and oilseed markets also experienced this week. Hopefully, a new month will lead to more stability with a renewed trend of a weaker US dollar supporting export competitiveness.

As I have continued to mention, the best policy decision for US farmers would be a boost in domestic biofuel blending given the increasing global competition for our commodity exports. President Trump made such announcement at a rally in Iowa this week by squarely putting his full support behind year-round E15 calling on Congress to get the legislation to his desk. Initially, the corn market hardly moved, but then found some support and we will see the speed at which this can become the law and start creating real demand.

The impending US government shutdown that was to occur this weekend was seemingly avoided with a deal announced on Friday and so that threat is off the table, at least for now. As a word of caution, the critical race for mid-term elections has officially unofficially begun. There are incredible divisions and rising tensions across the US that make this year’s elections some of the most pivotal in recent times. As a result, the campaign trail will be littered with significant rhetoric and promises to earn votes and persuasion that could be market moving. Bottomline is that volatility will continue to be present in meaningful ways.

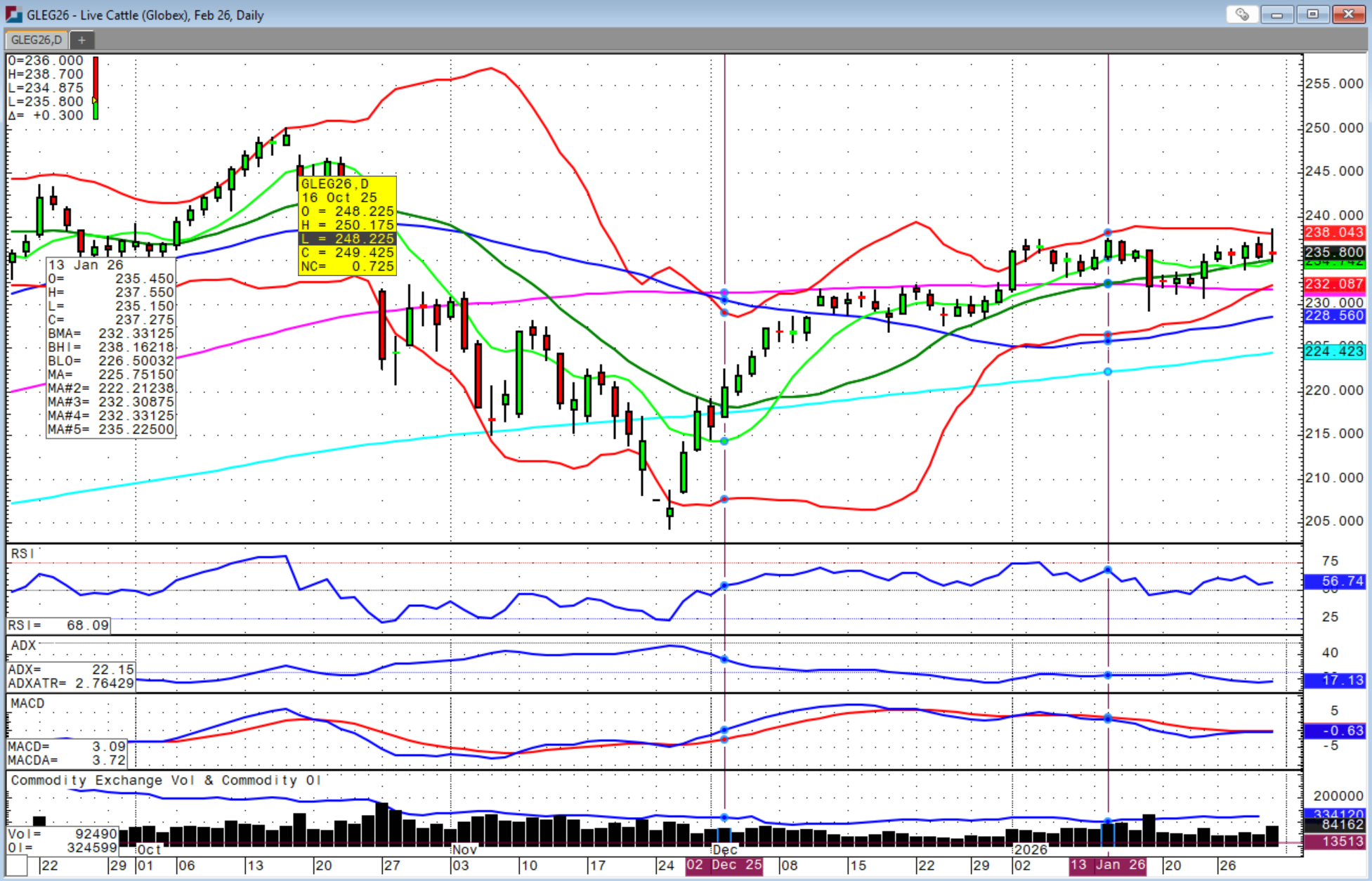

The cattle complex, in particular, can be impacted by such changing market sentiments. The bullish fundamentals for the cattle market are more intact than ever, but that doesn’t prevent selling pressures to return from unrelated events. Friday’s bi-annual USDA cattle inventory report added to the bullishness with All Cattle/Cows coming in at 99.6 percent of last year versus 99.7 percent average trade guesses. The beef cow number was the most bullish at just 99.0 percent of last year versus 100.4 percent expected.

Dairy cows came in at 102.0 percent versus 101.1 percent expected. There has been increasing talk of liquidation in the dairy herd to boost milk prices, but also to add more ground beef supply to the market to tame prices. We will continue to watch how this develops to see if the USDA steps in with policy.

The annual calf crop came in at 98.4 percent versus 99.3 percent expected. The US cattle inventory is now at the lowest level since 1951. It is important to keep in mind that cattle counts are indeed much lower, but the weights of carcasses and overall beef production are much higher and offset a large amount of this difference.

I believe that Friday’s selling pressure in the cattle markets was end of month profit taking and pressure from broader market selling. The fed cash cattle trade supports that with new highs reaching $240 in Oklahoma, Texas and Kansas and $241 in select parts of Nebraska. Packer margins are increasingly negative, but demand strength and tighter cold storage keeps them coming for more and at higher prices. Be advised that we will probably see more packing plant closures ahead that could impact this strength with market shocks. There was a fire at a facility in Texas this week and such events have been known to catch the market off guard, especially after large moves.

While this market can always go higher with the final chart gap still above, it is time to make sure you know your break evens and risk tolerance and get a risk management plan in place as there is a lot of money on the table again and it would be unfortunate to not capture it after getting another chance here. Such second chances seldom come, but when they do, it is important to remember the lesson from the last chance.

Reminder, there is no LRP offered on USDA report days.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)